The CIO’s Take:

Treasuries have been tanking

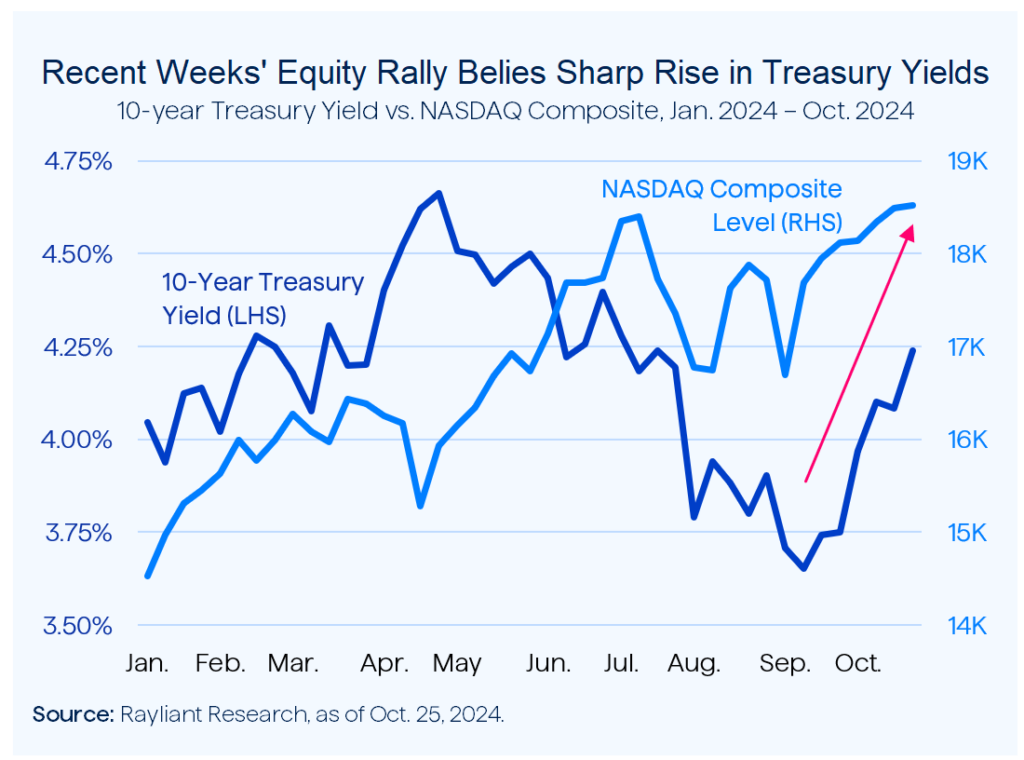

We’ve had a lot to say recently about stronger-than-expected macro data instilling some caution in the Fed, backing US central bankers off of what market participants expected would be a very aggressive campaign of rate cuts. In a relative rarity for early days of an easing cycle, Treasury yields have reacted to the Fed’s pivot by doing the opposite of what many would expect: significantly rising. Just last week, a further selloff in 10-year US Treasury notes pushed their yield up to end the week at just under 4.24%, a level not seen since July.

S&P 500 back in rally mode

One might be forgiven for thinking that a less dovish Fed and sudden spike up in Treasury yields just as rate cuts were kicking off might spook stock investors, but that’s also not what’s happened in recent weeks, with last week’s 1% retreat in the S&P 500 marking its first weekly fall since the week ending September 6th—when a downside surprise in jobs rattled investors’ nerves—and the index is still up 7.4% since then. The NASDAQ meanwhile is within striking distance of a new all-time high after rising nearly 11% over the same period (see below).

Soft landing odds improving

So, what explains recent bullishness toward risk assets, even as bets on Treasuries and Fed cuts sour? It comes down to strong data on the US economy, effectively unwinding fears that jolted markets with negative surprises at the beginning of September. The “flash” US composite October PMI, for example, released last Thursday by S&P Global, increased to 54.3 from 54 in September. Even better, unemployment benefits for the week ending October 19th came in well below consensus estimates, highlighting resilience in the US labor market and bolstering soft landing hopes.

Expect gradualism from the Fed

Fed officials are taking such evidence into account in deciding what to do with rates at their early-November FOMC. Last Monday, Minneapolis Fed President Neel Kashkari told his audience at a Chippewa Falls Q&A that he’s “forecasting some more modest cuts over… coming quarters”. On the same day, Kansas City Fed President Jeff Schmid expressed to a gathering of financial analysts that he favors “modest adjustments to policy” in the current cycle. Of course, if tempered rate cuts coincide with a US soft landing, it wouldn’t be bad news for stock investors after all.

Homebuyers favor quicker cuts

In few places is the rise in Treasury yields more strongly felt than in the housing market, where restrictive Fed policy and tight supply have conspired in the last couple years to put a damper on activity. There had been hope, as momentum built toward the Fed’s pivot on interest rates, that impending easing might lead to a recovery in US home sales. Unfortunately, as robust economic data in recent weeks diminished expectations for aggressive Fed cuts going into 2025, homebuyers’ enthusiasm has likewise slumped.

Mortgage applications skid lower

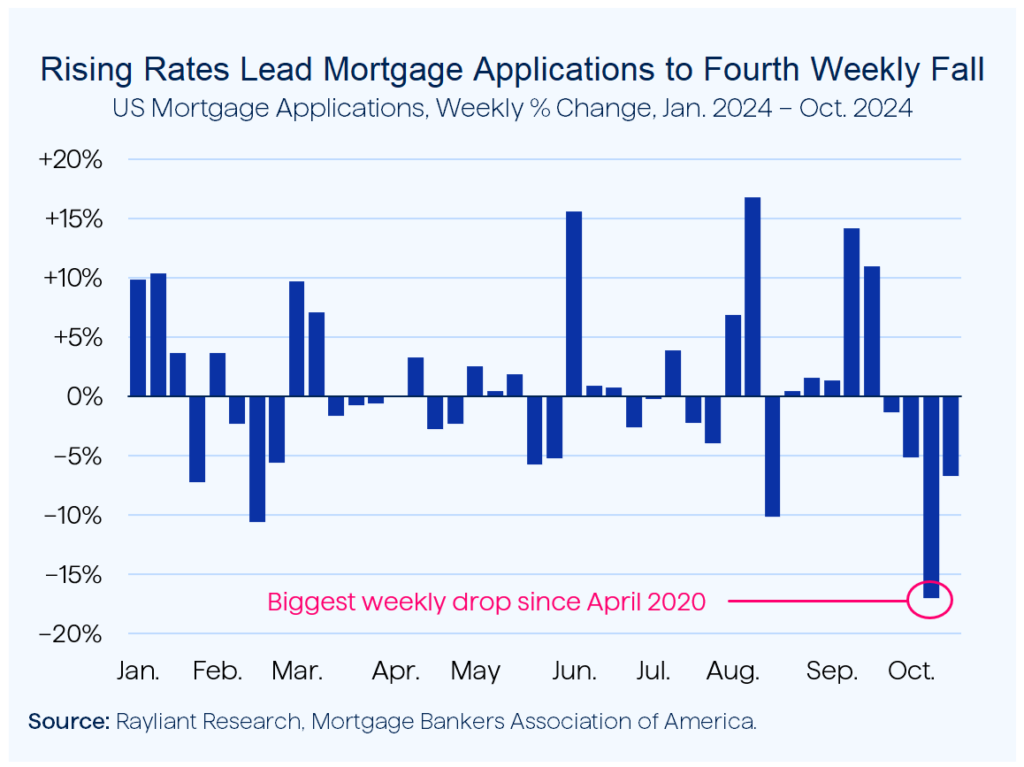

That turn in sentiment as mortgage rates hover close to a two-month high is very obviously reflected in data out last Wednesday on mortgage applications tracked by the Mortgage Bankers Association (MBA). That weekly report showed US mortgage applications dropped 6.7% over the one week ending October 18th, marking a fourth straight week-over-week decline (see below).

Refinancing applications—which are particularly sensitive to short-term fluctuations in borrowing costs—slipped by an even steeper 8.5% from the prior week. Applications for new home purchases similarly fell by 5% week-over-week, underscoring the impact that rising rates are having on potential homebuyers.

A bright spot in new home sales

Better news came on Thursday, as data from the US Commerce Department showed sales of new single-family homes rose by a seasonally adjusted annualized rate of 738K, solidly surpassing the consensus estimate of 720K. That figure was 4.1% higher than the rate in August and 6.3% better year-over-year. Chalk it up to the impact of falling mortgage rates in August. On the other hand, with housing affordability still abysmal and a tight supply of existing homes, sales in that category fell 1% month-over-month and 3.5% year-over-year in September.

Uncertainty keeps buyers on sideline

Divergent data—which seem to us, on balance, a bit negative—illustrate what a challenging environment it is for the US housing market. US economic strength continues pressuring mortgage rates upward, continuing a trend seen over the past few weeks, with the disconnect between pessimistic views and strong economic data contributing to an unusually high level of volatility in mortgage rates, despite the US economy being on a solid footing. In the meantime, Americans seeking to buy a home will likely be content to wait for more clarity.

Treasury slump boosts USD

Another implication of rising yields has been a rally in the US dollar. Since the beginning of October, the greenback has rallied by nearly 3.5% against a basket of major currencies tracked by the DXY dollar index, including a 0.74% increase over the last week, alone. Indeed, the dollar has a number of factors in its favor recently, from data supporting continued US economic growth, potentially sticky inflation, and a less dovish Fed to demand for safe-haven assets amidst rising geopolitical tension, underscored last Friday by Israel’s strike on Iran.

The “Trump trade” is back

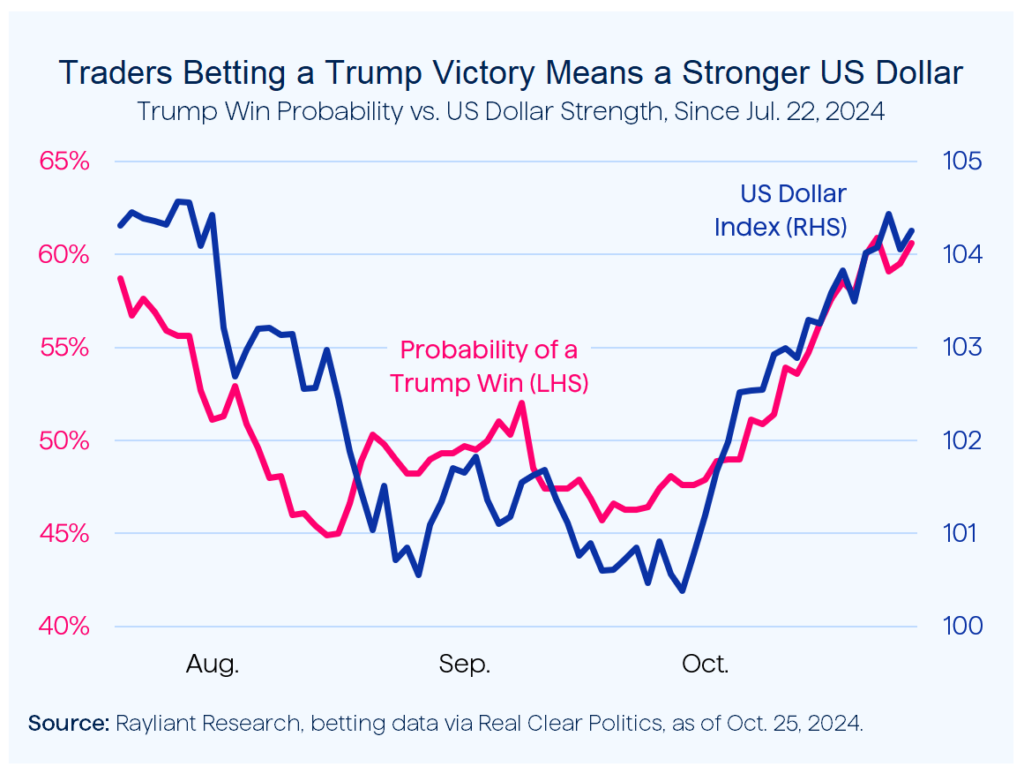

With just over a week until millions of US voters hit the polls on November 5th, we might add the so-called “Trump trade” to a list of things driving the dollar up. Kamala Harris jumped out to a big lead in polls and prediction markets following her taking the reins of the Democratic candidacy from President Joe Biden, though her lead has faded dramatically since reaching a post-debate high in mid-September (see below).

As former president Donald Trump’s market-implied probability of winning the election has risen—it breached 60% last week for the first time since Biden dropped out of the race—so too has the dollar climbed. The consensus among economists and traders suggests a Trump victory next week will lead to much more protectionist trade policies, much looser fiscal policy, and, ultimately, higher inflation, rising yields, and a stronger dollar.

Strong dollar weighs on EM

One place the dollar’s rise is making an impact: emerging markets. MSCI’s EM currency index is off 1.6% this month, since hitting a high at the end of September, and EM stocks tracked by MSCI’s EM equity benchmark have shed almost 4.5% since putting in a one-year high in early October. For emerging economies among the BRICS consortium hoping to break the USD’s outsized influence, Bloomberg News pointed out the cruel irony that organizers of last week’s summit in Kazan recommended foreigners attending bring dollars or euros—currencies Russia labels as “toxic” policy.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED