The CIO’s Take:

Stocks end the week with big losses

For weeks, as a rally in risk assets has continued—despite mounting indications much-anticipated Fed rate cuts won’t be happening in June, if at all this year—we have wondered what it might take to shake investors’ seemingly boundless confidence. Last Friday, we had an answer: Israel launched a strike on Iran, retaliation for an unprecedented drone and missile attack Iran had unleashed a week prior on Israel, and stocks sold off. The S&P 500 fell for a sixth consecutive session, losing over 3% on the week, while the NASDAQ dropped more than 2%, ending the week off by over 5%.

“Fear index” up on Israel-Iran tension

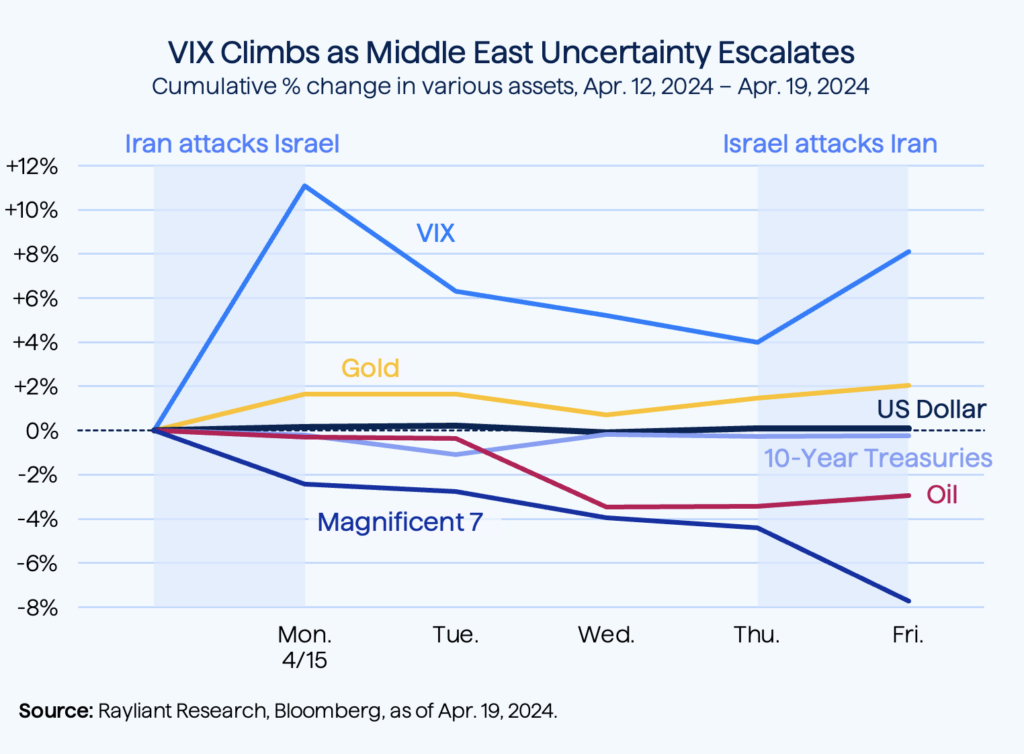

Looking across other assets over the last five days, we saw signs of a stark shift in sentiment. The VIX “fear index” jumped by over 10% after Iran’s initial assault on 4/13, as did gold, often seen as a safe haven (see below). Conditions were relatively calm throughout the week as Israel mulled its response, and the VIX popped again on Friday in the wake of what turned out to be a limited strike on an airfield in Isfahan, a large city 270 miles south of Tehran.

We find it telling that amidst a “flight to safety,” Treasuries and the US dollar made relatively muted moves. It seems to us that Israel’s response to a largely thwarted Iranian strike was well-calibrated to send a message while avoiding further escalation. As such, wider war appears to have been averted, and geopolitics likely served to catalyze markets’ revaluation of another scary—if less dramatic—prospect: increased Fed hawkishness.

Concern over change in Fed’s tone

Indeed, we counted four officials from the US central bank talking tough on policy by the end of last week, capped off by a speech on Friday from Chicago Fed president Austan Goolsbee—previously among the most dovish voices on the FOMC—in which he bluntly cautioned the “progress on inflation has stalled” and advised that policymakers should “wait ang get more clarity” before making the hoped-for pivot in rates. Goolsbee’s comments came after similarly hawkish remarks by Fed chair Powell, Cleveland Fed president Loretta Mester, and New York Fed president John Williams throughout the week.

Corporate earnings in focus

As we’ve warned before, the longer rates stay high, the greater the prospect for an overshoot by the Fed which could deal a blow to corporate earnings driving the last year’s risk-on trade. We got glimpses of that last week, as stocks in the vaunted “Magnificent 7” shed nearly 8%, with AI darling Nvidia dropping 10% on Friday, alone. We see weakness in NVDA shares, in particular, as an overreaction, though we do think investors are right to reconsider valuations more broadly in light of both geopolitical and policy uncertainty facing the market today.

Not all central banks on “pause”

Despite the Fed’s hesitance to begin loosening its monetary policy, many emerging markets are in a better spot than the US when it comes to handling inflation, having commenced rate hikes while the Fed was still talking about “transitory” shocks. As we have remarked before in Perspectives, that puts them in a better position to start easing now, and that is precisely what a number of EM central banks are doing. This has especially been the case for economies in Latin America, where the struggle against rising prices is a familiar one.

LatAm currencies trending lower

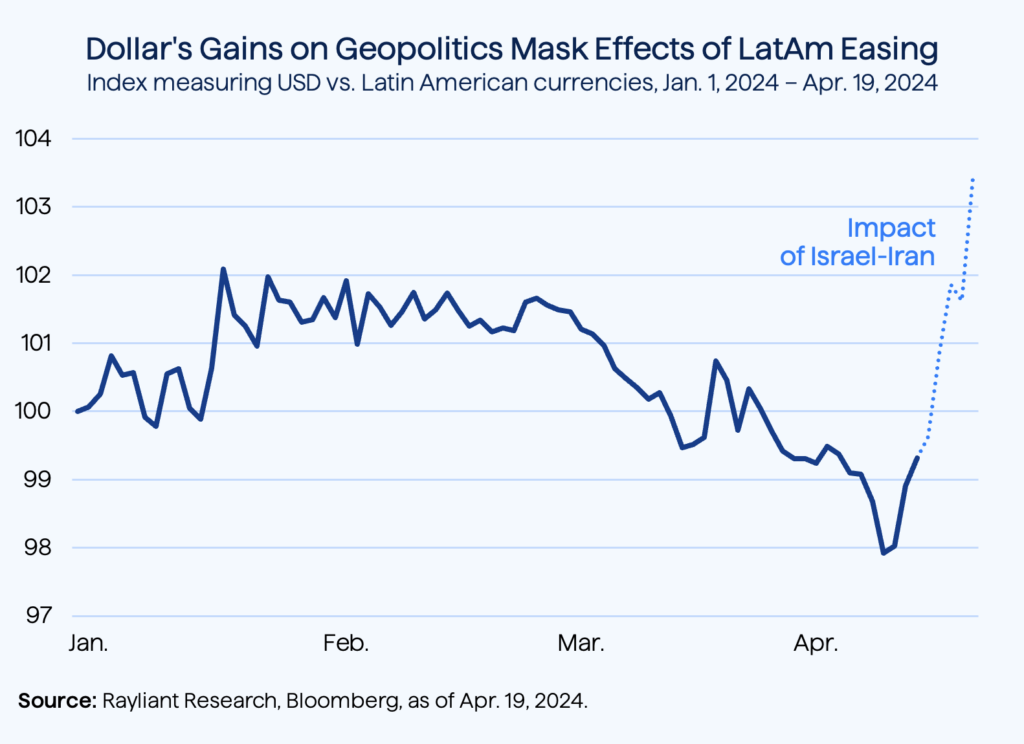

Indeed, the Banco de Mexico—known colloquially as “Banxico”—cut its policy rate for the first time this cycle last month, lopping 25 bps off its benchmark rate in March, down to 11%, making it the last major LatAm bank to begin easing. Brazil began slashing rates last August, and its Selic base rate is already down from 13.75% to 10.75%, falling at a rate of 50 bps per meeting by its central bank. It’s not surprising that Latin American easing and rising US hawkishness have seen a basket of LatAm currencies, depicted below, weakening against the dollar in recent months (notwithstanding a bit of a rally on geopolitical concerns in the last week).

Lower rates help with near-shoring

In fact, the currency dynamics plotted above are important for another theme we’ve been following in EM LatAm, especially with respect to Mexico: the notion of “near-shoring,” which has been a major boost to companies just south of the US border in a country that just recently regained the top spot within America’s network of trading partners. A cheap peso definitely helps along those lines—though Banxico, like the Fed, faces a delicate balancing act. Economic strength on the back of US supply chain re-orientation can lead to a resurgence of inflation and too great a rate differential between Mexico and the US could lead to capital outflows. As such, we expect Mexican policymakers will likely take a pause in May.

Are fiscal alarm bells ringing?

Finally, we turn back to the US for some comments on America’s troubling fiscal situation. The International Monetary Fund (IMF), in last Tuesday’s release of its semi-annual Global Financial Stability Report, singled out US debt as a cause for concern to the world economy, noting that “something will have to give” as current dynamics are simply unsustainable. Of course, we have been writing about US monetary policy for months—to the point of feeling a bit like a broken record—but the IMF report puts a spotlight on the other side of the coin: fiscal policy.

Large US deficits set to persist

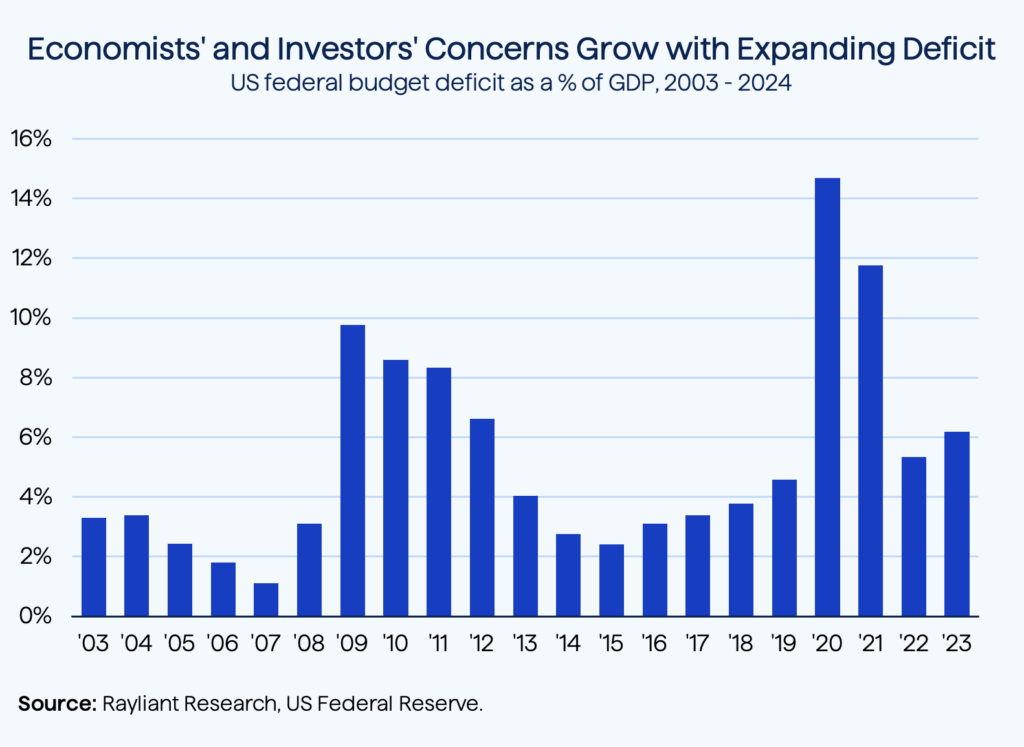

The US has historically run its economy in a deficit. That’s not concerning in and of itself; the US has typically been regarded as a very safe borrower, and has thus enjoyed a very low cost of capital to finance not only the wars that have been behind some of the country’s biggest deficits, but also social programs like the pandemic-era stimulus, which also caused the deficit to blow out in recent years (see below). The problem, as many see it, is that in good times—e.g., the astonishing growth that’s got investors so excited these days—a country should be working to reduce deficits, and that hasn’t been happening.

From fiscal concern to higher yields

The IMF expects the public debt of the world’s two largest economies, the US and China, to double by 2053, a trend that the group believes contributes significantly to inflation. From an investor’s perspective, this is troubling for a number of reasons, not least the fact that at some point those favorable terms on which America has historically been able to borrow could get worse as investors worry about risks, the pressures of inflation among them, and begin demanding more return. That would translate to upward pressure on yields and losses for bond investors—one reason we’re still cautious on longer-term fixed income.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED