The CIO’s Take:

Tech sells off ahead of high-profile reports

By way of a recap, going into last week, with more than half of stocks in the Magnificent 7 set to report first-quarter results, we weren’t too surprised to see US markets sell off. We speculated that uncertainty over conflict in the Middle East and worries about an increasingly hawkish Fed were just part of the story, with many investors dumping tech stocks out of fear that Q1 earnings could disappoint. The S&P 500 slid by over 3% and the NASDAQ shed more than 5%, their worst showings since March 2023 and November 2022, respectively.

Markets rebound amidst mixed results

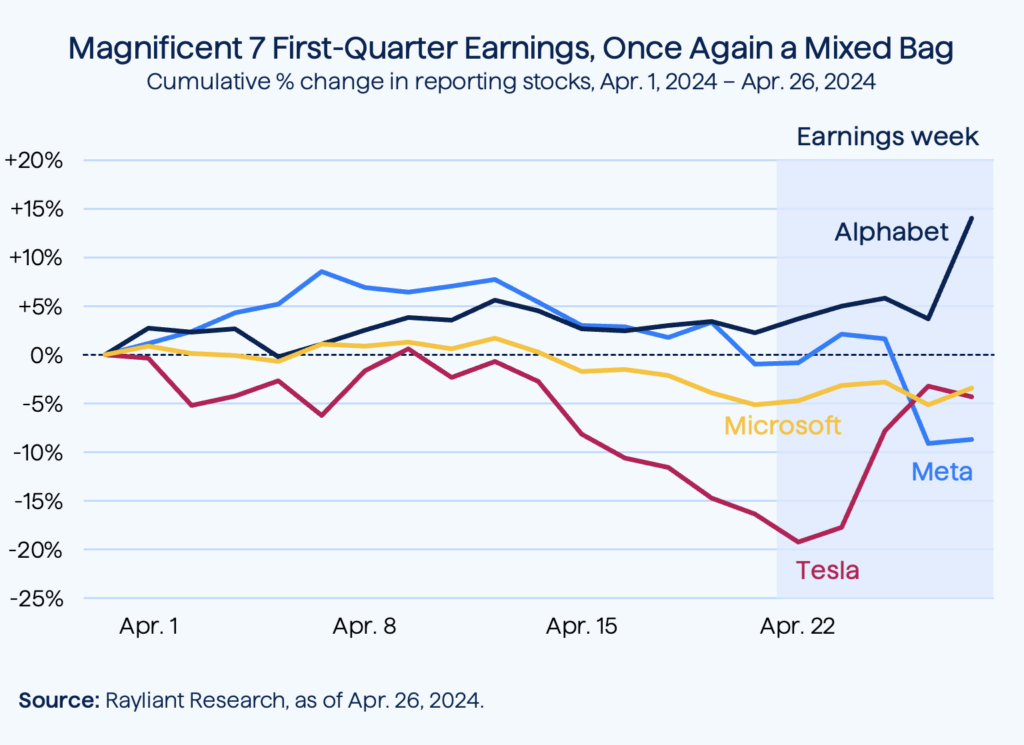

One week later, with reports from Tesla, Meta, Alphabet, and Microsoft in the bag, we imagine those selling ahead of earnings will be feeling some regret. Despite high-profile results and stock price reactions being somewhat mixed (see below), sentiment was generally positive in the wake of last week’s announcements. The S&P 500 bucked a three-week losing streak to gain 2.7%, while the NASDAQ added 4.2% for the week. Digging into the results a bit reveals some of the dynamics at play in US equities today.

Tesla shares rise on positive guidance

First to report was Tesla, a stock that entered the week down over 40% for the year on sagging demand and intensifying competition in the EV Space. From a fundamental perspective, Tesla’s Q1 results left much to be desired, with revenue declining by $2 billion year-over-year: the company’s first quarterly decline in revenues since early 2020. Even so, Musk’s assurance on the company’s earnings call that more affordable models were on the way apparently set investors at ease and the stock surged 9.5%, clawing back the prior week’s losses.

Meta plunges, despite earnings beat

If Tesla could rally on poor results, surely Meta would soar on top- and bottom-line beats, including a 27% increase in sales? Not quite. The stock cratered by as much as 19% after hours on Wednesday, wiping over $200 billion off its market cap. Chalk it up to something we’ve talked about plenty in recent months: expectations flying too high for firms to keep up. Though Meta still makes most of its profits on ads, CEO Mark Zuckerberg spent much of last Wednesday’s quarterly call outlining plans to plunk billions into AI and the metaverse. That apparently didn’t sit well with investors expecting faster results.

Alphabet, Microsoft show cloud success

A pair of companies already seeing the benefits of early AI investments are Microsoft and Alphabet, both of whom strongly beat analyst estimates for Q1 as cloud business boomed on the back of AI demand. Google’s parent company, for example, posted a whopping $900 million profit on its cloud division for the quarter, ahead of the consensus forecast for income of just $672 million. Its shares rallied almost 10% on Friday to close at an all-time high, putting the company in the $2-trillion-market-cap club.

Expectations getting harder to beat

Another illustration of how lofty expectations are at this point: Despite Microsoft’s Azure cloud sales surging 31% in Q1, its shares gained a relatively measured 1.8% for the day, and still trade 3.4% lower than they did at the beginning of April. As we’ve mentioned before, it’s clear the later we get in the cycle, the higher investors’ hopes and the shorter their patience. That’s something to consider ahead of two more Magnificent 7 stocks reporting this week, Apple and Amazon, both with shares also down modestly since the beginning of Q2.

Last macro data before April FOMC

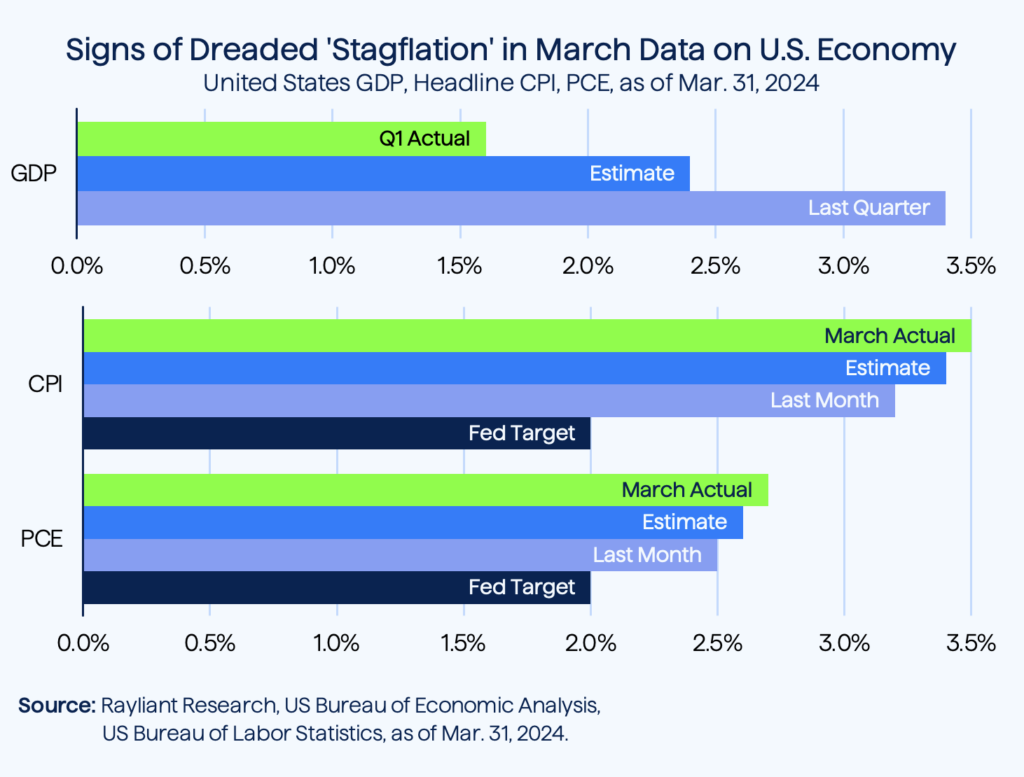

Of course, it wasn’t just expectations about individual stocks being tested last week. Two big pieces of macro data dropped, as well, each bearing on the questions of when and by how much the Fed could cut rates, not to mention how likely investors might be to enjoy a soft landing for the global economy. Sadly, both releases pointed in the wrong direction, giving rise to renewed concerns over a word nobody wants to hear, but one we’ve broached more than once over the last two years: stagflation.

US GDP disappoints in Q1

Thursday brought data from the Bureau of Economic Analysis (BEA) on US GDP, which came in at 1.6% for the first quarter of 2024 (see below), way below the prior quarter’s 3.4% growth, and well short of forecasts by economists surveyed by Dow Jones, who expected a 2.4% increase. It was the first quarter in the last seven to see the US economy expand by less than 2% year-over-year.

Optimists would likely point to a healthy 2.5% increase in consumer spending for Q1, although that was also below analysts’ forecast of 3% and considerably slower than the 3.3% growth in spending seen in Q4. The GDP report was a blow to confidence for those in the soft landing camp to be sure—but, on the flipside, could be taken as good news if one imagines signs of slowing growth could induce the Fed to loosen up a bit sooner.

March PCE inflation tops consensus

Unfortunately, the second bit of macro data, another inflation reading from the BEA on Friday, complicates the “bad news is good news” interpretation of slowing growth as getting us closer to Fed cuts. The Personal Consumption Expenditures (PCE) index, an inflation benchmark often tipped as a favorite of the US central bank’s, mirrored March CPI data, coming in rather hot at 2.7%—ahead of economists’ 2.6% prediction, above February headline PCE of 2.5%, and uncomfortably higher than the Fed’s 2% target.

Macro conditions warrant investor caution

Trends in the plot above don’t require much analysis. After a week in which Fed language was increasingly hawkish, further evidence of stalling disinflation won’t help matters at this week’s FOMC. As of last Friday, the odds of a June cut had fallen to 11%, while the probability of no cuts in 2024—sitting close to zero at the end of March—are now up to 20%. As we’ve mentioned before, something we’ve long feared is inflation running too hot for the Fed to ease, long enough for the economy to turn down. Last week’s data validate that concern and explain why our models are still positioned defensively.

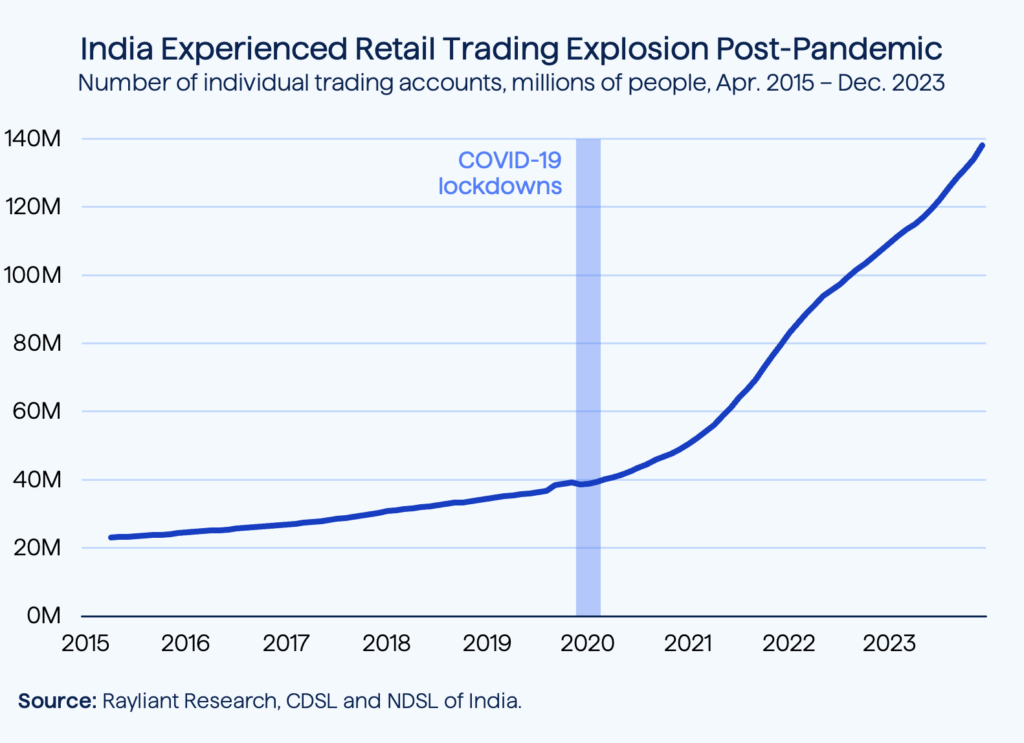

Individual traders piling into the market

While US equity investors mull the nuances of first-quarter earnings and the implications of inflation and growth for Fed policy, Indian retail traders are having a grand old time trading options. The data are rather astonishing: Since 2020, the number of individual trading accounts in India has skyrocketed from around 40 million to nearly 140 million, as depicted below.

That shift in India’s investor demographics mirrors one witnessed around the world—including in the US—with the boredom of pandemic lockdowns leading many to put some money into a trading account as a potentially profitable pastime. It’s just that in the world’s most populous country, such trends can lead to staggering numbers.

Popularity of options trading soars

Along those lines, it seems noteworthy to us that in 2023, India accounted for roughly 80% of all equity options traded around the world. Overall, Indian investors traded north of 84 billion equity index options in 2023, a total that was 153% higher than the one recorded in 2022. And this trend continues: In March of this year, total options and futures turnover in India amounted to some US$4.5 trillion.

Most retail traders lose money

In developed markets, we often imagine that more turnover leads to better “price discovery”: constant trading among buyers and sellers with little bits of information leads prices to better reflect fundamentals: the storied “wisdom of crowds” at work. In a market full of retail investors trading for fun, on the other hand, such an outcome strikes us as doubtful. For many retail investors, trading thrills aren’t cheap, either, with the Securities and Exchange Board of India (Sebi) reporting nine out of ten individual traders showed losses in 2022.

Professionals finding opportunity in EM

For professional investors—ourselves included—this isn’t just an entertaining case study in what happens when retail investors dominate trading. To the contrary, we believe high levels of individual investor participation present a big opportunity to those with an allocation to EM. It’s one of the reasons that even as a rally in Indian shares over the last year has made its market considerably more expensive, we still find stocks we like and include an allocation to India, alongside other emerging markets, in our global models.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED