The CIO’s Take:

Fed predictably holds on rates

As policymakers at the Fed convened last week to make a decision on US rates, there was little doubt as to the Fed’s April/May action, with CME Group data putting the likelihood of “no change” at 99.9% the day before Wednesday’s announcement. In line with expectations, the FOMC chose to hold rates steady at a 23-year high, its sixth straight meeting without an adjustment. As usual, though, markets focused on officials’ messaging around the decision and their outlook for future policy moves, and that turned out to be a bit more optimistic than many had expected.

Official statement highlights inflation risk

Despite the official press release always being a bit dry, this meeting there were at least a couple interesting tweaks. After March’s reference to the Fed’s dual mandate of low inflation and full employment “moving into” better balance, this time we got a note that those objectives “have moved toward better balance over the past year.” That sounds like progress. On the other hand, the release noted that “In recent months, there has been a lack of further progress toward the committee’s 2% inflation objective”—seemingly a more dour assessment.

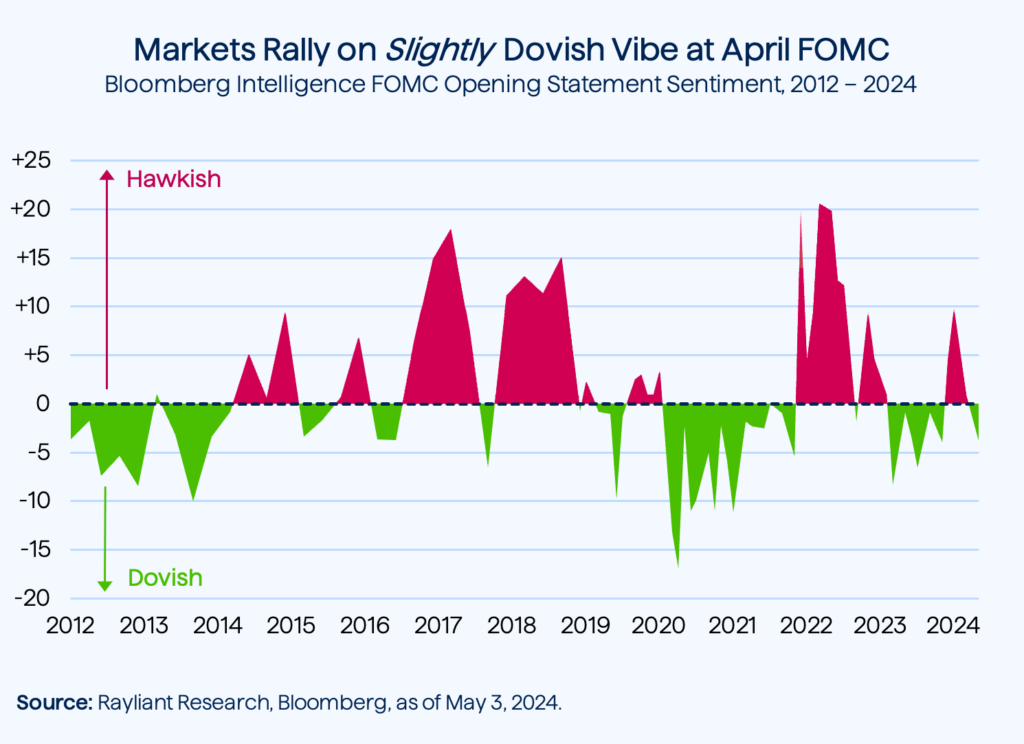

Powell’s comments more heartening

More hope came from Powell’s comments in the post-meeting press conference. Given our relatively hawkish read on the data, we sympathize with the Fed chair’s acknowledgement that his confidence in disinflation is “lower than it was” on the back of bad news on prices in the first quarter. That said, Powell also noted he sees it as “unlikely that the next policy rate move will be a hike” and textual analysis of his speech via Bloomberg confirms his overall tone moved modestly dovish after a gloomier March meeting (see below).

Markets reacted positively to the FOMC result. Stocks rose and Treasury yields declined, while the dollar weakened. Traders still don’t believe a June cut is in the cards, with futures prices implying just an 8% chance of easing by mid-year, though the perceived likelihood of a September cut ended the week at roughly 2-in-3 odds after entering May as less than an even-money proposition—and that despite Powell not tipping the possibility of rates coming down this year, as he had at past post-meeting pressers.

Biggest surprise was slower QT

In fact, we suspect it ultimately wasn’t Powell’s comments on rate cuts that moved traders’ opinions so much as action on the other important decision to come out of this FOMC: how quickly the Fed will reduce its balance sheet through its quantitative tightening (QT) policy. On that front, the Fed gave markets much better news, suggesting it wouldn’t run bonds off its balance sheet as quickly going forward. That “tapering” of QT is coming sooner than expected, suggesting the Fed would rather ease than tighten at this point.

Employment costs surge in Q1

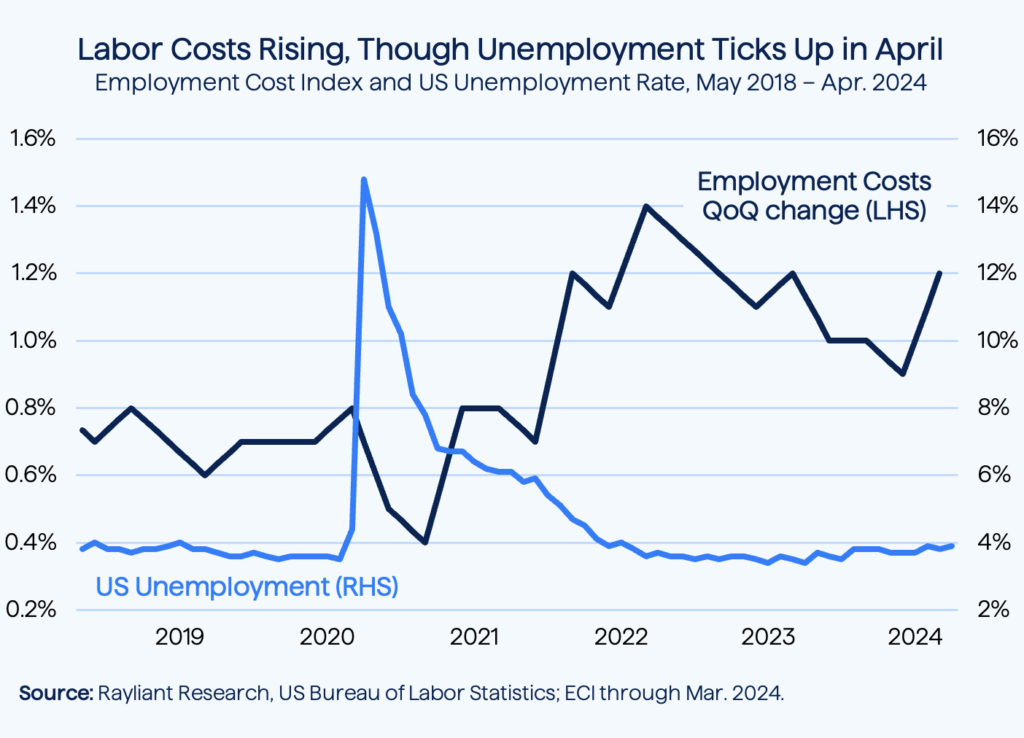

One of the things Fed officials were undoubtedly discussing early last week was their concern over pressure from labor costs on US inflation. On Tuesday, a crucial piece of data came through from the US Bureau of Labor Statistics: the Employment Cost Index (ECI), a quarterly check-in on growth in US firms’ total employee compensation, including all wages and benefits. In the first three months of 2024, employment costs tallied a 1.2% rise (see below), way ahead of economists’ forecast for a 0.9% increase, and also considerably higher than the 0.9% gain posted the prior quarter.

Fed fears a wage-price spiral

The Fed’s principal concern is that rising employment costs might contribute to a so-called “wage-price spiral,” whereby higher pay boosts consumers’ demand, leading prices to rise, which in turn means workers need higher pay. Tuesday’s hot reading on the ECI will reinforce the Fed’s desire to see more progress on contributors to inflation before thinking about rate cuts. As such, it wasn’t surprising that US equity futures traded down in response to the report.

Cool April BLS report confuses matters

In the wake of that sharp beat on employment costs, even more attention was focused on a second piece of labor market data out Friday of last week: April’s monthly jobs report, also from the BLS, with its closely watched nonfarm payrolls. US firms added 175K jobs last month. That was well short of the 240K new jobs analysts were expecting—a big negative surprise that serves to muddy the waters on rate cut expectations. Unemployment, also depicted above, rose from 3.8% to 3.9% in April, a tick higher than analysts’ prediction of no change.

A glimmer of hope, but need more data

So, what should we make of these mixed data on job market tightness? A rising ECI is good news for consumers and the economy, but bad news for inflation—and, hence, prospects the Fed will ease soon. Friday’s jobs report was great news, with labor market softening indicating rate hikes doing their job and perhaps getting the Fed closer to comfortable cutting rates. The latter data point is encouraging, for sure. But it is just that: a single data point. We imagine the Fed will need to see a clear trend emerge before getting serious about easing.

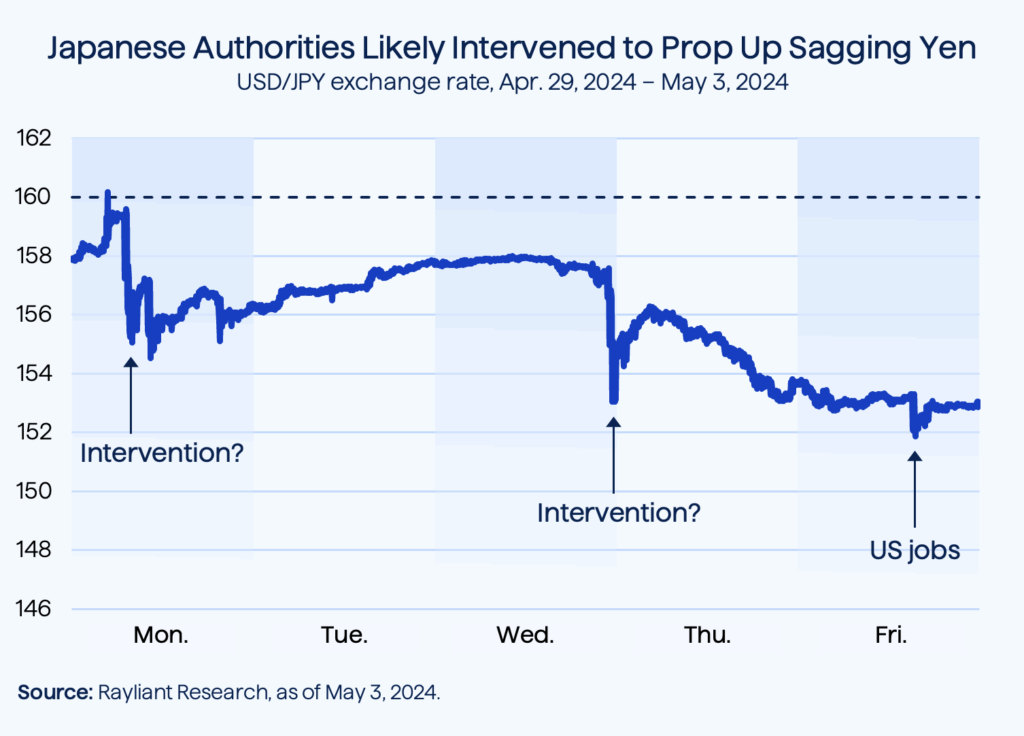

Government likely steps in to buoy yen

We have previously discussed in Perspectives what we see as the strong merits of Japanese stocks and, indeed, we recently added weight to the country’s market in our asset allocation models. One question that arises for foreign investors considering putting money to work in Japan is: To hedge, or not to hedge? We’re talking about currency risk. Early last week, with US yields surging on fears of “higher-for-longer” ahead of the FOMC and Japanese rates still near zero, the yen crossed a psychologically important 160/dollar mark for the first time in 34 years (see below).

What happened next is technically still up for debate. It’s clear from the plot above that the yen abruptly strengthened immediately after it breached the 160 level. That happened again near the end of Wednesday’s trading, after the currency had weakened progressively since Tuesday. Most market observers believe those two dips in the chart were interventions by Japan’s Ministry of Finance (MOF), ordering dollar sales. Analysis of the Bank of Japan’s accounts seem to confirm those suspicions, though the MoF refused to comment.

Japan’s MoF keeps traders guessing

Authorities have reason to be tight-lipped. Data from the US Commodity Futures Trading Commission (CFTC) show the yen as the most bet-against of all major currencies, with traders expressing an extremely bearish opinion on the Japanese currency. While traders are likely to infer the 160 mark has been designated as a line to defend against speculators, the MoF has an incentive to keep the market guessing. Finance Minister Shunichi Suzuki did confirm that policymakers would intervene to combat “excessive currency moves.”

Implications for investors in Japan

What does this mean for investors? For one thing, interventions like this make speculators trading against the yen uneasy, and bears did rein in their record bets against the currency in the wake of last week’s moves. Policymakers’ defense of the yen also makes FX risk seem asymmetric, in our view, with more likelihood of appreciation going forward—a point in favor of our unhedged exposure to Japanese stocks. At some point, of course, the Fed will ease, and that will also be good for the yen. In that sense, Friday’s strong jobs report, seen as a downward blip at the far left of the chart above, could be a preview of what’s to come.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED