A number of highly visible defaults by Chinese state-owned enterprises (SOEs) have revived a common refrain: can you trust Chinese companies and the Chinese State?

Let us recap first these recent defaults. Yongcheng Coal and Electricity, a Henan provincial SOE, defaulted on US $152MM; it has outstanding debt of $7.6B. Huachen Automotive Group, a Liaoning provincial SOE famous for its BMW Joint Venture, defaulted on $150MM; it has $5.1B in total debt. Tsinghua Unigroup a central SOE and a subsidiary of Tsinghua University1 (China’s Harvard) defaulted on $198MM; it has outstanding debt of $8.0B.

Well-known SOEs missing debt payments makes for tantalizing headlines. The troubling news hit particularly hard because global investors have begun to pin their hopes on Chinese bonds as a solution to low global bond yields. Bloomberg media is already reporting falling investor demand for Chinese debt. Without context, hundreds of millions in delinquent payments with tens of billions facing credit downgrade should scare bond investors.

Of course, facts and figures without proper context rarely lead to sensible investment decisions. As they say in statistics: “figures don’t lie, but liars do figures.”

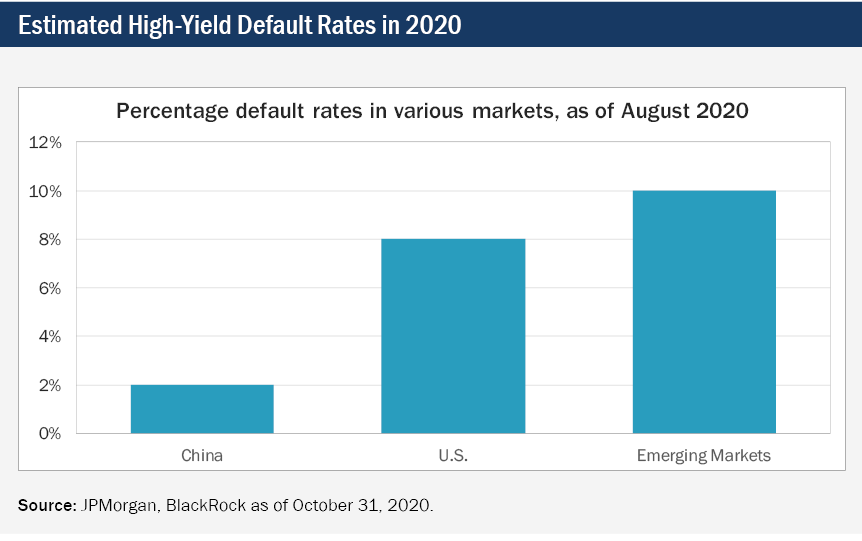

The Chinese debt market is US $13T in total size; the corporate debt segment, the majority of which are SOEs and quasi-SOEs, stands at $4T. Historically, the median investment grade Chinese corporate bond has experienced a default probability of 0.5%; whereas, the median US investment grade debt has experienced a 0.4% default rate. Similarly, historically, speculative grade corporate debts have a default rate of around 2%, while U.S. junk bonds defaulted at 3.3%. In the last 12 months, 110 corporate defaults were recorded in China, totaling $18B in delinquent debt. This represents a 20% decline in defaults versus the prior 12 months. The decline in default in 2020 was, in part, driven by an easy credit policy put into place by Beijing to help businesses cope with the impact of Covid-19. By comparison, U.S. issuer defaults have doubled. In addition, $360B in investment grade debts have already been downgraded to junk, with another 119 investment grade issues with $595B in debt are likely to be marked down.

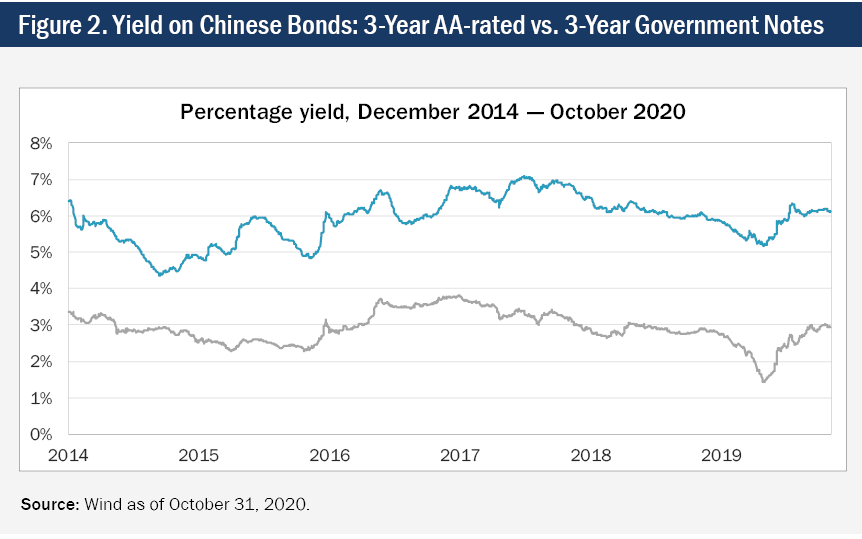

When benchmarked to global default rates and credit downgrades, the 2020 Chinese default experience hardly seems out of the ordinary. Indeed, Chinese corporate debt appears to be a fantastic deal with an average yield spread of nearly 3% on top of Chinese government bonds. By comparison, U.S. investment grade bonds average a yield spread of 1.4%. In fact, contrary to the headlines imploring caution and the waning demand, Chinese IG credit spreads have largely recovered after the initial blow out following Huachen Automotive’s default.

The complaint that underpins the souring view on Chinese credit seems driven by the realization that the Chinese government isn’t willing to underwrite poorly managed SOEs anymore. The easy arbitrage of lending money on fat spreads to debt-laden and inefficient SOEs that are implicitly backed by a government bailout—a so-called “free lunch”—is no more. Speculators, who have bought debt with little to no due diligence because of a naïve assumption that Beijing will always bail out SOEs—they have learnt an expensive lesson in risk management.

Shifting the blame to Beijing for not behaving as predicted hardly seems professional. To be clear, the bond investors, who have taken the brunt of the hit, are not global investors hoodwinked by Chinese issuers promising full government backing of their debt. Most of these bad debt holders are Chinese national and regional banks. The Chinese government is broadcasting as loudly and clearly as it knows how: Beijing will no longer be complicit in a racket where irresponsible lenders enable irresponsible borrowers. Taxpayers have been left holding the bag too many times while perpetrator faces real consequences for their poor behavior. This action by the Chinese government seems reasonable.

There are some clear implications from this shift:

Investors shouldn’t be surprised by this development. In fact, it is perfectly natural and predictable. Imagine mom and dad help start your career by co-signing your first car loan and lease. If you unfortunately lost employment due to the Covid pandemic, they will help make your loan and lease payments. But if begin racking up irresponsible credit card debt, trading up to nicer cars and apartments that you can’t afford, they will see that you are taking advantage of them. The only sensible path to save you from yourself would be to cut you off — announcing to your buddies and lenders that you are a bad credit risk. This is not different than what is happening between the Chinese government and certain SOEs. To be sure, Beijing will still lend a helping hand from time to time; but it will be judiciously offered to those firms facing a liquidity crush, not those who are perpetually mismanaged.

I hope it has not gone unnoticed that, in the West, investors have been critical of government bailouts for financial institutions, which were believed to be too big to fail, during the global financial crisis and the European debt crisis. The “central bank put” was viewed by many as contributing to irresponsible risk-taking by major banks as they ultimately shift risks to taxpayers while executives pocketed handsome bonuses for unproductive financial engineering and product pushing that fell grossly short of a fiduciary standard. The Chinese government is taking that advice to heart; Beijing is evolving as a wiser parent.

The losers from Beijing’s evolution are irresponsible lenders, unskilled equity investors, lazy credit rating agencies, and underqualified SOE management teams. As a result, in the long-run, a healthier investment grade and distressed credit market will emerge in China. Bond investors, with the right credit research skill, will benefit meaningfully from the resulting narrowing of investment grade spread. In parallel the high yield junk bond market will be deeper and more diverse as a large contingency of underperforming SOEs must necessarily offer higher interest rates to attract debt capital.

To conclude, recent developments should not be seen as China taking a step backward. Rather, they should be seen as Beijing taking a very measured step towards further financial market liberalization. Investors should celebrate the new investment opportunities and better societal outcome, even if their cheese did get moved.

1 Most investors have praised Yale’s allocation to private equity deals. However, most people are unaware that the top Chinese universities have all engaged aggressively in direct investments into private enterprises leveraging their brand and well as technology IP in addition to investment capital.

Subscribe to receive the latest Rayliant research, product updates, media and events.

Subscribe

Sign upIssued by Rayliant Investment Research d/b/a Rayliant Asset Management (“Rayliant”). Unless stated otherwise, all names, trademarks and logos used in this material are the intellectual property of Rayliant.

This document is for information purposes only. It is not a recommendation to buy or sell any financial instrument and should not be construed as an investment advice. Any securities, sectors or countries mentioned herein are for illustration purposes only. Investments involves risk. The value of your investments may fall as well as rise and you may not get back your initial investment. Performance data quoted represents past performance and is not indicative of future results. While reasonable care has been taken to ensure the accuracy of the information, Rayliant does not give any warranty or representation, expressed or implied, and expressly disclaims liability for any errors and omissions. Information and opinions may be subject to change without notice. Rayliant accepts no liability for any loss, indirect or consequential damages, arising from the use of or reliance on this document.

Hypothetical, back-tested performance results have many inherent limitations. Unlike the results shown in an actual performance record, hypothetical results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under- or over- compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical results in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any investment manager.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED