The CIO’s Take:

In the last few weeks, our risk-off orientation has paid off, with most US macro data reinforcing the Fed’s view that they’re making good progress on inflation, but not fast enough, while the economy continues to run strong enough that there’s scope for another hike and certainly no reason to bring rates down soon and risk prices reaccelerating. Such trends have culminated in a September pause by the FOMC, accompanied by enough hawkish language and forecasts from the Fed to shock markets into a view closer to the one we’ve held for a long time. With US stocks still trading at rich valuations, credit spreads still too tight for this stage in the cycle, and the UK and Europe appearing on the verge of stagflation, we don’t favor bold risk-taking at the moment. Instead, we’re underweight stocks, overall, underweight DM within equities, overweight EM—better valuations and well ahead of Western central banks on the path to easing—and prefer Treasuries to US corporate in fixed income space.

Fed holds rates, but messaging disappoints

Last Wednesday’s FOMC meeting delivered exactly what we expected: the Fed voted unanimously to hold interest rates steady in the current 22-year high range of 5.25-5.50%, but signaled we’re still far from easing. To that end, the Fed’s quarterly dot plot showed 12 of 19 committee members ready for one more hike this year and implied just 50 bps of cuts next year, down from 100 bps projected back in June. Based on the markets’ reaction, there were plenty of investors who did not anticipate the US central bank’s hawkish positioning, as two-year Treasuries hit a 17-year high of 5.2%, the dollar rose, and stocks sold off, with the S&P 500 experiencing its second-largest “Fed Day” decline so far this year.

Fed forecasts strong growth, gradual softening

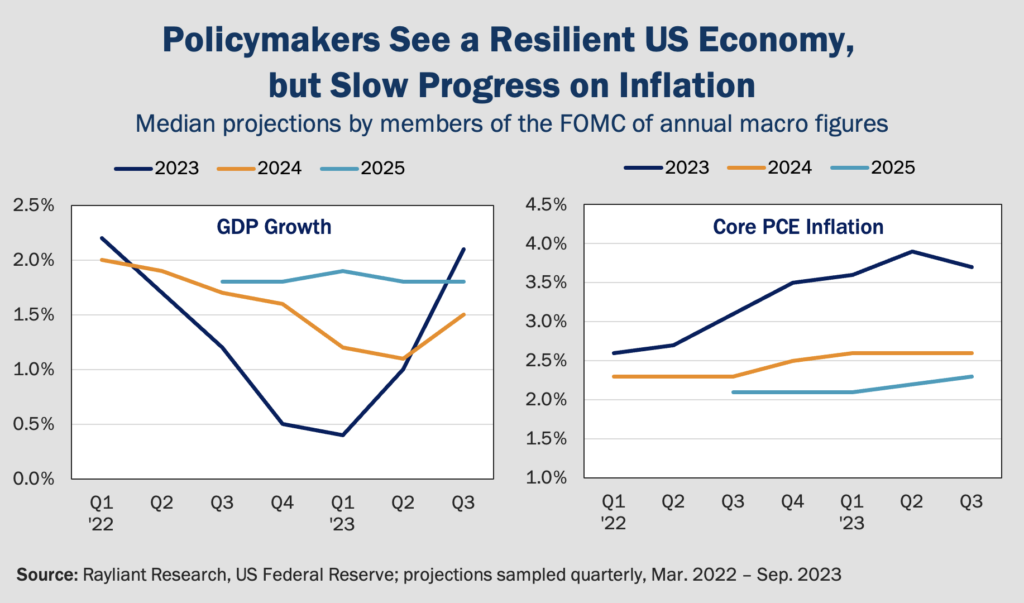

We find FOMC meetings around quarter end to be especially interesting because they come with loads of data and charts to help us unpack the group’s decision-making. Among the Fed’s quarterly economic forecasts, two plots nicely illustrate what’s motivating continued “higher-for-longer” thinking on the part of FOMC members. As we’ve often described in Perspectives, it’s really a combination of stronger-than-expected economic growth and slower-than-expected softening of inflation that’s motivating the Fed to err on the side of restrictive policy, which is exactly what the data show:

Noting that the Fed’s forecast of 2023 GDP has jumped a full 1.5% since March, while forecasts of 2023 core inflation have barely budged—and won’t likely come down to the bank’s 2% target until 2026—it’s easy to see why FOMC members aren’t ready to rule out another hike. Indeed, that economic robustness depicted in the first chart above not only helps to explain why inflation has been so sticky, it also suggests there’s some cushion for prolonged tightness in credit conditions and, possibly, additional rate increases if the second chart evolves unfavorably in coming months.

Soft landing by no means guaranteed

The caveat, naturally, is that nobody really knows how these charts will look at the next quarterly update. Powell himself acknowledged looming challenges to a soft landing for the US economy in his commentary last week, citing risks ranging from an autoworker strike and escalating oil prices to recommencing student loan payments and the prospect of a government closure. Similarly, the Fed dot plot isn’t etched in stone: it undoubtedly sits in an Excel spreadsheet somewhere, ready for future edits as conditions change. At the end of 2021, for example, the median FOMC member pegged rates closing out 2022 in the 0.75-1.00% target range; a year later the actual range was 4.25-4.50%. Given such uncertainty, along with what we see as excessive optimism reflected in asset prices—from the equity risk premium to high yield credit spreads—we feel better with a more conservative tactical footing, underweight stocks and overweight low-duration fixed income, a stance we see as less susceptible to negative surprises like flagging growth or an even higher peak policy rate.

Split decision at UK central bank

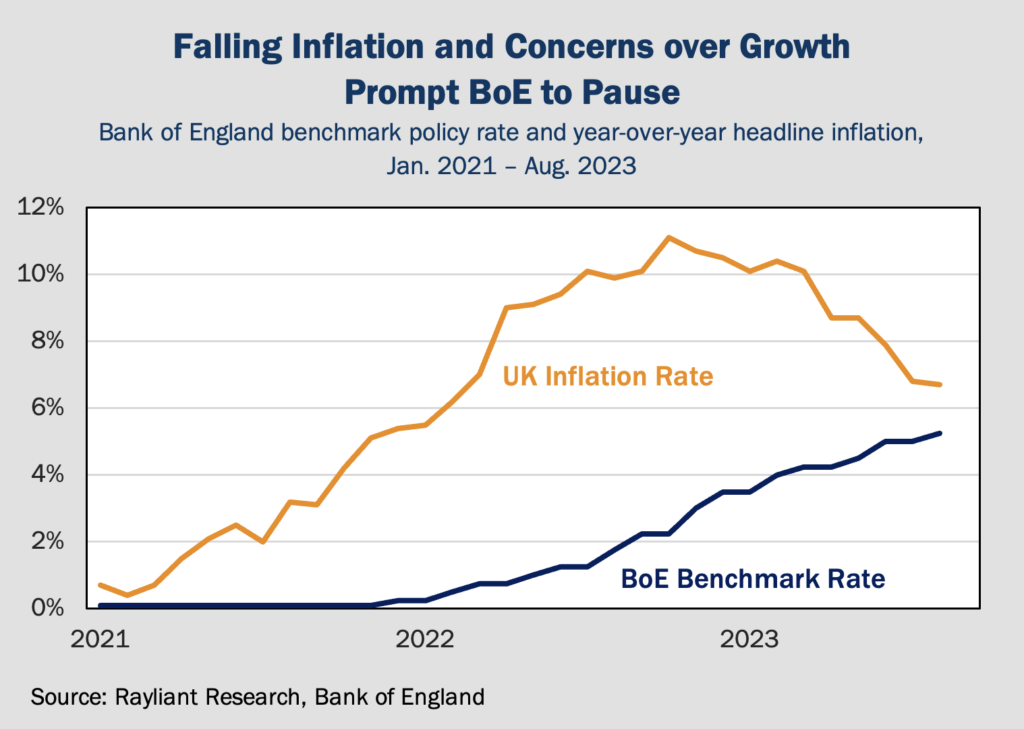

Meanwhile across the pond, the Bank of England (BoE) also had a decision to make, with its Monetary Policy Committee (MPC) meeting last Thursday. In its case, the outcome was far from unanimous, splitting five to four, with the majority voting to hold the UK central bank’s key policy rate at 5.25% for September. That move was the first break in the bank’s most aggressive sequence of hikes in over 30 year, and came after August inflation data showed a significant drop across headline, core, and service metrics (see below), with the labor market softening more than expected recently, leading policymakers to prioritize the risk of overtightening into a recession versus the risk of prices heating up again.

Gilts, pound unattractive amidst stagflation

Ultimately, much as we described in the case of the Eurozone last week—and despite a positive surprise in Q2 GDP reported last month—conditions in the UK look stagflationary to us, and we are inclined to bet against UK gilts and the British pound. Sensing a peak Bank Rate as the BoE shifts its attention to concerns over growth, the pound has weakened in recent months, ending last Friday at its lowest level against the dollar since March. In the face of traders’ inference that hikes are over and easing could come soon, the MPC attempted to create some flexibility for November and beyond, echoing previous statements indicating that rates would remain “high enough for long enough.” This aligns with other major central banks’ stance, and suggests to us we could be headed for a prolonged period of elevated rates.

Final hike usually good news for IG bonds

With inflation showing good progress in the US, just as rather bleak economic forecasts fall over Europe and the UK, many pundits see a good chance that the Fed, the BoE, and the ECB are all at or near peak policy rates. Historically, a cresting monetary policy cycle has been good for investment grade (IG) corporate bonds. In the case of the US, for instance, there’s been strong alignment over the past four decades between the final Fed Funds rate hike of a given cycle and highest yield on US aggregate corporate bonds, with peak rates often overlapping in the same month. That synchronization is fairly intuitive, as we either have a soft landing—where bonds benefit from decreased inflation and less rate volatility—or we fall victim to overtightening and investors flock to investment grade US bonds for safety amidst a downturn in growth, pushing prices higher.

COVID recession helped with ‘BBB Bubble’

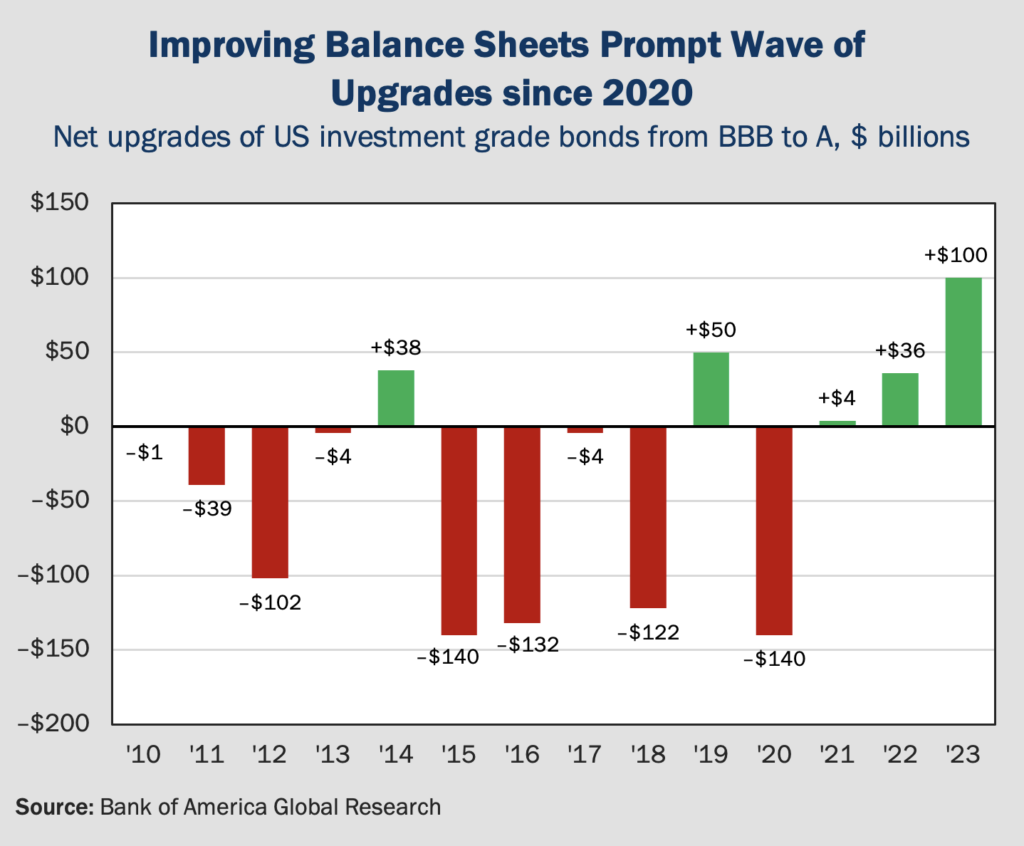

One criticism of popular IG corporate bond indices in the last few years has been a ballooning of BBB-rated companies—firms just one notch above junk—potentially making seemingly safe bond investments riskier than they appear. Recent research by Bank of America suggests this may be less problematic after a surprising wave of BBB upgrades in previously downgraded firms since the pandemic (see below). What gives?

The 2020 COVID recession certainly saw its fair share of financial distress, particularly within the high yield bond market, where default rates spiked to between 4-6%—though plenty of A-rated companies got downgraded, as well, as can be seen in the chart above. As the pandemic played out, however, attrition among weak firms ultimately boosted the quality of those that survived. According to BofA’s research, that winnowing of junk companies, combined with improving quality of companies’ balance sheets ahead of a long-awaited US recession in the current cycle, appears to have made investment grade safer in the process.

As Fed slows down, conditions still daunting

Of course, “safe” is a relative term and, in financial markets, everything depends on the price one pays. Along those lines, and as we mentioned above, credit spreads are a little too tight today: far from pricing, in our view, a very realistic chance the US economy comes in for a hard landing after all. For that reason, we still see Treasuries as significantly more attractive, and would definitely steer clear of high yield maturing post-2023. As Jay Powell reiterated last week, “the full effects of tightening have yet to be felt,” and companies already sporting a junk rating may have a difficult time navigating higher rates we fear may be with us for a while longer.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED