The CIO’s Take:

The October 7th attack on Israel by the terrorist group Hamas stoked investors’ anxiety going into last week. That said, despite a flight-to-safety which saw the US dollar, Treasuries, and gold catch a bid, the impact on global markets has so far been fairly minimal. Key takeaways for us? First and foremost: Don’t panic! In the short run, shifts in sentiment can stir up plenty of volatility, but geopolitical conflict has often rewarded those keeping an even keel—and indeed, moments of fear can even be a buying opportunity. By the same token, we don’t see the bump in Treasury prices due to their safe haven status having legs. Ultimately, we expect the greatest impact of war in the Middle East is adding to our list another serious upside risk for inflation, especially if the conflict expands and oil prices rally. Based on last week’s report of September CPI, there’s still nothing in the data to suggest anything but high(er)-for-longer to us, and we maintain a defensive stance, underweight stocks and overweight low-duration fixed income, with a focus on quality.

Hamas attack takes Israel by surprise

Just over a week ago, on October 7th, the terrorist group Hamas launched a surprise barrage of some 3,000 rockets at Israel from the Gaza Strip and simultaneously breached the border between Gaza and Israel, attacking military bases and massacring civilians, leaving over 1,400 dead in what is being described as “Israel’s 9/11.” In the week since, Israeli counter attacks caused considerable damage within Gaza and warnings of a full-scale ground invasion by hundreds of thousands of Israeli reservists have displaced one million or more Palestinians. In addition to the humanitarian crisis unfolding as this conflict escalates, war between Israel and Hamas threatens an already fragile global economy plagued with plenty of geopolitical challenges outside the Middle East. Here we examine some of the considerations we feel should be on the minds of investors confronting this fast-developing story.

Israeli stocks plunge, global flight to safety

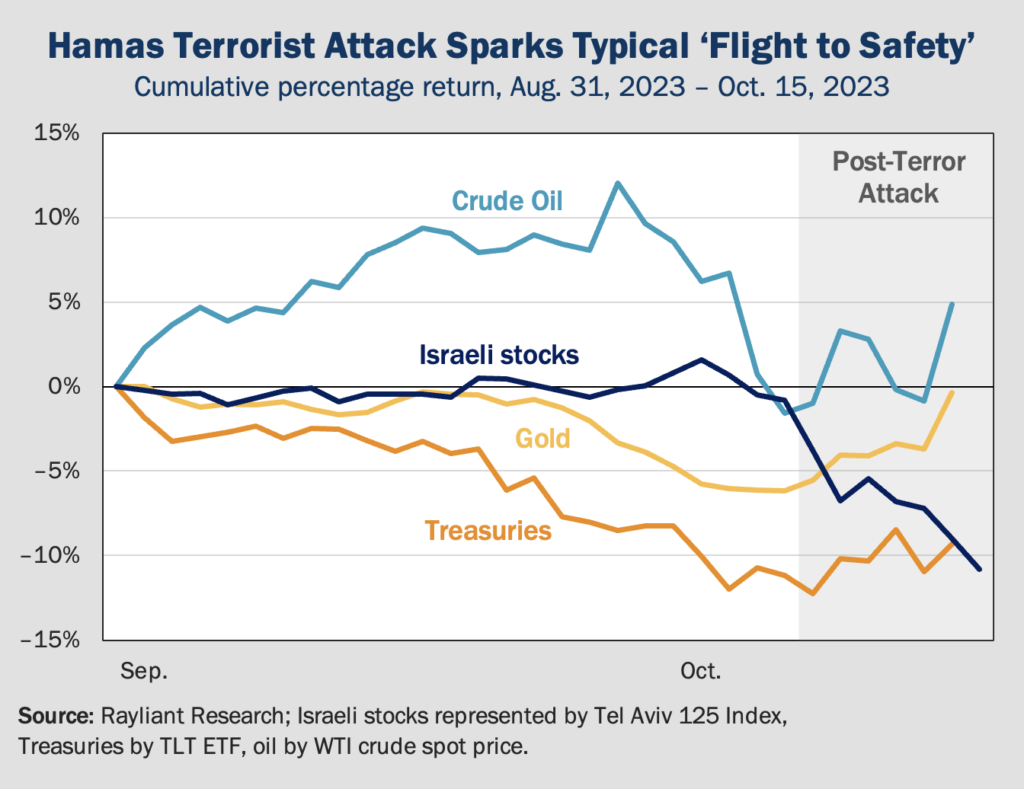

Israel’s equity market trades on Sundays, and local stocks opened significantly lower on October 8th, following the attacks, with the Tel Aviv 125 Index losing almost 7% by the close. The severity of the situation put global investors on edge prior to stocks in the US and elsewhere opening trading the next day, though the S&P 500 managed to claw out of the red by Monday afternoon, closing modestly higher, as did the MSCI World Index. Although we didn’t expect a large drawdown in risk assets, we were somewhat surprised not to see sentiment negative on balance, though one might chalk that up to “bad news is good news” type thinking on the part of global investors. It was not surprising to us, of course, that the brewing crisis did trigger a “flight to safety,” as Treasuries, gold, and the US dollar all rallied in the aftermath of the attack, while the prospect of disruptions to an already tight energy market sent oil higher over the last week (see chart below).

Escalation would boost oil, inflation

We expect investors’ reactionary push into safe haven assets like Treasuries to be relatively short-lived, especially the mini-rally in US government bonds, an asset class which has a number of things working against it in the medium term, as we’ve discussed at length in prior weeks’ Perspectives. Rather, we see the most important implications of war in the Middle East as centering on the conflict’s potential to boost inflation and drag on growth. Along those lines, the possibility of a spike in oil prices is obviously front of mind, given the involvement of Iran—a nation responsible for funding Hamas and which Israel has accused of directly supporting the attack—as well as Saudi Arabia, whose recent progress in normalizing relations with Israel many suspect to have motivated Hamas’ timing of the strike. As can be seen in the chart above, despite oil’s price popping in the last few days, it has yet to recover to levels reached at the end of September, leaving the commodity plenty of room to run if energy market stress intensifies. We note that the Fed has highlighted energy costs as a potential upside risk to inflation, underscoring the potential for geopolitical shocks to complicate inflation and central bank policy in the months ahead.

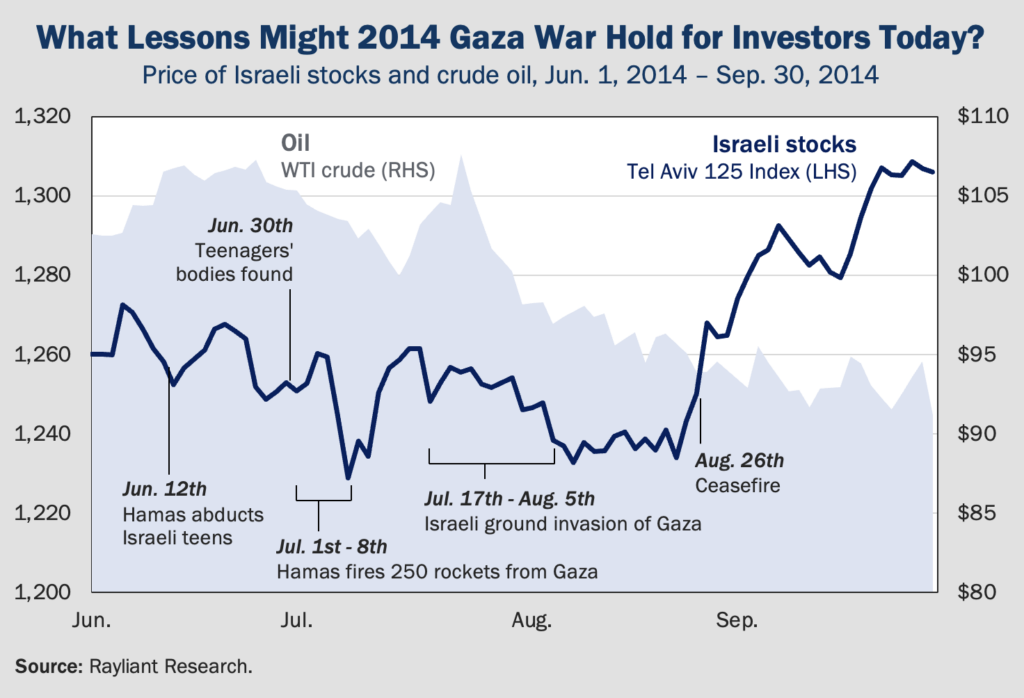

Investors should hope for replay of 2014

Of course, we can’t fully discount the possibility that events in Israel and Gaza impose a more severe impact on global financial markets: if fighting spills into Lebanon and Syria, for example, where Iran also backs militants, or if Iran is drawn directly into the fray. That said, there is reason to be hopeful, notwithstanding the intolerable human cost of the conflict, that its macroeconomic effects might at least be fairly contained. Indeed, the last time Israel mounted a ground invasion of Gaza, in response to Hamas’ abduction and slaying of three Israeli teenagers and a barrage of hundreds of rockets, we find the effects of the conflict were quite local and relatively brief, as the plot below depicts.

Back in 2014, stocks in Tel Aviv sold off in days following rocket attacks on Israel and oil jumped by $7/barrel around the start of Israel’s ground operations in Gaza. By the end of August, however, a ceasefire sent Israeli stocks soaring, while oil had slumped to below its pre-conflict price level. While it’s not yet clear whether the conflict that began this October will escalate and deliver a greater shock to the world economy—and in the most negative scenarios, Bloomberg economists estimate oil could surge to $150/barrel—we believe the simple case study above at least illustrates how short-term negative sentiment can create strong buying opportunities for investors with a longer-term perspective and a focus on fundamentals. We advise clients not to panic, but we do maintain our cautious footing, adding an expansion of Middle East hostilities to the long list of challenges confronting what we see as a vulnerable global macroeconomy.

Progress on inflation slows in Q3

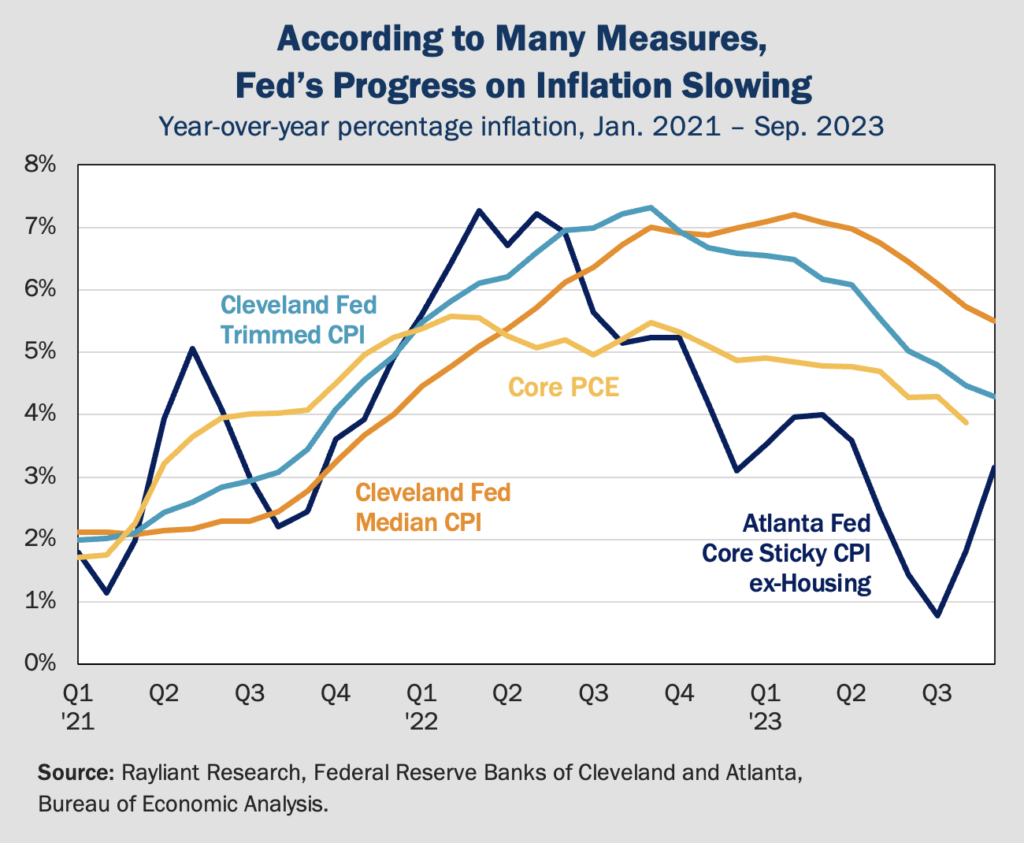

According to last Thursday’s US Bureau of Labor Statistics (BLS) release of data on September CPI, the deceleration observed in core inflation is tapering off. On the one hand, last month’s headline CPI saw a 0.4% rise from August, which was just slightly above expectations for a 0.3% increase; excluding food and energy prices, core inflation matched the projected month-over-month estimate of a 0.3% increase. On the other hand, core services saw a strong upswing, leaping by 0.6% versus August’s 0.4% rise and notching its biggest increase since February. Annualizing these numbers, headline CPI comes in at 3.7%, while core CPI sits at 4.1%—the slowest core inflation reading in two years, but still considerably higher than the Fed’s 2% target. A range of more sophisticated measures of inflation from the Fed also give the impression the central bank’s progress in its war on rising prices might be slowing, reinforcing the “higher-for-longer” sentiment taking hold over recent weeks:

Soft landing hopes belie Fed’s difficult position

In many ways, the inflation picture presented above is especially challenging for the Fed. That’s because while it’s clear inflation has softened since last summer, rising prices also clearly haven’t cooled enough for chairman Powell and his colleagues to declare victory just yet. Meanwhile, the easy gains have likely already been won and a host of upside risks to rising prices—including the conflict between Israel and Hamas detailed above—makes the stakes that much higher for a US central bank intent on avoiding stopping too soon and allowing inflation to surge back and become more ingrained. On top of all that, we expect the lagged impact of the 525 bps of hikes that have already happened to increasingly contribute to a dampening of economic activity, loosening the labor market and putting pressure on US consumers. Those additional disinflationary forces work in the Fed’s favor to combat inflation, but obviously work against the prospect of a soft landing. While a recent trend toward risk-off suggests these truths are finally sinking in, we remain defensive going into the last couple months of data and FOMC meetings of the year.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED