The CIO’s Take:

In a relatively quiet week on the macro data front—and with financial reaction to the conflict between Israel and Hamas quickly fading—rising yields remained a driving force in equities’ continued sell-off. One report out last week, US retail sales for September, seemed positive on the face of it, coming in well higher than consensus estimates, though we worry that (a) any data indicating robust US growth will only embolden the Fed to maintain its restrictive policy course and (b) while there’s always risk in underestimating the ability of American consumers to spend, the difference between “willingness” and “ability” to consume will be increasingly apparent as credit card balances stretch to their limits and the impact of already high rates continues rippling through the economy. As such, we remain underweight and opportunistic within US equities and overweight fixed income. Where we are investing in stocks, we’re highly active and looking for bargains, including in Japan and other international markets. As far as bonds go, nothing about last week changes our view that it’s hard to beat short-term Treasuries at the moment.

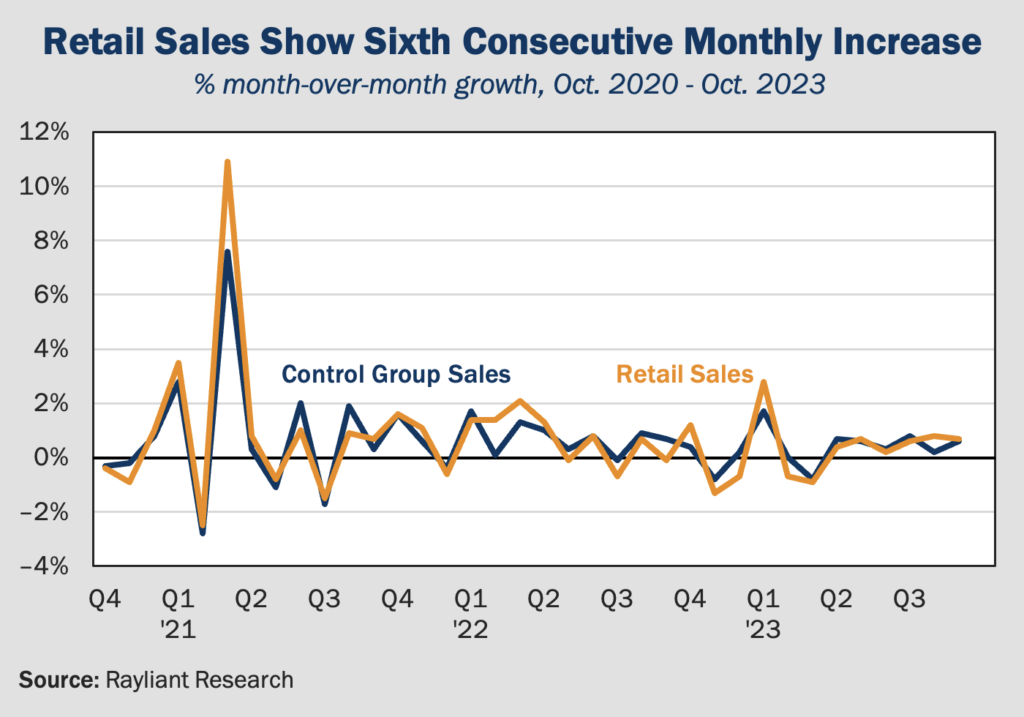

September retail sales surprisingly strong

Data released by the US Commerce Department last Tuesday revealed a surge in consumer spending as Q3 came to an end, showing once again the seemingly indomitable strength of the US consumer. The Retail Sales Report saw spending shoot up by 0.7% in September (see plot below))—more than double the consensus forecast—while August’s total saw an upward revision to 0.8% growth. Beyond the headline numbers, many traders look at so-called “control group sales,” a key building block for calculating GDP, which measures everything except car dealers, building materials, gas stations, office supplies, mobile homes, and tobacco. That figure also saw a 0.6% month-over-month increase, surpassing expectations. September’s increase in sales was notably broad-based, with 8 of 13 categories examined showing growth. It was enough to prompt economists at the Atlanta Fed to bump their third-quarter GDPNow growth estimate up by 25 bps to 5.4%.

Belt tightening begins in lower-income households

While the last few months in the plot above seem to reinforce calls for a soft landing, below the surface we’ve seen nuanced shifts in consumer spending behaviors that concern us. Insights from executives at US retail firms indicate that amidst escalating food and energy prices, much of the real growth in spending has actually been seen within the experiential/service economy and among households in the higher income bracket. That has served to partially mask a retrenchment in spending among lower-income consumers. This budget-conscious behavior is, of course, great news for low-price retailers like Costco, which reported higher revenues and net income last month, and Walmart, which saw an uptick in grocery market share among wealthier consumers, and upped its sales projections back in August. Both firms have seen their stocks rise in 2023.

Consumer sentiment slips in September

Interestingly, in releasing its numbers, Costco also noted a softening in high-value discretionary purchases, a trend we’ve been watching as consumers’ budgets become increasingly strained. One of the principal drivers of big-ticket purchases is consumer confidence, which the Conference Board saw sliding from 108.7 in August to 103 in September, its sharpest monthly decline in a year; economists had only expected the index to slip to 105. The survey’s Expectations Index, measuring consumers’ short-term outlook on income, business, and labor market conditions, saw an even more concerning drop, from 83.3 in August to 73.7 in September. A score below 80 is typically thought to signal an impending recession.

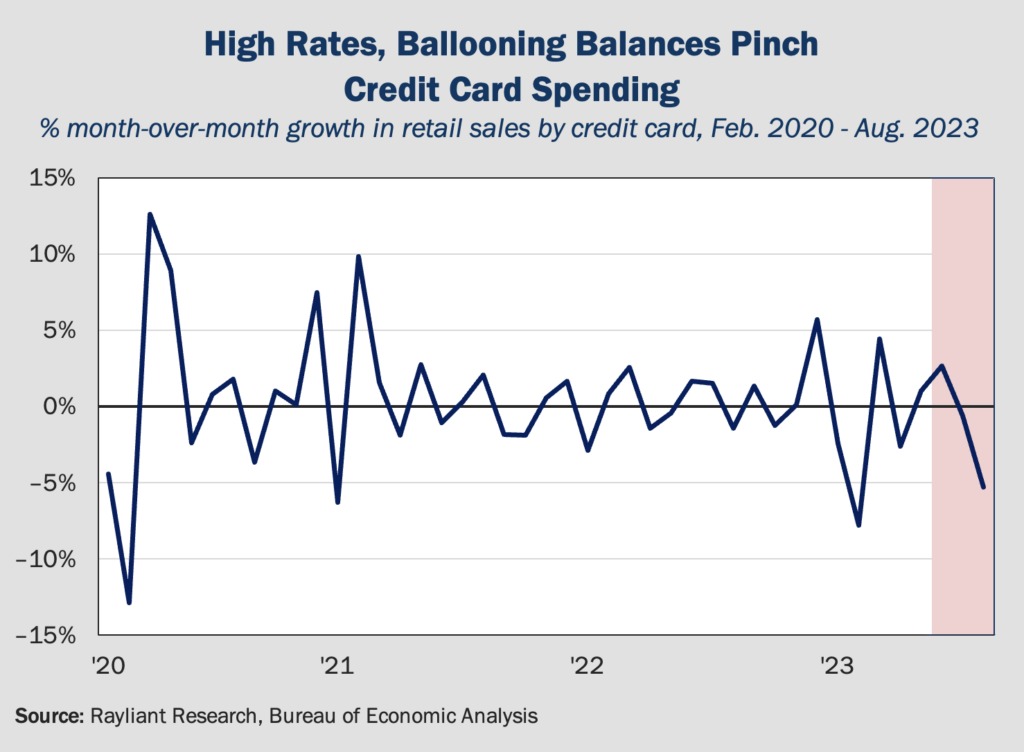

Strain on borrowers a risk to soft landing

We can understand the fears beginning to creep into consumers’ thinking, as pandemic savings begin to bottom out and credit card balances swell. Indeed, the latest data from the US Federal Reserve show credit card interest rates reached a new high of 22% in August, versus 16% the year prior, while consumer credit reporting agency TransUnion has seen borrowers securing loans from 2021 to early 2023 now struggling to maintain their repayment schedules. All of this is beginning to show up in spending, as well, with Citi reporting an 11% decline in credit card spending at retailers in September, a trend confirmed in data from the US Bureau of Economic Analysis through August (see below). Such numbers support what we see as a major risk to the soft landing narrative: the Fed continues tightening into seemingly strong US growth, just as consumer borrowing peters out under the pressure of excessively high interest rates—a classic “overshoot” scenario.

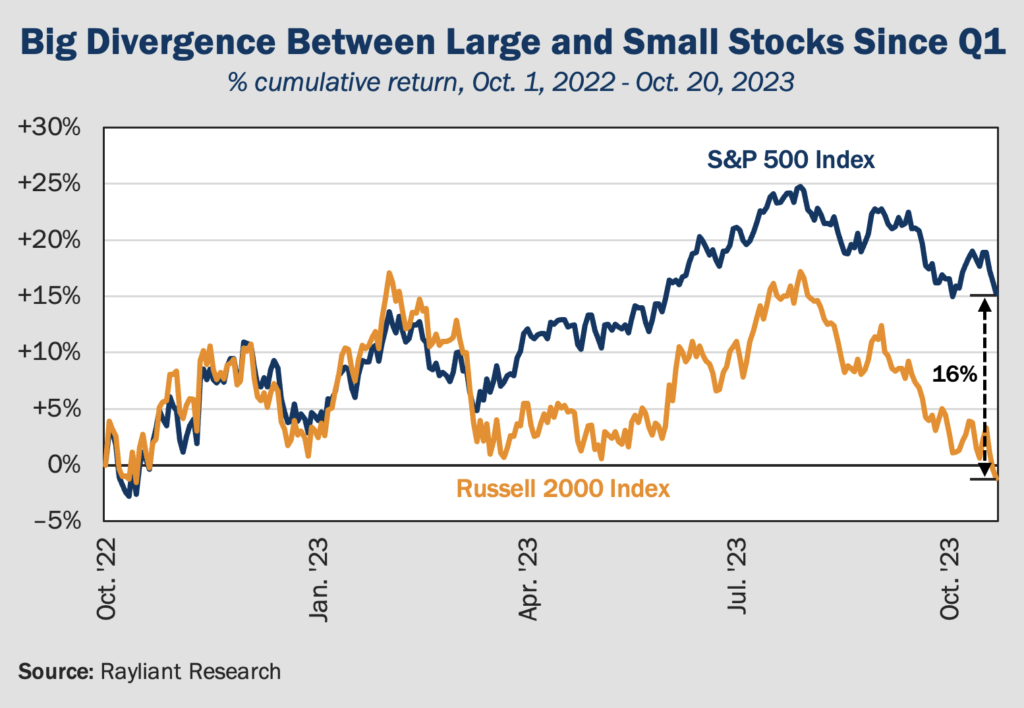

Traditional size effect flipped in 2023

Investors familiar with the “size effect,” a phenomenon by which small-cap stocks have often bested the performance of their large-cap counterparts, are scratching their heads in 2023. That’s because, despite a market rally this year—conditions under which smaller companies’ stocks typically surge—the size effect has seemed to operate in reverse, with small-caps significantly underperforming large-caps (see below). For investors hoping to capitalize on a soft landing by placing bets on smaller firms that might be more heavily geared toward a strong economy, this trend has produced a disappointing outcome, even as optimism rallied over the last six months that the Fed might bring inflation down without impairing growth.

Small-cap weakness a sign of macro stress

One straightforward explanation for the divergence between small-caps and large-caps could actually be revealing about some of the risks we’ve often highlighted in our Perspectives over the last year. It turns out that within academic circles, one of the most widely accepted explanations for the seemingly anomalous size effect is that the historical outperformance of small stocks isn’t some edge that small-cap investors earn: it’s merely compensation for an extra risk that small-cap investors are taking. These researchers—including famed economist Euguene Fama, a recent winner of the Nobel, and his long-time co-author Kenneth French—note that small firms often operate with less robust balance sheets and greater levels of debt, leading them to suffer more distress in recessions. If that observation is right, then it stands to reason the Fed’s campaign of aggressive rate hikes would hurt small firms more. Likewise, signs of a downturn should be seen first in the broader set of small firms, making these small-cap underperformers a potential bellwether of macro stress ahead. To the extent investors dump tiny stocks in favor of mega-caps in a typical “flight-to-quality,” as tempting as it is to bet on a rebound for the size effect, we see risk in that approach amidst increasing uncertainty.

Yields in Japan climb toward BoJ’s upper bound

Since Kazuo Ueda assumed leadership of the Bank of Japan (BoJ) back in April, the market has been closely following the central bank’s approach to its 10-year yield target, with a significant divergence emerging between Japanese bond yields and those in other developed nations: a spread that has been especially pronounced as the US and European central banks take a more hawkish stance on inflation. At issue is Japan’s Yield Curve Control (YCC) protocol, adopted in September 2016 to combat deflation and spur growth. YCC originally set the long-term 10-year yield target at 0%, with a band of ±50 bps around that target. Earlier this year, in July, the bank implemented new policies effectively relaxing the upper bound on 10-year yields to 1%, and yields have steadily risen since then, approaching a test of the revised upper bound, and prompting speculation the BoJ may altogether scrap YCC (see below).

BoJ wavers as market bets on policy shift

Despite the market’s apparent bet that it might cave, the BoJ has been quite consistent in its messaging that it has no intention to abandon controls in long-term yields. One factor giving traders confidence changes to Japan’s monetary policy could be on the horizon is the optimistic picture painted by recent CPI data, closing in on the bank’s 2% inflation target, which would mark a major turning point in the country’s struggle against deflation—and, many hope, a return to growth for one of the world’s largest economies, suffering a decades-long stretch of stagnation after its bubble burst in 1991. On the flipside, it may be memories of that painful lesson prompting the BoJ to take a complete overhaul of YCC more slowly, as economists in Japan worry tightening now might expose emerging growth to the drag of declining real wages and tepid consumer spending.

Pivot on YCC would bring big opportunities

We tend to believe the market is right and Japan’s central bank will find it difficult not to continue relaxing controls and allowing conditions to tighten as the government takes a victory lap on hitting its inflation target. Exiting YCC entails a number of challenges, however, as the BoJ tries to unwind over a decade of extreme interventions in its financial markets. For one thing, the bank has extensive holdings of securities, including over half of Japanese government bonds and a significant portion of locally listed ETFs, liquidation of which could be disruptive. Should yields rise, we would also expect Japanese investors, many of whom have been seeking returns abroad, to pivot back to the domestic market, creating new demand for local securities and an FX tailwind for yen-denominated assets. Despite rising rates being generally bad for equities, we see improving economic conditions in Japan, resurgent domestic investor sentiment, and a positive outlook for the yen as creating some compelling opportunities for investors in Japanese stocks who take an active approach like ours.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED