The CIO’s Take: The Fed did what pretty much everyone expected they would last Wednesday and maintained a pause on hikes. Although the market moved quickly to price the probability of a December hike at less than 5%, we believe the Fed is true to its word in balancing over-hawkishness against the risk of under-tightening, and could easily increase rates again if inflation data begin moving in the wrong direction. Regardless, it’s hard to imagine rates come down quickly, unless the US economy weakens significantly from its current position (e.g., capable of delivering 4.9% GDP growth in Q3). Unfortunately for risk assets, the higher rates stay at these levels, the more impact we’re going to see. Those effects were on display in US firm’s quarterly earnings, which gave way to average stock price declines, even for companies that beat on earnings, reflecting how disconnected valuations are from fundamentals. As such, we remain selective when it comes to stocks, and generally prefer short-term Treasuries.

Q3 earnings deal a blow to mega-caps

We’re once again in the midst of earnings season, and it has been a reality check for optimists around the “Magnificent 7” stocks (mega-caps including Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla), which have accounted for so much of the S&P 500’s stellar performance over prior quarters. The earnings themselves haven’t been particularly dismal—as of the end of October, Microsoft, Alphabet, Meta, and Amazon had all beat on both the top and bottom lines—but compared to investors’ amplified expectations, there was clearly major disappointment in reports so far, with those Magnificent 7 stocks that have already reported down an average of 12%, post announcement. The same went for the broader market, as stocks beating on EPS as of the end of October were trading -1% lower on average after reporting, according to FactSet. It has been even worse to report a miss, with the average stock posting lower-than-expected EPS falling -5.2% on average.

Effects of rate hikes showing in results

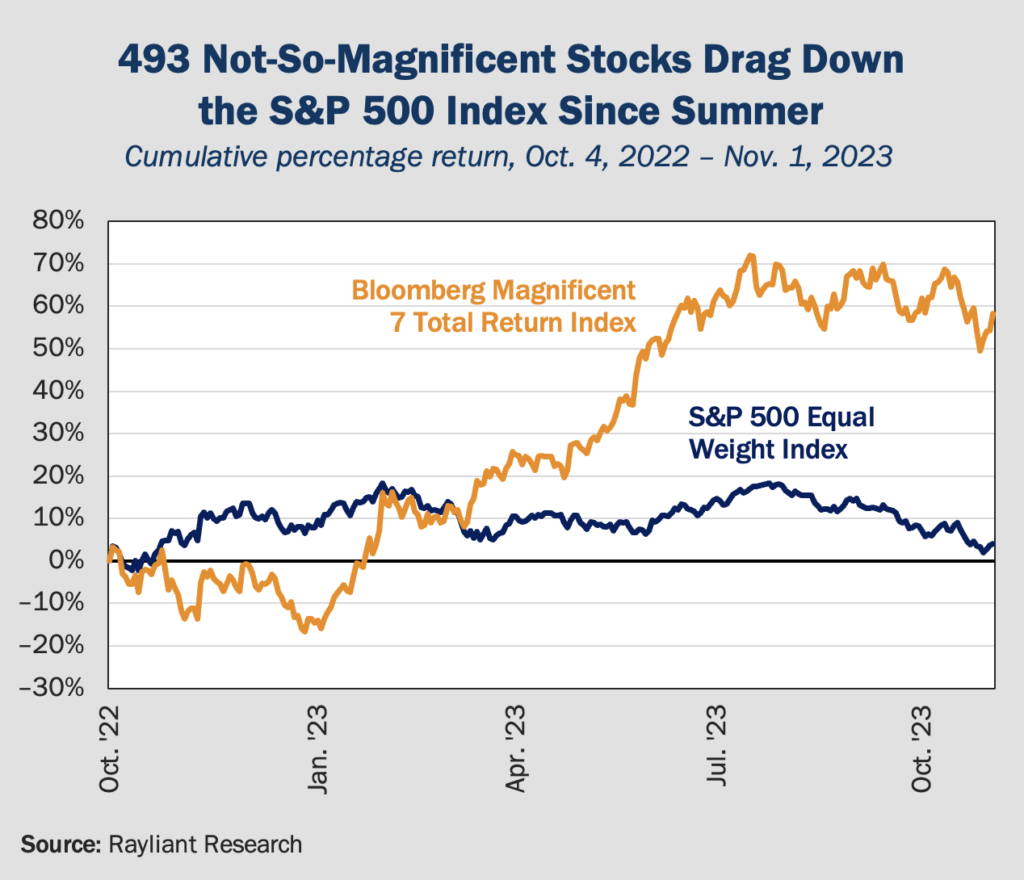

Alphabet saw its shares plunge almost 10% after reporting Q3 results, their worst daily return since March 2020, as profits in cloud computing—an area where we’ve heard much talk of belt-tightening—came in lower than what the Street was expecting. Meta, likewise, warned of reduced advertising spend, as rising costs, including those directly linked to an aggressive ratcheting up of interest rates over the last two years, see companies trying to cut back on things like marketing expenses. All of this evokes quite a different image than the AI hype that led US stocks, especially the Magnificent 7, on a feverish rally in the first half of 2023. Even excitement over transformational changes in artificial intelligence seems on the wane, with ChatGPT-related queries well off highs hit earlier this year, according to Google Search Trends. One upshot is that although the Magnificent 7 basket is still up around 60% over the past year, the full set of stocks in the S&P 500 portfolio is barely treading water, suggesting the other 493 stocks have actually posted very poor returns, indeed, on average during this period (see below).

Tech stocks especially exposed to high rates

As we’ve noted before, tech stocks are particularly vulnerable to the Fed’s aggressive monetary policy. That’s because in standard models for valuing companies’ shares, something like the Treasury yield will be used as a “discount rate” in the denominator of the pricing formula to calculate the present value of a firm’s stream of future cash flows. Growth stocks, in a funny way, are a bit like a 30-year bond, in that they have high “duration”: that is, for a company investors are buying not because of what it’s done so far, but because of the amazing business we all expect it to have down the road, are actually expected to pay most of their cash flows in the distant future. In addition to that rather mechanical effect of high interest rates disproportionately reducing growth stocks’ valuations, there’s also the effect high rates have on raising companies’ costs and hitting consumers’ wallets, which reduces companies’ sales. All in all, these are the effects we worry will be more and more observable the longer Fed policy rates remain elevated.

FOMC maintains pause at November meeting

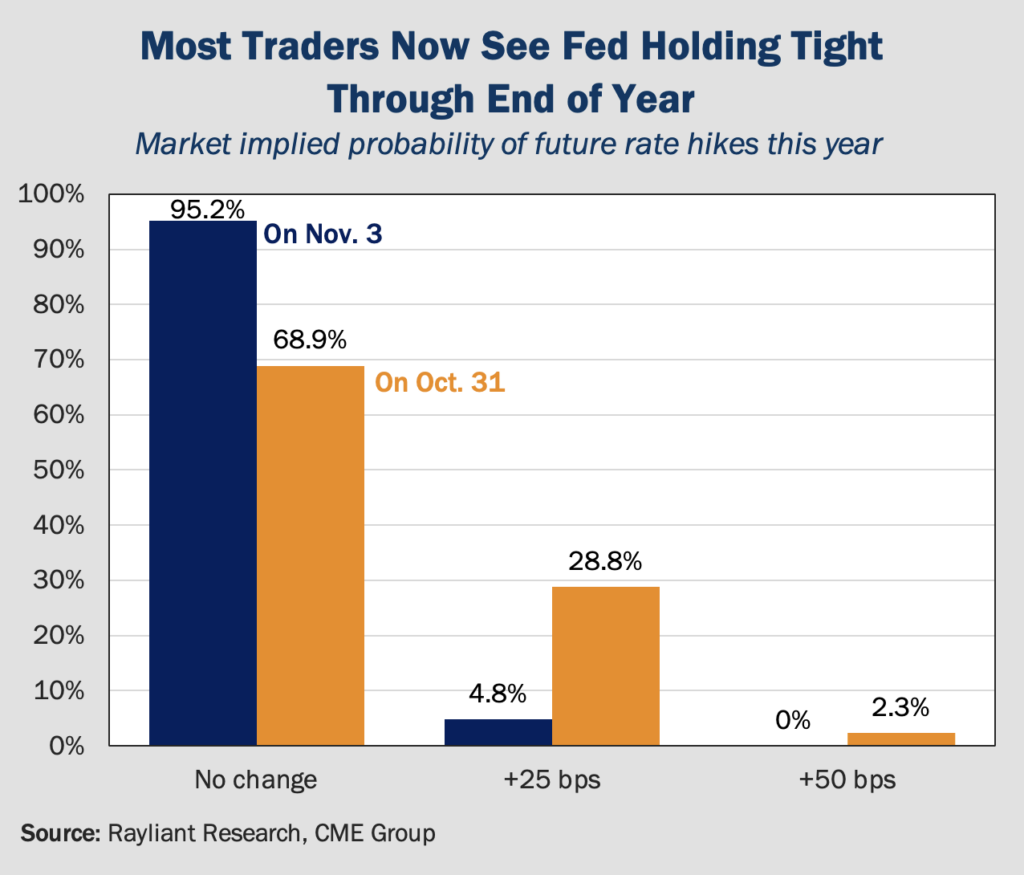

The US Federal Reserve announced last Wednesday that, in a unanimous decision by the FOMC, it would maintain its policy rate at a 22-year peak of between 5.25-5.5%, while keeping the door open for further tightening. That was by far the most expected outcome of last week’s meeting, and marks the second consecutive FOMC without a rate hike. Once again, Chairman Powell put on his best poker face, striking a balanced tone with emphasis on the “data-dependent” and “meeting-by-meeting” nature of the central bank’s approach to its monetary endgame for this cycle. Even so, the market seems to have read right through that and concluded the bar for another rate increase remains high, with the likelihood of a hike in December sitting at less than 5%, based on data from the CME Group (see below).

What could push the Fed to hike again?

The Fed’s mindset has changed little in recent months, with the primary objective remaining a balance between the risks associated with over-tightening (hard landing) vs. under-tightening (resurgent inflation). On the one hand, the economy appears remarkably strong, underscored by 4.9% growth in Q3 GDP: a level such that even if one assumes zero growth in the fourth quarter, annual real GDP would still reach 2.3%, year-over-year, surpassing the Fed’s 2.1% forecast for 2023. With inflation still quite a bit higher than the Fed’s 2% goal—the consumer price index stands at 3.7% as of September—it’s easy to see why the Fed isn’t ready to make a policy pivot. On the other hand, signs of cracks in the American consumer, including last Friday’s surprisingly weak nonfarm payrolls, along with harder-to-predict global factors (e.g., rising tensions in the Middle East, which the World Bank warns could drive oil prices above $150 a barrel) loom as reasons to forego a resumption of hikes. In our view, the former considerations will likely dominate, with that last 1-2% of unwanted inflation much harder to extinguish, quite possibly requiring a bit more tightening.

Growth slowdown induces ECB to pause

The Fed’s decision to pause came a week after the European Central Bank (ECB) also decided to stop rate cuts, a call that was likewise pretty fully anticipated. In the ECB’s case, the tea leaves were a bit easier to read, as Europe’s economy has been slowing down significantly, with the market pricing in stable rates over the near future and potential easing by the summer of 2024. The fact that the ECB is expected to begin cuts before the Fed is interesting, given somewhat more severe inflation in Europe and a far weaker currency. Just as in the US, inflation has come down, but not all the way to the central bank’s target. There are a number of other differences, however. Importantly, EU banks facer tighter standards for corporate loans, which has made policy that much more restrictive. Indeed, decreases in loan demand in the Eurozone have mirrored patterns seen around the Global Financial Crisis and Eurozone Debt Crisis—a level of stress not seen in the US yet. We agree that ECB hikes seem to be concluded and expect to see easing beginning as early as Q2 2024.

Treasury tips future issuance

Last Wednesday, the U.S. Treasury Department unveiled its borrowing plans for the next few months in its regular “quarterly refunding statement,” a routine publication on the government’s strategy to finance itself that has garnered increased attention in recent days. The Treasury noted in its plan for Q4 that it will be cutting issuance of longer-dated debt due to a surge in long-term interest rates, while increasing auction sizes for 2- and 5-year notes by $3 billion per month. Overall, anticipated upcoming debt sales tallied up to $112 billion, marginally lower than the $114 billion expected. While the market received this news favorably, we remain concerned about dynamics at the Treasury. It’s clear that supply of Treasuries is surging at the same time demand has softened, due to concerns over political dysfunction and a massive deficit, as well as anxiety over the Fed’s higher-for-longer approach; meanwhile, the Fed’s implementation of Quantitative Tightening (QT) has removed the biggest source of demand. Remaining buyers of Treasuries are much more price-sensitive than the Fed, and we fear yields will remain high for some time as a result.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED