The CIO’s Take:

This week, we focus on the credit market, a topic that often gets less attention than equities, but has recently exhibited some of the same strange dynamics, chock-full of risk in the face of skyrocketing rates, but offering investors little compensation for that risk in the form of yield spread over Treasuries. In particular, we believe companies issuing high yield bonds—many of which didn’t have the luxury of selling long-term paper to lock in low rates two years ago—will face increasing pressure as debt refinancing looms while sticky inflation and the lagged impact of Fed policy continue hitting their top line. We’re already seeing defaults creep up, though in the event the US is unable to avoid a hard landing, things will get a lot uglier. As such, we’re currently steering clear of high yield in favor of much safer Treasuries. For those inclined to take a little risk, we see Chinese stocks as relatively cheap, with sentiment still poor amidst ample signs the nation’s economy is finally on the road to recovery.

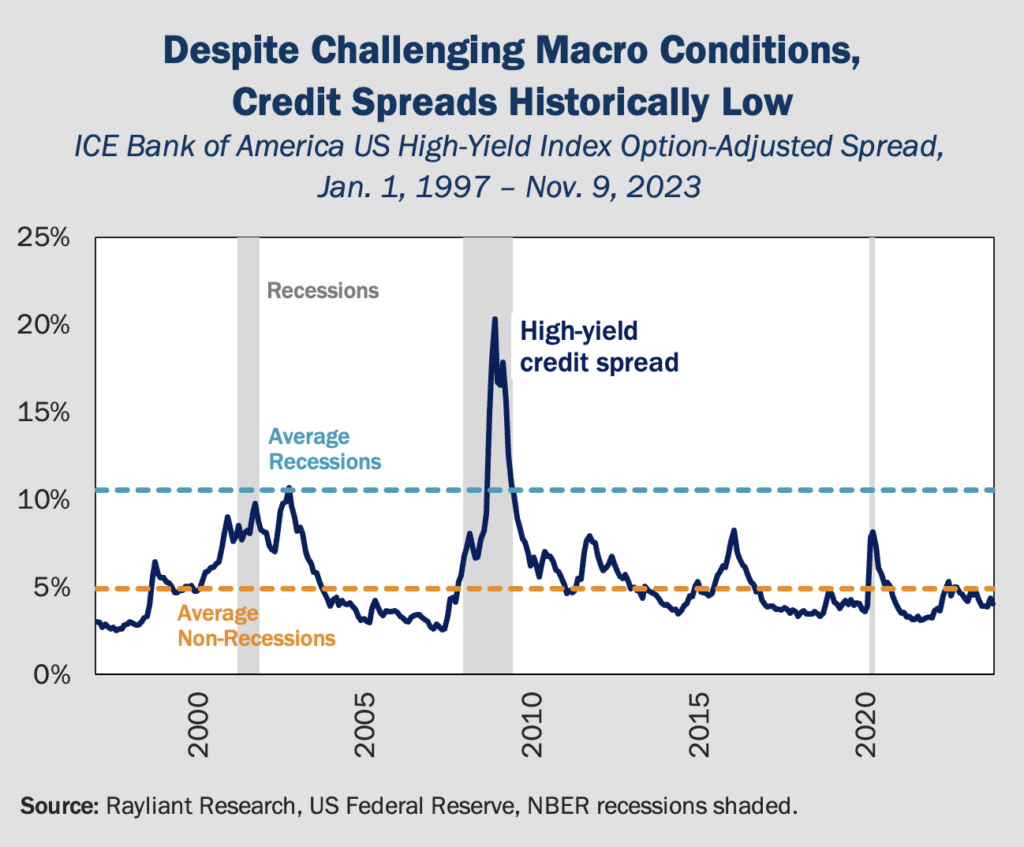

US investors don’t sweat credit risk

We have often commented that stock investors seem overly comfortable with equity risk these days, despite a highly restrictive environment brought about by the Fed’s campaign of rate hikes since early last year. In part, that optimism seems to be predicated on a belief that the US economy will enjoy a soft landing, avoiding a downturn. US GDP growth has come in hot enough in 2023 to support that view. As such, it’s probably not surprising that investors in the US bond market also don’t seem too worried about tight financial conditions. According to data from ICE Bank of America, high-yield US corporate bonds are only priced 4% above US Treasuries. That’s way below the 10.6% spread seen, on average, during past US recessions, and even below the non-recession average of 4.9% (see below). The story that bond prices are telling us is that things are going to be just fine—never mind about that massive surge in rates over the last year and a half.

Can’t escape rising borrowing costs

While investors might be calm enough, CFOs at US firms are facing a harsher reality: high rates inevitably mean high borrowing costs, and that’s quite an adjustment from the zero interest-rate policy American companies had gotten used to. Not only are domestic financing channels tough, so are international markets, where policymakers like the European Central Bank and Bank of England have also ratcheted rates up to multi-decade highs. Meanwhile, US corporate debt continues to grow, with data from the Fed showing just over $13 trillion owed by American non-financial firms as of the second quarter of this year, up more than $650 billion since rate hikes began in 2022. All of this obviously puts managers at US firms in a difficult spot, tasked with quickly adjusting to a rather radical change in the financial landscape that’s also pushed the cost of servicing corporate debt to a multi-decade high.

Distress takes time to show in the data

So, why haven’t we already seen a bigger impact of rising borrowing costs? Part of the story should give investors comfort. CFOs saw an opportunity when the Fed cut rates to zero amidst the COVID crisis, then read the writing on the wall when inflation surged in 2021, moving to lock in ultra-low rates on as much debt as they could. Much of that was issued at a 7-year tenor and, as a result, the amount of debt maturing won’t peak until around 2028. Unfortunately, there’s still over $3 trillion in debt maturing over the next five years, and another reason we haven’t seen much distress yet is that Fed policy operates on a long lag, and distress can also take some time to appear, even after the damage is done. Telltale signs of the Fed’s work are showing up in corporate default rates, which Moody’s reports ticked up to 4.9% in September, but expects to peak at 5.4% in its base case. In a more pessimistic scenario—a recession, for example—Moody’s predicts defaults could go as high as 14%.

More risk than reward for high yield

Ultimately, we do believe that the surprising resilience of the US economy has given higher-quality companies—many of whom managed to issue longer-term debt when rates were still favorable—a much better chance to navigate the current policy cycle without falling into distress. Firms with poorer fundamentals to begin with, from whom investors wouldn’t be very willing to buy bonds with longer maturities, are more likely to struggle, as debt comes due for refinancing while rates are still high. That’s obviously a bigger problem if “higher for longer” pushes elevated rates beyond the point at which their debt matures. Of course, high interest rates also hit consumers, reducing spending. With less revenue coming in, firms will find it that much harder to service their debt. To the extent they cut jobs to bridge the gap, unemployment feeds back and delivers another blow to consumer spending: a vicious cycle. It’s far from a certainty things will get this bad, but with junk bonds offering only a modest premium over Treasuries, we’re inclined to stick with the safer option and preserve capital for the possibility things get much worse, and high yield bonds get much cheaper.

IMF raises its China forecast

Last week, the International Monetary Fund (IMF) announced that it was raising its 2023 target for China GDP growth from 5%—which matched the number Beijing had set as its own bogey back in March—to 5.4%, citing the country’s “strong” rebound from COVID-19, as well as policy support that Beijing has slowly but surely begun to implement in recent months. Given challenges in the nation’s property sector and the possibility that tight conditions globally put a dent in demand for China’s exports, the IMF does see next year’s growth slowing to 4.6%, but even that’s still up from the 4.2% expectation the organization published in its World Economic Outlook less than a month ago. Indeed, Bloomberg’s consensus tally of macro forecasters’ expectation for China’s full-year GDP growth has popped from a median prediction of 5.0% in late-October to 5.2% as of last Friday.

Negative sentiment has been a drag

In fact, 5.2% equates to China’s economic growth over the first nine months of 2023, after Q3 GDP registered a 4.9% year-over-year expansion. That was higher than economists’ consensus forecast of 4.4%, and underscores once again how low expectations have been for China, which accounts for upward revisions in these forecasts as pundits play catch-up. It’s easy to see why those following China’s economy have been so pessimistic. When massive developer Country Garden plunged into distress over the summer, China’s real estate sector went through another wave of negative sentiment. At the same time, October marked the sixth consecutive month of declining exports as global demand has weakened, dealing another blow to confidence in China’s economy. And confidence has been China’s biggest problem in sustaining a zero-COVID exit recovery, as consumers and companies—sitting on massive pandemic savings and enjoying abundant liquidity—just haven’t shown a willingness to make big ticket purchases or meaningful investments.

Policy support feeds the recovery

The fact that China’s problems are more about weak confidence than some problem with its fundamentals is, it turns out, a good thing. That’s because sentiment inevitably changes, and policymakers have tools to speed that process. Near the end of Q2, our view was that Beijing, having failed to achieve a self-sustaining recovery with cheap talk alone, would almost certainly start pumping in some targeted stimulus. It’s taken longer than we would have liked, but that is exactly what happened beginning in August, and those policy moves—particularly in terms of support for infrastructure and manufacturing—are a big driver of recent improvement in China’s GDP. That good news on growth can become a virtuous cycle, restoring consumers’ faith in the economy and prompting greater spending. This process may already be underway, as consumer spending continued to move up in recent months, even as Chinese households’ disposable income flagged (see below). An impressive RMB 1 trillion of additional central government bond issuance in Q4, announced late last month, should help to keep that fiscal stimulus going, and gives us a bit more confidence that growth will sustain into 2024.

At these prices, we like China’s odds

Going into the end of the year, we believe sentiment toward China’s stock market on the part of both foreign and domestic investors continues to lag the turning tide of fundamentals in the world’s second-largest economy. It’s not that the risks concerning investors aren’t real. There’s no doubt that China faces serious challenges in its property sector, cracks in the global economy expose Chinese exports to further declines, and geopolitical tensions remain a source of potential downside shocks (though we are hopeful Xi’s upcoming visit to the San Francisco APAC summit will offer some relief on that front). The question for investors is always this: Are the risks correctly priced? Ironically, in that respect, the US and China appear to be a mirror reflection of one another. Whereas in the US we aren’t ruling out a soft landing, but see risk assets like stocks and high yield credit as pricing too high a probability of good news, we believe Chinese assets are priced as though perpetual stagnation is a foregone conclusion—the good news is priced with too low a probability. As such, although we’re generally bearish on stocks at the moment, we believe investors looking to take a little risk will find a bet on China’s recovery currently offers pretty compelling odds.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED