The CIO’s Take:

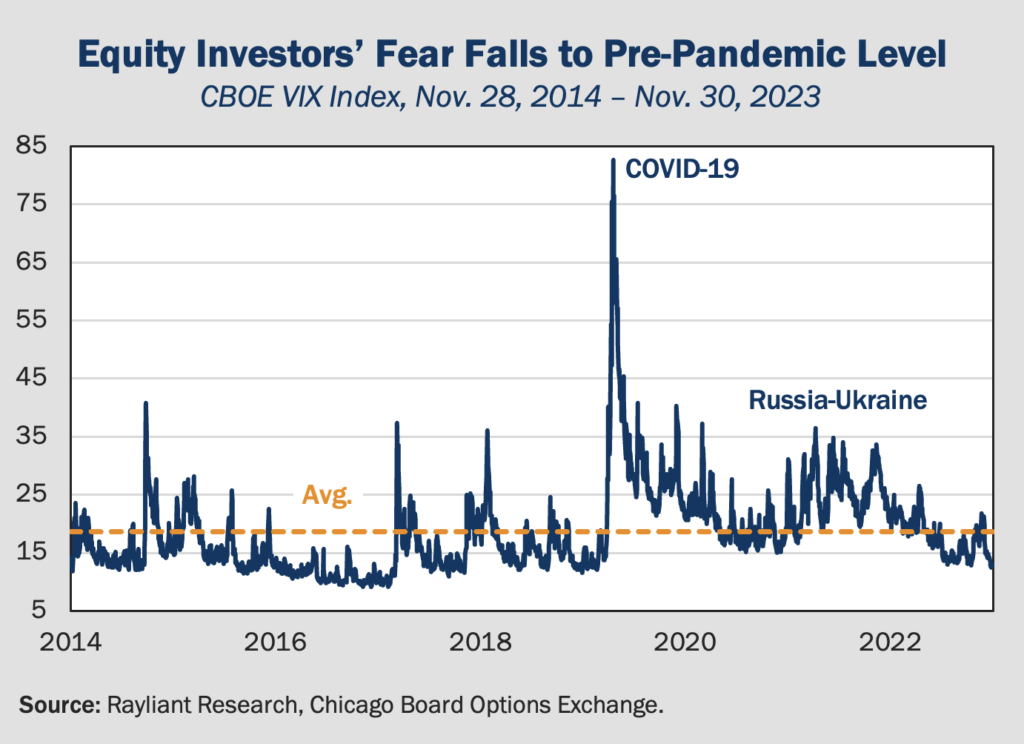

Although our view has been generally defensive since just before the Fed began hiking policy rates last year, we still hold plenty of stocks and bonds in our model portfolios. That made November a happy month, as a continuation of favorable macro trends led equities to rally and yields to fall. Now, sitting just about two weeks out from the Fed’s last rate decision of 2023, a recap of the past week’s chatter from current and former Fed officials tells us there won’t be another hike this year, but that further increases aren’t out of the question and the timeline for easing could be longer than many suspect. That said, the obvious optimism of stock and bond traders, whose excitement has brought the VIX back to pre-pandemic levels, suggests to us markets are pricing much more upside than downside risk. As such, we remain cautious, with concern over the economy finally succumbing to a Fed overshoot—our first look at consumers’ holiday spending trends points to cracks forming—leading us to focus on preserving capital and seek opportunistic bargains rather than bet the farm on relatively low-yielding risk assets.

Attention shifts to timing of first cut

With only two weeks’ worth of economic data remaining before the FOMC’s mid-December meeting, markets are heavily discounting the likelihood of another hike this year. According to the CME Group, futures traders currently place a 97% probability on the Fed extending its pause into 2024, with just under a 3% chance of a December hike. Of course, that doesn’t stop investors from speculating as to what comes next for US monetary policy, and there was ample attention last week on speeches by Fed chair Jerome Powell and his colleagues. With inflation trending lower and labor markets showing signs of softening, traders seem to have transitioned from a game of “Will they or won’t they hike again?” to “How long until we get the first cut?”

Hawks seem happy with current policy rates

Speaking to the American Enterprise Institute last Tuesday, Fed Governor Christopher Waller expressed cautious optimism about the current trend in disinflation, stating that he is “increasingly confident” policy is sufficiently restrictive to bring inflation down to the bank’s 2% target. Even though he qualified himself, warning that he “cannot say for sure whether the FOMC has done enough”, the market seemed impressed with such a change in tone from an FOMC member regarded as one of its most hawkish, contributing to sentiment that the Fed is likely done hiking at this point. Along similar lines, another noted hawk, Atlanta Fed President Raphael Bostic, said Wednesday that although with PCE inflation above 3% “we still have a ways to go”, he expects restrictive policy rates and presently tight financial conditions will get us there, eventually—likely by the end of 2025. Back in June, Bostic had suggested keeping the Fed funds rate at what was then a 15-year high through the end of 2024.

Market bets on a dovish Fed by next spring

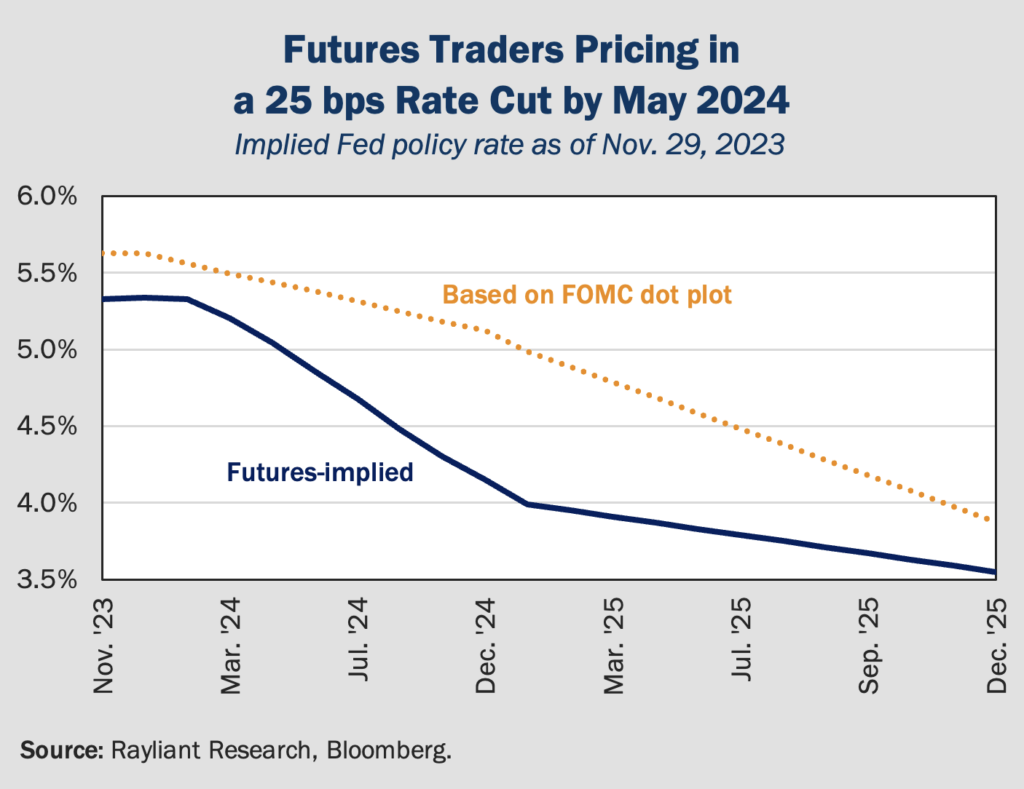

Powell weighed in himself on Friday, just hours ahead of a pre-FOMC communication blackout period, delivering a warning that “it would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease.” In other words, we ought not assume future hikes are off the table, nor should we start marking our calendars for coming rate cuts. Powell also suggested the Fed would act cautiously going forward, as “the risks of under- and over-tightening are becoming more balanced.” Traders apparently focused on the Fed chair’s latter point—and generally took a glass-half-full view of Fed commentary throughout the week—as stocks finished the week up and the market moved to price in rate cuts by May of next year (see below). Indeed, data from CME Group showed market-implied odds of a rate cut by March increasing from 21% to over 70% in the last week, while the perceived chances of a rate cut by May’s FOMC rose from 48% a week ago to over 85% today.

We fear traders overconfident in forecasting cuts

While we certainly agree with traders ruling out another hike in December, and although we find it quite easy to imagine a scenario in which rates go no higher, we also agree with chairman Powell that it’s too early to begin counting on cuts. The Fed’s policy has clearly evolved, beginning with rapid increases in rates last year and transitioning to much more gradual adjustments through the end of 2023. It’s that “data-driven” approach to policy that gives us confidence the Fed won’t feel a need to hike again at its next meeting. But we also recognize the Fed will be in no hurry to bring rates down and risk inflation surging back unless the economy turns down severely—which is obviously nothing to get bullish about. New York Fed President and FOMC Vice Chair John Williams explained it nicely speaking last Thursday when he called current risks to the economy “two-sided”: we could end up with persistent inflation or a weaker economy and higher unemployment. Our bet is that Fed will err on the side of the latter, cutting by next May only if the economy finds itself in a much worse place before then.

Muted kickoff to 2023 shopping season

With sparkly decorations and colored lights going up all over the place, you know we’ve entered holiday shopping season, and given the importance of consumer spending to the US economy, it’s worth taking stock of how things have started. Certainly for investors in retail firms, much focus in the last week has been on reports of results from Black Friday sales. Despite the economy’s unlikely surge in GDP through the first three quarters, this year’s post-Thanksgiving splurge saw only a modest rise in retail spending, up 2.5% year-over-year, though online sales jumped 7.5% to reach $9.8 billion. Interestingly, for a group of forty retailers posting the highest year-to-date proportion of holiday sales, 2023’s Black Friday receipts were down 4% versus last year. While it’s still early in the season, these stats support growing concern over a potential slowdown in Americans’ consumption as financial conditions get tight.

Shoppers’ use of “BNPL” cause for concern

One type of sales has been booming as holiday shopping season ramps up—but sadly, it’s a category that could spell trouble down the road. According to Adobe Analytics, use of the increasingly popular “Buy Now, Pay Later” (BNPL) option for online purchases hit an all-time high on Cyber Monday, climbing 43% from a year earlier, with the number of items per order rising 11%. Such payment plans allow consumers to borrow, typically without a hard credit check and in a manner that’s still under the radar of the Federal Reserve and other groups tracking American households’ debt. Such plans are reportedly seeing uptake beyond the big-ticket purchases for which they were originally introduced, as more consumers whose budgets have been stretched by inflation and whose credit cards are at the limit use installment plans to pay for groceries and other everyday purchases. We view the surge in BNPL as both a sign of cracks in the American consumer, as well as a source of risk as conditions worsen and those balances become due.

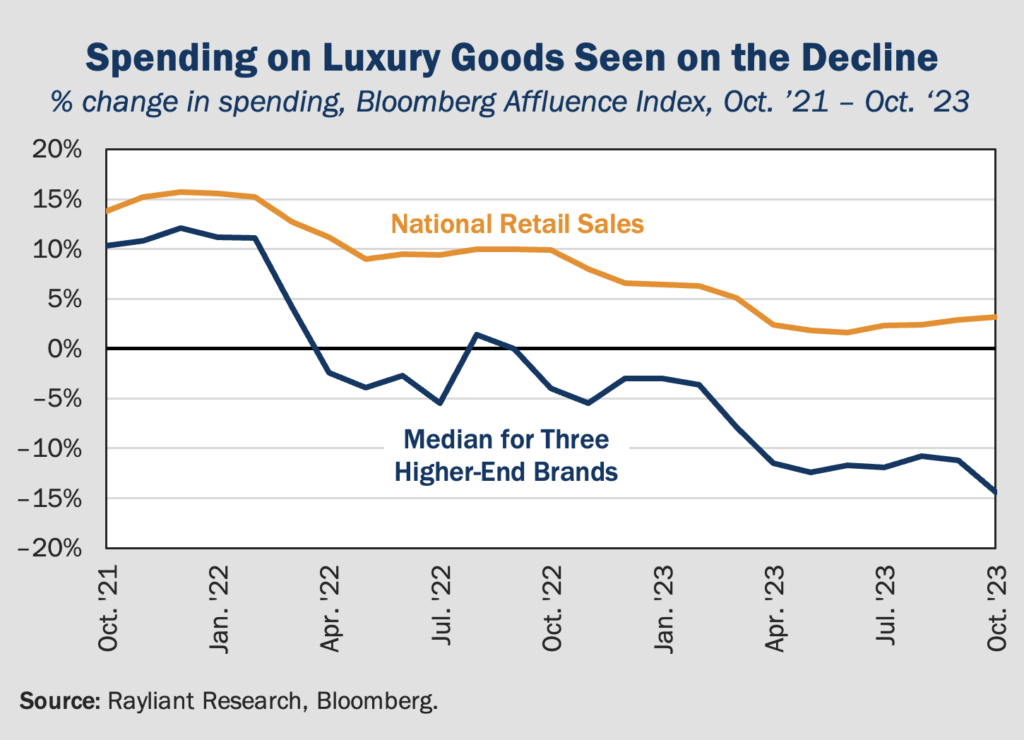

Watch for weaker spending by the wealthy

Another dimension along which we’re tracking changes in spending is household income. While mainstream retail sales figures and purchases on installment plans speak to the strain from higher prices and tighter financial conditions on lower-middle-income America, they tell us less about higher-income households’ activity. It turns out that wealthier Americans, whose excess savings from the pandemic have not yet been exhausted, are also beginning to slow down their consumption, directing their still-substantial buying power more toward experiences versus material goods. That jibes with Bloomberg’s so-called Affluence Index, tracking spending across various luxury categories, which has turned down in recent months (see below).

With the bulk of pandemic-era savings now held by wealthier Americans, a trend among upper middle class households toward converting liquid wealth to less liquid assets, and a negative wealth effect from falling property prices, we worry this year’s holiday sales could surprise to the downside relative to rosy expectations given the last few quarters’ growth.

Rising optimism spurs November rally

We close this week’s commentary by putting on our “risk management” hat and making a sober observation on what’s transpired in November. It was surely the case that investors with a bullish orientation had much to be thankful for by Turkey Day, as positive economic data and optimism over peak Fed policy rates—along with hope that easing could start soon—swept safe and risky assets alike up in a major rally. The S&P 500 rose over 9% in November, while the NASDAQ moved almost 11% higher. Just last week, on a surprisingly soft Eurozone inflation report, Europe’s Stoxx 600 Index rallied to end the month up 6.7%. Bonds also performed well in November, with the 10-Year Treasury yield sliding from 4.9% at the end of October to 4.3% by the end of last month. Bloomberg’s index tracking global sovereign and corporate debt climbed 5% for the month, its best performance since the GFC, and over $17 billion flowed into corporate bond funds in November, the sharpest monthly inflow since July 2020.

Falling VIX suggests complacency on risk

In fact, markets saw another development harkening back to just before the pandemic, as the VIX Index, which tracks equity investors’ perception of future risk, fell on Black Friday to the level at which it sat in January 2020 (see below). On the one hand, this might not seem surprising: The same bullish sentiment that led risk assets to rally last month implies investors aren’t nearly as worried as they were at the onset of the current Fed tightening cycle, let alone the period of immense uncertainty that hit with the first wave of COVID infections. That fact is also borne out in the cost of protecting a portfolio through market hedging, which is currently making record lows.

While we agree that the macro picture looks better today than it did when US inflation was raging over 9%, we like to think not just in terms of average forecasts, but the full range of outcomes: good and bad. In that vein, it’s worth remembering that increased optimism shouldn’t stop us from recognizing risks—be they macro, financial, or geopolitical. In our view, it’s precisely when the consensus is calm that a prudent investor should take a moment to imagine what might go wrong. With that in mind, and judging by the plot above, we still see the market as underappreciating those possibilities.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED