The CIO’s Take:

We’re now just a few days away from December’s FOMC meeting, and although an extension of the current pause seems a foregone conclusion, investors are still rightly dissecting every bit of macro commentary and data in an effort to infer (a) whether a soft landing is in the cards and (b) when the US central bank might pivot to easing. Friday’s jobs report, arguably last week’s most important release along the lines just mentioned, came in hotter than expected, giving investors plenty to chew on. Equity markets cheered the news, figuring better chances of a soft landing must be good for stocks, though bond investors saw the data as providing the Fed ample justification to keep its foot on the brakes. We tend to agree with bond traders and view labor market strength as validating our current positioning: light on exposure to stocks—which we see as priced for perfection and thus majorly vulnerable to a Fed overshoot—and underweight duration, which should benefit our portfolio if the Fed does push back its timetable for easing.

Who said the labor market is loosening?

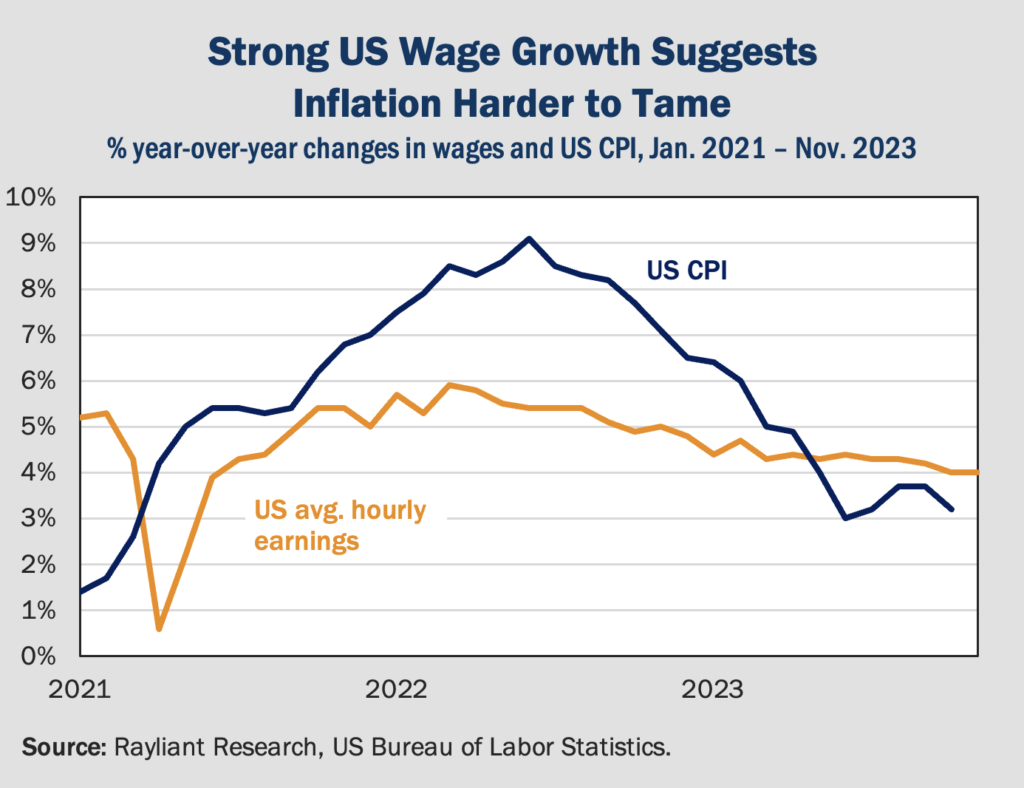

Last week, we discussed how investors’ focus has shifted from whether the FOMC will hike again to when they’ll begin cutting rates. Still central to the Fed’s decision making is the US labor market, which not only speaks to the strength of the nation’s economy, but also the pressure employment and wage growth are likely to exert on prices going forward and, hence, the path of future inflation. On Friday, the US Bureau of Labor Statistics (BLS) gave us one of the biggest pieces of data remaining before the Fed’s December decision on rates, reporting both changes in employment and average hourly pay for November. Both showed signs of tightening. Nonfarm payrolls increased by 199K, versus forecasts for just around 175K new jobs, putting the unemployment rate at 3.7%, down from 3.9% a month before—and marking the longest streak of a jobless rate below 4% since the late ’60s. Average hourly wages grew 0.4% in November, outpacing a 0.2% rise in October and leaving the year-over-year increase in wages at 4%, significantly higher than the Fed’s 2% inflation target (see below).

The markets’ reaction and our take

Equity investors interpreted Friday’s jobs data as a bullish sign that the economy is more likely heading toward a ‘soft landing’, with the S&P 500, NASDAQ, and Dow all ending up for the day. Treasuries, which had been rallying since mid-October on hopes of a quick Fed pivot to easing, immediately sold off on the report’s release, suggesting bond investors read the data as bearish for central bank policy. We agree with that assessment. Based on comments from current and former Fed officials, one of the bank’s big fears when it comes to inflation is the so-called ‘wage-price spiral’, in which rising earnings boost consumers’ demand, leading companies to increase prices, sending wages higher: essentially, an inflationary feedback loop. As long as the economy keeps going strong—definitely the takeaway from Friday’s data—the Fed has no reason to take its foot off the brake, pushing back the timetable for rate cuts. Futures prices echo our sentiment, as CME Group data saw the implied odds of the Fed holding rates at current levels through at least March rise from 35% before the BLS report to 53% at Friday’s close.

Conditions perhaps softer than they seem

On the other hand, persistent inflation keeping the Fed from a pivot was just one of the “two-sided” risks we talked about last week. It’s also possible that the Fed does cut by the middle of next year, but as a result of a sharp downturn in the US economy that forces them into easing. It turns out there are signs in the data that the job market isn’t as tight as last month’s data suggest. One indicator we watch is job openings, which the US Department of Labor showed last Tuesday falling to 8.7 million at the end of October, a significant decrease from previous months. Digging deeper into Friday’s BLS data, we also find a big chunk of November’s gain in nonfarm payrolls stems from resolution of the autoworker and Hollywood actors strikes; those one-offs account for 47K ‘new’ jobs, in total, making the month’s hiring of 199K workers significantly less impressive. Meanwhile, uncertainty around politics, supply chains, and the macroeconomy will tend to induce employers to hang onto workers longer—the ‘labor hoarding’ effect—such that the process of layoffs isn’t triggered until there’s some sort of big negative shock. All in all, we see plenty of risk currently happy labor market conditions will deteriorate in 2024: good news for rates, but not so great for those in the soft landing camp.

Gold surging despite high real rates

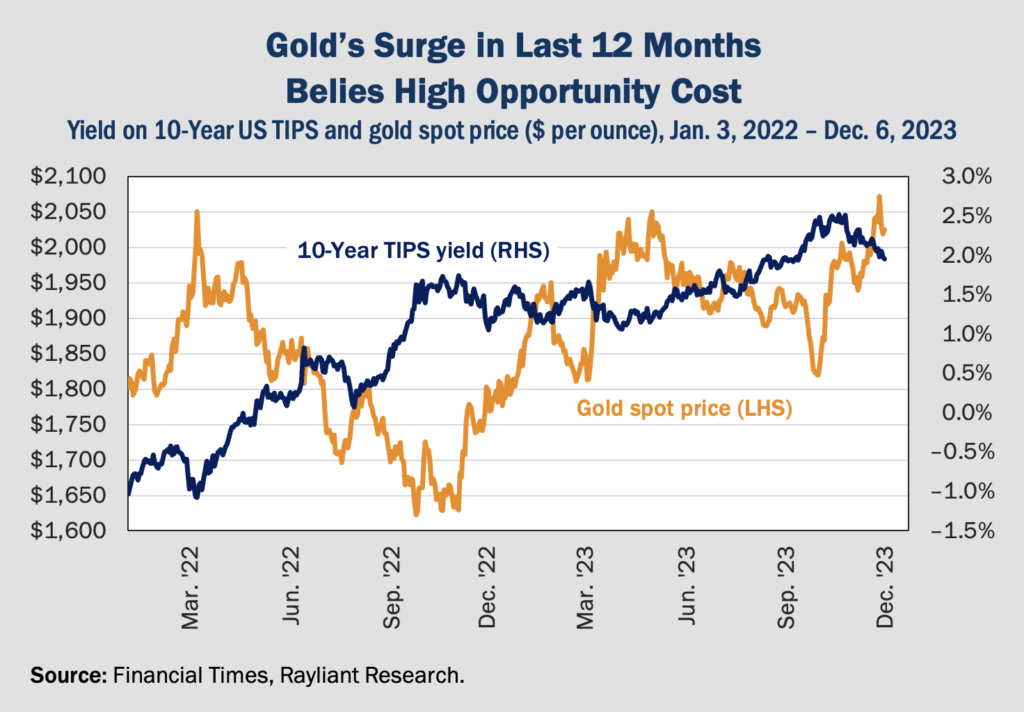

Those who closely follow the gold market will be familiar with the strong inverse relationship between the precious metal’s performance and the level of interest rates. Rising rates are generally bad for gold because it’s a non-yielding asset: the higher the yield on Treasuries, the greater the opportunity cost of holding a vault full of gold, which won’t ever generate a cash flow until it’s sold. It’s real interest rates in particular that gold investors care about, making it somewhat surprising that amidst a surge in real yields, as the Financial Times recently reported, gold has also been performing quite well (see below). Indeed, the price of gold hit record highs in trading at the beginning of December, reaching $2,135 per ounce. These developments have excited gold bugs, but left many other investors scratching their heads.

Explaining gold’s recent rally

So, what gives? Robert Armstrong and Ethan Wu at FT offer a checklist of factors, beyond real rates, that could explain the move. For one thing, traders expecting the Fed has reached peak rates are betting on weaker demand for USD, sending the dollar lower, thereby enhancing the purchasing power of non-US buyers of gold, which is mostly denominated in USD; that has the effect of increasing demand and boosting prices. There’s also the popularity of gold as a hedge against geopolitical risk, and plenty to worry about in the wake of Hamas’ attack on Israel, which sent gold surging in October, as can be seen above. One of the biggest drivers of gold’s strength could be central bank demand, with actors in the BRICS+ bloc buying the commodity at record levels in 2022, a trend that has continued through 2023.

Beware the allure of shiny metals

Investors chasing performance might look at the chart above, consider the prospect of Fed rate cuts, imagine a host of hedge-worthy risks, and conclude it’s time to make an allocation. On the contrary, while we’ll often hold a very modest allocation to gold through a highly diversified commodity exposure, we think it’s generally undesirable as a strategic investment. In this stance, we’re aligned with famed economist John Maynard Keynes, who our colleague Ben Ashby points out attributed investors’ fascination with gold to a “fetish” that places psychological desire for the metal above rational financial decision-making. Keynes’ view is backed up by the data. In recent analysis, Ben notes that since 1980, gold has returned just 2.6% per annum, far below the S&P 500’s 11.6% per year, and even short of Treasuries’ 6.8% yield over that period. Tactical bets on gold could make sense, but these stats suggest against holding it as a long-term investment.

Market cap gain reflects rapid growth

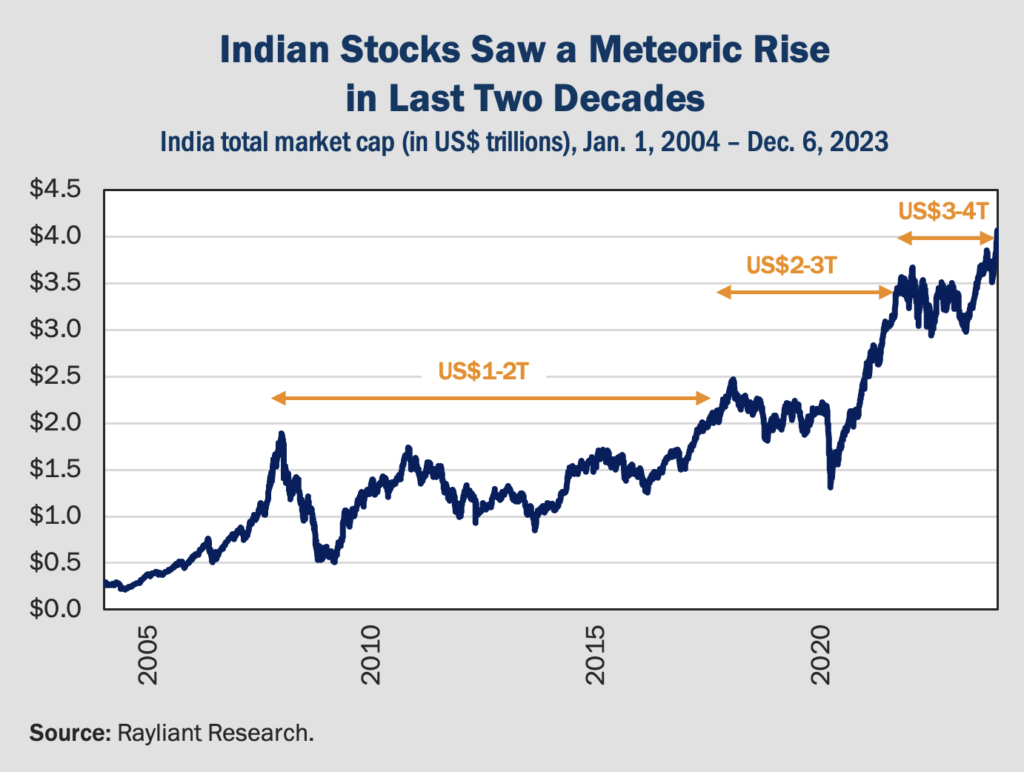

The Indian stock market crossed a significant milestone on Tuesday, surpassing a valuation of US$4 trillion for the first time. That makes India the world’s fifth-largest equity market, ahead of France, but still trailing the US, China, Japan, and Hong Kong. Indeed, in around two and a half years, the market capitalization of Indian stocks has increased by US$1 trillion: a feat that took India nearly four years in the climb to US$3 trillion, and just over a decade in the push to US$2 trillion (see below). The accelerating gain in Indian stock valuation highlights the astounding pace of expansion in what was this year’s fastest-growing major economy—which unsurprisingly lifted the market—though flows into Indian equities have also been impressive, as domestic funds have plowed more than US$20 billion into the market this year, with another US$15 billion of net injections by foreign investors in a market notorious for being difficult to trade by outsiders.

Plenty of opportunity—but risks, too

India’s market cap milestone comes only months after the country surpassed China as the world’s most populous nation. That population is considerably younger than its East Asian emerging market peers, although, like China, Taiwan, and South Korea, India’s people are increasingly well educated, producing a large number of engineers to feed growing global demand for high-technology exports in both goods and services. India’s people are also getting wealthier, putting the country on a path toward greater development of its domestic consumption economy, with projections that its share of global middle class consumption will rise from 5% today to around 40% by 2050. On the flip side, those looking to India as a destination for “friend-shoring” and supply chain diversification have sometimes found its still-developing political and financial institutions to be a hurdle, creating significant risks for investors hoping to exploit such trends.

Active management is a good fit for India

Another big challenge: Indian stock valuations. The “Nifty 50” index of top stocks on India’s National Stock Exchange (NSE) currently trades at a 64% premium over the broader MSCI Emerging Markets Index in terms of forward price-to-earnings. That’s high in absolute terms, but also much more expensive than the Nifty’s own 10-year average premium of just under 48%. Investors should be willing to pay more for growth, and there’s plenty of that in India, but not all companies will grow enough to justify such a premium, and the risks of investing in India—as with any emerging market—are also higher, particularly given the developmental stage of the country’s standards of corporate governance and financial institutions. In such a market, we believe in a diversified but active approach, providing broad access to the growth opportunity in emerging markets like India, but also seeking to avoid overpriced “growth traps” and manage the risks that abound in such developing economies.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED