The CIO’s Take:

Last Tuesday, November CPI came in mostly as expected, with headline inflation clocking in at 3.1% year-over-year and core posting a 4% increase. That latter number didn’t look great, and combined with the preceding Friday’s nonfarm payrolls, we saw data leading into the FOMC as marginally unfavorable. As such, it was obvious the Fed couldn’t hike in December. Instead, the big surprise turned out to be a dovish pivot in the Fed’s tone and, even more importantly, its own projections for the trajectory of rates, with December’s dot plot indicating 75 bps of cuts in 2024. That’s still not our base case, though we can imagine faster easing if the US economy turns down sharply: hardly something that should stoke a rally in stocks. We’re even less optimistic the Fed will deliver the six rate cuts in 2024 that futures markets have now priced in (apparently unwilling to take Powell at face value, no matter what he’s saying). Given sticky inflation and surprisingly loose financial conditions, along with how little margin for error exuberant markets are currently baking in, we remain underweight equities and situated near the front of the yield curve.

December’s dot plot is an early Christmas gift

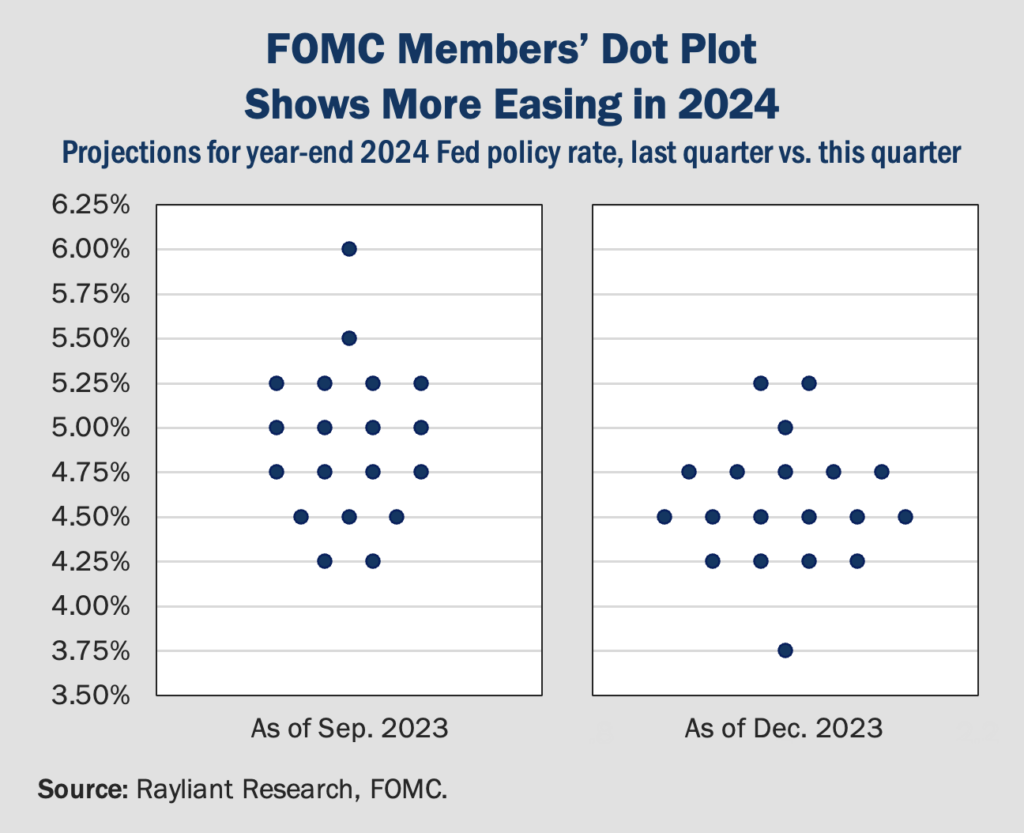

Last Monday, with the FOMC meeting just two days away, CME Group data showed markets expected a 99.8% chance the Fed would maintain its pause going into the new year. Not much in the way of suspense. Of course, as we explained in our brief last week, the big news all along was really going to be economic projections released by the Fed once per quarter, including the much-discussed “dot plot”: a visualization of where each committee member stands on the future trajectory of rates. The pause at last Wednesday’s FOMC caught nobody off guard, but the dot plot was truly a shocker, with the median row implying three rate cuts in 2024 (see below). The bond market reflected traders’ surprise, with the US 10-year Treasury yield—which topped out around 5% in October and has been sliding since—shooting down from 4.2% ahead of the meeting to 3.9% by the weekend, the first time that yield has seen a three-handle since August. Equities likewise rallied, with the S&P 500 up 1.4% on Wednesday, while the US dollar slumped, closing 1.2% lower against a basket of major currencies.

Powell’s messaging pivot is especially stark

The committee’s shift in posture was extreme enough to take us by surprise, as well. Merely two weeks ago Perspectives quoted Fed chair Jerome Powell, speaking just before the pre-FOMC communication blackout period, proclaiming “it would be premature…to speculate on when policy might ease.” We noted at the time that other Fed officials speaking in the weeks leading up to this December’s FOMC seemed similarly undecided on when restrictive policy might give way to rate cuts. In light of the abrupt U-turn in Fed signaling, it is telling that Powell didn’t use his post-meeting press conference to talk down the market’s enthusiasm for rate cuts in early 2024. As the massive drop in Treasury yields indicates—and as policymakers at the Fed surely understand—central bank policy directly influences rates, but financial conditions will also loosen based on the market’s expectations, whether the Fed acts or not. With futures implying close to a 70% probability of rate cuts by March, versus just 28% likelihood one month ago, and with markets pricing in six rate cuts for 2024, versus three seen in the above dot plot, such a sharp pivot in the Fed’s messaging is already serving to bring about easier money.

Fed might fear a weakening economy

Of course, the Fed’s challenge is precisely that: they’re working with a limited set of tools to effect change, but markets have a mind of their own, and fluctuations in things like risk-taking appetite and lending standards are hard for policymakers to fully anticipate, let alone control. Moreover, what policy the Fed is able to implement only hits the real economy on a “long and variable lag” we’ve discussed before, making it hard for central bankers to determine what impact their past tightening will ultimately have and whether they’ve done enough. As such, we imagine part of the debate behind closed doors at the FOMC is whether the Fed has already overshot, in which case easing sooner would help to minimize the damage if the US economy does abruptly start to slow and unemployment takes a turn for the worse. In fact, we have long been of the view that one scenario in which cuts could come sooner is an unexpected economic downturn that pushes the Fed to stimulate, so it makes sense policymakers might want to open the door to an earlier pivot if the economy heads south—though, as we’ve also said many times, investors shouldn’t be excited for that prospect.

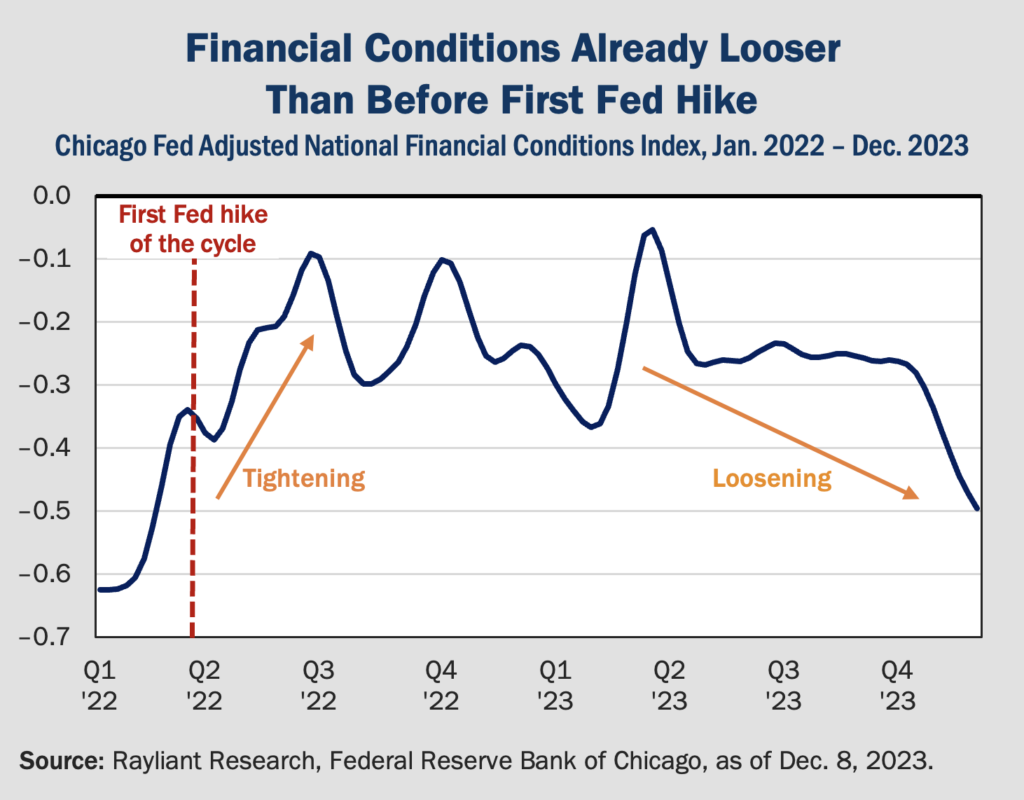

We see conditions as too loose for quick cuts

Adding credence to this view was Powell, himself, in Wednesday’s press conference, when he explicitly acknowledged the risk the Fed might “hang on too long” to high rates and pledged he was “very focused on not making that mistake.” It’s true that as inflation falls, the current level of rates will naturally become more restrictive; at some point, sensible policy must adjust rates downward if the goal is to maintain a specific level of tightness in financial conditions. On the other hand—going back to the argument above that the Fed is fighting markets in its bid to properly calibrate policy—judging by the central bank’s own measure of financial conditions in the US, things are already looser than they were before the Fed began hiking back in March 2022 (see below). Along those lines, and considering the market continues to price more easing than the Fed is indicating, even as it gets more dovish, we see risk of unhappy surprises in inflation that would upset the Fed’s new timeline for easing, leading us to stay cautious.

European central banks hold the line

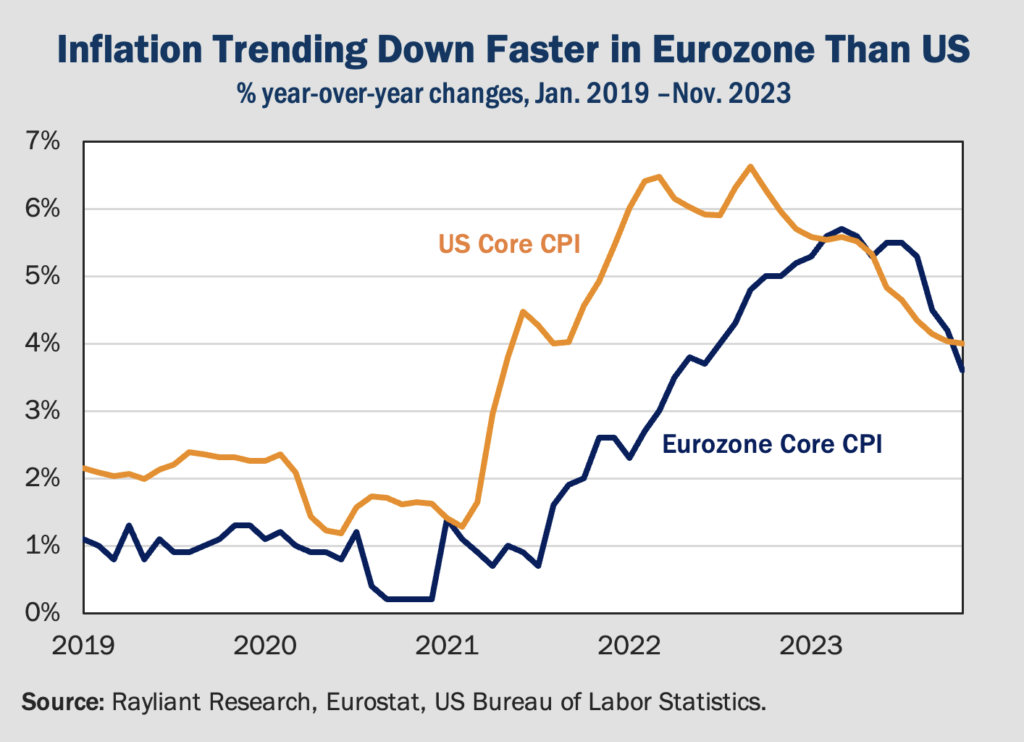

Not all central banks have been as quick as the Fed to signal “mission accomplished” on inflation. The European Central Bank (ECB) and the Bank of England (BoE), in particular, have been vigilant in their stance against persistently rising prices, holding their policy rates at elevated levels and resisting the temptation to get dovish in their messaging. Both banks’ policy meetings last Thursday saw them hold rates steady, with the ECB still planning on phasing out its Pandemic Emerging Purchase Program (PEPP) in the second half of 2024 and indicating in comments last week that it would maintain rates at restrictive levels as long as necessary to vanquish inflation. Norway’s Norges Bank actually surprised markets with a 25 bps hike on the same day. Such discipline is especially impressive at a time when Europe’s growth has slowed versus the US, even as its inflation falls more quickly (see below).

Will the Fed’s pivot push other banks to ease?

The big question now is whether other central banks will be able to maintain their resolve in the face of the Fed’s decision. We already mentioned how Treasuries have rallied since US investors got more bullish on rate cut expectations, and strength in US bond markets preceding Fed easing could inadvertently stimulate Eurozone asset prices, further entrenching inflation. On the other hand, big deviations from the Fed in other countries’ monetary policy have historically been challenging to support. For one thing, a more accommodative stance by the Fed can put pressure on trading partners’ exchange rates versus the US dollar, reducing the competitiveness of those countries’ exports. We might not see the dominoes fall until the US actually commences lowering rates, but financial markets are already discounting European policymakers’ messaging, with swaps markets predicting several rate cuts from the Fed, ECB, and BoE next year. We tend to agree that if the Fed gets dovish, it will become harder and harder for European central banks to resist following suit.

Last month’s inflation report was mostly in line

On Tuesday, just a day before the FOMC’s meeting, markets got another big piece of data that happens to be a critical input to the Fed’s decision-making: November US inflation. Headline CPI increased by 0.1% last month, modestly higher than the consensus “no change” predicted by forecasters, though the 3.1% year-over-year number was in line with forecasts. Core CPI, which drops volatile food and energy prices, was spot on economists’ estimates, rising 0.3% for the month, and 4% from a year prior. That’s big progress relative to where prices were trending a year and a half ago—and clearly enough to prevent the Fed from even considering a hike at its December meeting—though inflation is still well above the Fed’s 2% target. Even so, there wasn’t much in the report to excite traders one way or the other, leading to a muted response going into Wednesday’s market-moving FOMC meeting.

Under the surface, reasons for doubt

Despite not seeing anything decisive in November’s CPI, we’re still following a number of threads deeper in the data, particularly in light of our concern that markets are too optimistic and the upside inflation surprises could thwart the Fed’s December dot plot, leading that positive sentiment to correct. For one thing, though goods inflation has effectively returned to zero after jumping during the pandemic, services inflation is still roughly double its pre-pandemic rate, and November’s core services number didn’t budge from October. That’s just the type of sticky inflation we fear might make the last one or two percentage points back down to the Fed’s target a bumpier road than some expect. Things get even more problematic when one strips away shelter costs from services to get so-called “supercore” inflation, which jumped 0.4% month-over-month, versus a 0.2% increase in October. And those shelter costs themselves remain stubbornly high, rising another 6.5% year-over-year last month. All in all, there are plenty of trends worth watching in coming months as potential hurdles to those expected March cuts.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED