The CIO’s Take:

As holidays wind down and with a new year underway, we survey areas outside of US equity space that merit some reevaluation entering 2024. Our portfolios’ REIT exposure has rallied with other risk assets since late October, as the prospect of rate cuts raises investors’ hopes of better performance in the property market. Although we don’t expect massive relief for homebuyers to come quickly, dynamics in the housing market should support prices until falling rates come into full effect. We continue to view commodities as an effective hedge within our balanced models and are particularly inclined toward energy exposure this year, given the impact of extended Saudi and Russian production cuts on supply, as well as the potential of worsening tensions in the Middle East and US sanctions on Iran to shock prices higher. Within emerging markets, we remain overweight China A shares, with signs policymakers will make a bigger fiscal stimulus push this year, boosting strategic sectors in China’s domestic economy in a bid to catalyze high-quality growth, which we expect to finally lift an exceedingly cheap market.

What will rate cuts mean for real estate?

It has been some time since we covered the US housing market, and when we did last consider properties, it was to comment on the implications of 8% mortgage rates, which have hindered homebuyers, cast a cloud over homebuilder sentiment—though limited supply has helped mitigate the fall in property prices—and made rentals more compelling in the face of staggeringly poor affordability. Since then, of course, we have witnessed a remarkable shift in perceptions about where rates are headed, with futures pricing in at least half a dozen cuts in the new year, making this an interesting time to check in on the housing market. As the potential for a Fed pivot has sunk in, mortgage rates have declined to around 6%. But that’s still quite high. Will we ever get back to the good old days, when rates were closer to 3%, potentially reversing some of the gloomy trends just mentioned?

Dissecting the mortgage spread

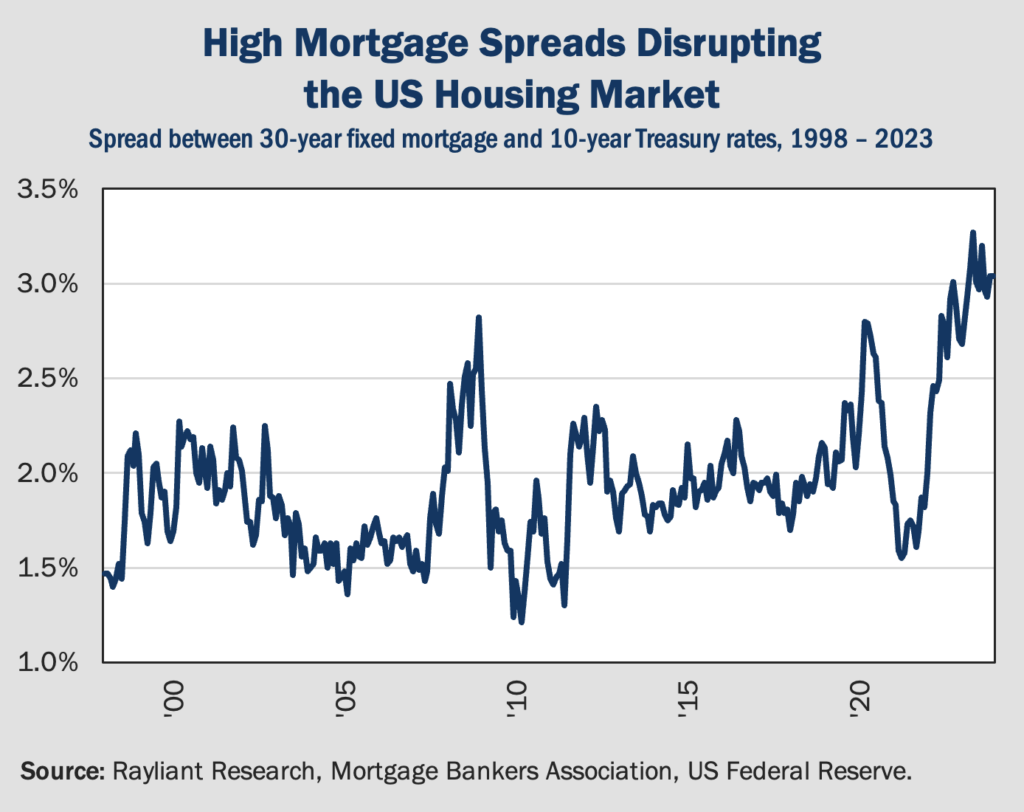

To answer that question, it helps to understand the mortgage market structure: in particular, the mortgage spread, the difference between 30-year fixed mortgage rates and 10-year Treasuries, depicted below. It’s clear from the graph that the pandemic period and subsequent Fed tightening cycle have witnessed some massive gyrations in the pricing of mortgage rates versus government bond yields. Spreads spiked around the original COVID outbreak, then rose again when the Fed began hiking. It’s not unusual to see mortgage spreads blow out in times of economic stress, but that definitely puts a pinch on housing market activity, like we’ve seen.

Don’t expect spreads to fall fast

Unfortunately, it turns out that about half of the increase in spreads comes from technical factors that might be slow to correct. The first is something called a duration adjustment, which just accounts for the fact that although the spread uses a 10-year Treasury rate as its baseline, mortgages are often held for a shorter period—closer to 7 years. Because the yield curve is inverted, with longer-maturity bonds yielding less than shorter ones, that adjustment pushes the spread up. The second is an adjustment for prepayment risk, which is higher given uncertainty over Fed policy. Though rate cuts in 2024 would prompt recent homebuyers to refinance, that scenario is anything but a certainty, and the volatility in Fed policy means we need to bake an additional risk premium into the mortgage spread. Other features, like the primary-secondary spread that tracks differences between rates to borrowers and those paid on mortgage-backed securities, and the option-adjusted spread, which measures investors’ demand for risky mortgages, are similarly unlikely to change much in the short-run.

We see limited downside risk

The silver lining is that even if we don’t believe the mortgage spread will soon fall to its pre-pandemic level, much of the negativity from high spreads has already been priced in. Sure, even with recent improvement, affordability remains stretched. Past cycles of deteriorating and improving affordability have seen a meaningful lag between the beginning of an improvement phase and increasing sales volumes. Inventory levels are still low and most homeowners have rates below 6.5%, which also make a sudden jump in activity less likely. But sales volumes are already at their lowest since 2011, and the dynamics just described have been in place long enough that they’ve registered with investors. In other words, none of this is a surprise, and any additional bad news is likely to be incremental. Moreover, part of what’s driving hopes of Fed rate cuts is the “soft landing” narrative, supported by households’ surprising strength and a continued hot labor market. As such, even if the promise of rate cuts doesn’t trigger an immediate bump in sales, we expect moderation in home prices rather than a correction.

Cautiously optimistic, despite ’23 weakness

After commodities’ remarkable outperformance in 2021 and 2022, driven by pandemic-related supply chain disruptions and Russia’s invasion of Ukraine, last year witnessed a period of stagnation for the asset class. There were exceptions, including some resurgence in oil prices—bolstered by escalating tensions in the Middle East—a rally in gold that we’ve commented on in recent weeks, and a surprising surge in orange juice futures (reminder to rewatch Trading Places). But the prevailing sentiment toward commodities in 2023 was really concern over weak global demand on the back of high central bank policy rates and a strong US dollar, sending the Bloomberg Commodity Index 12.6% lower on the year. Going into 2024, we see commodity fundamentals as ranging from neutral to somewhat bullish, and believe the possible tailwinds from Fed cuts and a gradually weakening US dollar could provide some upside, making us cautiously optimistic.

Outlook for metals and agriculture mixed

While China’s disappointing recovery and a manufacturing contraction in the US and Europe saw industrial metals taking a hit in 2023, we see more risk of upside surprises for iron ore, with weakness in supply creating a bit of a backstop, as policies to boost growth in 2024 see Beijing doing more stimulus spending on infrastructure and manufacturing, boosting demand. We’re less enthused about copper, which was the only industrial metal to finish last year in the black on concerns over Latin American production, but which would likely suffer if the global economy doesn’t quickly rebound this year. Nickel faces similar macro risk, and is actually in a surplus on Indonesian output. We see less visibility and more volatility for agricultural commodities, subject to unpredictable weather, but also geopolitical shocks and trends like food protectionism.

Risks to supply could see oil rally

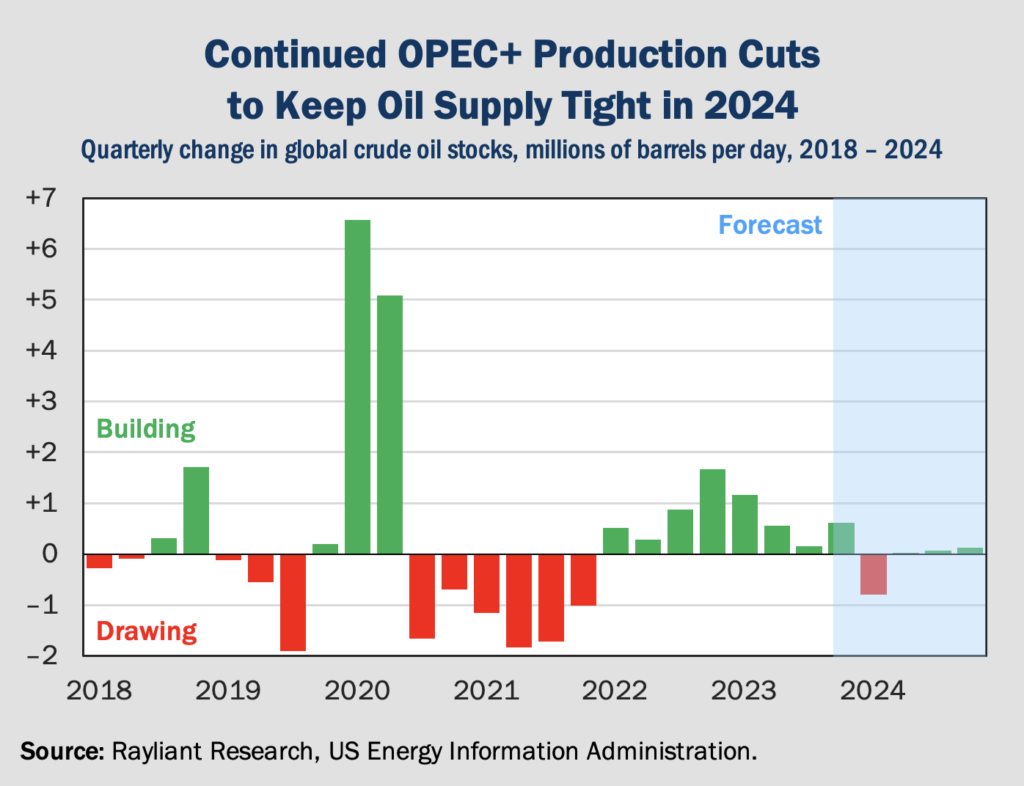

The sector we see as strongest this year is energy, where we believe conditions are right for oil to make a decent run. The basis for that call won’t be a surprise to readers of past Perspectives, as we’ve discussed before tightness on the supply side. We don’t believe much has changed there, with policy interventions by the OPEC+ alliance serving to offset non-OPEC production growth, as output cuts by Saudi Arabia and Russia will likely keep the market in a small deficit throughout what has historically been a seasonally weak first half of the year in 2024 (see below).

Meanwhile, despite what we see as better-than-consensus odds of continued slowdown in 2024, the possibility of Fed rate cuts points in energy’s favor on the demand side, and additional supply shocks if Middle East tensions worsen or the US applies stricter sanctions on Iran heighten the risk of upside pressure on crude prices. In light of these factors, we remain convinced there’s value to including some commodity exposure in a balanced asset allocation going into the new year.

China’s economy, market disappoint in ’23

We commented last week on the difficulties of market timing, and if there’s a single country that’s most disappointed us on this front in the last two years, it has to be China. Despite looking remarkably cheap since at least mid-2022, when massive zero-COVID lockdowns cratered sentiment and sent share prices tumbling, and notwithstanding potential policy catalysts that might have turned things around in short order since then, to call China’s post-pandemic economic recovery ‘underwhelming’ would seem like a big understatement. Although Chinese stocks briefly rallied at the beginning of 2023 at the prospect of a return to growth as the nation reversed its harsh pandemic-era public health rules, weak business and consumer confidence failed to quickly bounce back, stimulative fiscal policies never transpired, and China’s market proceeded to trend lower for most of the year. So, does that make Chinese stocks an even bigger bargain, or is now the time for investors in the biggest emerging market to finally abandon hope and cut their losses?

In this case, we choose to stay the course

One of the strongest behavioral biases afflicting investors is something called the disposition effect, which leads traders to sell their winners too quickly and avoid liquidating their bad bets because they don’t want to feel the very real pain of realizing what, until one clicks “sell,” is only a “paper” loss. We’re keenly aware of this mental quirk. Indeed, it’s a big reason we promote disciplined periodic rebalancing of our portfolios, and it’s why we spend so much time reexamining trades on both sides of our P&L statement, looking not just at how they’ve performed, but also at how fundamentals have changed. In the case of China, on the basis of that deep dive into the macro case for Chinese stocks, we do believe the market is still cheap, and aren’t inclined to sell our position. In part, that’s because we believe the world’s second-largest economy and second-largest stock market warrant a strategic place in clients’ portfolios; there’s growth and diversification we want to access there. But we also see catalysts in 2024 for unlocking what strikes us as very deep value and, for that reason, have chosen to stay modestly overweight to a market we believe offers strong diversification and growth at a more-than-reasonable price.

Policymakers signaling greater support

We’ve often talked about policy lags with respect to the US Fed, and we note that even though China stimulus has been disappointing thus far, we have seen a shift in authorities’ orientation since the July Politburo meeting, with an obvious escalation in reflationary measures meant to address a struggling housing market and challenged local government financing vehicles. So far, that’s manifested as budget expansion, initiation of local government debt resolution, and easing (albeit at the margins) in the real estate sector. All of that is fine, but it’s clearly not been enough. As such, we were looking toward the Central Economic Work Conference (CEWC), an important policy meeting that kicked off in the middle of last month, for signs the support could be scaling up. The clear message from that meeting was that economic growth was a top priority—no surprise—but much more importantly, we finally got a very clear acknowledgment that more fiscal support was needed and, at long last, some explicit reference to the need for boosting flagging demand, which we see as a much bigger problem than liquidity, which is actually quite ample by this point. In our view, these pronouncements foreshadow much more significant fiscal stimulus coming through in the year ahead. And there will be strong incentive to follow through, given what we expect will be another “around 5%” GDP target for this year, which becomes much harder to hit without the base effects from a supremely soft 2022 comparison that Beijing enjoyed last year.

Support to target “high-quality” growth

The challenge for policymakers this year will be to balance the need for greater support with the party’s desire for shifting to a higher-quality growth, moving beyond less productive manufacturing and real estate as core drivers of China’s economy. While there’s clearly a need to do something to fix sentiment in the property market in the short run, our reading of the CEWC is that investors shouldn’t expect a massive bailout in that sector. Instead, we believe Beijing will target fiscal support at more strategic sectors that fit with the party’s long-term objective to make China more like Germany: a powerhouse in precision manufacturing, significantly higher up the value chain in production from where the country is today. Which sectors will policymakers target? Think semiconductors, AI, industrial automation, and biotech—areas where US policies of technological “containment” force China to nurture its homegrown tech industries—as well as green energy technology, including EV, where China already has an incredibly strong foothold.

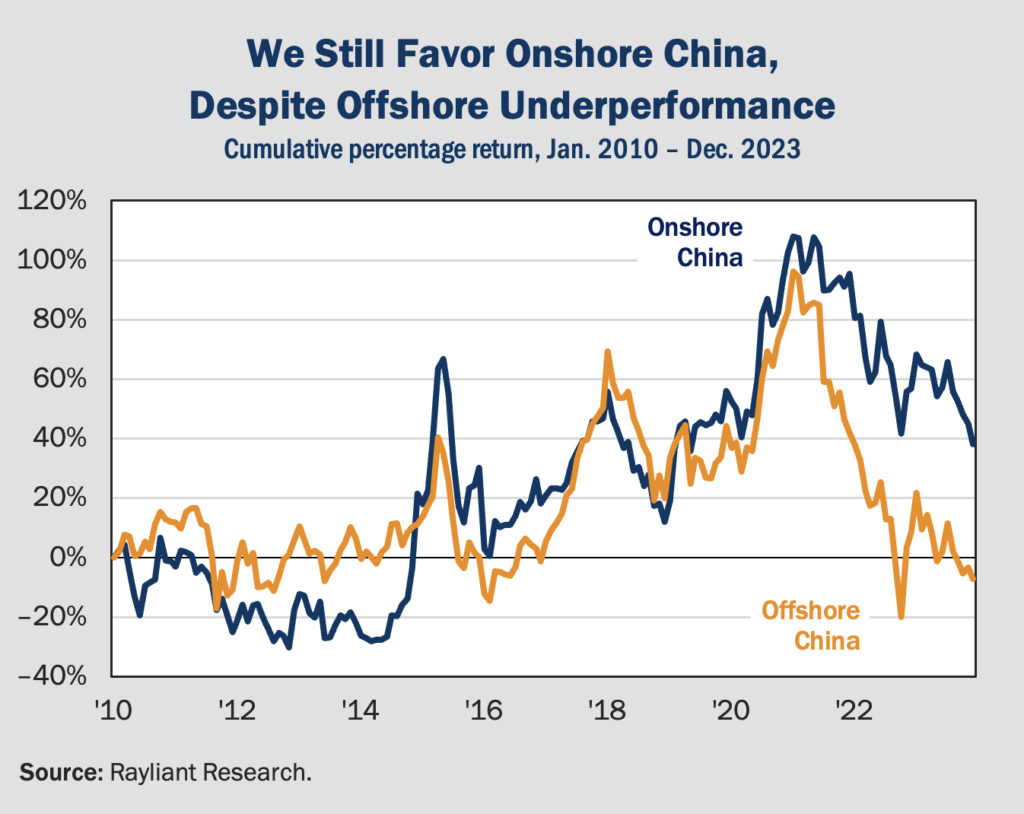

Onshore stocks look to us a better buy

All of this jibes with our means of accessing China, through the so-called “A shares,” since policy support of this kind is much more likely to benefit mainland-listed companies driving the domestic economy. That helps to explain why, through the last few years, onshore listings have held up significantly better than offshore Chinese stocks. At the level of individual stocks, we do see some bargains among US-listed ADRs and Hong Kong shares, though by and large, we expect A shares to feature more of the high-quality growth plays that future policy will favor. That nuanced distinction between policy tailwinds and potential regulatory hurdles was underscored less than two weeks ago by China’s announcement of stricter rules applied to game developers, most of which are listed offshore, lopping more than $80 billion off of prominent gaming stocks in a further hit to foreign investors’ sentiment toward Chinese equities. As such, we imagine investors who see the chart below and imagine offshore Chinese stocks offer the greatest opportunity to benefit from a 2024 economic rebound will be sorely disappointed.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED