The CIO’s Take:

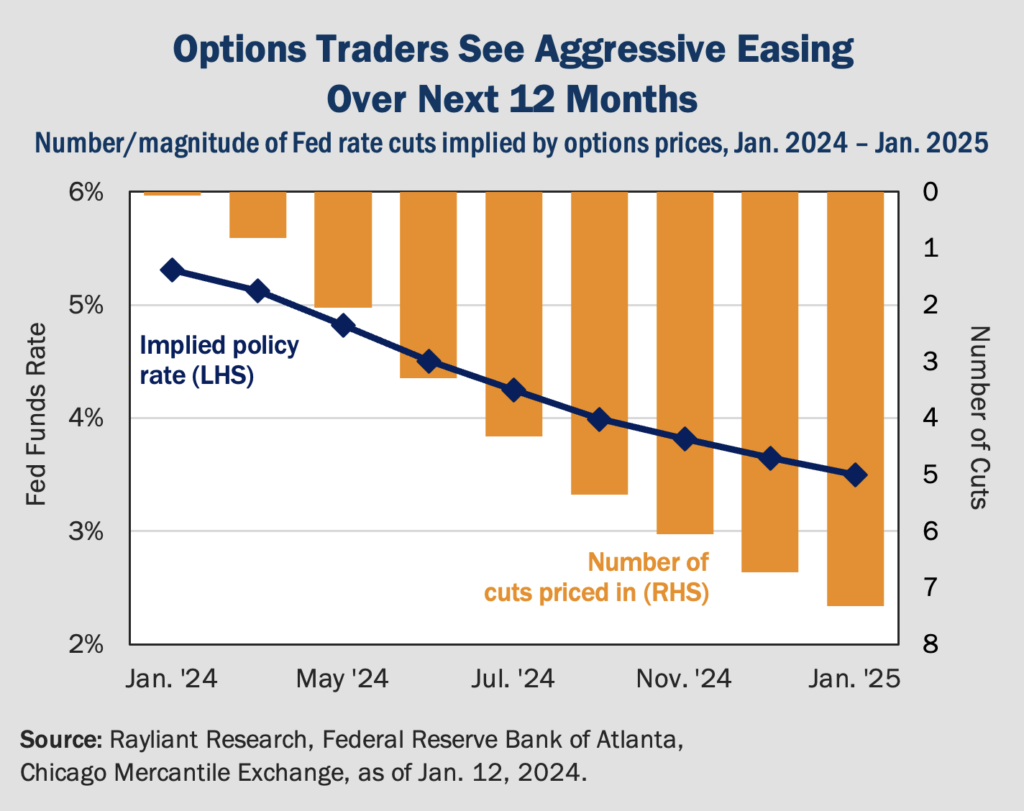

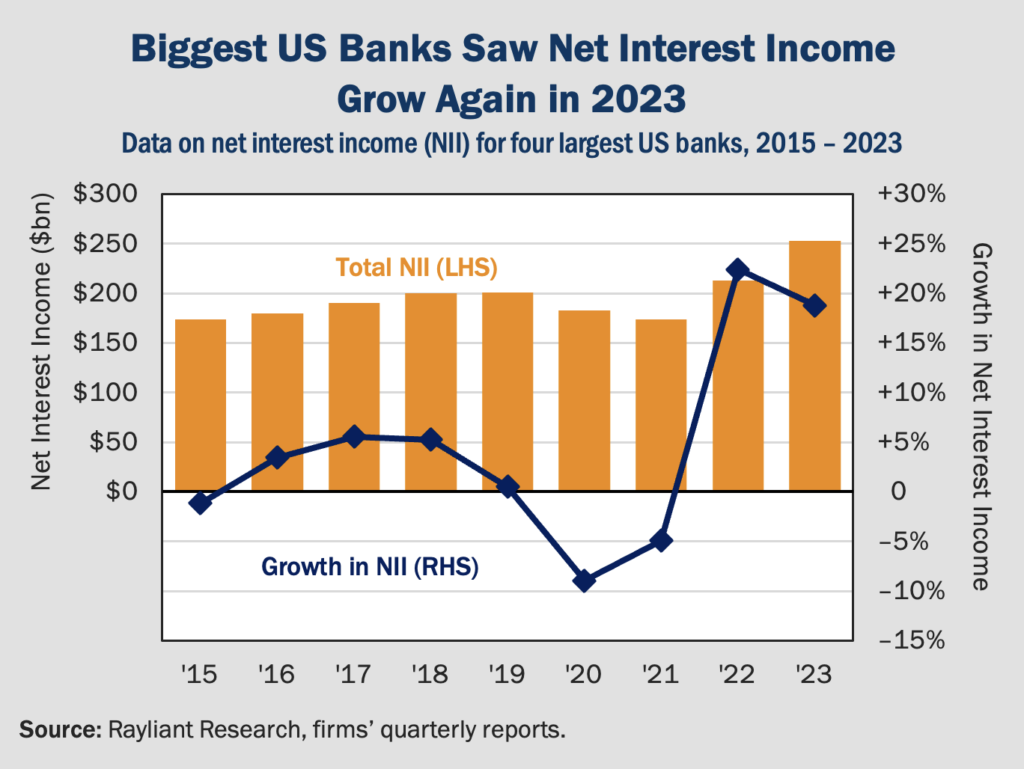

While a hotter-than-expected December CPI might sound like a disaster, given markets’ lofty expectations for rate cuts this year, last Friday’s inflation report could have been much worse. Sure, inflation is looking stickier in services and the easy disinflation in goods prices seems to be behind us—things we’ve talked about for a while—but there has been progress in PCE inflation and we agree with the Fed that shelter costs will likely come down much more this year. Still, options prices implying a half dozen cuts by year end seem off base to us in the absence of a sudden deterioration in growth or much faster softening in the CPI than we saw last month. US banks would benefit if rates stay higher, which would boost their net interest income, seen climbing again in 2023. Despite solid profitability last year, however, and setting aside one-time charges related to 2023’s regional banking crisis, bank results reflect enough uncertainty with respect to the economy’s health to put markets on edge going into Q4 earnings season. While strong economic data and Fed messaging have us more optimistic than we were on average last year, we see plenty of downside risk and our allocations remain relatively defensive.

Inflation crept back at year end

In last week’s Perspectives, we discussed a hot jobs report and the risk of sticky inflation derailing what future markets implied would be a smooth ride to rate cuts in the first half of this year. Last Thursday’s US Labor Department report of December CPI gave us another data point to worry about, showing an unexpected reacceleration of inflation at the close of 2023. Prices climbed by 0.3% in December, representing a 3.4% increase for the year, higher than consensus forecasts of 0.2% and 3.2%, respectively, and the biggest increase in three months. Core CPI looked a little better, rising 0.3% in December, which was in line with estimates, though the year-over-year increase was 3.9%, a tick higher than economists’ 3.8% expectation. What drove prices so much higher in December? Persistent service costs and a halt in goods disinflation did most of the damage. Shelter prices, which make up roughly one-third of the CPI basket, and car insurance costs witnessed their biggest jump in over fifty years, while core goods—things like used cars and apparel—saw price increases.

Not good news, also not terrible

Compared to the 6.4% inflation Americans experienced in 2022, last year’s 3.4% increase in prices might not feel too bad. More importantly, the Fed has clearly signaled its preference for more refined measures of inflation, especially the personal consumption expenditures (PCE) index, which places less emphasis, for example, on hot categories like car prices, and has been trending a bit closer to the Fed’s 2% inflation target. November’s PCE inflation came in at 3.2% year-over-year, with December’s number expected out on January 26th. We also note that although shelter prices’ 0.5% rise in December contributed more than half of the month’s overall rise in CPI, Fed economists expect lease renewals at lower rents to alleviate pressure in that category as 2024 progresses. In light of these caveats, while it’s not great to see inflation coming in hotter than expected, the immediate reaction of stocks and bonds to Thursday’s CPI—with equities down modestly and yields inching up—seemed reasonable to us. Bottom line, the numbers that matter are still clearly well above the Fed’s 2% target and won’t provide policymakers at the US central bank with a strong case for shifting to rapid easing.

Market pricing too much easing

So, how has all of this impacted traders’ expectations for Fed policy over the next twelve months? Below, we plot the Fed funds rate trajectory implied by options prices through next January. Markets still see the Fed kicking off its easing cycle in March, putting in at least five cuts by November. As we’ve been describing over the last few months, the pace of disinflation has been pleasantly surprising and odds of a soft landing have improved. Given fairly rich valuations and risks that we’ve also highlighted in past commentary, we remain bearish, but the balance of data coming through in recent months has undoubtedly been good news for investors. Even so, we view the implied path of policy rates as overly optimistic, since (a) a tight labor market and bumps in the road on a path down to the Fed’s 2% inflation target likely push the start to easing out and (b) the one thing that could get cuts happening faster, a brutal downturn in the US economy, isn’t yet obvious in the data we’re seeing. Short of entertaining the idea that Powell might accelerate easing to help Biden’s election chances as the incumbent slips in the polls—a fun, albeit farfetched plot line—it’s hard for us to see what gets us to the picture below).

Banks post strong (adjusted) EPS in Q4

Last Friday morning, the four biggest banks in the US—JPMorgan, Wells Fargo, Bank of America, and Citigroup—reported fourth-quarter earnings. On the face of it, the numbers looked bleak versus analysts’ estimates. America’s largest bank, JPMorgan, saw its EPS come in at $3.04, significantly below FactSet’s forecast of $3.35; Bank of America reported EPS of $0.35, far short of FactSet’s $0.53 estimate. In fact, those misses were largely a result of one-time charges, “special assessments” by the FDIC to account for the costs of intervening in last year’s regional banking crisis, which cost JPMorgan $2.9 billion in Q4 and set Bank of America back $2.1 billion. Without that charge—which many analysts apparently didn’t bake into their forecasts—JPMorgan said earnings would’ve hit roughly $3.97 per share, crushing FactSet’s bogey. Adjusting for those one-offs, it was another solid quarter for US banks, with net interest income (NII) showing double-digit growth for the second straight year (see below).

Uncertain Fed policy looms large in reports

JPMorgan’s net interest income, in particular, benefited from its buy-out of First Republic Bank, which succumbed to the aforementioned crisis and agreed to be acquired in May. That said, the true driving force behind growth in NII over the last two years has been Fed tightening, which increases the interest banks can charge on loans faster than the rate they’re paying for deposits. By that logic, one might imagine expectations for rapid Fed easing in 2024 would put a damper on forecasts, though JPMorgan was upbeat in its outlook, tipping another good year for the bank’s margins on the bank’s belief rates will stay high for longer—an apt assessment, in our view. Market optimism around easier conditions this year did seem to breathe new life into investment banking, which had struggled in past quarters, as revenue from debt underwriting soared and a positive outlook for deal activity in the year ahead took hold. Meanwhile, data in banks’ earnings showed American households continued to struggle under higher rates, with bigger carried-over balances on credit cards and more late payments.

Results failed to boost investors’ sentiment

Adjusting for FDIC charges, it’s hard to argue that banks weren’t riding high in Q4, though looking past the headline numbers, investors digesting banks’ earnings—often viewed as a barometer of the broader economy’s health—didn’t find enough in the results to propel confidence higher. JPMorgan’s stock jumped to a record high shortly after trading commenced on Friday, before retreating to end the day -0.73% lower; BofA likewise finished Friday down -1.06%. Investors likely have some anxiety around the evolution of credit conditions, as Q4 saw a significant increase in loan charge-offs at major banks, which totaled $6.6 billion for the quarter, double the amount from a year prior. The commercial real estate sector, in particular, remains a critical area of concern, with Bank of America and Wells Fargo reporting substantial charge-offs related to CRE loans. Overall, we see Friday’s bank earnings as good enough to keep hopes alive for this quarterly earnings season, but far short of justifying the optimism implied by broad market valuations as other sectors prepare to report in.

Blackstone fund targets “mini millionaires”

Earlier this month, the private equity space saw alternative asset behemoth Blackstone Group roll out its Blackstone Private Equity Strategies Fund (BXPE), its first private equity fund designed for individual high-net-worth clients, raising a remarkable $1.3 billion at launch, the largest sum Blackstone has amassed at kickoff for a retail product. The fund caters to investors with a minimum of $5 million to invest and offers a unique fee structure relative to other buyout funds, charging investors 1.25% of net asset value and 12.5% of total returns above a 5% hurdle. The strategy places Blackstone in direct competition with other major firms like KKR and Apollo, vying for so-called “mini millionaires” as an alternative to the large institutional clients Blackstone has courted in the past. By creating a perpetual investment vehicle that allows individual investors to enter or exit at will—more on that in a moment—Blackstone seeks a more sustainable fee generation model: one that’s robust to an increasingly competitive institutional fundraising landscape, diversifying its revenues and dipping into a clientele perhaps more willing to pay up for exclusive opportunities, which would also address fee compression on the institutional side.

Private funds may mask hidden risks

Indeed, the allure of exclusivity and promise of diversification into exotic alternative investments can be tempting enough to drive private clients away from more traditional asset classes and more transparent vehicles for accessing them, including passive—and even active—ETFs available at a fraction of BXPE’s fees. Investment in private vehicles is also subject to somewhat hidden risks, especially with respect to liquidity, as private funds’ smoother return profiles often understate volatility as a result of lags in valuation, while gates on redemptions can create a sudden freeze on liquidity at the worst possible time. Blackstone is no stranger to that sort of risk, having experienced a rush for the exit at its popular BREIT fund in late 2022 as concerns over the property market led to a surge in redemption requests. While BREIT allowed up to 5% of its assets to be withdrawn each quarter before limits kicked in, BXPE’s offering terms show the fund imposing a gate at 3% of assets per quarter. We view such complexities in private funds’ terms, not to mention high fees and macro sensitivities that might not be obvious given a lack of historical data, as giving investors a lot to think about prior to taking the plunge into private vehicles.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED