The CIO’s Take:

Given where the markets’ expectations for Fed easing were at the beginning of 2024 and the way risk assets are priced, we have cautioned on the asymmetric risk of unfavorable surprises, including with respect to inflation, where we expected some bumps in the road on the way down to the central bank’s 2% target rate. That risk materialized last week, as January’s inflation report—including core, supercore, trimmed, and sticky measures—showed an unwelcome acceleration in rising prices to start the year. Markets corrected sharply on the news, but recovered through the remainder of the week, which makes us think the potential downside here hasn’t yet really sunk in. We agree with former Treasury Secretary Larry Summers who, on Friday, told Bloomberg TV he doesn’t expect the Fed to ease before it’s clear they’ve got inflation in hand; he suggested there might be a 15% chance the next move in rates is up, not down. As such, we maintain our cautious stance on risk assets and duration. Turning to international markets, we note that one side effect of changing expectations over later Fed easing has been a battering of the yen—to the point that if, like us, you see spring as bringing a long-awaited policy change for the BoJ, this could be a good time to add some exposure to JPY.

January headline, core come in hot

Last Tuesday’s Bureau of Labor Statistics (BLS) report on consumer prices brought the type of unfavorable upside surprise we’ve been warning about, as January CPI came in unexpectedly higher than economists’ forecasts, increasing 0.3% month-over-month versus expectations for a 0.2% rise. That equates to 3.1% inflation on a year-over-year basis: better than the 3.4% reading in December, but significantly worse than the 2.9% rate markets had been expecting. Things didn’t look better from the perspective of core prices, excluding volatile food and energy, which rose 0.4% in January vs. expectations of a 0.3% increase. That acceleration, driven by escalating prices in core services, including shelter, transportation, and medical care, was the biggest in nine months and makes for a year-over-year increase in core price of 3.9%—in other words, no progress bringing down core inflation over the first month of the new year.

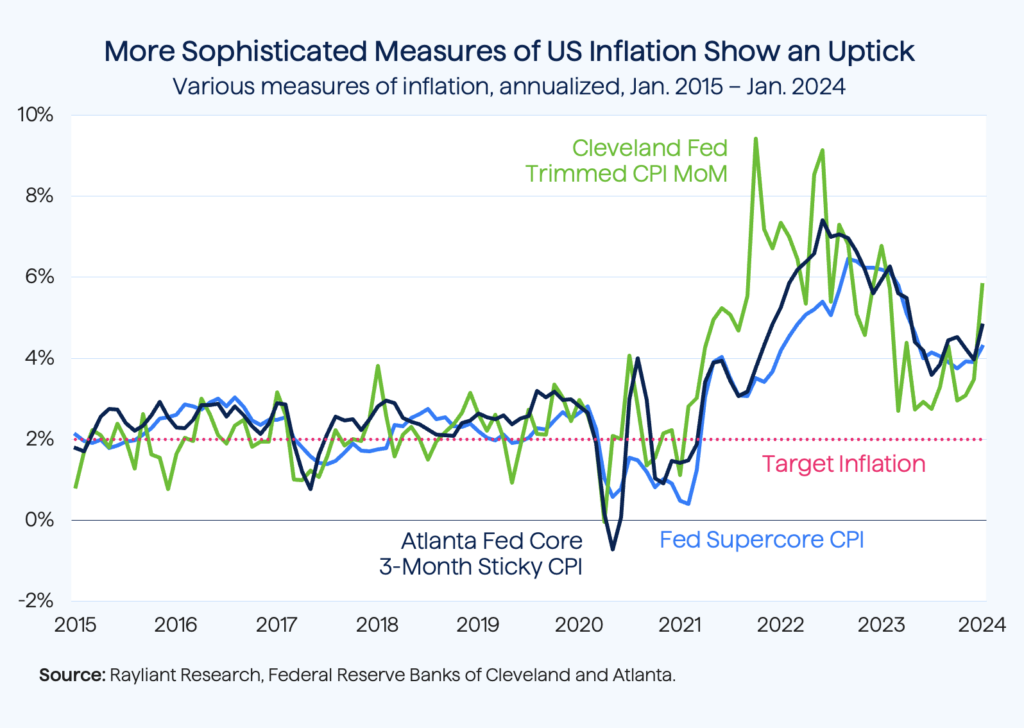

Other measures tell the same story

We can run through plenty of other ways of clocking inflation (see below) and, just like core inflation referenced above, the data seem to tell the same story any way we look at them. Take the Fed’s preferred “supercore” measure, for example, which also excludes shelter costs that have been especially volatile since the onset of the pandemic. That version of CPI surged by a whopping 0.9% in January. That’s important because supercore inflation tends to be highly correlated with wages (i.e., the budget for service companies). Although the service sector has been slow to respond to higher borrowing costs, skyrocketing prices for essential goods since 2021 could lead wage demand higher, creating a vicious cycle—something the Fed has been worried about from the get-go.

Another sophisticated measure, the Cleveland Fed’s “trimmed mean inflation” figure, removes extreme outliers in the basket of goods and services whose prices the CPI tracks, averaging the remainder. That version of CPI recorded its most substantial monthly increase since early 2023, jumping 0.5% in January, suggesting the acceleration we’re witnessing is broad-based. The Atlanta Fed’s “sticky price” index, which we’ve covered before as a potential indicator of goods and services for which disinflation will likely be harder to achieve, likewise continued a concerning trend in January. Since reaching 3.6% back in July, it’s been climbing: up to 4.8% last month according to data released by the Atlanta Fed last Tuesday. The conclusion from all these measures is that inflationary risks seem to have become more entrenched.

Markets discount soft landing

Of course, the risk of upside surprises like these is that markets have been pricing in a very smooth ride to the finish line of 2% target inflation, with rate cuts commencing even before the Fed enters the home stretch. When the data deliver up a bump like this, it’s a major shock to those rosy expectations. At the beginning of February, futures traders tracked by CME Group were putting literally zero probability on the Fed not cutting rates at least once by June’s meeting. After Tuesday’s hot inflation report, the implied probability of the Fed holding through at least June more than tripled, from less than 8% to over 26%. Changes in views on the timetable for easing naturally corresponded to stocks sliding, Treasury yields surging, and the US dollar strengthening. Although each of those moves partially reversed over the rest of the week—investor sentiment continues “climbing a wall of worry,” so to speak. We see the initial reaction as but a preview to potential downside risk if forthcoming data continue running counter to the soft landing narrative.

Rising shelter costs, persistent unaffordability

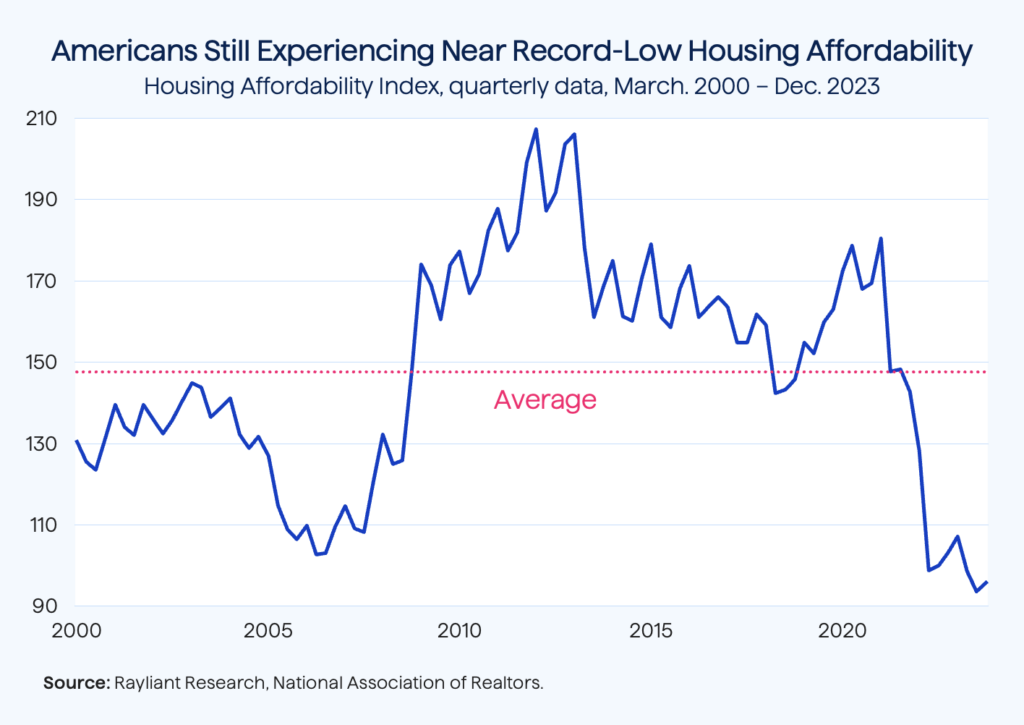

It’s been a while since we checked in on the US housing market, and residential real estate has gotten off to a rocky start in 2024. Having just discussed last week’s CPI report, it’s worth noting that the housing component of BLS data has garnered much attention in recent months and, according to Tuesday’s release, shelter costs were actually the greatest contributor to inflation’s upside surprise in January, popping by 6% in January. That increase was somewhat puzzling, given apartment rents have stabilized and the growth in single-family rent is in the low single digits, although it does accord with the frustration being felt by homebuyers, who face a stall in mortgage rates’ decline and national-average housing affordability which, despite a modest improvement last December, still rates pitifully low relative to its long-term level (see below).

No quick fix likely on the supply side

January turned out to bring more trouble on the supply side, with a notable decline in housing starts. That downturn was exacerbated by bad weather, yet even seasonally adjusted data suggest an ongoing housing shortage, which has been part of the problem with respect to unaffordability referenced above. Multi-family construction saw a 37% year-over-year decline last month, marking one of the lowest levels of building activity in the past decade. That contraction wasn’t for a lack of demand from renters, but rather due to oversupply in the market resulting from robust construction over the last three years; developers have simply scaled back projects temporarily at a time when loan rates remain high. Single-family construction likewise witnessed a 5% month-over-month decline, though it managed to stay above what industry insiders view as a critical level of 1 million units. We remain convinced that the underproduction prior to COVID has led to an imbalance that won’t be quickly reversed, even as easing begins and mortgage rates fall. As such, we don’t expect issues of affordability to resolve in the near to medium term, either.

BoJ keeps rates negative in January

As most of the world is deliberating over the timing of rate cuts, observers of Japan’s economy have been trying to predict when the country’s central bank, the BoJ, will start to unwind a negative-interest-rate policy brought on by decades of economic stagnation and deflation. That didn’t happen at the bank’s January meeting, where policymakers elected to keep rates unchanged. That decision was widely expected and, in part, must have been driven by some weakness in growth, reflected in Japan’s Q4 GDP, which contracted for the second quarter in a row: a technical recession. On the flipside, inflation continues to show progress. Core CPI excluding fresh food, is now projected to rise by 2.4% in FY2024, and although that figure was adjusted downward from previous forecasts of 2.8% inflation, the revision was mostly a result of declining oil prices and other external factors. The BoJ’s core CPI excluding both fresh food and energy is expected to remain stable at 1.9% for FY2024 and FY2025—just below the bank’s 2% target.

Still expect policy changes by April

Despite not getting a move up in rates at the BoJ’s January meeting, there are signs Japan is still on track for big changes to its monetary policy this spring. For one thing, in the bank’s Outlook for Economic Activity and Prices report, there was a new phrase added referencing an increasing likelihood of the country hitting its 2% inflation target—the strongest hint yet, in our view, that policy normalization is approaching. At the post-decision press conference, BoJ Governor Ueda hinted at the potential for a series of interest rate hikes once negative interest rates are lifted, but emphasized the continuation of an extremely accommodative monetary environment for the foreseeable future. Although he provided no definitive guidance as to the timing for initiating policy revisions, he did clarify that policy changes could occur at meetings where the outlook report is not published. We see the annual “shunto” process of negotiating labor contracts, currently underway, as a potential catalyst for change, with robust wage growth in March’s Rengo survey a key to solidifying the BoJ’s stance toward policy adjustment in April, where we do believe negative interest rates will be lifted, Yield Curve Control (YCC) policy will be dropped, and ETF purchases will be suspended.

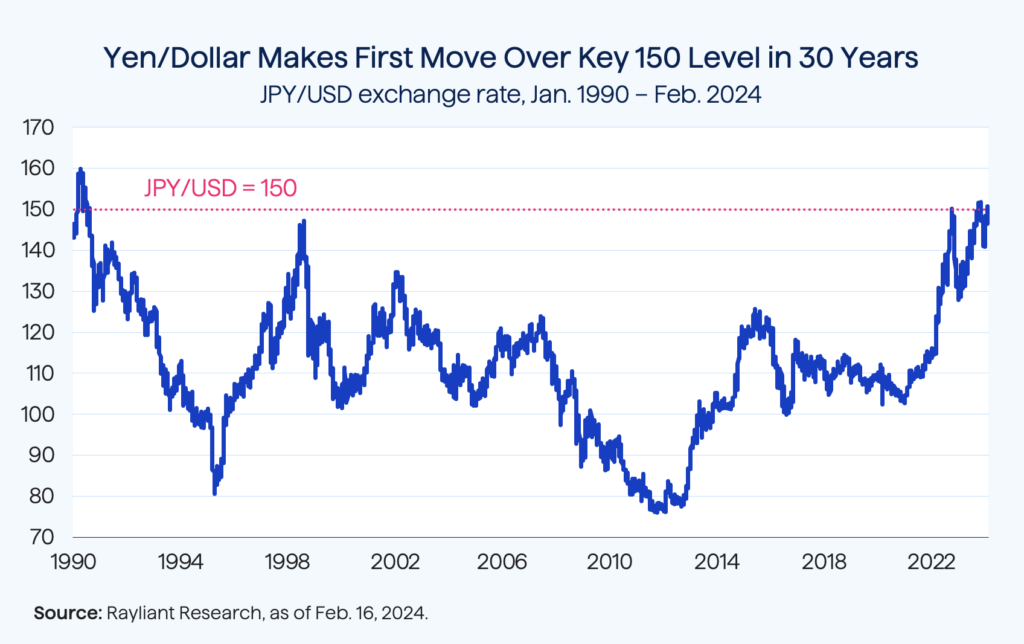

Hot US inflation weakens the yen

Meanwhile on the currency front, for the third time in fifteen months, the yen has weakened beyond 150 per dollar, a threshold it hadn’t hit prior to that for three decades (see below). The yen has seen major depreciation in recent years—the biggest loser among major currencies—due to disparity in monetary policy between the BoJ and other major banks, like the Federal Reserve and the European Central Bank (ECB). Not surprisingly, as the Fed has hiked interest rates, the yield gap between US Treasuries and Japanese government bonds has widened, putting more pressure on Japan to adjust its yield curve control policy. The yen’s most recent spike through that psychologically important 150 mark comes as unexpectedly hot inflation in the US pushes back investors’ timeline for Fed easing, which would help to narrow the gap between US and Japanese policy rates.

The BoJ, for its part, faces a sensitive balance. On the one hand, a weaker currency has boosted tourism, provided an advantage to exporters, and helped the economy on its path to reflation. On the other hand, weakening as sharp as the yen has experienced in the last two years can be destabilizing, and policymakers have made plenty of comments—including over the last week—suggesting authorities would step in to defend the currency when it made moves deemed unacceptably large. A policy normalization would, of course, be the best recipe for reversing some of the yen’s recent losses. The BoJ fears scrapping YCC only to find recently inflationary trends were a fluke and landing back in a deflationary slump. Nevertheless, as mentioned above, we see monetary changes coming in the spring, and that should be a benefit to investors with some yen exposure in their portfolios.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED