The CIO’s Take:

Last week turned out to be a good one for risk assets, as Fed chair Jerome Powell’s semi-annual testimony before the House and Senate revealed no big surprises: No, the Fed is not yet confident enough they’ve defeated inflation to declare victory and begin slashing rates just yet. But are we still on track for rate cuts sometime this year? The answer to that question was a definitive “Yes.” True, there wasn’t much change in the pricing of Fed funds futures—which, having gradually moderated from expectations at the end of last year for six rate cuts commencing as early as March, were still, in the wake of Powell’s visit to Washington, showing three to four quarter-point moves down starting in June. An ECB policy decision last week likewise presented no surprises, rather seeming to firm up a summer timeline for cuts in European rates. Though perhaps not getting as much fanfare as central banking matters in a perusal of last week’s calendar, Friday’s jobs report turned out to be one of the most important data points, as it surprised on the upside in terms of headline nonfarm payrolls, but featured downward revisions to December and January figures, along with a higher unemployment rate and slower wage growth: all good signs for policy doves. Given all that, though we remain cautious, with valuations elevated and CPI looking stickier to start the year, last week’s evidence seemed positive to us, on balance.

Fed chair goes before House, Senate

With speculation around 2024 Fed rate cuts still driving much of the market’s swings as we enter the last month of Q1, all eyes were once again on the central bank’s head, Jerome Powell, as he visited Capitol Hill last week to give testimony before Congress. In his prepared remarks and in the subsequent Q&A with legislators, visiting the House Financial Services Committee on Wednesday and the Senate Banking Committee on Thursday, the Fed chair covered topics ranging from prospects for a soft landing and the risk in commercial real estate to speculation as to whether the bank might ever launch a digital currency (Powell shut that down as not even “remotely close” to happening). As was the case last time the Fed chair visited Washington, Republicans spent considerable time griping over new banking regulations the Fed plans to introduce in coming years. And there was, of course, plenty of discussion on the all-important timeline for easing.

Not confident enough to cut—but “not far” either

On that latter question, Powell remained quite clear in his messaging, reiterating a point made again and again in recent weeks: the bank needs to get “more confident” in inflation’s progress back to its 2% target before commencing with cuts. To be sure, he described that progress as “considerable” up to this point, and suggested there’s no expectation we’ll need more hikes. Indeed, Powell made clear in his testimony that the very reason for charting a cautious course was to avoid a scenario in which easing too rapidly might lead to “a reversal of progress” and “ultimately require even tighter policy to get inflation back to 2% target.” On the other hand, Powell pointed to the risk of an overly conservative approach: that “reducing policy restraint too late or too little could unduly weaken economic activity and employment.” Along those lines, in what must be the doves’ favorite soundbite to come out of his two days’ testimony, Powell tipped that the bank was “not far” from deciding progress was sufficient to begin unwinding the last two years tightening, which has brought policy rates to a 23-year high.

Markets narrowing in on June start to easing

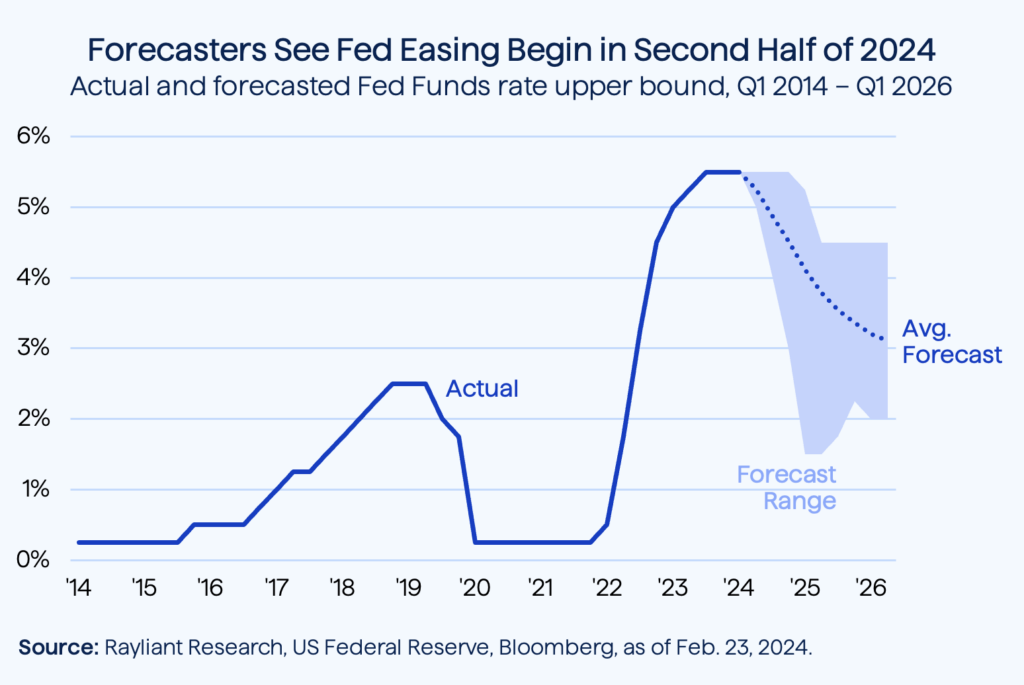

Equities seemed to take Powell’s visit to Capitol Hill as “no news is good news” and rallied through the second half of the week, with the S&P 500 recouping losses in the first half, closing roughly flat through five sessions ending Friday. Meanwhile, the two-year Treasury fell modestly in the wake of Powell’s testimony, though CBOE data showed little change in traders’ pricing of rate cuts to begin in June. As mentioned in the last few weeks’ Perspectives, forecasts for the trajectory of Fed policy rates have been moderating so far this year, as data showing a strong US economy and hinting at stickier prices to start 2024 have the Fed in no rush to ease. At this point, Wall Street strategists see just 3-4 rate cuts by the end of this year, with a gradual path to a 3% Fed Funds rate in the first half of 2026 (see below). As we’ve emphasized before, this is what the market ought to be pricing in—though we suspect equities are incorporating somewhat rosier assumptions than these rate forecasts imply.

Good news in Friday’s BLS report

Naturally, the more data economists see, the sharper their forecasts become. Friday brought more updates on the US labor market, where tightness has been putting upward pressure on wages and thus fueling inflation, as the US Bureau of Labor Statistics (BLS) posted February’s job numbers. On the face of it, headline jobs came in hot again, with a gain of 275K in last month’s nonfarm payrolls, greater than the 200K consensus expectation. Digging deeper into the figures, however, the news was actually more positive for investors. Not only were previously reported numbers for December and January revised downward by a combined 167K jobs, the unemployment rate—which economists had expected to stay level at 3.7%—edged up to 3.9% in February, as more Americans entered the workforce. Wage growth likewise slowed, with average hourly earnings increasing by just 0.1% month-over-month, down from a 0.5% increase in January. While that still puts wages up 4.3% over the past year, Friday’s numbers were undoubtedly a step in the right direction, if the goal is giving the Fed confidence inflationary forces are on the decline.

March brings no cuts, positive messaging

As was widely expected, and echoing monetary policy developments since last summer on this side of the Atlantic, the European Central Bank (ECB) decided at its meeting last week to keep its benchmark interest rate unchanged at 4%, an all-time high for the Eurozone. But just as in the absence of rate moves US investors search for hints at upcoming action in the Fed’s official releases and speech, those handicapping a future shift in ECB policy had much to consider around the Thursday meeting. Much attention was focused on the content and tone of president Christine Lagard’s language in addressing the decision. She commented that she and her colleagues felt they were “making good progress toward [their] inflation target, and…are more confident as a result”—though, pulling a page from chairman Powell’s book, she also indicated that members of the ECB “are not sufficiently confident” and “clearly need more evidence and more data.” On the bright side, Lagarde denied that the bank was in no rush to cut rates, pointing out there was serious discussion on the timing of cuts and laying the groundwork for cuts in the summer, stating that the ECB “will know a little more in April, but…a lot more in June.”

ECB revises economic forecasts downward

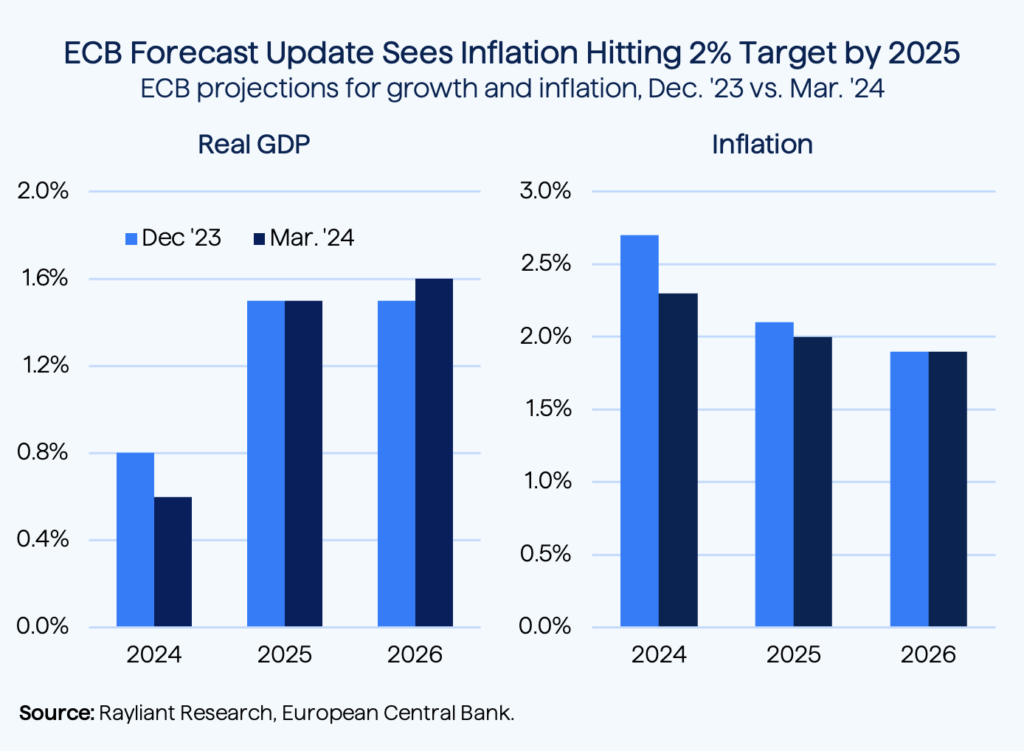

Positive signs for summer easing came in the bank’s official forecasts, as well, with expectations for both growth and inflation retreating a bit from the last round of figures released in December (see below). The bank now sees inflation at the end of this year softening to 2.3%—down from a 2.7% year-end rate forecast last time around—and puts inflation right at the bank’s 2% target to end 2025. That outlook on prices reflects the intended effect of record-high policy rates, which have also served to rein in predictions of 2024 GDP, forecast last December to grow by 0.8%, but now pegged at 0.6%; that marks the fourth consecutive quarter of downward revisions in the ECB’s growth forecast.

Dimming growth prospects naturally play into the ECB’s seriousness in cutting rates sooner than later, though a hotter-than-expected February core inflation reading has put European policymakers on edge, with wage growth in the Eurozone a central concern. Of course, that’s a familiar argument to those following the Fed’s deliberation on rate cuts, and it will resonate with those watching the Bank of England and Bank of Canada, as well. It is precisely this anxiety over sticky inflation that has prompted yield traders across Western markets to bake in a somewhat longer timeline for easing than had been expected at the end of last year.

Can nickel get out of its bear market?

We often think about the world’s transition to green technologies as impacting energy commodities, though consumers’ environmentally motivated shift also turns out to have some big implications for industrial metals. Indonesia offers an illustration, as the world’s largest producer of nickel: a commodity widely used in steel production, but also a key input to EV batteries. Ironically, the country’s nickel mining industry has recently faced growing criticism for damage to the ecosystem, including deforestation, mining waste pollution, and high carbon emissions—the last of which, many EV buyers are sad to discover, doesn’t only come from the traditional autos their electric cars are replacing. Dimming prospects for EV sales have helped to keep nickel prices under pressure lately, falling around 40% from the beginning of 2023. In fact, the greatest part of that decline is a result of Indonesian smelters, backed by big investment from China, flooding the market with cheap nickel produced in those eco-unfriendly coal-fired plants. Some investors will be concerned with the ESG aspect of this trend, but those with a direct bet on nickel are mostly wondering whether the industrial metal has bottomed out. We look at mine closures as prices languish, factories put out of business by competition from Indonesia, as well as any potential recovery in demand for EVs and China’s need for steel as features that could work to eliminate the glut and send the commodity higher this year.

OPEC+ nations extend voluntary cuts

Crude oil has averaged just under $80/barrel over the last year, supported not just by anxiety over a broadening conflict in the Middle East, along with a wave of Houthi attacks on Red Sea ships, but also voluntary production cuts by members of the OPEC+ group, initiated at the end of 2022. Saudi Arabia, Russia, along with a number of other producers in the coalition announced just over a week ago that they intended to extend those supply cuts through the end of this year’s second quarter. There has recently been some speculation that voluntary constraints on production will soon give way to higher supply. That’s because not all members benefit from these cuts; Saudi Arabia has been carrying a significant portion of the cost, while non-OPEC+ producers like the US and Canada gain market share. Vikas Dwivendi, a global energy strategist at Macquarie, recently suggested Saudi Arabia might soon give up cuts and accelerate production, given it has ample capacity to do so. That would certainly be a negative development for oil bulls, though increasing production could also stem for something that would drive gains in oil: an economic recovery in China. The nation’s weak demand for oil in recent years is, we suspect, the biggest reason prices haven’t rallied in the face of supply cuts and above-average geopolitical tension.

Rate cut hopes see gold continue its rally

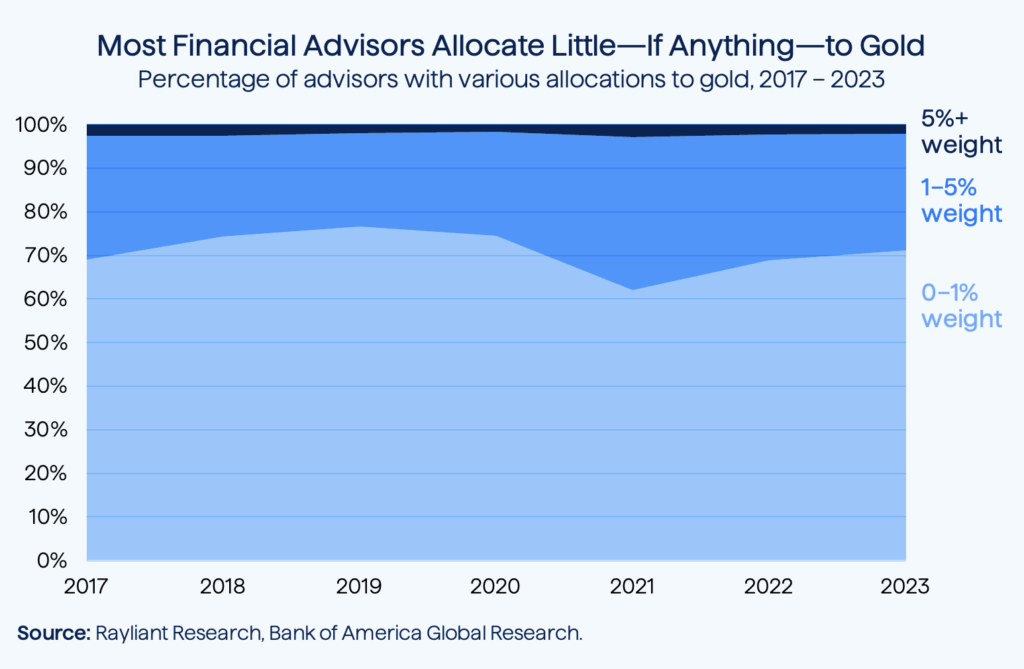

Oil—the so-called “black gold”—may have been rangebound over the last twelve months, but the yellow kind just keeps setting record highs. We commented on gold’s massive rally near the end of last year, and the precious metal has done it again to kick off March, gaining in eight consecutive sessions and trading as high as $2,183 per ounce on Friday, an all-time high. Much of the commodity’s recent strength seems to come as investors bake in the increasing probability of rate cuts in the US and Europe at some point in 2024. Because gold provides no yield of its own, high policy rates imply a greater opportunity cost to holding the metal; if rates come down later this year, demand for the commodity would naturally rise. Meanwhile, geopolitical concerns around Russia-Ukraine and the war in Gaza provide support in assets like gold which have historically been regarded as “safe haven” assets. Despite gold’s strong momentum and the potential tactical case for an allocation, as we explained in our lengthy discussion of gold’s merits as a strategic investment, we still don’t like the asset as a long-term weight in client portfolios. We recently came across some interesting data from Bank of America that show we’re in good company: as of 2023, it seems only around 2 in 100 advisors allocate 5% or more of client assets to gold (see below). So, perhaps that trade isn’t so crowded after all.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED