The CIO’s Take: Heading into the March FOMC—the month in which traders last December expected rate cuts to begin—even before last week, there was pretty much no chance the Fed would start easing. Any hope of a Q1 pivot were completely dashed by last week’s data on inflation, which showed CPI and PPI rising faster than analysts had predicted: a fresh sign of sticky prices that will surely reinforce the prevailing sentiment at the Fed, erring on the side of keeping rates high as long as growth is strong and prices aren’t definitively decelerating. None of that has stopped stocks rallying, of course, as equities aim to close Q1 with impressive year-to-date gains, driven by increasing prospects for a soft landing, robust corporate earnings, and continued faith in the AI revolution. Our stance remains cautious. We don’t view this as a “bubble” per se (at least not compared to the late 90s dot-com craze), but stock’s aren’t cheap, either. Our approach calls for opportunistic stock picking and allocations to markets, like Japan, where the macro environment seems to hold more potential for positive surprises (e.g., the Rengo survey discussed below, which bolsters the case for BoJ hikes in March).

February CPI and PPI running high

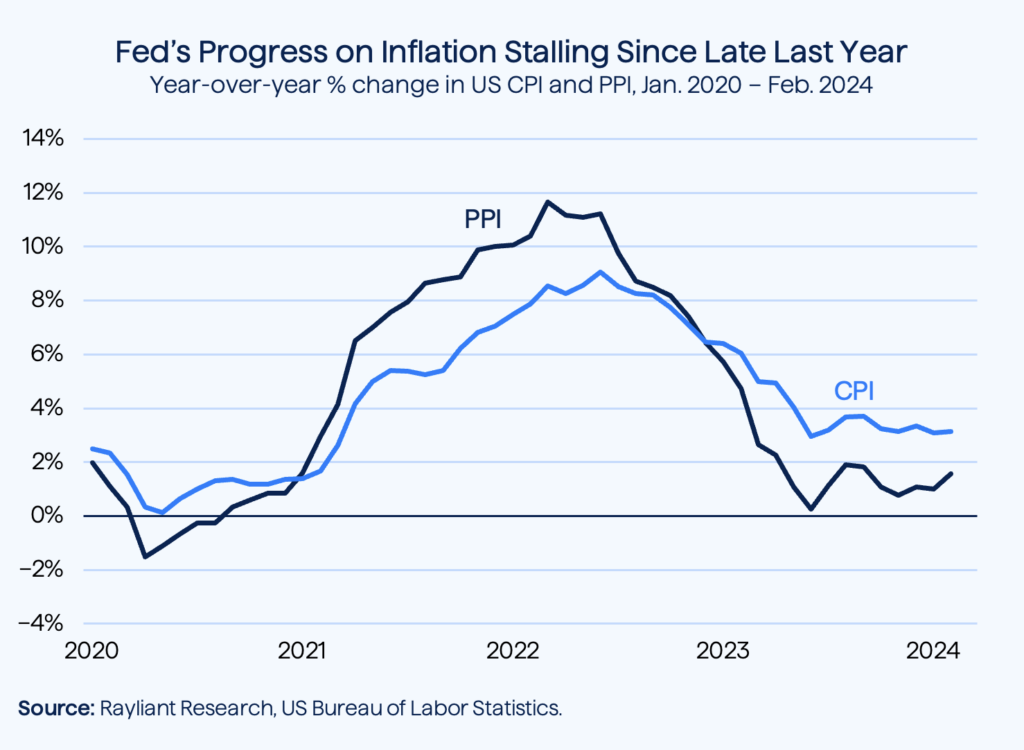

Last week’s US Bureau of Labor Statistics (BLS) reports on consumer and producer prices showed more signs of the sticky inflation we’ve been warning about in Perspectives since last year. February CPI, reported last Wednesday, increased by 3.2% year-over-year, slightly faster than expected, while Thursday’s report of February PPI showed a 1.6% year-over-year jump (see below): the highest inflation in producer prices since September 2023, and well above forecasts for a 1.1% year-over-year rise. PPI inflation, though seemingly innocuous below the Fed’s 2% inflation target, presents a concern since consumer prices will eventually reflect some of the higher costs to producers. Bulls reading last week’s data might point to a slight decline in core CPI—a more relevant measure to Fed policymakers—which came down to 3.8% from 3.9% a month prior, though even that was a tick above economists’ expectation for a 3.7% rise in core prices. Energy and shelter prices accounted for over three-fifths of the gain in CPI last month, according to the BLS, with owners’ equivalent rent popping to the tune of 4.8%, annualized. Overall, seeing CPI flatten out above 3% in the chart below won’t give the Fed that “confidence” officials keep talking about to cut rates in the near-term.

March FOMC may yield less dovish dots

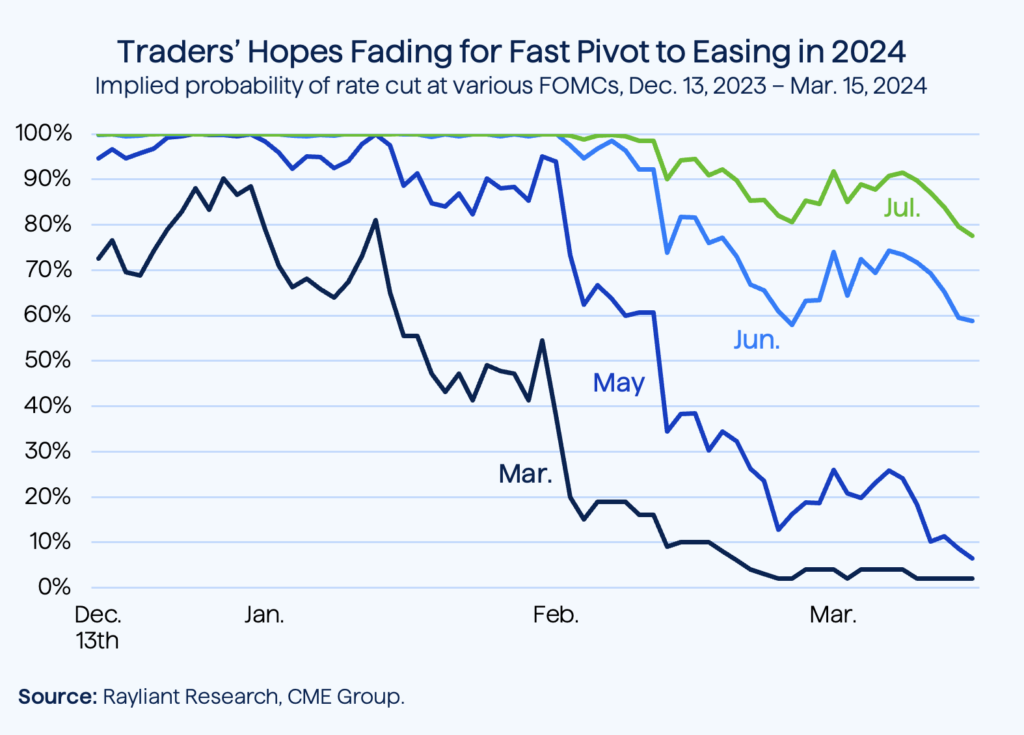

That lower likelihood of a quick pivot, as we’ve remarked in recent weeks, has become well reflected in market implied odds of rate cuts, steadily declining since the beginning of the year (see below). Inflation data like February’s don’t help. The market-implied probability of rate cuts by June, considered an inevitability by traders at the end of January, started last week at 73% and ended the week at just 59%. All of this is relevant going into next week, as the FOMC will convene on Tuesday and Wednesday for a meeting that will deliver the Fed’s March decision on rates and—more interesting, given “hold” is currently priced at 98% probability—a new set of dot plots that show how opinions have evolved over the last quarter on the pace and magnitude of cuts. Based on December’s figures, only two committee members would need to shift in the direction of less accommodation to bump the median number of cuts in 2024 down from three to two. Based on the data we’ve seen so far this year, all of which underscores the Fed’s flexibility to play “wait and see” on plans for easing, our view is the consensus has greater potential to unpleasantly surprise markets.

Easing timeline could creep further back

So, beyond the upcoming Fed meeting, where is Fed policy headed in 2024? At the end of last year, we thought the market’s move in December to price in six 2024 cuts was grossly overexuberant. We still don’t see rate cuts coming before June, at the absolute earliest. And while continued resilience in the US economy has upped the chances of a soft landing, in our view, February’s CPI and PPI—not to mention January inflation data we’ve unpacked over the course of Perspectives in recent weeks—make us think sticky prices will marginally reduce the Fed’s willingness to make a big reduction in policy rates this year. More economists are taking such a view, with RBC last week reducing their forecast for moves down at every meeting in the latter half of the year to a quarterly pace of cuts, with 75 bps of easing now expected vs. a 125-bps move down in the Fed policy rate by the end of 2024. Quickly surveying macro forecasters we follow, many expecting the first cut in May are now thinking June more likely. Depending on next week’s Fed guidance and coming months’ price data, we see a real chance that timeline creeps further into the second half of the year.

Equities march upward in 2024

Turning to equities, we acknowledge that there’s no reason more stubborn inflation and gloomier forecasts for the Fed’s policy pivot have to rain on the stock market’s parade. It’s clear there was plenty of good news being priced into shares starting last December, when investors looking at newly minted FOMC dot plots suggesting the possibility of three cuts at some point in 2024 and decided it would probably be more like a half dozen rate cuts commencing in March. What we haven’t seen is any sign the market is pricing that scenario out as data roll in throughout the first quarter challenging such a rosy view. As of last Friday, 2024 has seen a 7.6% year-to-date rise in the S&P 500 Index and a 6.6% increase in the NASDAQ Composite. And it’s not just a US phenomenon; around the world, equity markets are betting central banks have succeeded in the fight against inflation and cleared the risk of a severe recession on the horizon. The MSCI World ex-US Index, tracking developed stock markets outside the United States, has posted a 4.3% rise so far in 2024, with Europe’s STOXX 600 Index climbing 5.9% year-to-date and Japan’s Nikkei 225 up a whopping 15.7% since the start of the year.

“Bubble” still sounds a bit extreme

But is it a bubble? We’ve been concerned about broad equity valuations for some time, but invoking that “b-word” implies another level of irrationality in prices, and we’ve heard that word used more often lately. Perhaps that’s not a big surprise, as everywhere one looks there seem to be signs of equities’ staggering advance. Consider, for example, that through last Friday’s close, the S&P 500 has closed at 17 all-time highs this year, making a record on roughly one-third of all trading days in 2024. To be fair, although views on the path to Fed easing have certainly dimmed so far this year, there’s been plenty of good news, as well. Last quarter’s earnings turned out to be stronger than many had feared and that strength was broader than expected. On top of that, the US economy still looks amazingly robust, despite a very challenging macro and monetary policy backdrop, and we do believe there’s a better chance (still no guarantee) that the US has escaped a hard landing. Although we see AI hype as somewhat overblown, companies like Nvidia (an overweight in our models) continue to post mindboggling top- and bottom-line growth, substantiating at least part of the story that another digital transformation is underway. So, although we believe prices have largely captured the good news—and, in some areas, we think they’ve overshot—we don’t see prices as way out of whack with fundamentals.

Rally’s breadth seen improving

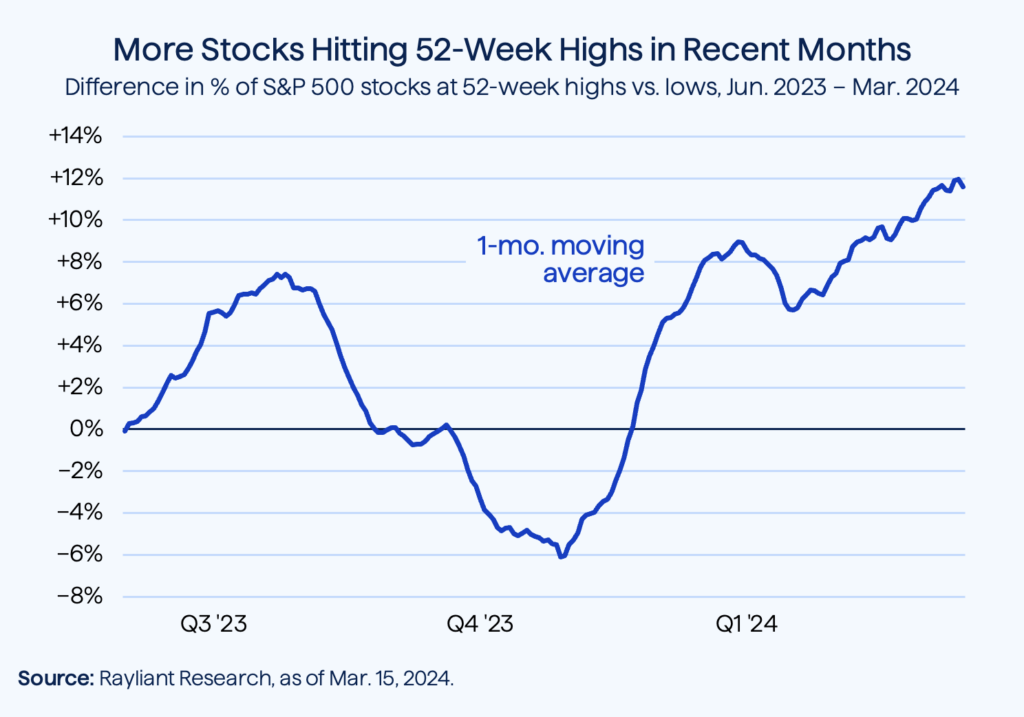

Of course, to the extent it’s only Magnificent 7 stocks like Nvidia driving the market higher, there will always be concern that increasingly top-heavy benchmarks’ gains belie weakness in the broader collection of US stocks. Interestingly, as we alluded to above, stock market strength seems to finally be broadening out. On the earnings front, JPMorgan tallied a collective beat by S&P 500 companies of 7% during the fourth quarter, with FactSet reporting over 70% of companies delivering positive EPS surprises. We can see it in data on constituents of the major indices, as well, with a broader swath of the market participating in the rally. The number of stocks hitting annual highs versus those marking annual lows has continued to increase throughout 2024, confirming it’s not just the usual suspects enjoying a rally so far this year (see below).

That’s especially reassuring to active stock pickers looking for opportunity outside the most-followed names in the S&P 500. And it matters as bargains become harder to find, with FactSet reporting the S&P 500’s forward price-to-earnings ratio in February breached 20x for the first time since February 2022. Bulls will cheer that valuations can still rise 20% before hitting the modern record of 24.4x forward P/E set in July 1999, amidst a definitive bubble: the dot-com mania that gripped traders in the late-90s. As that dubious milestone approaches, we believe careful selection becomes that much more important.

Rengo survey shows big wage hike

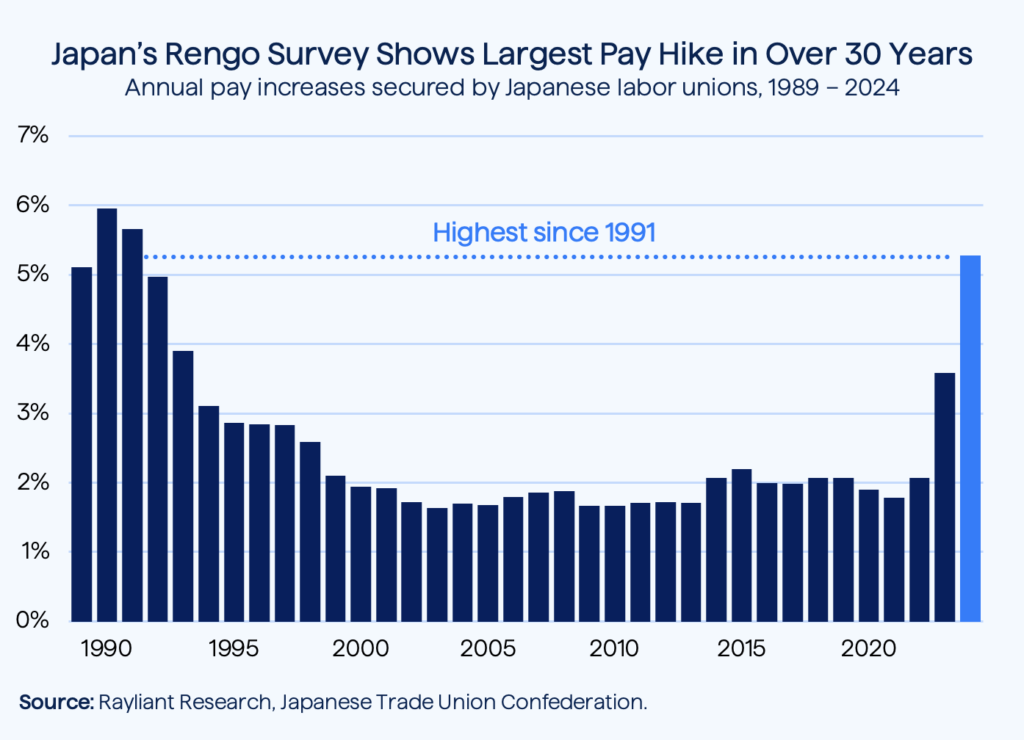

Finally, given we previously mentioned Japan’s monetary policy and the importance of labor unions’ wage negotiations, we thought it might be helpful to check in with an update. Policymakers have been eagerly awaiting a survey released by the country’s Trade Union Confederation, known commonly as Rengo, reporting on wage hikes in 2024: a critical component in assessments of the trajectory for prices in Japan, whose economy has been struggling under decades of stifling deflation. The Rengo report showed large firms hiking wages by an average of 5.28%, compared with a 3.8% increase in the prior year’s survey (that figure was later revised down to 3.58%). This marks the largest increase in wages going back to 1991 (see below), and adds meaningful fuel to the fire in deliberations among Bank of Japan (BoJ) officials trying to decide at their next meeting, held from March 18-19, whether it’s finally time to exit a negative interest rate regime and scrap its current Yield Curve Control (YCC) policy. The Rengo data reinforce our view that these moves are very likely to happen in March or April.

Negative rates pose technical challenges

Other questions about the future of BoJ policy are harder to answer. Particularly challenging is how the bank addresses its complicated three-tier bank deposit rate system. That program was adopted eight years ago to encourage trading on its interbank markets and limit the adverse effect of negative real rates on earnings. As policy rates increase above zero, such a system seems redundant, and there is expectation the BoJ will abandon it. On the other hand, through decades of extremely accommodative policy, the bank has accumulated nearly ¥600 trillion in Japanese government bonds, and officials believe an uneven maturity schedule will allow them to wind down that large portfolio even as they continue buying new bonds—so long as a two-tier system is maintained. Such are the headaches Japan’s longstanding negative interest rate policy creates.

Rates will go positive—but not high for now

Regardless of how the bank chooses to manage technical considerations like these, we do expect positive rates to reemerge within the next couple months—though, as we’ve mentioned before, we don’t expect the BoJ to get restrictive by any stretch of the imagination. Instead, we believe rates will remain positive, but very low for the foreseeable future. That’s because Japan’s economy, though seemingly on the verge of recovering growth, will still be growing very slowly. During the final three months of 2023, for example, quarterly growth was a mere 0.1%, in large part due to weak consumption. Inflation is not yet entrenched either, with January marking the third consecutive month of cooling in core CPI, sitting right at the banks’ 2% target. We don’t expect the bank to get ahead of itself, hiking once in March or April and then waiting to see how growth and inflation progress before following up with more tightening.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED