The CIO’s Take: As expected, the FOMC left US rates unchanged at its March meeting, but what drove stocks up on Wednesday was the Fed’s acknowledgement, through Powell’s statement and the committee’s dot plots, that three cuts are still penciled in for the remainder of 2024. And what of apparently sticky prices making a comeback in the opening months of this year? Possibly just a “bump on the road,” according to Powell, though the Fed will be monitoring the situation. We agree with many other asset managers surveyed by BofA that persistent inflation is a tail risk worth watching: probably the biggest threat to a happy year for the stock market. Of course, “biggest” is a relative term, and anxiety over rates holding high for longer hasn’t really reflected in equity prices, which just keep hitting record highs. Judging by the put-call spread in S&P 500 options implied volatility, investors are more optimistic than they’ve ever been about the US market. We maintain a healthy exposure to equities, but remain somewhat underweight US shares at these valuations, preferring international stocks, like emerging markets—which would also benefit from Fed easing, but still look fairly inexpensive—or markets like Japan, which finally exited negative-interest-rate policy and seems on a path to renewed growth. With respect to our models’ bond exposure, we expect there will be better opportunities to lock in high rates, as the fight against inflation is likely not done.

Rates unchanged, outlook barely budges

Fed policymakers elected for a fifth straight time to leave US interest rates unchanged at their March meeting, concluded Wednesday of last week, in a decision that surprised literally no one. Indeed, in the days leading up to the FOMC, data from the CME Group showed the market-implied probability of “no change” was already at 100%. Where analysts and commentators were more divided was in terms of how the Fed would guide markets: both in terms of Powell’s language at the press conference and in the dot plots released as part of the central bank’s quarterly Summary of Economic Projections. Before the meeting, we suggested there was a chance officials could shift slightly more hawkish, given data on US prices in the first two months of the year and an economy that still looks strong. That turned out not to be the case, with Powell explaining his outlook on disinflation hadn’t changed substantially in recent weeks and the median committee member still plotting at three cuts through the end of 2024.

Less consensus on recent months’ inflation

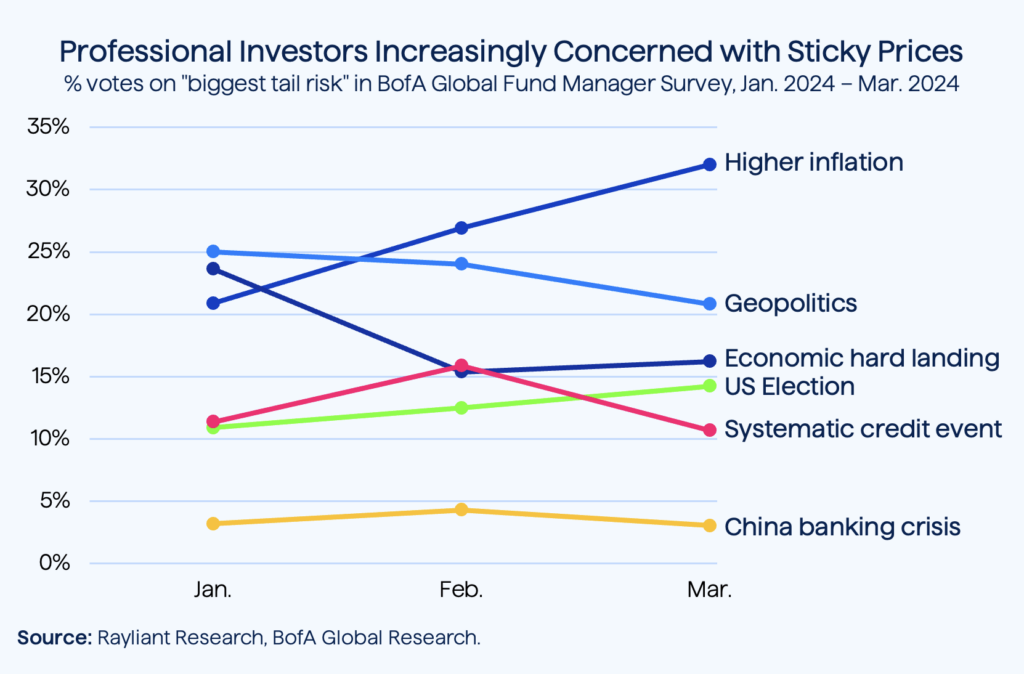

In focusing on continuity in the Fed’s game plan for rate cuts in 2024, it would be easy to overlook a slight adjustment to dot plot projections further out on the calendar, with the longer-term rate outlook dimming just a bit since last quarter’s iteration. Estimates of both the 2025 and 2026 year-end target ranges moved up by 25 bps, suggesting policy rates will be held higher a little longer than committee members anticipated before the last two months’ data on inflation came in. Powell remarked in the press conference that officials don’t really know whether the recent reacceleration of prices was “a bump on the road or more”; the modest shift in long-term rate forecasts reflects more of a speed bump to us than a serious concern on the Fed’s part. Professional money managers surveyed by Bank of America in March (see below) have become more concerned about sticky prices in the last few months, with “higher inflation” rising to become the consensus “biggest tail risk” facing investors at present.

Fed must be thinking about November

Interestingly, though geopolitical risk fell somewhat in the eyes of survey participants since the beginning of 2024, concerns over the upcoming US Presidential Election seem to be gradually rising. Despite its presumed independence of any political party—or perhaps because of it—the Fed’s timeline for easing this year could be influenced by the election cycle. In a sense, no matter how patient the Fed wishes to be in its wait-and-see approach, initiating cuts too close to voting in November would create the perception of a central bank intent on affecting the election’s outcome, leading to a potentially damaging loss of confidence in the institution. We imagine part of the expectation that rate cuts will come in June, now priced by CME Group as the month in which easing most likely begins, stems from traders’ belief that this is the latest officials might credibly get the ball rolling on more accommodative policy and avoid taking too much heat on the political dimension.

We see a timetable for easing at risk

Bumps in the road are usually unexpected—otherwise you turn to avoid them—and we have long anticipated prices becoming stickier on approach to the Fed’s 2% inflation target. We remain concerned that this is not a “bump” and that upside surprises, of which there’s a higher probability in our view, don’t give the FOMC as much flexibility in easing off the brakes so much or so soon as the market expects. It’s also worth noting, as we have in past commentaries, that conditions at present aren’t as tight as one might imagine, given the neutral rate of interest balancing growth and inflation is likely not too far below the current policy rate. As such, we don’t believe it would take much bad data to push the Fed’s timeline further into the second half of the year, even with the election-related considerations mentioned before. One potential mitigating factor worth watching? Consumer weakness. Retail sales have softened in recent months, highlighting the “two-sided risk” facing policymakers in the months ahead.

Puts and calls provide a gauge of sentiment

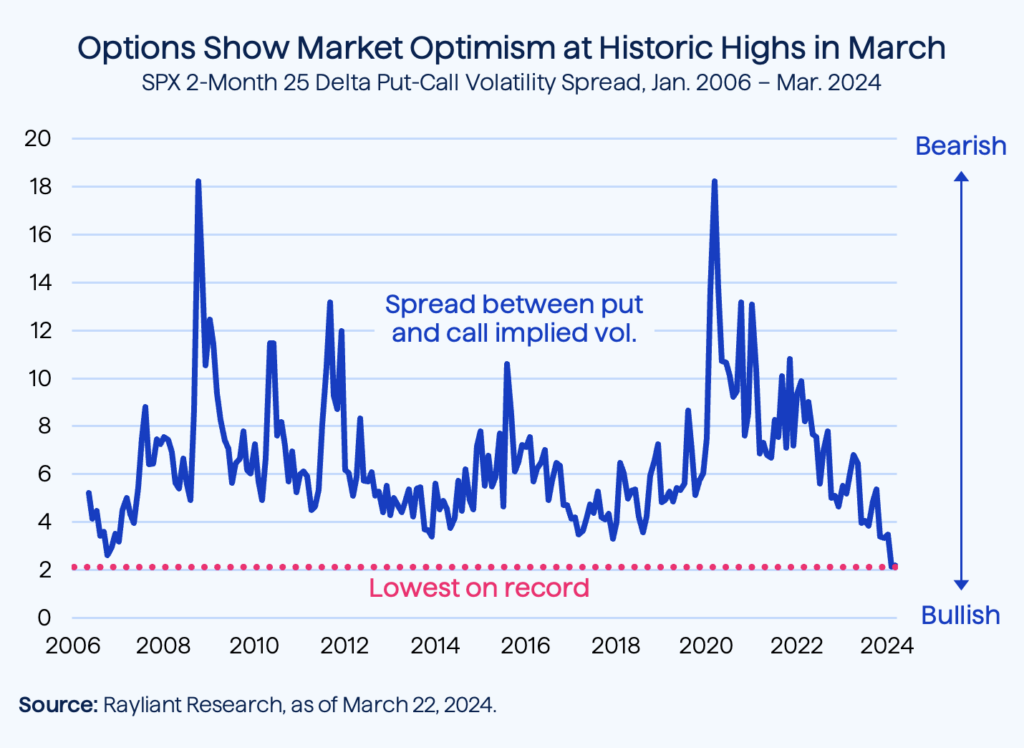

We discussed equity valuations at length last week, concluding that it’s probably too soon to call this a bubble, but cautioning that with stocks rallying ever higher and indices becoming increasingly concentrated, it likely pays to be selective. Our view hasn’t changed, but we thought it might be interesting this week to take a look at investors’ extreme positive sentiment from another perspective: data pulled from options prices. Equity index options are derivatives that allow traders to place “bets” on the price at which popular indices will close at some specific point in time. Practically, traders use options for either hedging or speculating, buying calls when they’d like to wager the market will keep climbing, and purchasing puts when they want to bet on or insure against a market meltdown. For a prominent index like the S&P 500, options markets are extremely liquid, offering us a chance to look at how these securities are priced to infer something about traders’ demand for bullish vs. bearish bets.

Bullish bets as extreme as ever in Q1 2024

Without getting into too much technical detail, one of the key inputs used to calculate the fair value of an option is the expected volatility of the underlying asset, called the “implied volatility.” One might imagine that puts and calls on the same index would imply the same volatility: after all, they’re linked to the same underlying asset. But it turns out the ratio of volatility implied by put and call options on something like the S&P 500 varies over time, as the (chart below) illustrates. That’s because when there’s more demand for bullish calls than bearish puts, the price of calls goes higher, implying a higher volatility for calls and creating a spread.

It’s obvious that this spread has tended to spike up during times of crisis—for example, the Global Financial Crisis in 2008, the COVID-19 shock in 2020—as investors suddenly have much greater demand for downside protection and wagers that negative momentum will drag stocks lower. On the flipside, it’s clear that since pandemic panic subsided, the spread has been steadily declining, hitting an all-time low in February, suggesting investors using options to express opinions about the trajectory of the S&P 500 are historically bullish on stocks. We are fond of quoting Warren Buffett’s suggestion “to be fearful when others are greedy,” though we might suggest it’s better to be careful, and put more thought into stock selection when the rest of the market is apparently throwing caution to the wind.

Japanese policy rates finally positive

Following up on another item from last week’s Perspectives, we can’t help but comment on a pivotal decision by the Bank of Japan (BoJ) last week to exit its negative-interest-rate regime, raising rates for the first time since 2007. That move up in the bank’s overnight rate, from -0.1% to a range from just above zero to 0.1%, came on a majority vote of 7-2. In an even more emphatic display of optimism on the economy’s positive trajectory, officials also chose to scrap Japan’s yield curve control, something we expected to happen soon enough, but weren’t sure the bank would announce at this meeting. Japan had famously kept rates below zero since 2016, when it enacted the policy in an effort to mitigate the impact of a strong yen on the nation’s exports and achieve radical stimulation of its economy to counter decades of deflation. As we expected, with evidence mounting since last year that inflation was gaining traction, this year’s Rengo survey showing the greatest pay increase to Japanese workers since 1991 was enough to push the balance of policymakers into the tightening camp.

But don’t expect policy to get restrictive

For international investors concerned rate hikes might put a damper on the rally in Japanese stocks—which has seen the Nikkei 225 finally break a record it set 34 years ago—we believe the BoJ’s policy pivot is little cause for concern. Despite the shift from negative to positive rates, the BoJ is exercising caution in the process of normalization. Governor Kazuo Ueda made clear last week that he sees it as “important to maintain accommodative financial conditions even as we carry out a normal monetary policy,” reflecting concerns that stepping too hard on the brake at this moment could jeopardize the Japanese economy’s burgeoning return to growth. As such, we wouldn’t expect borrowing costs to increase sharply. Moreover, with inflation only modestly above the bank’s 2% target, there is little urgency to aggressively tighten out of fear inflationary expectations might run out of control in an economy coming off three decades of stagnation in prices. We remain quite bullish on Japan.

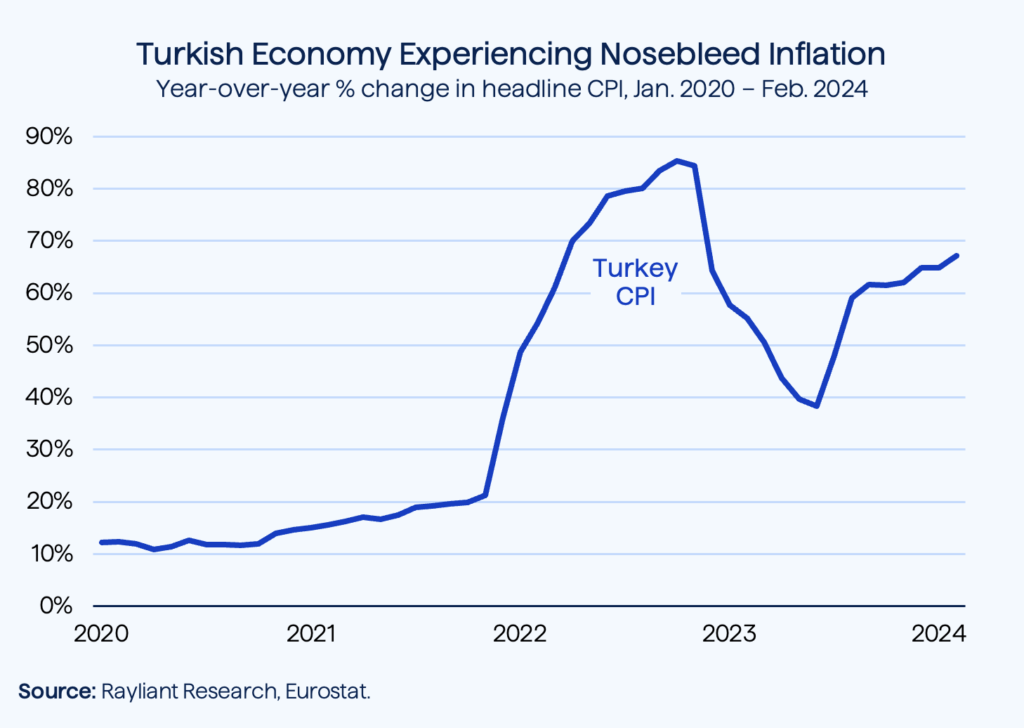

Turkey’s CPI forces its central bank to hike

In one final bit of follow-up, we highlight an economy much smaller than Japan’s, but in the midst of its own surprise monetary moves: Turkey. A few weeks back, we discussed an impressive rally in the retail-dominated Turkish stock market, as households looked for any asset that might possibly outperform staggeringly high levels of inflation (see below). Despite that rapid rise in prices, with local elections coming at the end of March, analysts didn’t expect any action out of the Central Bank of Turkey that might hurt the governing party’s chances. It came as a surprise last Thursday, when the bank tacked 5% onto its one-week repo rate, bringing the policy rate up to 50%. We see this as an acknowledgement on the part of policymakers that the situation is quite bleak, with inflation, its effect on the local currency, and dwindling FX reserves essentially forcing the bank’s hand. It remains to be seen whether even a 50% rate of interest will be enough to tame excessive inflation in a country where, as the chart below suggests, real rates are still negative.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED