The CIO’s Take: Bulls seemed energized at the end of last week by a BLS jobs report on Friday indicating better-than-expected gains in employment—even as workforce participation rose—alongside a modest decrease in wage growth. Those stats came just two days after an ISM manufacturing survey showing the sector had finally snapped a 16-month streak of contractionary readings: more evidence of an economy whose strength seems unstoppable. Of course, none of this is good news for the chances of June rate cuts, which we’re seeing more and more Wall Street strategists acknowledge as slipping away. Even so, they’re still projecting a median drop in the Fed funds rate of 75 bps by year end, with quite a few predicting even more than three cuts. We’re concerned at an increasing number of Fed officials messaging greater patience and much-discussed “two-sided risks” tipping back toward easing too soon. This leaves us defensive in our positioning, slightly underweight risk assets and not yet ready to aggressively extend duration. We’re seeing more bargains among European stocks, but don’t have a strong view on where ECB policy rates go after what we strongly suspect will be a first cut in June.

Major beat in nonfarm payrolls

We’ll get to where our thoughts are going on Fed rate cuts, but first it’s worth taking a detour into jobs data, which we know is near the top of the FOMC’s list in terms of inputs to that decision. Along those lines, last Friday’s US Bureau of Labor Statistics (BLS) report on the state of the job market in March surely got their attention. Economists polled by Reuters were expecting 200K new jobs created in March, though the BLS report showed nonfarm payrolls rise to the tune of 303K jobs. That led unemployment to tick down to 3.8%, lower than the 3.9% level expected ahead of the data. Employment growth in the healthcare and construction sectors was particular strong, with government jobs also contributing significantly to the rise. Average hourly earnings rose 4.1% year-over-year, in line with estimates and the lowest we’ve seen since June 2021. And while that wage growth looks a little better than February’s 4.3% rate and much better than the peak rate of 5.9% hit in March 2022, it’s still well above the Fed’s 2% inflation target.

Markets pricing in higher rates

We’re familiar by now with the markets’ reactions to data like this: Treasuries sold off, sending yields on two-year notes up 7 bps to 4.71%, while the market-implied probability of rate cuts coming by June slipped from 66% to 53%, and the dollar modestly strengthened after the BLS report. Stocks rose, with both the S&P 500 and NASDAQ closing up over 1% by the end of trading on Friday. Bond investors seem to recognize that US macro data showing conditions hotter than expected play into the Fed’s increasingly hawkish narrative: not yet confident enough that inflation is coming down to its target and inclined toward patience as strength in America’s economy buys them time to wait before cutting rates. Doves will be comforted to see ample job creation alongside further softening in the pace of wage growth—though, as noted above, we believe that number is still too high and not coming down quite fast enough. Equity investors, meanwhile, appear happy enough that the economy looks so strong and not yet ready to internalize the damage such data do to the easing timeline currently priced in.

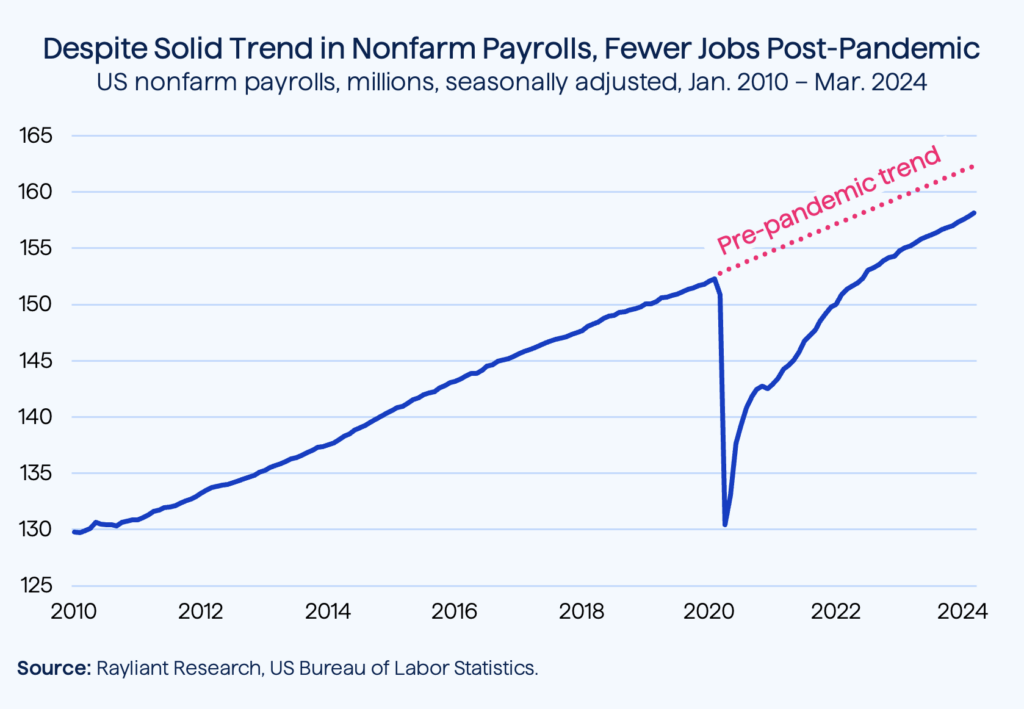

Don’t count on gains in workforce

It’s worth noting one other interesting aspect of last month’s BLS data, a potential silver lining in terms of inflation: the March “household survey” showed a surge of 469K people into the US labor force, boosting the labor force participation rate. Among the pandemic’s many disruptions to the macroeconomy, since COVID hit there’s been a notable decrease in the ranks of Americans participating in the labor market. That’s easy to see in the nonfarm payroll data, plotted below, which show total jobs in the US economy way below the pre-pandemic trend, despite apparent strength in job growth.

Much of that shock is explained by Baby Boomers deciding amidst the weirdness of the last few years that it was a good time to retire and exiting the workforce. That shortage of workers created tight labor market conditions transmitted to inflation via blistering wage growth through the first half of 2022. To the extent more workers enter the job market—as the March data show—it would help to get things moving in the right direction. Unfortunately, we expect that to happen too slowly to make a big difference for this year’s easing.

Manufacturing data add to Fed’s stress

In fact, it wasn’t just last week’s jobs data throwing a wrench into the Fed’s policy plans for 2024. Data from the Institute for Supply Management (ISM) released on Wednesday showed manufacturing in the US finally breaking back into expansion for the first time since 2022, after sixteen straight months of contraction. That report prompted bond traders to dump Treasuries, resulting in some of the biggest upward moves in yields seen so far this year. Ultimately, readings on the labor market, manufacturing surveys, and even data on inflation itself are all pieces of a puzzle the Fed is assembling to figure out what to do with interest rates in 2024.

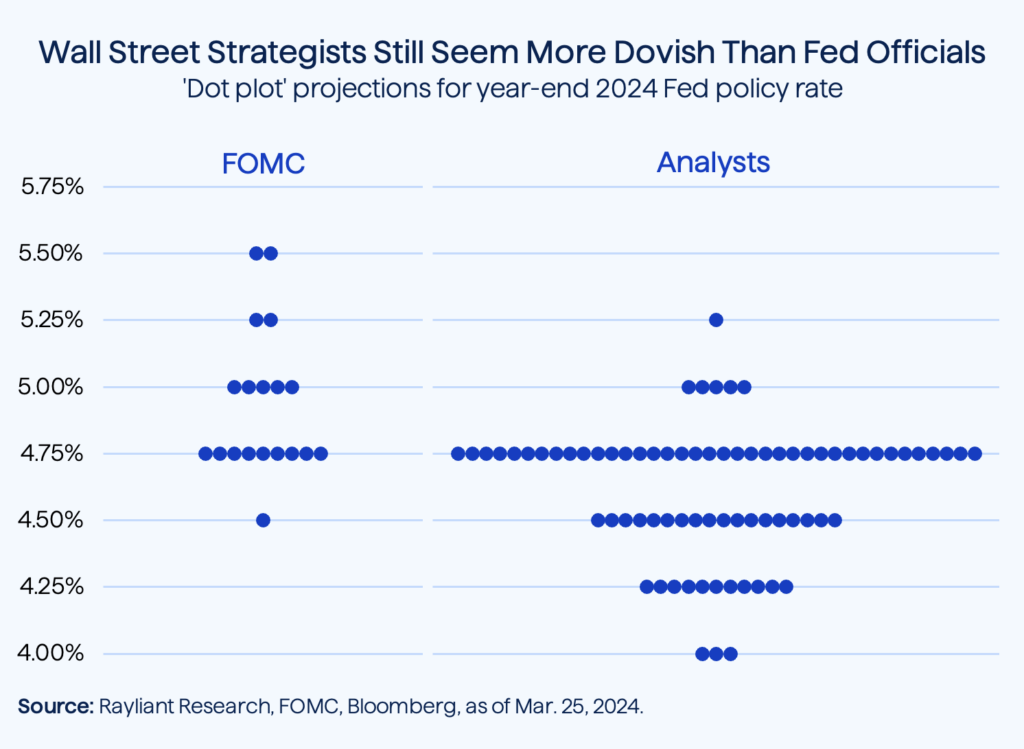

Wall Street consensus still too dovish

Though things were looking up for a solid pivot to more accommodative policy with the Fed’s December dot plots showing three cuts by year end, pushing investors to predict a full six cuts in 2024, data throughout the first quarter have rattled those rosy forecasts. The Fed’s updated quarterly projections released in March still penciled in a median expectation for three cuts, but Wall Street experts seemed a little less bullish than before at the end of Q1. We thought it might be interesting to create a version of the FOMC dot plots based on economists’ predictions for where rates would land in December ’24 (see below). While forecasters are now showing a median expectation identical to the Fed’s—three cuts by the end of the year—we note that they still seem a bit more optimistic in terms of a fatter tail on the dovish end of the distribution, with plenty of experts still projecting four or more cuts before the year is out.

Tone of Fedspeak changing

Over the last couple weeks, Fed officials have given us plenty of chances to better understand policy considerations in their own words, with Powell and others speaking on how their thinking has evolved. For his part, at a conference in San Francisco just over a week ago—something we actually discussed a bit in last week’s Perspectives—the Fed chair explained that although “job gains and inflation have come in higher than expected,” he didn’t think it should “materially change the overall picture” of a robust economy and inflation moving bumpily down to the bank’s 2% target. We’ve heard other Fed officials messaging patience. Cleveland Fed President Loretta Mester last Tuesday said she thought “the bigger risk would be to begin reducing the funds rate too early,” which she believed could “risk undoing the progress” the bank has already made cooling prices down. Although Mester tipped three cuts as her baseline, she said two moves down could also be appropriate. Speaking on Friday, Dallas Fed President Lorie Logan said to an audience at Duke University that “it’s much too soon to think about cutting interest rates”.

Risk of an overshoot is increasing

There are voices on the other side, as well. Chicago Fed President Austan Goolsbee, in a Thursday speech delivered to local business associations in Oak Brook, Illinois, cautioned on a different type of policy error: that the Fed might “stay restrictive for too long” in which case “we will likely see the employment side of the mandate deteriorate.” Indeed, we worry about this as well—the Fed “overshoot” that we fear might result if progress on inflation doesn’t get into the central bank’s comfort zone fast enough and the timetable for rate cuts continues being pushed down the calendar to the point that the Fed accidentally falls behind the curve when past restrictive policy finally catches up with the economy. These concerns, in our view, become starker by the week, as more data rolls in that might push those FOMC dots up the plot. We’ve witnessed a number of strategists in recent days suggesting labor market tightness could have “closed the door” on a June start to easing, and there’s plenty more on the economic release schedule that could further muddy the waters. We’re keeping a very close eye on US CPI, coming out this Wednesday.

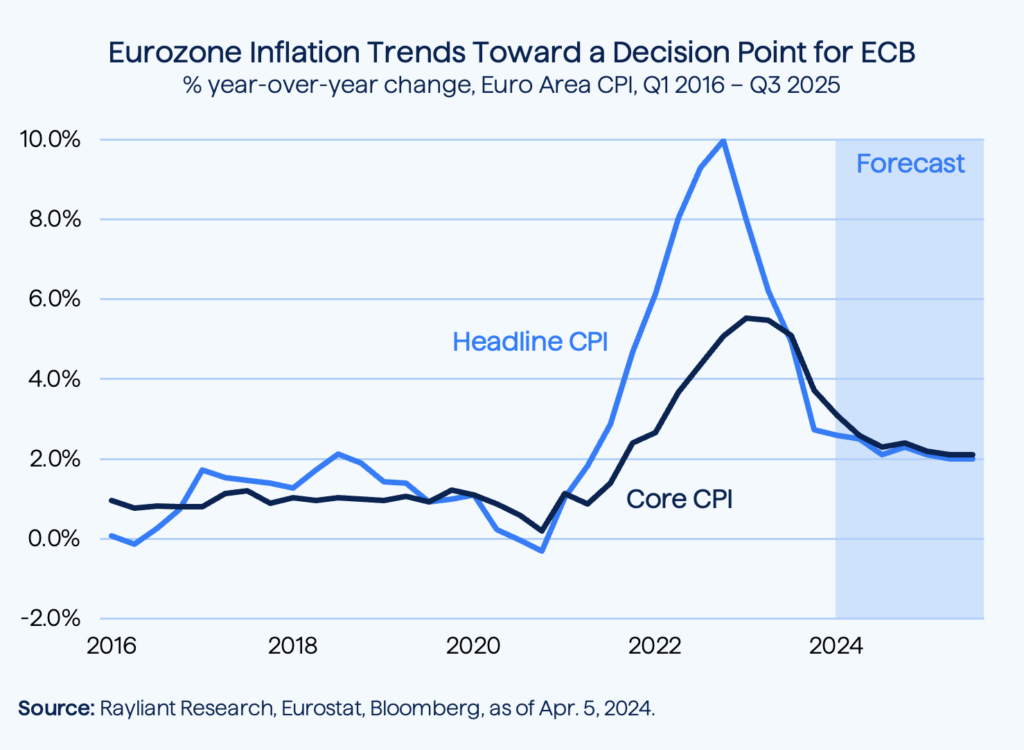

Chances of ECB rate cuts rising

Although our commentary above makes it clear we lean toward glass-half-empty in terms of the timing of Fed rate cuts, there could be hope for a quicker pivot to easing by the European Central Bank (ECB). Much depends on inflation, of course, and the numbers in 2024 have so far been more favorable this year on the continent. March data for the Eurozone showed a 2.4% year-over-year rise in CPI, closing in on the ECB’s 2% target with the fourth straight month of declines in month-over-month inflation. Looking at how disinflation has been trending in the euro area (see below), the path down to the ECB’s target has been fairly smooth and economists expect that normalization to effectively conclude within the next 18 months. That’s reflected in interest rate swap markets, whose prices suggest a 0.90% reduction in policy rates by the ECB this year—equivalent to nearly four quarter-point cuts. By comparison, swaps in the US and UK put cuts by the Fed and Bank of England (BoE) at a total of roughly 0.70% in 2024, nearly one quarter-point less in expected easing.

Much less clarity after June pivot

Like the US, the UK is dealing with persistent inflation. In February, for example, services inflation notched 6.15% on the back of strong wage growth. That said, the BoE actually expects total inflation, which fell to 3.4% in February, to recede to its 2% target in the second quarter of this year. Unfortunately, as we discussed in last week’s Perspectives, the UK is also dealing with exceedingly weak growth, which is a big part of the reason prices are expected to soften more quickly. The ECB is facing a somewhat similar situation on the growth front, with Eurozone GDP growth clocking in at 0.5% in 2023, in stark contrast to the US economy’s 2.5% expansion over the same period. Indeed, policymakers at the ECB fear they might fall behind the curve if they delay cuts for too much longer, which is a big reason we see a strong likelihood of a 25-bps cut in June. Beyond that, the crystal ball is a bit hazier. In our view, cuts at subsequent meetings will depend heavily on what the Fed does when they meet later on in June—ECB officials don’t want to see too much divergence between US and European policy rates—as well as the pace of services inflation. As in the UK, that important sub-component of prices has been elevated, rising to 4% year-over-year in March, its fifth straight monthly increase.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED