The CIO’s Take:

Mindboggling gains for meme stocks last week

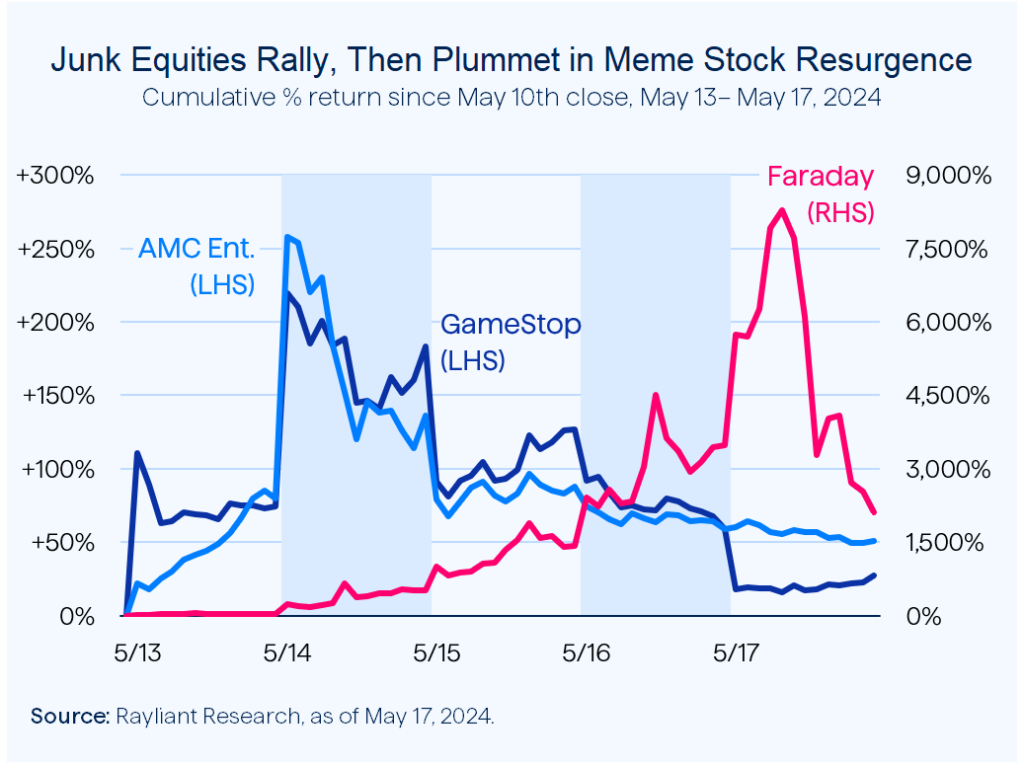

Last week brought more evidence of frothy conditions in US equities in a fresh rally for ‘meme stocks’, a collection of often-struggling companies whose shares have attained cult-like status among retail investors through social media. Such stocks had been relatively dormant since a massive bubble and burst in 2021, but they came roaring back last week, with shares of perhaps the most famous meme stock, GameStop, rising by more than 200% on Tuesday, and others making even more startling gains, like Faraday Future, up over 8,000% for the week as of mid-day last Friday (see below).

So, what was driving a rally that added up to $18 billion of market cap to GameStop’s shares alone? Hours before trading began last Monday, Keith Gill—a.k.a. ‘Roaring Kitty’, a central figure in 2021’s frenzied speculation over heavily shorted GameStop—tweeted a hand-drawn picture of a man leaning into a video game. That’s all it took. Another well-known meme stock, movie theater chain AMC, rose over 250%, seemingly as a result of the same social media post: just a crudely rendered cartoon, without a single word of text, let alone anything to do with either stock’s fundamentals.

Shares surge, even as fundamentals sag

Fundamentals matter, of course, and in the case of many meme stocks, the fundamentals aren’t great. Both GameStop and AMC have struggled as online gaming and streaming services disrupted brick-and-mortar video game stores and movie theaters. Faraday Future was a penny stock on the verge of delisting going into last week, so strapped for cash that it also faces eviction from its offices. On Friday, fundamentals came squarely into focus for GameStop, which warned before Friday’s open that its sales and profits would be worse than Wall Street estimates, sending its shares sliding.

Rally was losing steam by Friday’s close

Even before Friday’s –20% slide for GameStop, it had shed a large part of its gains from earlier in the week. AMC and Faraday likewise slumped within days of reaching their respective highs: a pattern characteristic of speculative buying in which everyone hopes to finding a ‘greater fool’ willing to purchase at prices higher still—a game of financial hot potato. CFOs at GameStop and AMC were some of the biggest winners, with both companies filing by the end of the week to issue more shares at inflated prices—another reason their stocks sold off as the week progressed.

FOMO signals markets’ risk-on sentiment

As in the aftermath of the 2021 meme stock rally, there’s more to unpack here than we have space to cover—great material for future MBA case studies. In the meantime, one key takeaway from the latest round of meme stock mania is that retail exuberance is alive and well: a sign of lower risk aversion that jives with our view markets are currently more attuned to ‘FOMO’ than they are to anxiety over uncertain macro conditions, precarious valuations, and risk of earnings disappointment with expectations as high as they are. As such, we remain cautious.

Finally, some good news on inflation

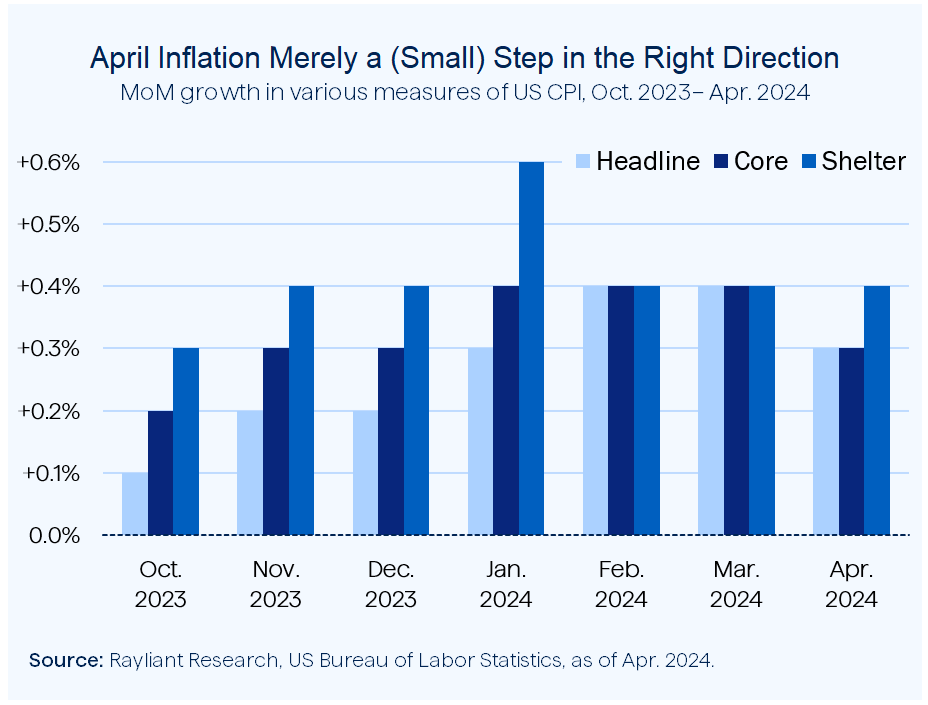

Last week’s action in meme stocks threatened to upstage a broader rally in US shares on the back of positive inflation data, which rekindled flagging confidence in Fed rate cuts this year. On Wednesday, the US Bureau of Labor Statistics released its report on April CPI, showing a 0.3% month-over-month increase, one tick short of consensus forecasts for a 0.4% rise and also a shade better than the 0.4% increases posted in February and March. That equated to a 3.4% year-over-year increase, down from 3.5% last month and in line with analysts’ expectations.

Shelter costs remain too sticky

One component of inflation that’s been particularly problematic is shelter costs, representing around one-third of the weight of the CPI basket. The Fed’s means of measuring housing prices records those costs on a long lag, such that progress seen in private data has yet to show up in CPI calculations. While April’s 5.5% year-over-year growth in shelter costs was the lowest witnessed since May 2022, it was the third consecutive monthly increase of 0.4% (see below), a sign of just how stubborn the component has been.

April data unlikely to sway Fed

While April’s easing of inflation is undoubtedly positive, much like last month’s jobs data, it represents but a single month of progress rather than a decisive trend. Moreover, judging by much softer month-over-month inflation prints seen in the chart above for Q4 2023, April still falls short of much stronger disinflation recorded at the end of last year. All in all, we don’t see anything in the report that will alter Fed policy at this point. In our view, that requires much more than a single month’s data, making figures over the next couple months crucial.

Retail sales also slower in April

Investors were also enthused by a separate release by the Commerce Department last Wednesday, which showed retail sales flat in April, well short of the 0.4% economists had expected. Some observers took cooling consumer strength as another sign the Fed could act sooner. Again, we’re less sanguine. The worst-performing segment was online retail sales, down 1.2% since March, suggesting to us American households are closer to tapped out and raising the risk to US corporate earnings—not a trigger for earlier Fed easing we’re inclined to celebrate.

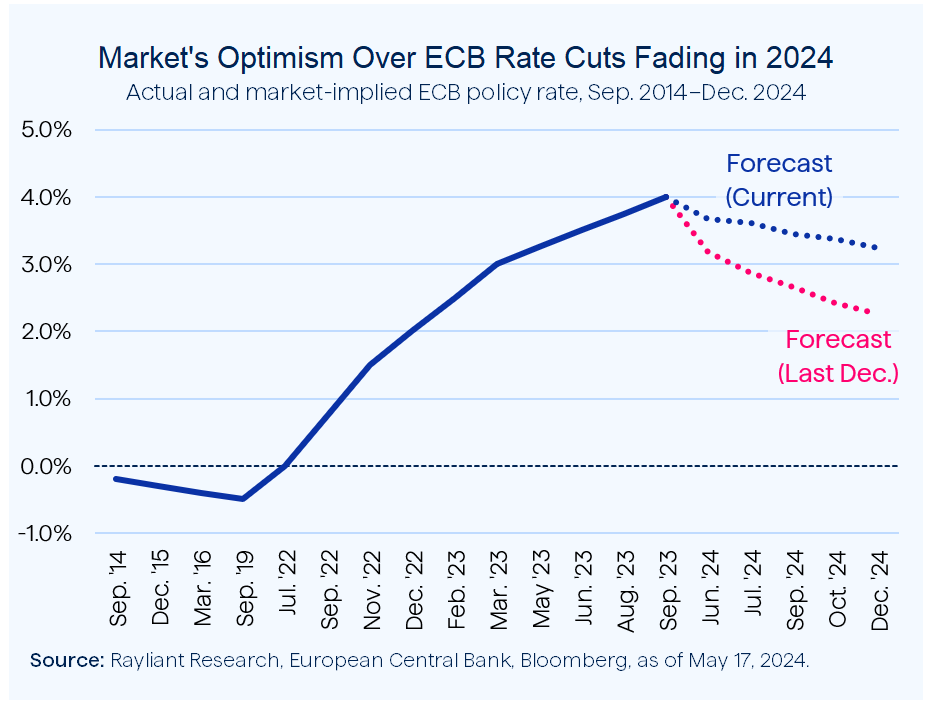

Fewer cuts expected in 2024

On the other side of the Atlantic, though, there has been much less uncertainty over when rate cuts will begin—economists still expect to see a start to easing at the June meeting of the European Central Bank (ECB)—views on how many cuts we’re likely to get in 2024 have also backed off considerably since the beginning of the year (see below). The European policy rate currently sits at 4%, an historic high, and markets had been pricing in nearly seven 25 bps reductions by December 2024 as of the end of last year; that expectation has since fallen to three cuts.

Eurozone inflation trending down

Beliefs that the ECB will soon pivot to easing are based on the same thing driving hope for Fed cuts: cooling inflation, with the Eurozone CPI trending down since hitting a high this cycle of 10.6% year-over-year in October 2022. April’s CPI clocked in at a much less concerning 2.4% year-over-year, with moderating energy costs since 2022 helping to bring prices down. Yet, even as inflation has moved within sight of the bank’s 2% target, ECB executive board member Isabel Schnabel explained that beyond June, policymakers would need to take a “cautious approach.”

Geopolitics a major risk to CPI

Such caution is being driven by policymakers’ recognition of the many upside risks to euro area inflation. Most prominent among those is the issue of geopolitics, as Ukraine continues defending a Russian attack, conflict in the Middle East rages, and the United States faces off against China—all of which threaten to impact prices in Europe, mainly through the energy import channel, but also as a result of greater European defense spending bringing stickier prices on industrial products. And, just as we’ve seen across the world, wage pressure has been an inflationary force in the services sector.

ECB also closely watching the Fed

One final factor in the ECB’s decision-making worth considering: Fed policy. That’s because divergence between Fed and ECB policy rates impacts the strength of the euro versus the dollar, which can feed through to prices. Although ECB President Christine Lagarde has emphasized that the bank is “data-dependent and not Fed-dependent”, we see a less dovish outlook for US central bank policy this year justifying greater pessimism around ECB cuts after a pivot at its June meeting.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED