The CIO’s Take:

Bonds not safe from market turbulence

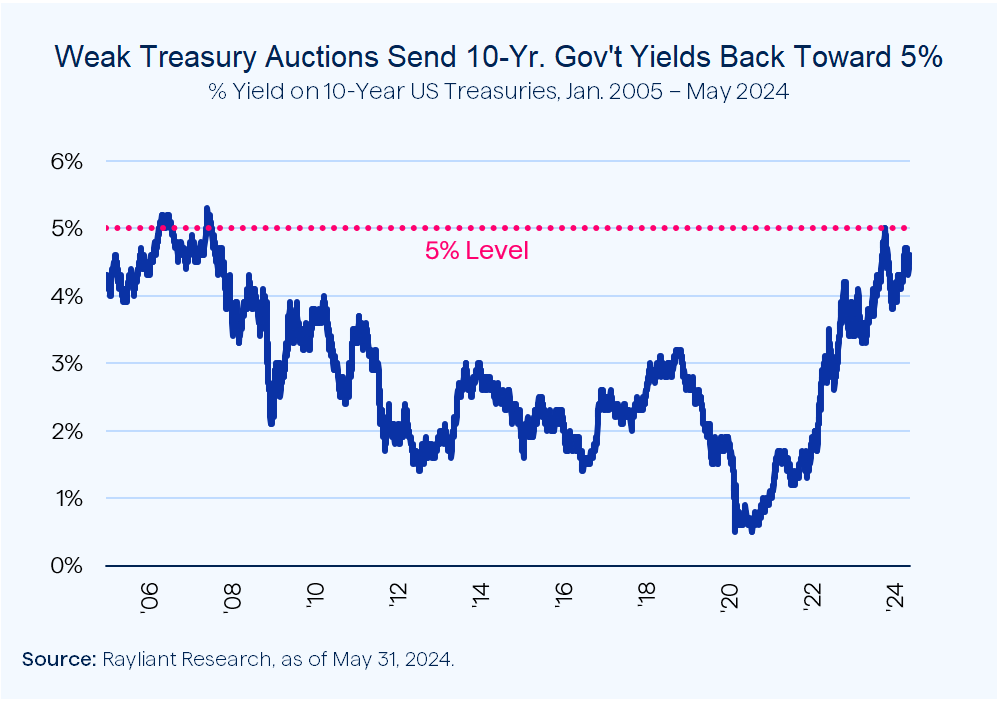

As tech stocks took a breather and sold off last week, investors might have reasonably expected to find safe harbor in their holdings of US government bonds. That turned out not to be the case, as a sequence of three dismal Treasury auctions—occasions on which America’s government floats more debt with historically high coupons for investors to snap up—sent Treasury prices plummeting and yields rising, with 10-year government bond yields moving a little closer to the psychologically meaningful 5% mark, hit late last year (see below).

Auction results point to very weak demand

Two-year notes, which, given their shorter horizon, tend to be more sensitive to changes in sentiment toward Fed policy, have been flirting with the 5% level recently, having breached it at the beginning of May. They got as high as 4.9975% after Wednesday’s depressing auction results, where $44 billion worth of seven-year notes priced at a yield of 4.650%, above the 4.637% pre-auction level. Tuesday’s sale of two- and five-year notes also highlighted extremely weak demand, both resulting in yields above pre-auction levels.

Treasury turmoil speaks to macro problems

Trouble in the world’s largest bond market tells us something about precarious macroeconomic conditions that could go unnoticed were one only looking at sky-high stock market valuations. Even accounting for an unusually large supply of bonds hitting the market in a holiday-compressed auction calendar, demand was surprisingly weak, highlighting investors’ concerns about the amount of government issuance, the state of America’s large fiscal deficit—with no end in sight—and a central bank that keeps pushing out the timeline for easing in the face of stickier prices.

A question of when to extend duration

That last point is an important one, as fixed income investors face a key decision as to whether it’s worth moving out on the curve to take advantage of high yields at longer maturities. As inflation declines and the Fed inevitably gets more dovish, expectations for future rates will fall, which sends prices on those longer-term bonds up. Instead, what we’ve seen recently is expectations revising in the opposite direction, as stalling disinflation and Fed wavering on the timetable for cuts sends yields rising and prices falling. Conditions could get worse before they get better, and we are still biding our time.

April inflation in line with estimates

Friday brought a little relief for bond investors, as the Bureau of Economic Analysis (BEA) released its closely watched Personal Consumption Expenditures (PCE) Index, which showed April essentially in line with market expectations (i.e., no obvious negative surprise). April’s headline PCE inflation came in at 0.3% month-over-month, the slowest increase since December of last year and consistent with April’s CPI, which also showed US inflation moderating after a hot Q1. Core PCE, dropping food and fuel, came in at 0.2% month-over-month, also meeting economists’ estimate.

Won’t be enough to sway the Fed

Of course, with headline and core PCE inflation clocking in at 2.7% and 2.8% year-over-year, respectively, prices were still running well ahead of the Fed’s 2% target. Moreover, despite Friday’s data point marking a step in the right direction, it’s obviously just that: a single data point, not a trend—which is what the Fed has made clear it wants to see before thinking more seriously about cutting rates. Minneapolis Fed President Neel Kashkari said as much to CNBC last Tuesday, indicating he would need “Many more months of positive inflation data” to establish the confidence to ease.

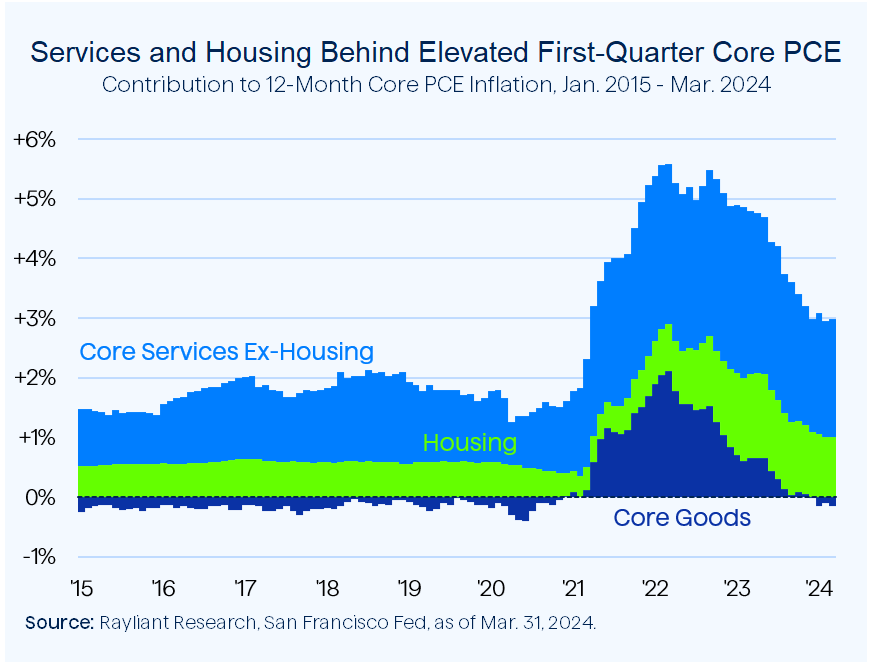

Core services still way too hot

There are some more concerning trends beneath the surface of the BEA’s PCE data. While core PCE saw its slowest increase since March 2021, data from the San Francisco Fed (see below) highlight a troubling rise in core services inflation so far this year, even as goods inflation recedes. Indeed, supercore PCE inflation—the non-housing core services component that appear as the biggest driver of rising prices—managed to tick down from 3.5% to 3.4% year-over-year in April, but still plots above where it was in December 2023.

Fall in spending as high rates hurt

Perhaps the most worrisome data were on personal consumption expenditures themselves; accounting for inflation, consumers’ spending was down 0.1% month-over-month, a sign that households, beset by so many worries we highlighted last week amidst tanking U. Michigan sentiment numbers, are finally nearing their limit. Of course, nobody said engineering a soft landing should be easy. What we’re seeing in the data is just how fine a line the Fed is now walking, as inflation doesn’t slow fast enough, while high rates appear to take an increasing toll on growth.

Tech heavyweight Samsung struggling

We didn’t have much to say about Nvidia’s earnings a couple weeks ago: It barely feels like news anymore when the leading player in an AI revolution beats on earnings for the umpteenth time in a row. The same can’t be said for one of South Korea’s top stocks in the semiconductor space, Samsung Electronics, which has struggled with flagging sales of its chips last year, the departure of its division head in mid-May, and last Wednesday’s announcement of the first strike by workers since its founding in 1969, which led its shares to tumble once again.

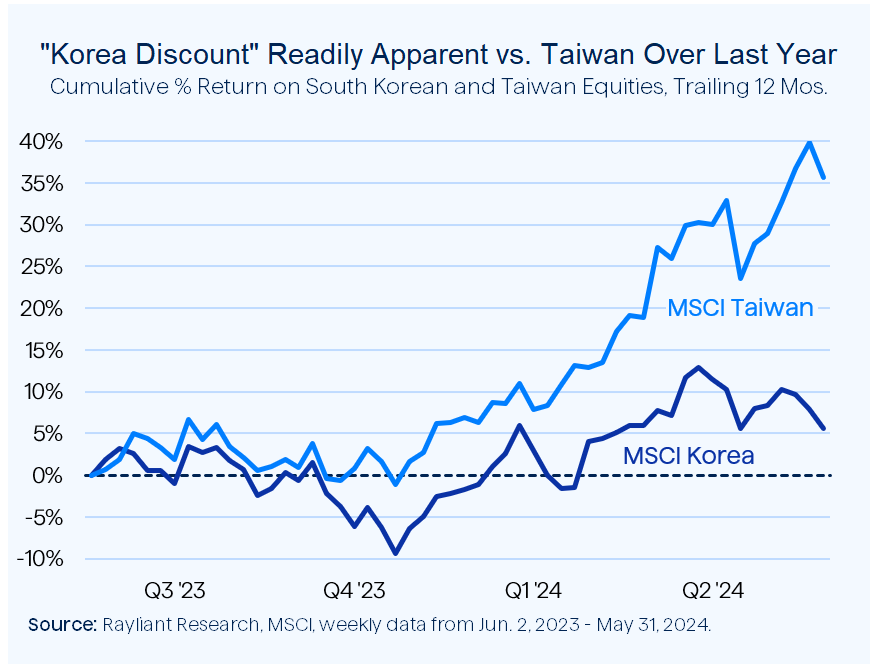

Taiwan on top within East Asia EM

But that’s not just Samsung: Despite South Korea’s strong presence in the red-hot global tech sector, its market performance has been merely lukewarm since late last year, rising just about 5% over the past 12 months. That’s an interesting contrast to another major emerging market, Taiwan, whose shares are up more than 35% over the same period, as depicted below.

The comparison is a truly compelling one, in that these two markets bear striking similarities: each features a well-developed, fast-growing economy with a vibrant tech industry; both have been expected to benefit from a buildout of AI data centers and trends in EV; both countries seem likely to reap the gains of friendshoring and supply chain adjustments in the wake of rising US–China tensions. So why has Taiwan’s market so strongly outpaced Korea’s in recent months?

“Korea discount” holding shares down

Consider valuations: on forward price-to-earnings (P/E) ratio, MSCI Taiwan currently trades at 19x—higher after the last year’s rally, but still below the S&P 500’s 22x and the NASDAQ’s 30x—while MSCI Korea sits at a multiple of just 11x next year’s earnings. It turns out that disparity isn’t a fluke. Despite the size of its economy and its flourishing tech sector, South Korean stocks have historically traded lower than counterparts in other emerging and developed markets around the world, an effect known as the “Korea discount”.

Governance a persistent problem

Whether that makes South Korean stocks a value play or not is a subject of some debate. One of the big reasons investors apply a hefty discount to Korea’s market relates to complicated corporate structures, weak governance, and a poor record in terms of shareholders’ rights. Many of Korea’s biggest firms are so-called chaebols, massive family-owned firms like Samsung, LG, and Hyundai, where transparency, accountability, and even firm value can take a backseat to the interests of a company’s founding family. In that sense, many South Korean stocks could be ‘cheap for a reason’ rather than rare bargains.

An opportunity for active investors?

Such issues are actually central to our view of active management in emerging markets. Whereas local retail investors may ignore issues like state ownership or chaebols altogether, while foreign investors often simply apply a blanket discount to a market adjusting for the unknown risk of such features, we take effort to understand such market-specific nuances. We spend time scoring companies on things like corporate governance and the managers’ competence—and that can help us to spot stocks being unfairly penalized and whose growth will shine in the longer-term: true value investments.

Japan-style reforms offer hope

Even passive investors might find reason to put money to work in South Korea. Earlier this year, in a plan seemingly modeled after the reforms that have catapulted Japanese stocks recently to new all-time highs, South Korea’s Financial Services Commission launched a “Corporate Value-Up” campaign, designed to boost shareholder returns and address a range of issues keeping the market’s valuations down. We see the plan as a meaningful step in the right direction and—although details are a bit light thus far—if authorities follow through, it could be a catalyst for a broader revaluation.

Cheaper tech plays in EM Asia

Policymakers’ promotion of Korea’s technological competitiveness is another potential draw, with recently announced government stimulus targeting the chip industry a positive for shares. That’s not a bet against Nvidia; the king of AI chips remains compelling. Rather, for investors willing to look outside the United States—especially to markets like Taiwan and South Korea, where interesting names may fly under the radar and trade at a meaningful discount—there are plenty of opportunities to get exposure to the AI revolution at much more reasonable valuations.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED