Layoff news doesn’t square with hot jobs reports

The Fed has made it very clear that they’re paying close attention to the labor market as they decide when to pause their tightening. Goods inflation has cooled off in recent months, as acute supply chain pressures ease and China reopens its economy, shifting the fight against rising prices to stickier services inflation, which stems from a tight job market putting huge pressure on wages. Although we’ve seen waves of tech company layoffs hitting the headlines, Bureau of Labor Statistics (BLS) weekly jobs reports continue to show an historically tight labor market, with the unemployment rate falling unexpectedly again in January, as the US economy added more than half a million jobs for the month. This apparent disconnect between news reports of massive staff cuts and weekly reminders of how little unemployment there is can be confusing. What’s actually happening in the US labor market?

Inflation and Fed policy will hit employment—but it takes time

Milton Friedman noted that Fed policy impacts the economy with a “long and variable lag”—in other words, it’s hard to say when exactly last year’s gargantuan rate hikes will actually show up in employment statistics, but it won’t happen right away. We’ve started to see the effects, initially revealed in round after round of job cuts at FAANG companies: growth firms that had been rapidly expanding their workforce during the pandemic boom period for big tech, when markets were perhaps a bit too optimistic about a permanent shift in consumption habits amidst work-from-home and binge shopping online. More recently, we’ve seen the layoffs gradually rippling out to financial firms and even the manufacturing sector. But it will still take time for existing inflation and restrictive monetary policy to do their damage. According to Goldman Sachs, of the S&P 500 companies raising headcounts by at least 40% during the pandemic, less than one-fifth have announced layoffs at this point. Meanwhile, the initial wave of staff cuts is less likely to show up in BLS figures, since highly paid workers fired from tech firms have more transferrable skills, allowing them to find new jobs within three months of their termination, on average.

Credit card spending data belie slowing consumption

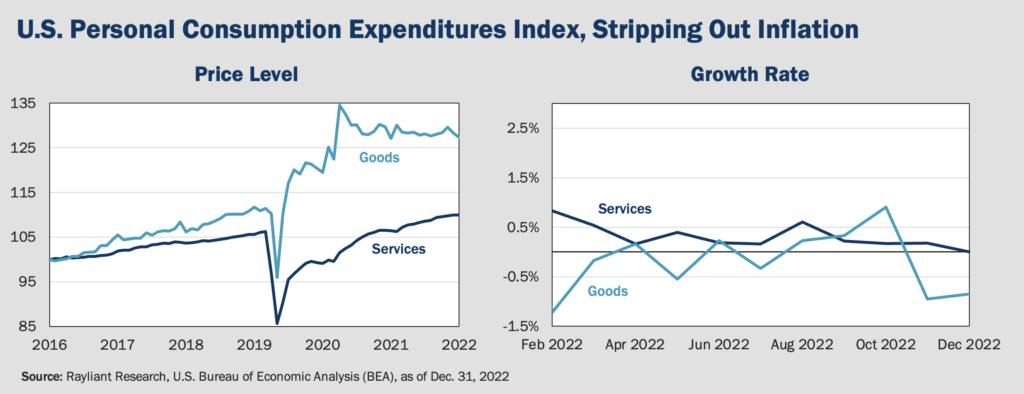

Colossal credit card companies reported earnings early this month, a chance for us to see how Americans are changing their spending habits. Nominally, the news seemed good, with no change in the overall trajectory of spending and consumption still comfortably above its pre-pandemic level and long-term trend. A number of firms in the Consumer Discretionary sector reported strong earnings for Q4, apparently telling the same story as credit card company data: consumer spending is alive and well. Unfortunately, when one adjusts for inflation, the numbers tell a different tale. While nominal services spending remains steady, real services consumption stopped growing in December, as can be seen in the plots below, which show the U.S. Personal Consumption Expenditures Index after stripping out inflation, tracking what a typical American household pays for goods and services. The slowdown in growth in real consumption is even more pronounced in the goods market, where we can also look at data on sales volume to get a better handle on how consumption might be changing. Consumer Staples giant Procter & Gamble, for example, reported positive sales growth in Q4, but actually saw sales volume fall by 6%.

Powell likely willing to overshoot into a robust economy

As the labor market situation described above underscores, the underlying strength of the US economy and pandemic-related factors have confounded attempts to see Fed policy playing out in the data. A combination of low unemployment, increasing wages, pandemic-era handouts, and the resulting savings ‘buffer’ has served to support consumer spending, even in the face of rapid price increases. While the latest readings show wage growth coming off its peak and pandemic savings drawing down, there is still some slack. A marginal decline from an all-time high is not enough for Fed to get inflation all the way to its target. As mentioned before, goods inflation is coming down, but the cooldown in services remains questionable at best. Given the Fed’s concern with a repeat of ’70s-style inflation, look for Powell to err on the side of overshooting, especially with such a strong economy in place to absorb the shock.

Amateur investors once again driving market action

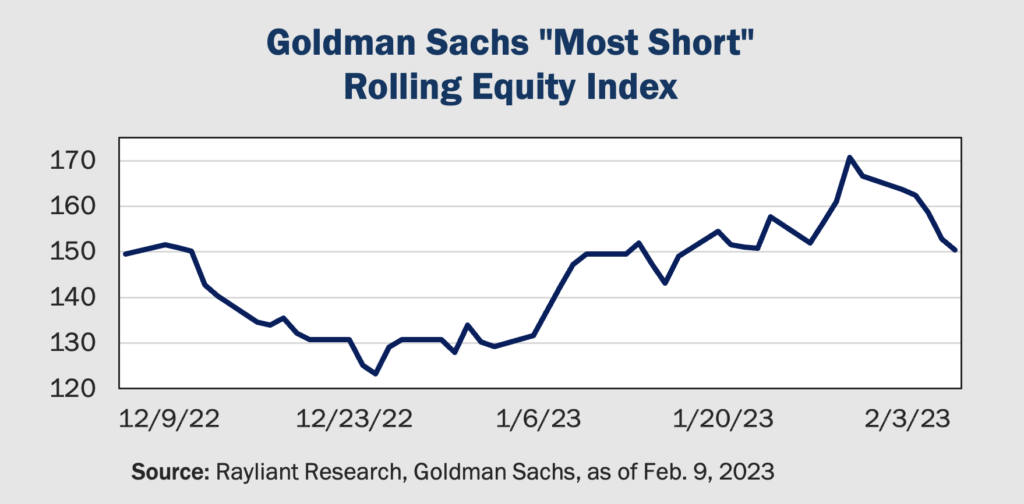

In the midst of a barrage of data, some of it obviously quite nuanced, investors are clearly having some trouble correctly pricing risk. With seemingly contradictory reports on core elements of today’s economic narrative—employment, inflation, consumption—market reactions lately have been…well, for lack of a better word, a little weird. Once again, part of the issue is apparently the high level of retail trading, leading prices to often react more to emotion than hard data and macroeconomic analysis. According to JP Morgan, from the end of January to the beginning of February, amateur individuals accounted for 23% of total trading volume in US stocks: even 1% higher than their top reading during the days of pandemic meme stock mania. Goldman Sachs data on the most shorted stocks confirms that take, with an index tracking the 50 most bet-against stocks by short sellers, mostly institutions, rallying massively in January (see below). Witnessing amateur investors beating the pros, the market’s often bullish response to obviously negative news in recent days at least rhymes with the data.

Mixed data, increasing disagreement predict one thing: Volatility

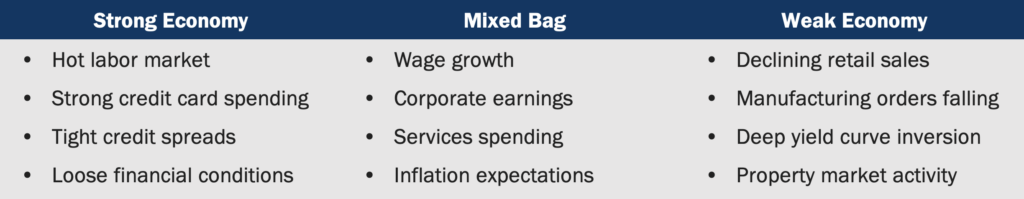

Against the backdrop of high retail investor participation, we have observed aggressive ‘short covering,’ as hedge funds close out their bets against the market’s rise. That trend has been part of an overall ‘de-grossing,’ in which big institutions reduce the size of their bets, both long and short, reflecting a more cautious position on the market amidst high uncertainty. Part of the lack of clarity, alluded to before, comes from the unique set of undercurrents at play. Fed Chair Powell remarked that “this is not like the other business cycles in so many ways,” and a simple back-of-the-envelope accounting of some salient data points attests to that:

Mixed data and conflicting views among investors, large and small, mean asset prices will likely be much more sensitive to data releases, news headlines, and comments from the Fed. Unlike the economic story, which often develops slowly and gives us plenty of time to spot emerging trends unfolding, financial markets respond immediately to expectations about the future, leading to much more volatility when investors disagree or can’t make up their own minds. We continue tracking both the facts on the ground and markets’ sentiment, and are bracing for some potentially big swings as 2023 brings us to an inflection point in the economy and central bank policy.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED