Headline inflation cools, but the “core” heats up

Last week’s focus was squarely on Tuesday’s inflation print, which saw inflation easing for the seventh consecutive month in January, as the CPI year-over-year change fell from 6.5% in December to 6.4% in January, in line with economists’ expectations. Although that sounds like a positive, analysts noted that prices rose by 0.5% from December to January, an acceleration from the prior month-over-month change of only 0.1%, indicative of the ‘stickiness’ the Fed fears may warrant more rate increases and longer-term restrictive policy. To that point, stripping out noisy food and energy prices, the so-called “core” CPI rose by 0.4% for the second straight month, coming in at an annual rate of 5.6%. Fed Chair Jerome Powell and many others in the market have taken metrics one step further and now fret over what’s been dubbed “supercore” inflation, representing core services minus shelter costs: the prices you would expect to rise most if wage pressure is driving inflation. That measure also rose in January by 0.2%, bringing its year-over-year increase to 4%—an uncomfortable level for the Fed.

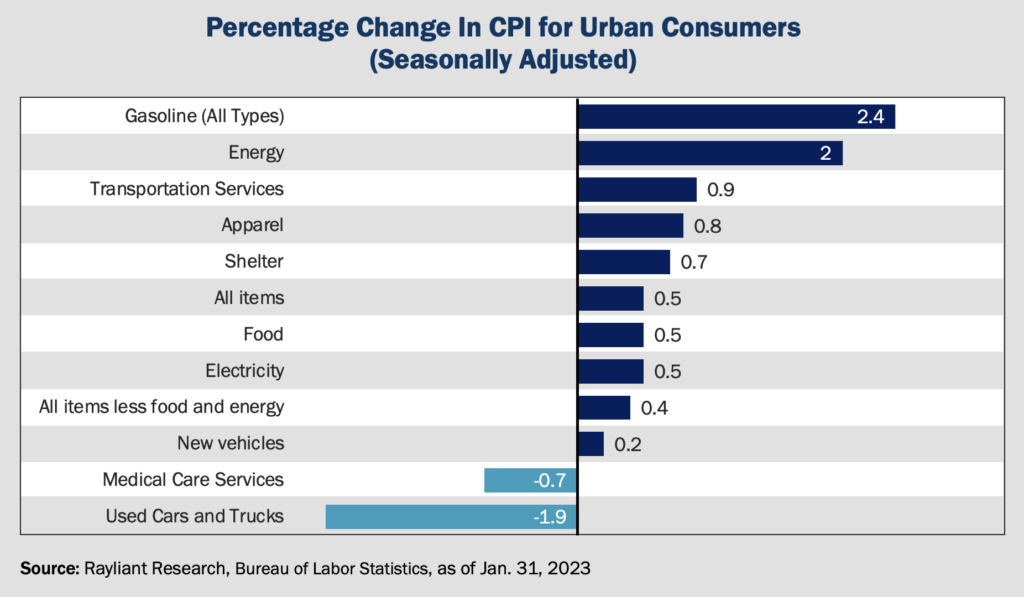

Unpacking Tuesday’s CPI

So what’s underlying reaccelerating inflation? The basket of prices tracked by Bureau of Labor Statistics turned out to be a mixed bag in January (see below). Energy prices were partly to blame for the high headline reading, rising 2% month-over-month, reversing declines in December and November. Technical issues with the calculation also contributed, as the January report used a new set of weights to model evolving spending habits, resulting in the shelter components becoming the largest element of the overall index. Shelter prices increased by 0.7% in January, slightly slower than in December, though still high and obviously sticky. Falling used car prices were a major offset to energy and shelter in the headline number, although wholesale data from Manheim, one of the largest used car marketplaces, have crept back up in February.

Rebound in consumer spending doesn’t help

Another interesting development was the 0.1% increase in core goods prices in January, which ended a streak of three straight declines. January retail sales showed US households’ spending roaring back last month, with a 3% increase in consumption after several months of weakness. Retail sales grew in almost every category including dining out, automobile purchases, as well as spending at department stores, on furniture, and on appliances. Spending at restaurants and bars rose 7.2%, the most since March 2021. Part of this rebound in consumption is mechanical, as households respond to prices that had been falling for a few months at the margin; companies have also been adjusting inventories based on better information about the outlook for demand. ‘Coincident’ indicators like retail sales, which puts a finger to the pulse of the underlying drivers of inflation play into the Fed’s decision-making, and as long as they’re signaling growth, we expect the Fed to remain vigilant.

Margins are clearly shrinking

At this point, over two-thirds of companies in the S&P 500 have reported their Q4 2022 results. Based on FactSet data, among those on the board this season, earnings declined an average of 4.9%, while revenue increased by 4.6%. This is clear evidence of the margin compression we’ve tipped in prior Perspectives, as companies find it harder and harder to pass cost increases on to consumers. Indeed, the S&P’s blended net profit margin for Q4 2022 is 11.3%, lower than the margin of 11.9% reported for Q3, and well below the year-ago margin of 12.4%. At the sector level, we find energy firms, industrials, and services companies have experienced improving margins, while profitability is sliding in the IT and communication services space—one of the reasons we’ve seen tech companies leading in layoffs this cycle.

Downward revisions continue

Another point we’ve made in past Perspectives is to pay attention to management’s outlook. This earnings season, we’ve seen that heavily influencing analysts’ forecasts, as downbeat guidance in the midst of Q4 reports has triggered a wave of cuts in earnings growth projections by sell-side analysts. Naturally, firms have a strong incentive to underreport and overdeliver, and that gamesmanship is part of the story, though it can’t explain the whole haircut in analysts’ forecasts for full-year EPS growth, which have fallen from 10% back in June 2022 to just 1% today. Unfortunately, despite a range of macro risks casting dark clouds over analysts’ Excel models—rising wages, high interest rates, falling demand—we find that for all their gloomy discussion on earnings calls, managers by and large still haven’t made big cuts to capital expenditures, suggesting guidance could go even worse if the US economy’s strength further fades in the face of the Fed’s determination.

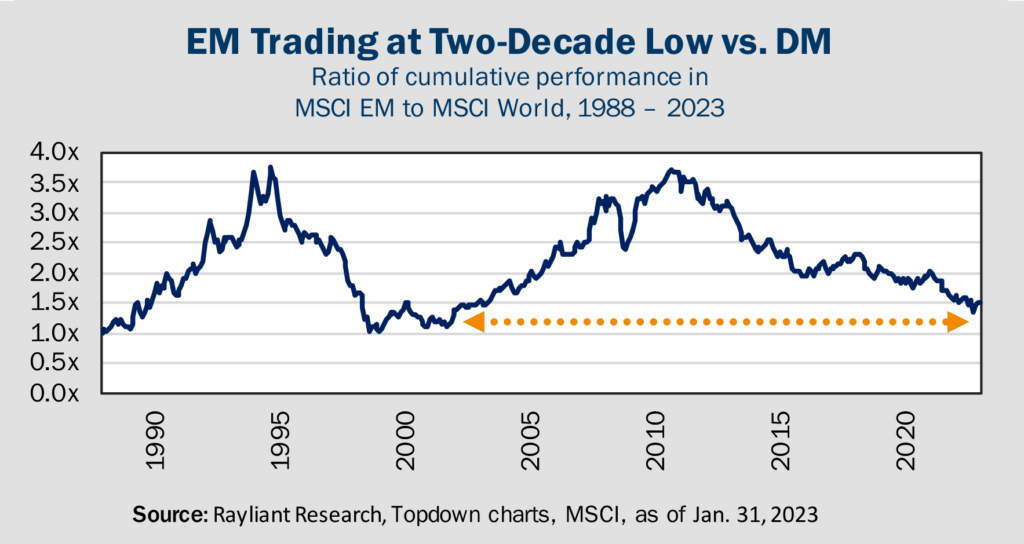

Could this be a good entry point for EM?

With US stocks heading into uncertain terrain and quite likely facing another leg down, investors who want some exposure to equity upside will rightly wonder where they might get it. Many investors associate emerging markets (EM) equities with higher risk, though as strange as it sounds, adding EM to one’s asset allocation today might be one of the most compelling ways to reduce a portfolio’s volatility in 2023. Part of the story is valuation. EM stocks were remarkably quick this cycle to price in the global growth slowdown, putting them at their biggest discount relative to developed markets—including the US—in two decades (see below).

Fundamentals also in EM’s favor

It’s not just prices: fundamentals bear out the same story. The MSCI Emerging Markets Index currently sells at a forward price-to-earnings (P/E) ratio of 11.2x. Investors must pay 17.5x forward P/E for developed markets stocks in the MSCI World Index, and a whopping 32.5x for stocks in the NASDAQ. Beyond this growth-at-a-reasonable-price rationale, there are also macro catalysts pointing in EM’s favor. While developed market central banks have been struggled to combat high inflation, emerging markets central banks began tightening monetary policy in early 2021, nearly a full year before the Fed, setting up a ‘policy divergence’ that enhances EM’s diversification benefits. Add to that the systematic headwinds to the US dollar we expect in 2023 as the Fed’s endgame comes into focus, and it’s easy to see why we expect this year (and perhaps this decade) to be a good one for investors with an allocation to emerging markets.

Adani Group’s meltdown highlights EM ‘fear factor’

Of course, emerging markets’ reputation for risk comes with good reason. Anyone following EM headlines in recent weeks will no doubt have heard reports of a scandal at India’s massive Adani Group, a conglomerate accused by US short seller Hindenburg Research of accounting fraud and stock price manipulation. In the wake of the short report, Adani shares fell by nearly US$100 billion in market cap. The company’s leader, Gautam Adani, previously the world’s third-richest person, saw his wealth cut in half. This kind of headline risk scares off many investors, who associate emerging markets with lower transparency and weaker regulations, and avoid the space altogether. In fact, the Adani case more than anything illustrates why EM stocks often trade at such a heavy discount—but also what makes active research so essential.

Real risks warrant an active approach

Although the most popular passive funds held Adani, many active investors managed to avoid it. Our models pegged Adani as a screaming ‘sell’ since last year. How did we spot it? Even a cursory fundamental review of the Adani Group companies would have revealed that while the firm was growing fast, its share price had grown even faster. It was anything but a bargain. On top of that, the company’s operations were far from efficient and much of its growth had actually been achieved through expensive acquisitions, creating a dangerous mountain of debt: a quintessential case of ‘empire building’ and a reflection of terrible governance. Because markets bake a healthy ‘fear premium’ into EM shares, opportunities to capture cheap growth abound; in such a market, we believe active management provides that much more benefit to sort the true bargains from cheap-for-a-reason ‘growth traps,’ like Adani.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED