Soft landing, hard landing, or none of the above?

With all the debate about whether the US economy will see a soft or hard landing, it was probably inevitable that market pundits came up with a third option: the ‘no landing’ scenario. This nihilistically named outcome represents a situation in which the economy just keeps growing—not only do we not experience a recession, but we see labor market tightness continue, inflation remains elevated, and investors’ fears about a downturn just around the bend persist. The problem with this view is that the Fed isn’t going to just let the economy keep flying forever; at some point, we’re going to land, be it hard or soft. The looming ‘policy error’ people have begun talking about again is a Fed overshoot that could happen as rates keep rising in the face of a strong economy and unrelenting inflation, eventually hitting too hard on a lag and sending us into a much more painful downturn than was really necessary.

The Fed’s fine with growth—but not if it must come with inflation

The fear of excessive tightening and a hard landing is precisely why, despite very strong macro data, equity markets have responded so negatively in recent days. The Fed, for its part, still hopes for a soft landing: that the central bank might thread the needle and deliver reasonably smooth economic deceleration, prompting just enough of a softening in the labor market to bring things down easily. An apparently robust US economy might just convince policymakers that the fundamentals are strong enough to absorb higher rates needed to cool inflation without a big drop-off in growth. That said, the Fed won’t tolerate continued growth if it must come with high inflation. So, as long as the CPI is running hot, the Fed will keep its foot firmly on the brakes. While those braving a blizzard in California (!) might not relate, some skeptics have pointed to mild weather so far this winter as giving recent economic activity an artificial boost, such that seemingly solid macro data will soon succumb to the Fed’s restrictive policy. In this view, the “reacceleration” we’ve seen in 2023 is essentially just delaying an inevitable recession.

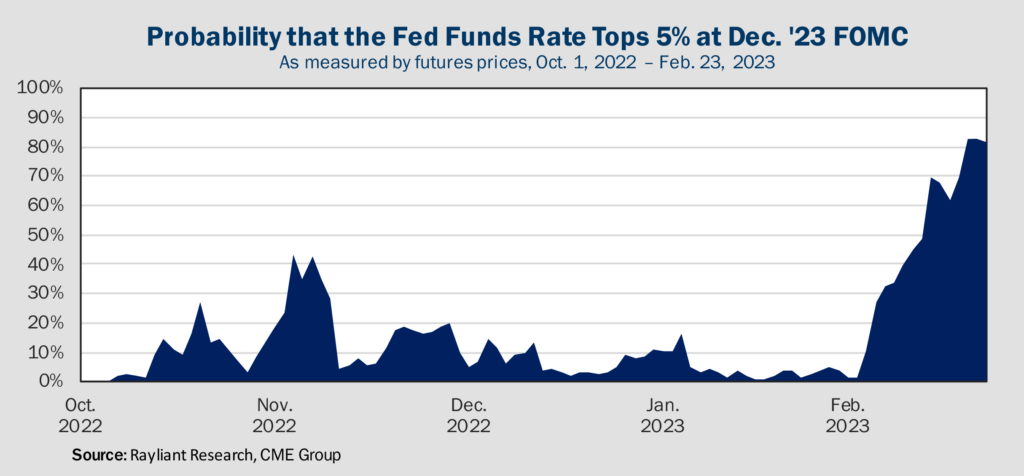

Fed Funds futures traders see the writing on the wall

Back in early February, we highlighted that the market was factoring in a 50 bps reduction in policy rates for the latter half of 2023. At that time, interest rate futures had pinned the Fed Funds rate at 4.6% by year end. How things have changed in the last few weeks, as the CME Group’s FedWatch illustrates. Below, we chart the probability of US policy rates exceeding 5% at the end of 2023.

Back in October, the market pegged this as an impossibility. Forecasts for higher rates did spike in November on hawkish comments from current and former Fed officials. By the beginning of February, however, traders once again saw Powell’s work as done. Fast forward three weeks, and bond investors finally hear what the Fed’s been saying all along: Rates won’t soon fall—and may go considerably higher before they peak. Confirming such fears are justified, FOMC minutes from the late-January meeting, released last week, showed a few members calling for a 50 bps hike as opposed to the expected 25 bps increase the committee ultimately approved. As markets further price the reality of our inflation situation, we expect volatility to spill into stocks, as well as recently rallying corporate credit.

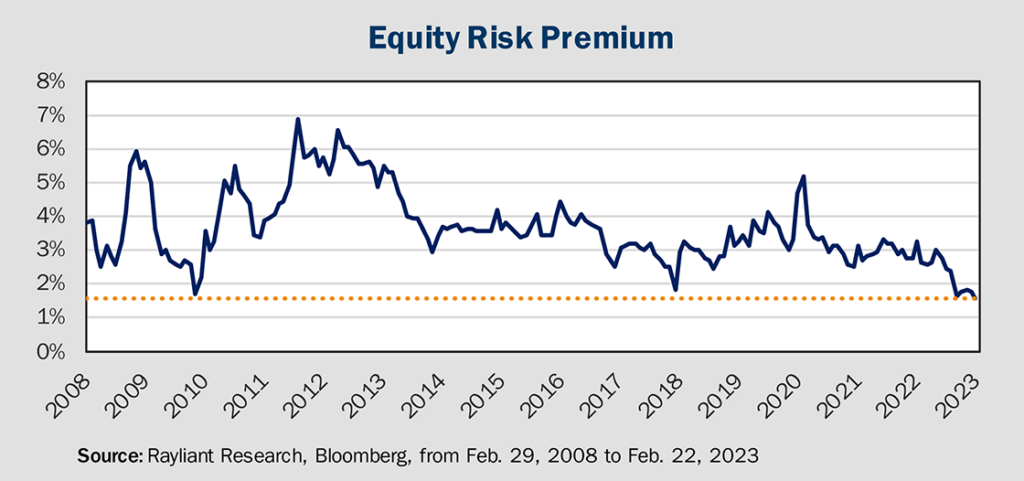

Equity risk premium squeezed

Anyone long stocks the last two weeks will feel like equities are getting cheap again. Nevertheless, despite regaining 50% of their bear market decline and rallying 20% from October lows, US stocks have risen above their longer-term average, resulting in both higher highs and higher lows. The S&P 500 is currently trading at 18x forward earnings, while 10-year Treasury yields are approaching 4%. This combination of rising equity prices and falling bond prices has resulted in a big drop in the so-called “equity risk premium”: the difference between public companies’ earnings yield and the yield on long-term bonds, which tracks how much extra return stock market investors earn over government bonds to compensate them for the equity risk they’re taking. As of last week, that premium had fallen to 1.6%—the lowest it’s been in over a decade. Simply put, despite huge uncertainty as to which way the economy is heading, equity investors are not being paid much for taking risk.

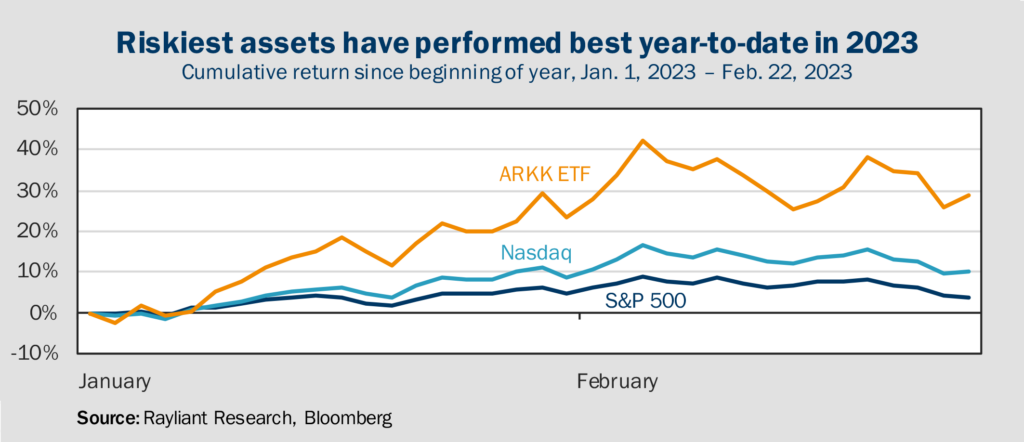

Retail investors hungry for risk at any price

Government bonds also sold off last week, marking the first time in 2023 that year-to-date returns on Treasuries have gone negative, as the yield on 10-year Treasury notes increased toward 4%, the highest it’s been since 2008. In fact, there has been growing concern about the disparity between stock market optimism and bond market realism, with many observers pointing to retail investor participation in US stocks, which recently breached highs recorded during its meme stock heyday in early 2021. Since the beginning of this year Cathie Wood’s ARK Innovation Fund, loaded with risky growth stocks demolished by Fed tightening in 2022, has staged a rally that’s beaten the tech-heavy NASDAQ, which itself is outperforming the more balanced S&P 500 (see below). This performance mirrors a year-to-date rally in crypto currencies, unprofitable tech firms, and stocks most heavily shorted by professional money managers. As such, we remain highly skeptical of this year’s risk-on rally. Our view is that the current rally—driven more by individual investor enthusiasm than fundamentals—will fizzle, especially as retail day traders blow through what little remains of their pandemic stimulus bankroll.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED