Yield traders price one more hike before a sudden shift to easing

Just as bond markets were coming to grips with “higher for longer”, a banking crisis hit and traders gave up that narrative in favor of the one with a wave of rate cuts kicking in by the end of this year. Without a nasty economic downturn, we see this view as hard to square with persistent inflation and a job market that isn’t loosening fast enough for the Fed’s comfort. Friday’s March jobs report brought another data point on that front. Although the numbers were pretty much directly in line with forecasts, investors seem to have been spooked by an upward revision of February nonfarm payrolls and traders appear increasingly uneasy with labor market tightness, which continues to feed services inflation. The stock market was closed for Good Friday, so we couldn’t see a reaction there, though futures markets were open for trading. According to data from CME Group, Fed Funds futures showed the odds of a quarter-point hike in early May jumping from just under 50% before the report to nearly 70% probability after, suggesting investors accept we’re getting at least one more rate hike this year. Since March, however, two-year Treasury yields have fallen more than 100 bps, and the 10-year yield has declined by almost 50 bps, indicating traders still expect the Fed to rapidly shift to easing.

Credit spreads don’t register much anxiety

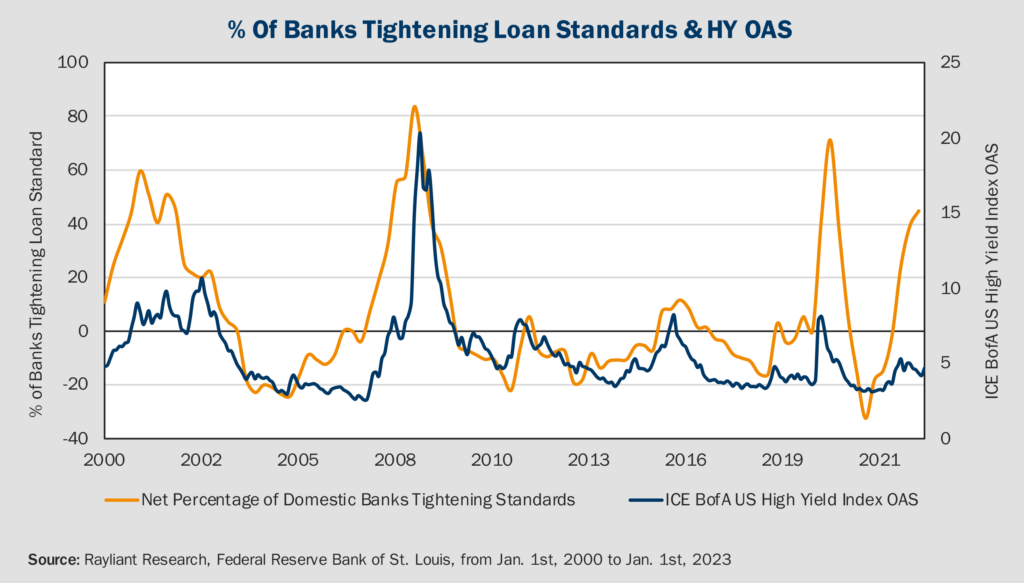

One might imagine this expectation for a shift to easing rests on an assumption economic conditions will deteriorate to a point the Fed’s hand is forced. Along these lines and despite strong nonfarm payrolls, other pieces of data do point to a weakening of the economy’s primary pillar of strength: strong consumption supported by resilient employment conditions. For example, another release by the Bureau of Labor Statistics, the so-called JOLTS report, showed job openings falling in February. Likewise, the Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) in March showed the US manufacturing sector contracting for the fifth straight month. But if these signs are right and business conditions are worsening, credit spreads don’t show it. To better illustrate the disconnect, below we superimpose high yield bond spreads—the additional return junk bonds pay to compensate lenders for added risk—onto data we highlighted weeks ago, showing a tightening of lending standards by bank loan officers.

Historically, high-yield spreads tend to come in close to 8% when lending standards tighten to the point we’re at today. In this cycle, by contrast, credit spreads are still below 5%—short of the spread’s long-term median even if we exclude recessionary periods, which falls at 6%. If credit investors expect a recession deep enough to induce a hawkish Fed to reverse course, they ought to be more concerned about the corresponding credit crunch. Even without further deterioration of the economy’s fundamentals, we expect defaults to pick up in 2023 as companies try to roll their debt this year and find out after a few hundred basis points of hikes, they can no longer afford it.

Tech shares drive equities higher in Q1

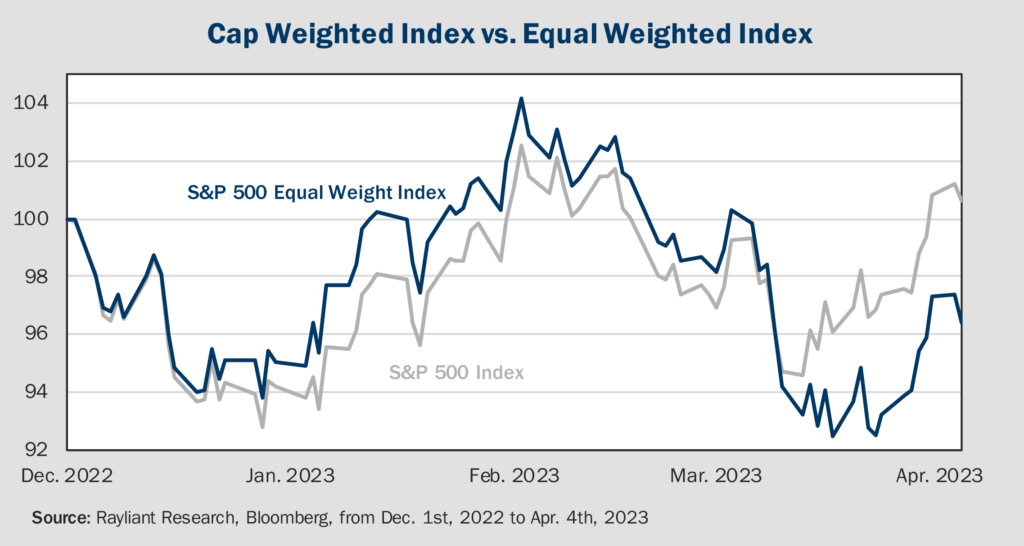

While credit traders don’t seem too shaken a few weeks on from March’s banking crisis, equity investors almost look carefree, with the NASDAQ verging on a new bull market on hopes that weakening macro data and bank runs will prompt the Fed to call it quits sooner. If turmoil in the banking sector has had any effect, it seems only to have redirected the market’s exuberance. Entering April, Communication Services and Information Technology have emerged as the biggest sector-level winners year to date. At present, the tech industry accounts for more than a quarter of the S&P 500 Index’s cap-weighted value. One upshot of a top-heavy index is that strength in a few mega-cap behemoths like Apple and Microsoft can mask weakness in the average stock. We face just such a situation today, with tech shares rallying more than 45% from their 2022 lows, to the point that the cheapest among them, Meta, is currently valued at 22x forward earnings, while Nvidia enjoys a multiple of 60x. The fact that most stocks have not similarly benefited from this year’s bear market bounce is nicely illustrated by divergence between cap-weighted and equal-weighted versions of the S&P 500 (see below).

Equity investors should be careful what they wish for

Of course, part of the story behind rallying risk assets in Q1 has been covering by short sellers, upward pressure induced by momentum trading, and investors’ general fear of missing out. Many traders spent the final weeks of Q1 rushing into stocks with flimsy credit conditions, apparently oversold during the banking crisis, as well as long-duration tech stocks they expect to rocket up when the Fed finally does begin slashing rates. Unfortunately, as we’ve highlighted before, the recent bank funding program is not injecting fresh cash into the system, and isn’t designed to stimulate risk assets: it was meant to stop troubling conditions from worsening. Likewise, if rates ultimately come down fast as the economy dives into a recession, the benefits of lower rates in the denominator of investors’ discounted cash flow models will be more than offset by vanishing profits in the numerator. These are not developments for equity investors to cheer. Ultimately, we fear many stock traders may be living in the past—at least, the past ten years of ultra-lax monetary policy—and are likely setting themselves up for disappointment, especially if the Fed reverses course before inflation is in hand.

Surprise: Big production cuts on the way!

Just over a week ago, the nine oil producing members of OPEC+ unexpectedly announced output cuts that will total nearly 1.7 million barrels per day. Oil prices surged over 5%, with Brent crude topping $84/barrel. Reportedly, the move was prompted by Saudi Arabia in reaction to frustration with the Biden administration’s announcement that the US wouldn’t soon replenish its depleted Strategic Petroleum Reserve. We imagine OPEC+ members are emboldened by weak US shale production, which would otherwise have helped fill the gap. At present, members of the collective are increasingly acting in a preemptive fashion, slashing output to support prices in the face of threats to oil producing states’ profitability. In this case, forecasts of oil demand have come under pressure as a result of the past month’s banking crisis and increasing concern over global growth, sending prices sharply lower in March, continuing a long slide that began last June. In the wake of the announcement, Goldman Sachs revised their end-of-year forecast for Brent prices to $95 per barrel.

Differing views on near-term oil demand

Where do projections of oil prices for 2023 come from? Over the last year, an active conversation among oil pundits on the demand side has come down to two competing narratives: Will China’s reopening win out, or will a global slowdown keep demand depressed for the foreseeable future? To the former point, we note that China imported over 11 million barrels of seaborne oil per day in March, matching the previous record high from 2020. That said, China also has strategic reserves and could choose to dip into its own supply if prices get too high. With respect to the risk of a global downturn, though US banking turmoil seems to have faded, the manufacturing sector reported a sixth consecutive reduction in orders for goods—a clear threat to demand. Reports of stockpiles of oil products at the UAE’s Port tend to confirm those fears, climbing for the first time in a month, with gains registered across all product categories in March. On the face of it, those looking at demand alone will have serious concerns about oil prices through the rest of 2023.

Supply is the other side of the equation

Of course, prices are determined not just by demand, but also supply of a commodity. Along those lines, analysts expect expansion of oil production in the US this year—which at the end of 2022 was forecast to make up roughly half of global oil production growth—to be more muted than originally anticipated. The nation’s shale boom seems to be coming to an end, and US oil producers are suffering from a series of operational and financial issues, including declining productivity of existing wells, rising oilfield services costs, and a shift in focus to capital discipline, all of which add to pressures on supply. On top of all that, as mentioned above, US strategic reserves are at their lowest in nearly four decades, constraining one more potential source of supply under ordinary circumstances.

How likely is production to ramp back up?

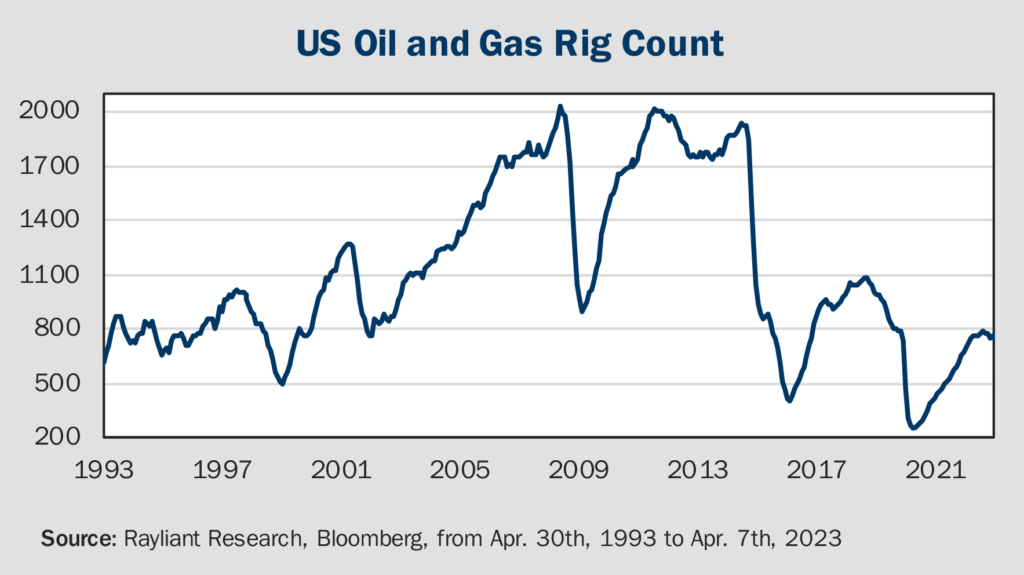

For those thinking back to past oil and gas production cycles and imagining $95/barrel oil will trigger a wave of expansion in capacity, it’s helpful to remember that back in 2008, the industry was dedicating 70% of its cash flow towards growing production. Nowadays, companies are reinvesting a meager 30% of their cash flow toward expansion, the lowest level of production spending observed in the past three decades. The decline in US rig count growth during March (see below) indicates that operators are still cautious about the economy and have no plans to massively ramp up drilling and production anytime soon. Moreover, since 2017 the cost curve of oil has been squeezed by fewer available production resources, and it’s become steeper because higher oil prices are increasingly driven by global manufacturing and the energy supply needs of a growing world population.

Oil’s future: Volatility, but also downside support and potential upside surprises

As Saudi Arabia’s energy minister recently observed—no doubt with a bit of satisfaction—the world has been underinvesting in oil supply for many years. America’s lagging upstream investment is not unique. The situation was exacerbated by the COVID pandemic, as energy producers reduced their supply in response to dramatic uncertainty, while the drop in consumption by consumers and businesses will likely come to represent little more than a blip in the commodity’s longer history. In light of these issues maintaining adequate supply, elective production cuts on the part of OPEC+ like that witnessed last week should serve to further support oil prices whenever pessimists push the market too low. It’s true that even a powerful cartel probably couldn’t prop prices up in a global recession, though we see China’s reopening mitigating some of the damage a downturn might do and providing plenty of upside in the event of the improbable soft landing, or even a mild recession.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED