Inflation is moderating but core components remain elevated

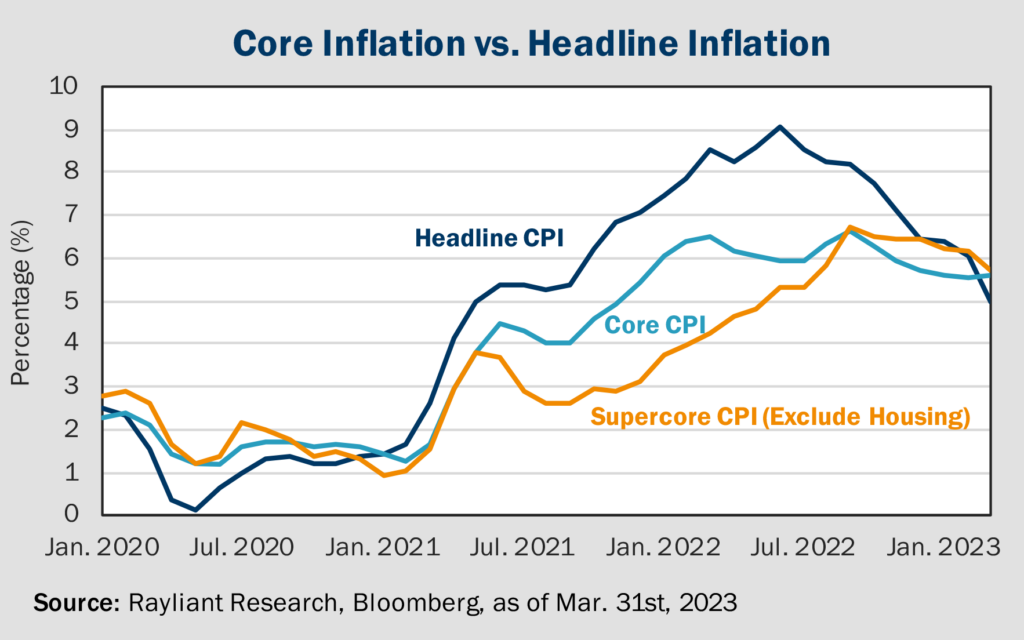

As reported on Wednesday by the Bureau of Labor Statistics (BLS), US inflation seems to have eased a bit in March, mostly lining up with consensus forecasts and sending stocks higher for the week. Headline CPI in particular gave investors a rosy view of price pressures, posting a year-over-year rise of 5%, down from February’s 6% increase. Contributors to the decline included falling grocery prices—which dropped for the first time since 2020—and base effects from a comparison to March of last year, when Russia’s invasion of Ukraine caused a sudden surge in energy prices. Stripping out volatile food and energy prices, however, so-called “core” CPI delivered a more sobering assessment of inflation, showing a 5.6% year-over-year increase through March, up from a 5.5% increase in February and marking the first time in two years that core inflation came in above the headline number, as can be seen below.

The divergence in core and headline CPI reveals the sticky nature of inflation’s underlying subcategories. Around 43% of core CPI is made up of shelter costs, which finally stepped down in March and are expected to decrease more over the next year, albeit at a much slower pace. Changes in actual rents and owners’ equivalent rents should be noticeable by the end of the year, given a typical 12-15 month lag in the data. Meanwhile, though core goods have been a significant deflationary force for several months, they are losing steam as companies finish working through inventories in the wake of weakening demand; core goods inflation actually increased by 0.2% in March. Even energy costs, falling in recent months on fears of slowing global growth, spiked in the face of an unexpected OPEC+ production cut, knocking out one more source of relief for price pressures going forward.

Plenty of data now indicate Fed policy finally kicking in

It was a busy week in terms of macro releases, with March’s Producer Price Index (PPI), reported on Thursday, coming in 0.5% lower than a month prior, putting the year-over-year rise in producer prices at 2.9% for March, well below February’s 4.9% increase. Investors looking on the bright side might conclude cooling production costs signal a future decline in consumer inflation, assuming corporations pass on lower costs. On the labor front, last week saw unemployment benefits claims rising—a move in the right direction for a red hot job market. Even so, that figure remains close to those seen in 2019, suggesting the labor market is still tight, despite layoff announcements and strains in the banking industry. Friday’s retail sales report served up more evidence of a weakening economy, revealing a second consecutive decrease in monthly spending, driven by building materials, electronics, department stores, and automotive—discretionary categories strongly pointing to belt tightening by American consumers.

Signs of macro softening likely won’t stop quarter-point hike in May

Although data pointing to cooling prices and economic softening will surely be welcomed by the Fed, inflation is still too high and the economy too robust in our view to prevent a 25 bps hike at the central bank’s May meeting. Moreover, as some pundits have pointed out in recent weeks, we may no longer be in an environment in which “bad news is good news.” Sure, signs of an economic slowdown make the Fed more likely to stop raising rates, and even begin easing at some point. But we’re already very clearly nearing a pause in tightening, such that further negative macro data only seem to weaken the case for equity valuations to be this high, this late in the cycle. It remains to be seen whether a year of aggressive rate hikes was enough to send us into a recession, but if we do end up facing any kind of contraction, it’s hard to imagine equities won’t retrace a good part of their gains in this year’s rebound—and possibly test new lows.

Doom cycle or headline hype?

Speculation over the other shoe to drop after last month’s banking liquidity crisis has begun to focus on US commercial real estate (CRE). That’s because regional banks, the center of the storm after Silicon Valley Bank’s spectacular failure, are known to be an important player in the financing of CRE projects. The fear is that regional banks tightening lending standards in response to recent bank failures might put CRE loans in a position to default, driving down property valuations, further increasing loan-to-value (LTV) ratios and prompting further failures: a vicious cycle bound to end in systemic disaster. But how risky is the current environment for CRE, and are regional banks really on the brink of another major crisis? A look at the nature of CRE financing and the size of the potential problem will make it clear why we’re much less concerned than scary recent headlines might suggest.

CRE exposure not overly concentrated among regional banks

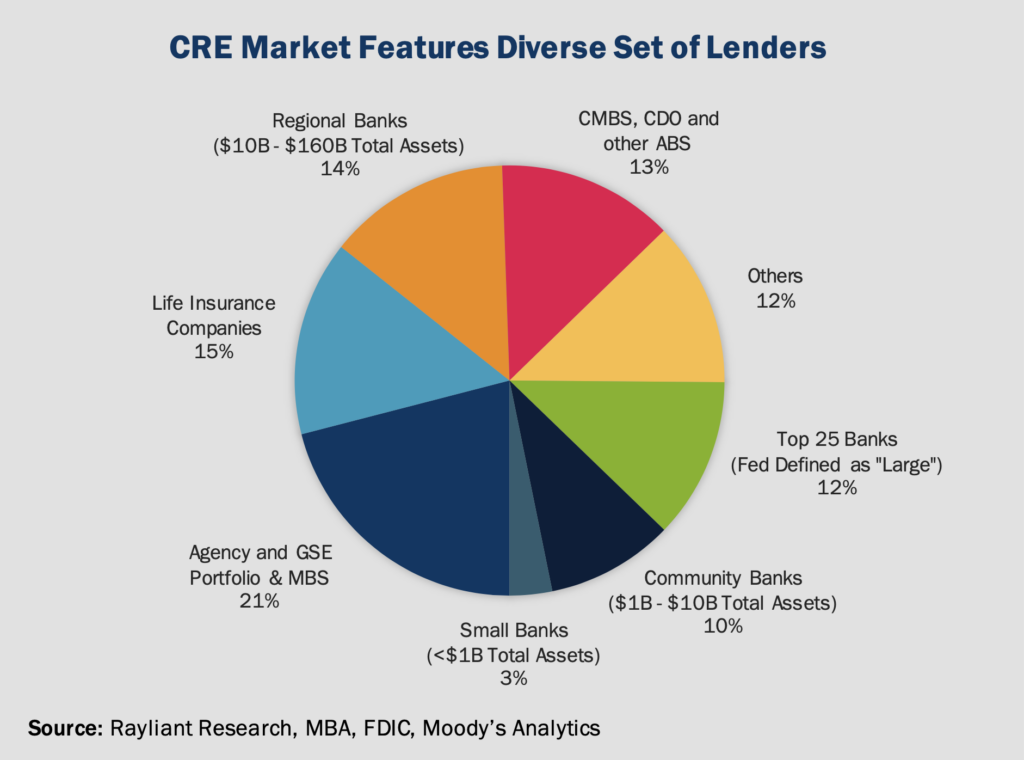

First, it’s worth noting that commercial real estate loans originate from a wide array of players beyond regional banks. Even as Treasury yields climbed in recent months, investors have remained committed to searching the fixed income markets for yet higher returns, creating plenty of alternative sources of financing in the CRE space. A range of lenders, including mortgage REITs, private equity funds, and life insurance companies, have often stepped in to fill the void left by a decline in regional bank lending. Indeed, distressed loans tied to offices and retail properties suffering under pandemic-related changes in real estate dynamics have created attractive opportunities for such specialized lenders. As the chart below illustrates, growing diversity within the CRE market has made for a much more interesting and less concentrated mix of lenders in the space. So, while it’s true roughly $450 billion of CRE debt matures this year and needs to be refinanced, regional banks account for only around $50 billion of those loans.

Most CRE loans maturing soon are high-quality, low-risk

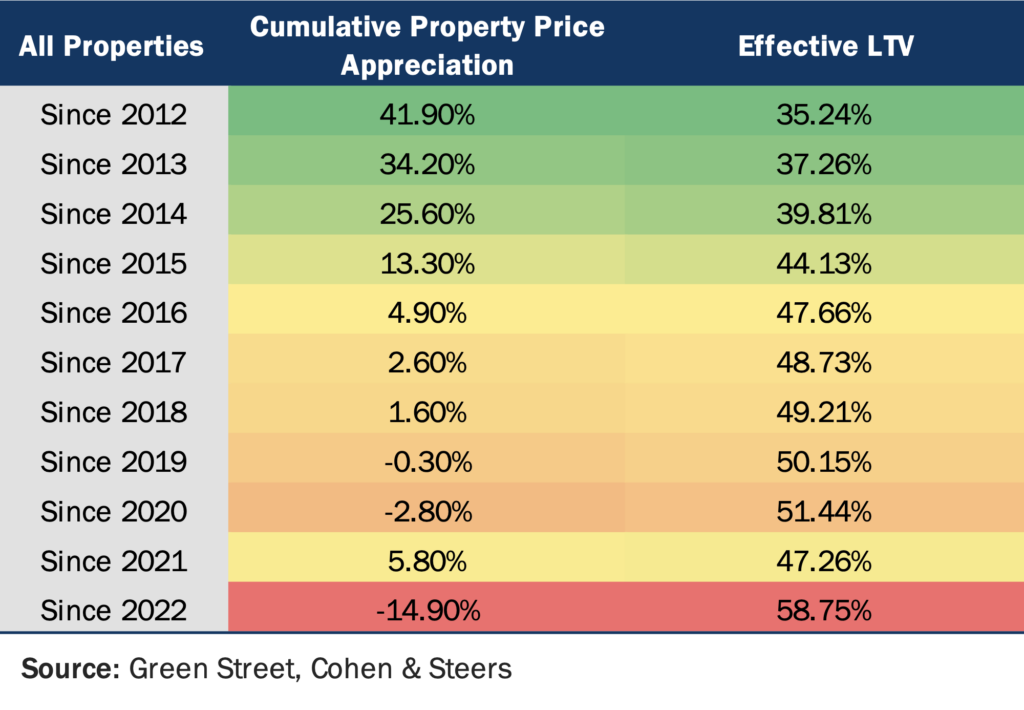

It’s also true that regional banks have ramped up CRE lending in the last two years, though these recent loans won’t reach maturity for several years to come. The lion’s share of loans coming due in the next few years were originally issued between 2013 and 2018. Those vintages are generally supported by real revenue growth and importantly came with terms set at significantly more conservative levels than those issued in the run-up to the Global Financial Crisis (GFC), including with respect to leverage. Even so, market observers have been closely tracking property valuations and the impact that a downturn will have on LTV ratios. The data below give a sense for how problematic property market weakness are likely to be for loans issues in different years, assuming an LTV of 50% at loan origination.

Of course, as property valuations increase, effective LTVs decrease. Although commercial real estate valuations have fallen around 15% from their peak in 2022, they are still up significantly since 2011, providing quite a bit of cushion for loans issued in the first half of the last decade. The biggest risk is with respect to loans issued in the last few years at much higher valuations. Even for those loans, however, most debt coming due in 2023 was packaged in commercial mortgage-backed securities (CMBS), which are accepted within the Fed’s new lending facility, placing an effective floor to price declines. We agree with a recent report by Cohen & Steers (from which the data above are taken) that concludes the fallout from continued decline in CRE valuations will be most felt on recently originated short-term loans associated with office properties. That’s hardly a systemic risk, in our view.

Office properties are struggling, but exposure isn’t large

It’s also important to remember that despite the ongoing correction in office space—and the fact that this struggling segment of the property market is the most visible in the financial media—a strong labor market continues to support the overall CRE sector. Storage facilities have proven to be particularly resilient in the last few years, as have multi-family rentals, which represent the biggest slice of loans, at 44% of the total market for CRE mortgages. The vacancy rate for apartments is at an historic low of about 4.7%, and rents are expected to grow by 2-3% this year. Even with mounting concerns of a recession, operating margins for retail CREs and apartments have been going strong. While there will no doubt be greater distress to come in the office space, it represents only around 17% of loans and only around one-quarter of the 16% of loans maturing in 2023.

The market was prepared for March banking crisis

It might seem hard to swallow for those surveying the damage from last month’s bank runs, but things could have been much worse if the industry hadn’t been so well-positioned going into the crisis. According to the Fed’s survey of senior loan officers—data we have presented in past issues of Perspectives—US banks have actually been tightening their standards over the last three quarters and had become increasingly cautious months before SVB hit the headlines. Industry insiders remember well the situation during the GFC: cash-generating assets couldn’t be refinanced, putting negative pressure on asset prices. Lenders responded with even stricter standards, perpetuating a downward spiral that only stopped when the government stepped in. This time around, by contrast, lenders were ahead of the game, raising the bar on new loans in response to the first signs of weakness in property prices. Loan officers seem to be one of the few demographics to have taken the Fed at its hawkish word, with recently originated loans signed at lower LTV ratios and at higher interest rates, anticipating further rate hikes and stress on the economy. The result has been lower loan activity, but also less risk in the system.

CRE lending poses a risk, but not as dire as headlines suggest

So, can regional banks withstand upcoming stress in the CRE sector? We have highlighted the diversity of lenders in the CRE market, the modest proportion of loans coming due in the near-term, and the higher general quality of loans in question today. All of these data points suggest that while the industry is undoubtedly going through a painful stretch, we still seem some ways from a crisis. Consider that amidst the turmoil of the GFC, in which commercial property plunged by over 30%, the dislocation wasn’t enough to trigger a systemic crisis in that space. In the current environment, JPMorgan analysis concluded that even if banks with the highest exposure to CREs were to see further losses on office and retail properties, as long as they were able to spread it over the next few years the haircut required to tier 1 equity capital ratios would be minimal. In other words, what we’re talking about here is not really a liquidity crisis or a solvency crisis, but more likely an unpleasant hit to regional banks’ earnings. The imminent refinancing needs of some CRE projects pose a problem, to be sure, but real estate developments tend to be slow-moving, and it would take a few significantly more negative surprises to make us sound the alarm.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED