No surprises at the July Fed meeting

Last Wednesday, the Fed raised its benchmark interest rate by 25 bps, putting the US central bank’s policy rate at its highest since 2001. The vote to hike was unanimous, and nearly everyone outside of the Fed seemed to expect it, with Fed Funds futures one week ago pegging the likelihood of a quarter-point hike at 99.6%. As we’ve often pointed out, market moves are all about surprises, so if the Fed’s July decision matched expectations, there had to be something else pushing major US equity benchmarks closer to record highs by Friday’s close. It likely wasn’t comments from Fed chair Jay Powell around the meeting. He was fairly definitive in his assessment of the “worst outcome” for Americans—unanchored inflation expectations and consequently volatile prices—and resolute in how he wants to deal with it: getting inflation under control now, “whatever the short term social costs” of doing so. When asked at the press conference about the timing of rate cuts, Powell was likewise blunt as to when he would be comfortable moving to easing: “that won’t be this year” (bulls will be happy that he followed up by qualifying “…I don’t think it would be”). The market seems to have taken the Fed chair at his word, indicating a prolonged hold on the policy rate, pricing in pretty much no change in the Fed Funds rate until March 2024, when traders expect Powell might get comfortable with cuts.

Sentiment surges on strong GDP, softening CPI

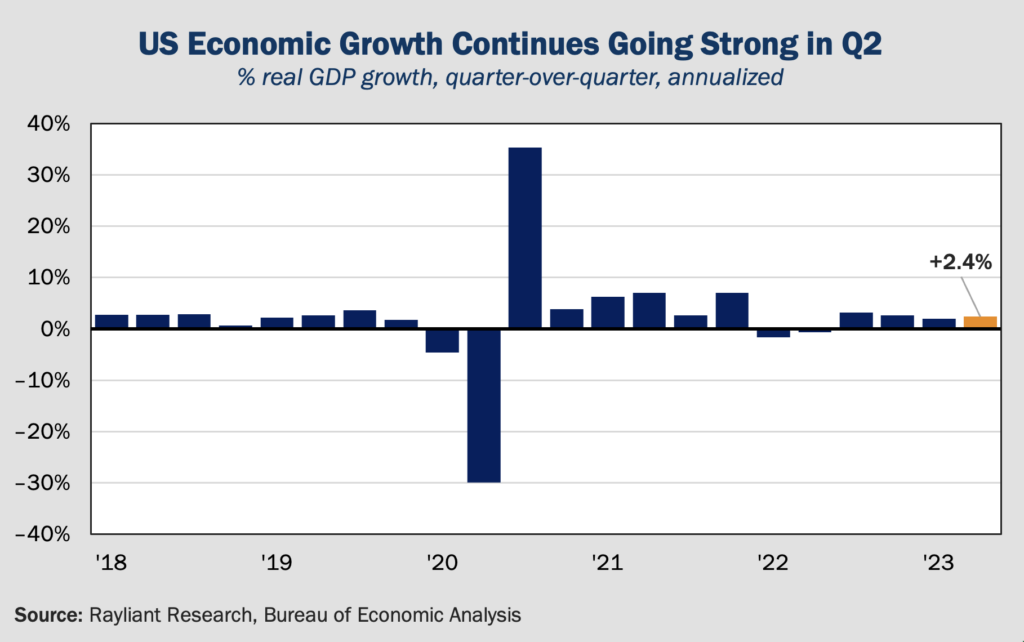

So if it wasn’t the Fed signaling sooner-than-expected easing, what accounts for equities’ weekly rise? If last week’s FOMC was the ‘main event’, a series of ‘undercard’ macro announcements arguably delivered much more exciting action. For one thing, the US Commerce Department’s first look at Q2 GDP, released on Thursday (see below), showed the American economy expanding much faster than expected: growing at an inflation-adjusted 2.4%, annualized, vs. economists’ consensus forecast of 1.7% growth. Despite a drop in US exports, consumer spending rose at 1.6%—albeit slowing from a 4.2% increase in Q1—and firms’ investment clocked in at an annualized rate of 7.7%.

On the one hand, such robust stats seem to cut against the narrative for a quick Fed pivot, as the central bank might feel emboldened to err on the side of killing inflation with so much apparent economic cushion to absorb further hikes. However, investors seemed more inclined to view good news on growth as substantially increasing the odds Powell might pull off a soft landing for the US economy. That interpretation is bolstered by the chorus of soft landing cheers coming from pundits over the last week or two. Another big release came on Friday, when the Fed’s preferred measure of inflation, the personal consumption expenditures (PCE) index, showed 3.0% year-over-year growth through June, its lowest level since March 2021. While that number was in line with estimates, it strengthened sentiment that policy is sufficiently restrictive and bringing inflation down fast enough to begin celebrating.

Going forward, where are the risks?

While we’ve always seen the possibility of a soft landing as plausible, we’ve never thought it was particularly likely. With recent data, that possibility has undoubtedly increased, though we feel it’s still being overpriced by equities and credit markets, and thus we remain cautious. In terms of risks that could unravel the bulls’ story at this point, the strong labor market seems to us the biggest challenge to a quick Fed pivot and the most likely cause of a policy overshoot. With the labor market as tight as it is, it’s hard to see the Fed easing off restrictive policy unless inflation really falls. But to that end, while headline inflation has slowed as energy and food prices declined, core inflation is still way above the Fed’s comfort level. Energy prices have also been on a recent upswing, as producers enact supply cuts, with prices at the pump threatening to contribute in the formation of another inflation wave. We also note (as we explained in much greater detail last week), that base effects in the way year-over-year CPI is calculated have made it easy for inflation to soften in recent months, but will flip to making it much harder for the remainder of the year. To the extent investors have been confused by this, markets might face a rude awakening in the two months of data pending before the Fed’s next move.

Across the Atlantic, a similar situation

The US Federal Reserve wasn’t the only central bank in action last week: Europe’s ECB also saw fit last week to raise its benchmark deposit rate by 25 bps, to 3.75%, the bank’s ninth consecutive hike and its highest policy rate since 2001. This was also the odds-on favorite outcome for the meeting, with most investors betting it will be the ECB’s last, as Eurozone inflation has been falling faster than expected. There were even some indications from the bank’s post-meeting press conference that the tightening cycle could be coming to an end. ECB President Christine Lagarde called the potential for a pause at the September meeting a “decisive maybe” and went as far as to ask “Do we have more ground to cover?” and then answered herself, “At this point in time, I wouldn’t say so.” The Eurozone had already slipped into a recession in the first quarter—albeit an exceedingly shallow one—as Eurostat reported in early June, so it is perhaps not surprising that seeing inflation trend down, policymakers would choose now to err on the side of preventing more economic damage.

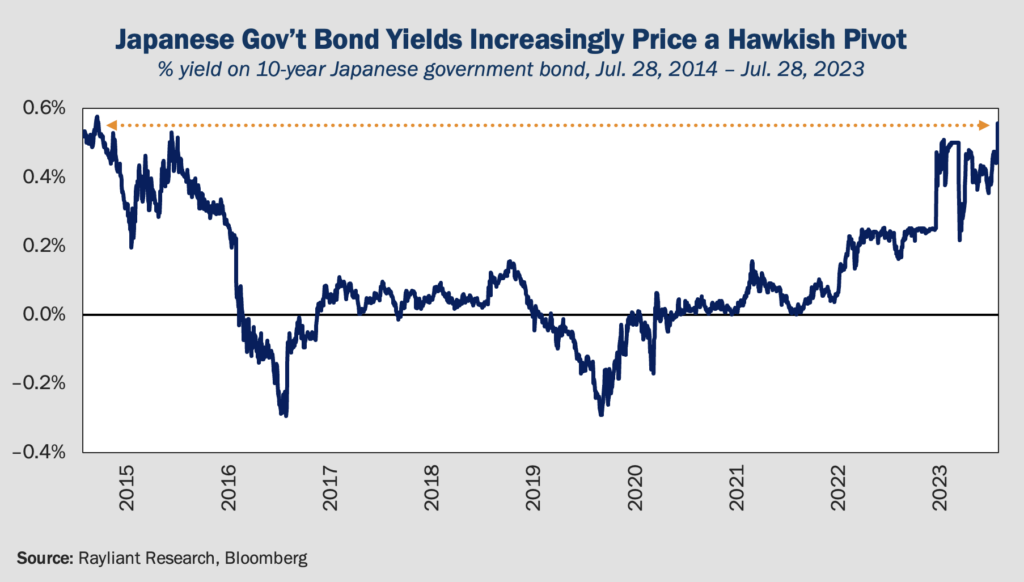

We did get a surprise out of the Bank of Japan

In the midst of boring consensus moves by the Fed and ECB, Japan’s central bank delivered what was surely the biggest surprise, making a completely unexpected modification to relax the ‘yield curve control’ (YCC) system it uses to achieve its monetary policy target of 0% on 10-year Japanese government bonds. For a long time, the Bank of Japan has maintained an ultra-loose policy geared at stimulating the nation’s dormant economy, but recently surging inflation—which hit a four-decade high this year, and surpassed its US counterpart in June for the first time in eight years—has led some to speculate we might finally see a hawkish shift from the bank, given the risk inflation might rise far beyond a level the bank is happy with and become significantly harder to contain. While the BoJ has argued that Japanese inflation is now driven by more transient increases in imported commodities as opposed to consumer demand and been reluctant to tighten policy and derail a return to growth, markets clearly see this as a potential beginning-of-the-end for YCC, with the country’s benchmark bond yields rocketing to their highest level in almost nine years (see below). We tend to agree with yield traders and see this as a bullish sign for a compellingly priced yen, which should rise as the BoJ ultimately becomes more restrictive.

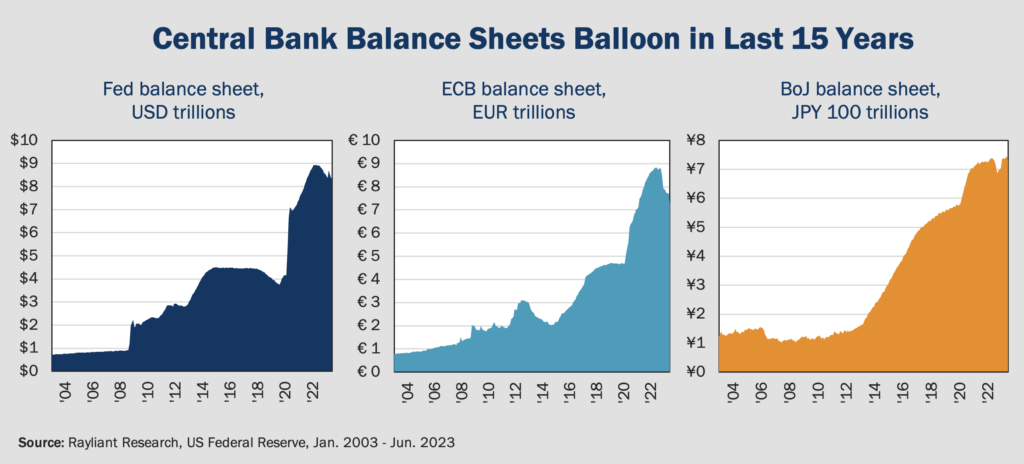

Beyond rates: Consider bank balance sheets

In the last year’s fight against inflation, rising policy rates have been the primary tool deployed by central banks. In recent months, monetary policymakers have begun using another weapon in their arsenal: quantitative tightening or ‘QT’ for short. Banks pursue QT by shrinking their balance sheet, either selling bonds outright or letting them mature and removing them from their cash balance. The result is simply a matter of supply and demand: when the central bank stops buying bonds or begins selling them, prices must fall, which means yields go up—hence the ‘tightening’. Of course, this is the opposite of quantitative easing (QE) central banks have been implementing on and off for most of the last twenty years, as can be seen in the charts below. At the end of the Fed and ECB time series, we see a trend down, a visual reflection of QT in action.

Risks of QT make us question banks’ resolve

With banks’ balance sheets so large after a binge of QE—the ECB and BoE hold more than a quarter of their governments’ outstanding debt, while the Fed holds a fifth of the US Treasury’s—suddenly shifting to reverse can be disruptive. The 2013 ‘taper tantrum’ episode was evidence of that, as bond prices crashed and stocks slumped amidst mere signaling by the Fed that it would begin to taper its Treasury buying. That happened again in 2018. So far, despite central banks’ size in the bond market, QT has been running fairly smoothly, but the degree of tightening could increase significantly in the year ahead. A number of economists are predicting that the ECB could start shrinking its pandemic emergency purchase program in January, fully dropping the policy by July 2024. The BoE has also indicated it might quicken the pace of QT after September. The Fed has been more circumspect, only moderately reducing its balance sheet. Given mid-March bank runs, it’s clear why Powell and his colleagues are wary of tightening too much, too fast. All of this naturally complicates the Fed’s policy endgame, while also making the pace of QT a meaningful indicator of the bank’s determination to correct large imbalances created by more than a decade of QE.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED