Soft CPI bolsters hopes for Fed pause

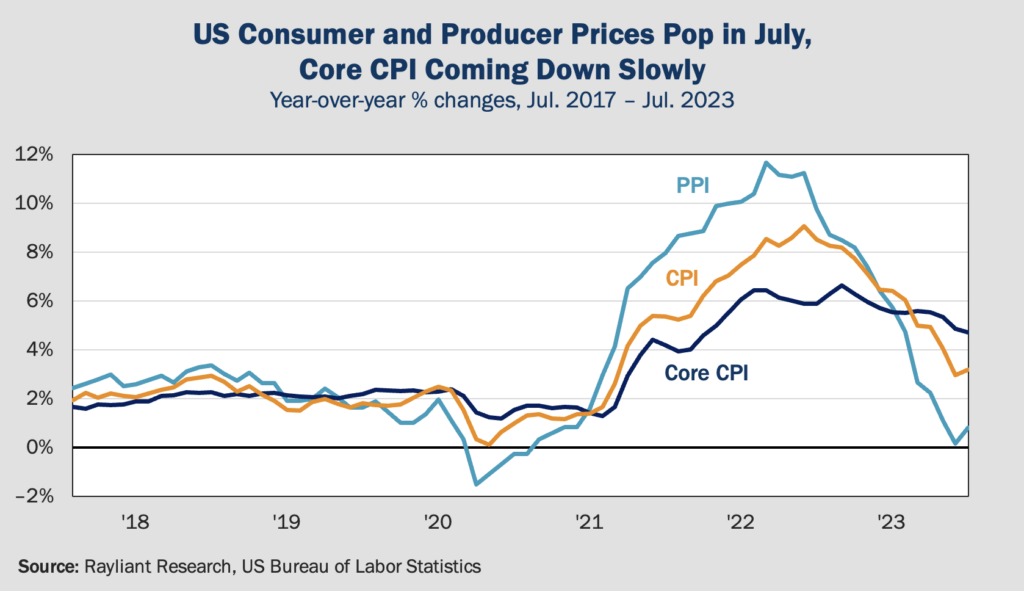

Markets had to wait until the second half of last week for the data on most traders’ minds: US inflation figures from the Bureau of Labor Statistics (BLS). Ahead of Thursday’s report on consumer inflation, futures were pricing in an 86% chance the Fed would pause at its September FOMC meeting, with investors looking to the CPI as something that could confirm the prevailing view the US central bank is pretty much finished here—or suggest a higher likelihood of additional hikes. The implied likelihood of a September pause inched up to 89% by the end of Thursday, indicating markets were reasonably pleased with a 0.2% monthly increase in consumer prices, in line with estimates and identical to last month’s rise. That implied 3.2% year-over-year headline inflation, slightly less than the 3.3% economists were forecasting. Core CPI softened as well, with prices excluding food and energy also rising by 0.2%, the same as forecasts and equating to 4.7% year-over-year core inflation, the lowest level since October 2021.

Friday’s hot PPI complicates things

Of course, 4.7% core CPI is still way hotter than the Fed’s 2% target and, although the increase in headline CPI was definitely a modest one, it represents the first monthly rise we’ve seen in the annual inflation rate since last June, as those base effects we’ve been talking about for the last few weeks start coming into play. More concerning for those hoping for the Fed to declare ‘mission accomplished’ on inflation was Friday’s BLS report of rising producer prices, which will force the FOMC to think harder about what to do in September. After no change in June, the PPI moved up by 0.3% in July, topping expectations for a 0.2% increase. That may seem like a small rise, but the categories driving PPI higher—things like health care, brokerage service and investment advice—are also components of the personal consumption expenditure (PCE) basket that the Fed considers a better measure of inflation, creating the possibility of one more disappointing data point at the end of August. The fact that wholesale service costs rose by 0.5% in July after a 0.1% decline in June aligns with our view that inflation has moved from goods to services, where we fear it will be stickier than many expect. All of this leads us to suspect the market may be somewhat overconfident on a September pause.

Recession odds seen declining

In recent weeks, the chorus of pundits calling for a US soft landing—that wonderful scenario in which inflation returns to 2% as the economy cools down just right without falling into a recession—has become louder. Bullishness over the prospect of avoiding a big hit to the US economy has driven a rally in risk assets since the end of Q1, and it’s hard to argue with the logic underpinning increased soft landing hopefulness. With every bit of cheerful macroeconomic data in a year characterized by many more positive than negative surprises, the US has seemed to move further away from impending recession. GDP grew at a surprisingly strong 2.4% in Q2, after rising by 2% in the first quarter, and the Atlanta Fed’s real-time GDPNow estimate of Q3 growth is up to 4.1%. With an exceedingly strong job market and solid consumer spending, the ingredients are clearly there for output to remain robust as services pull the US through a cyclical downturn in manufacturing without a contraction in the overall economy. Indeed, a vast majority of economists polled by the National Association for Business Economics saw the probability of a recession in the next twelve months at 50% or less, marking a sharp reversal from the March survey, in which over half of those surveyed expected a downturn over the next year.

Fed policy will likely decide

With risk assets now definitively pricing in a gentle touchdown for the US economy, there’s potential for major pain if that scenario doesn’t come to fruition. So, what could go wrong? As is clear from the previous section’s discussion, inflation and the Fed’s policy path are big question marks in this equation. We see the true odds of a soft landing as ultimately contingent on continued softening of inflation and the Fed’s tolerance for rising prices. If, as we fear, stickier components of inflation—including rising prices in the services sector driven by a too-tight labor market—turn out to be harder to rein in the closer we get to the Fed’s 2% target, it’s not hard to imagine the Fed keeping rates high enough for long enough that consumer spending falters and we do get a downturn, albeit on a meaningful lag. As Jeanna Smialek of the New York Times recently noted, since the term ‘soft landing’ entered America’s lexicon in the early ’70s, with the exception of the COVID recession in 2020, the phrase has often been invoked just before things go south, as high rates act like a “slow-release medicine given to a patient who may or may not have an allergy.” As the Fed continues quantitative tightening and mulls over a twelfth rate hike in September, we see uncertainty around hawkish Fed policy as the number one threat to a soft landing.

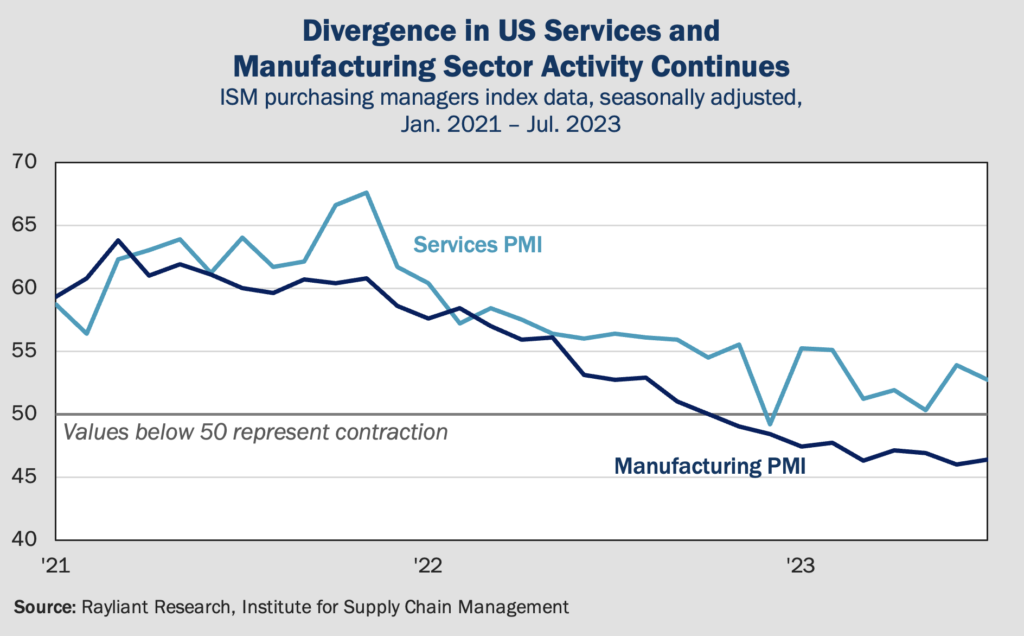

It could be a ‘rolling’ recession

Another interesting theory has emerged for the absence of a broad slowdown in the US economy, despite restrictive rates over the last year: a ‘rolling recession’, characterized by weakness that moves across the economic landscape sector-by-sector, instead of hitting all at once. As Bloomberg columnist Chris Bryant pointed out last week, talking to executives from individual industries—from chemicals and cardboard boxes to commercial real estate and advertising—they’ll tell you to forget about a soft landing, as they’re already deep in a downturn. What are the commonalities of those industries already feeling the pain? Bryant noted particular weakness in those segments associated with durable goods, those especially sensitive to interest rates, and those exposed to upstream corporate spending cuts. That breakdown jibes with a broader trend toward weakness in manufacturing, which has spent the last nine months in contraction, while services remain resilient, hovering firmly in expansion territory (see below). Moreover, pandemic disruptions are still shaking out, further confounding our traditional view of a single sweeping business cycle. AI hype notwithstanding, for example, semiconductor firms have struggled as customers destocked inventories accumulated amidst supply chain bottlenecks of prior years, but may see better times ahead. All of this nuance makes picking winners at the sector or stock level perhaps more compelling than trying to call a broad downturn.

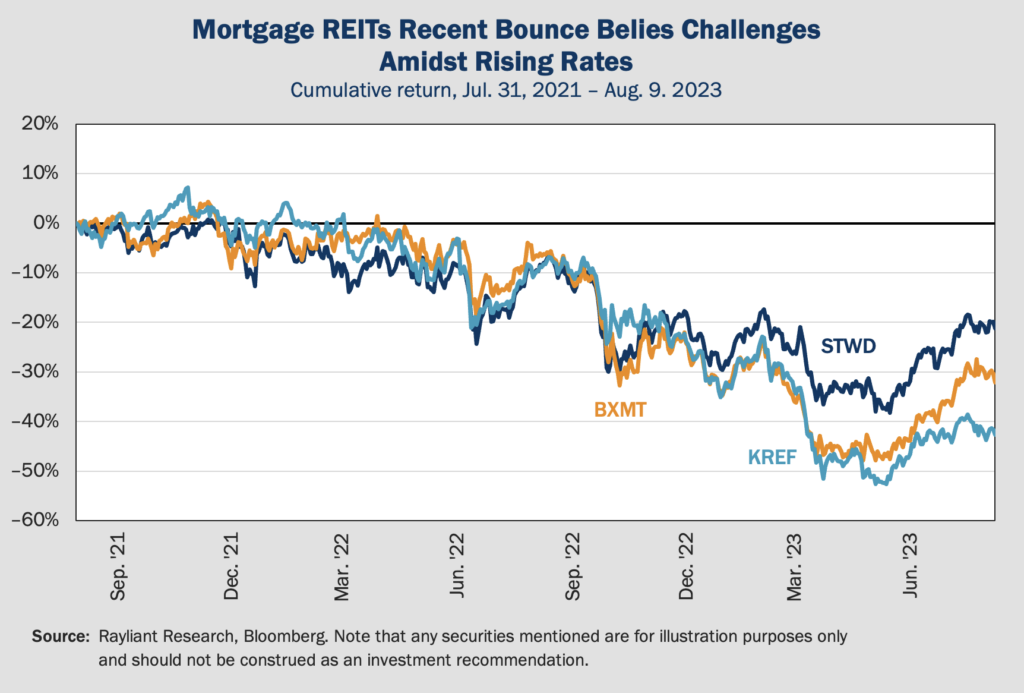

Top trusts stop making new loans

Commercial real estate obviously fits the description of a sector already in the throes of a contraction. Last week, reporting from the Wall Street Journal highlighted a massive drop in financing by two leading mortgage REITs—abbreviated ‘mREITs’—the Blackstone Mortgage Trust (BXMT) and the KKR Real Estate Finance Trust (KREF), neither of which originated any loans in the first half of 2023. The Starwood Property Trust (STWD) hasn’t halted new loans completely, but has significantly reined in its activities in the sector. While each of these trusts maintain a book of existing loans, the failure to originate is significant and speaks to Fed policies still working their way through the system. That’s because, in contrast to equity-oriented REITs, which buy and develop properties themselves, mREITs’ very business is lending to clients in the real estate sector. Now, surging interest rates making it tougher for borrowers to refinance have combined with elevated post-COVID vacancies to drive higher default rates, pushing mREITs to play it safe and go on defense with respect to their balance sheets.

Not a crisis, but points to macro challenges

Pain in the mortgage lending business can be seen in the stock prices of the trusts mentioned above, which trended down since rate hikes began in 2022, though better perceived odds of a soft landing have prompted a sharp rebound since Q1 of this year (see below). In part, that rebound reflects the fact that the funds below aren’t yet near a crisis, as most have plenty of liquidity at the moment. That could obviously change if the economy does veer into a recession, when loan quality might deteriorate to the point of triggering banks to make capital calls on mREITs’ financing. In the meantime, a bigger issue is profitability, as mREITs have already begun to face problems passing higher rates onto increasingly struggling borrowers. Because investors commonly associate REITs with income, narrowing margins at the precise moment rates are rising would make mREITs meaningfully less compelling. More generally, of course, the dynamics just described serve as a prime example of financial tightening gradually rippling its way through the economy.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED