Stock traders cheer as Powell tips a pause in rate hikes.

Stocks rallied and the dollar declined last Wednesday, as Fed chair Jerome Powell’s speech to the Brookings Institution made it clear the US central bank is ready “as soon as December” to slow down the pace of rate hikes. Fed Funds futures quickly reacted, re-pricing a peak in the policy rate at just below 5% next May. While much attention was focused on what seemed to be the bottom line—confirmation of a half-point hike at the Fed’s next meeting in mid-December—investors might want to revisit the full transcript of Powell’s remarks, where he also reiterated that rates will stay high for an extended period, with cuts not even in the conversation at this point.

Fed policy can’t touch scorching US labor market.

Friday’s November jobs report doused cold water on investors’ enthusiasm on the back of Powell’s speech, with nonfarm payroll climbing 263,000 for the month—way above expectations for 200,000 new jobs—and average hourly earnings doubling economists’ forecasts, up by 0.6% in November. Labor market strength clearly features in the Fed’s decision making. Indeed, the topic came up in Powell’s Wednesday remarks, where he noted that “strong wage growth is a good thing. But for wage growth to be sustainable, it needs to be consistent with two percent inflation.” Unfortunately, Friday’s numbers won’t cut it in that regard. While the stock market only temporarily plunged on Friday before recovering by the end of trading and Fed Funds futures traders barely budged on their forecast of a 50 bps hike in December, the US central bank will definitely want to see moderation in job market strength before coming anywhere close to a pivot on rates.

Conditions presently much more robust than in ’08.

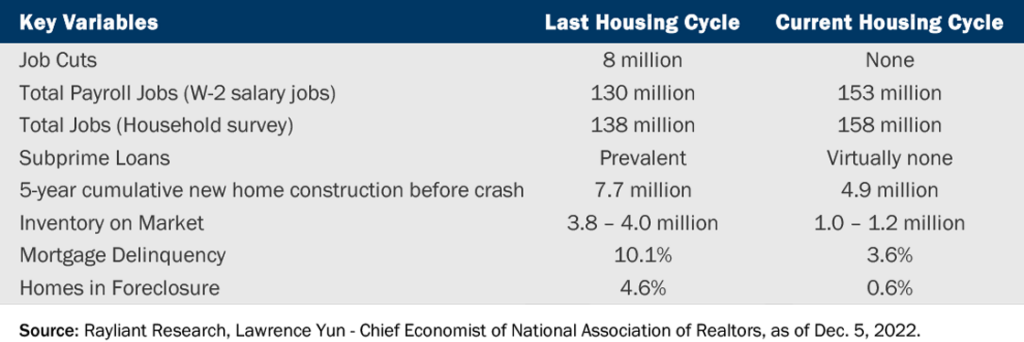

This year has seen a rapid housing market slump in the face of surging mortgage rates. Media coverage has touted falling home prices across the US and raised questions as to whether a crisis is brewing in the real estate market. A quick look at the fundamentals makes it clear that this time, things really are different. The table below, from Lawrence Yun, Chief Economist, National Association of Realtors, nicely highlights structural changes that have taken place since 2008’s subprime crisis.

Unlike during the last cycle, where layoffs impacted homeowners’ ability to pay their mortgages, today’s labor market is strong—perhaps too strong! Subprime mortgages have all but vanished since the last crisis, with banks much stricter on lending criteria. Inventories are also much tighter, sitting at around one quarter of those prevailing in the prior cycle, with far fewer distressed sales today. Contributing to shorter supply of new homes is the lower number of single-family constructions built in the past five years. While high interest rates certainly hurt housing affordability for first time buyers, current homeowners, most of whom will have locked in the historically low rates in the range of 2-3%, have a strong incentive to keep their homes—also weighing on supply of those on the market. We expect these supply pressures to largely buttress home prices as this cycle proceeds.

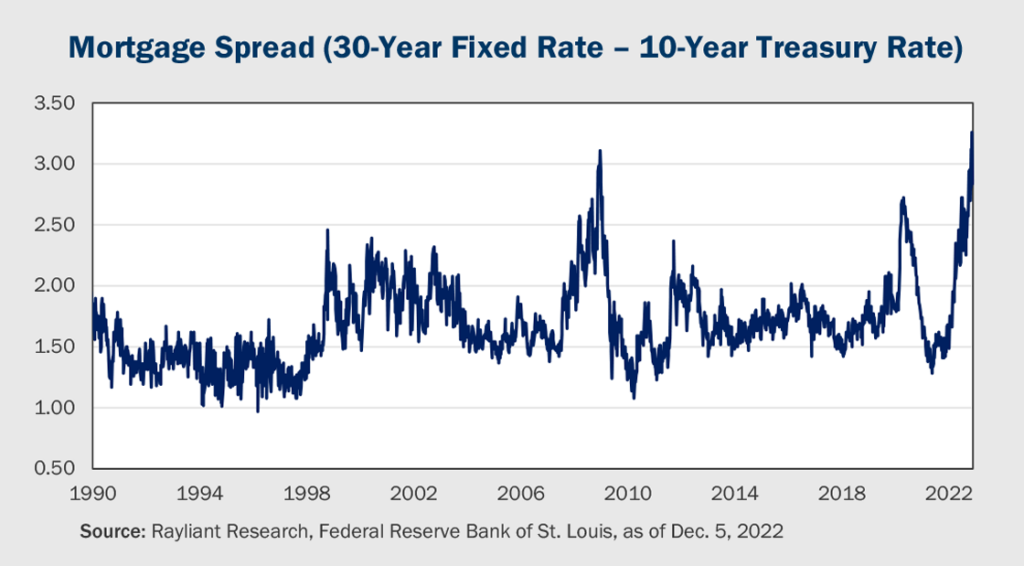

Mortgage rates premium sits at an historical high.

The gap between the 30-year fixed mortgage rate and the government borrowing rate is much higher today than it has been in the past. Indications from the Fed suggest rate cuts won’t come until sometime in 2024, though the mortgage risk premium could narrow a bit when the market does begin to price easing. That said, if we look at the distribution of mortgage rates among US households, the average rate is close to 3.5%—meaning rates would need to come down by over 300 bps to really incentivize the current universe of borrowers to refinance. Rate cuts will be helpful, but only marginally.

How far might home prices fall from here?

The rate lock-in effect just mentioned will likely serve as a support for home prices for the foreseeable future, even beyond 2023. While we’re reading more anxiety recently in commentaries on the housing market, the data suggest to us that most of the pessimism is really anchored to vivid recollections of the prior property market crisis, when home prices fell over 30% from the peak. Ignoring the unnatural jump in home prices around COVID and conservatively extrapolating growth in prices from 2015-2019 through to today, prices are only about 10-15% higher today than where we might expect them to be. Given the exceedingly tight supply and a lack of defaults and foreclosures—sellers can afford to be patient—we don’t see a crash like that witnessed in ’08. Instead, we expect the Fed’s ‘quantitative tightening’ (QT) policy to mechanically drive down asset prices, with stock markets suffering a considerably larger correction than residential real estate. Inevitably, the next course of easing will benefit asset owners and initiate another round of growth.

What were protesters fighting and why now?

A draconian year-long COVID lockdown in China has driven domestic sentiment—which is what drives the onshore stock market—to near rock bottom, basically pricing in never-ending COVID controls. Recent protests reflect citizens’ frustrations boiling over: frustration at the effect of public health restrictions on quality of life, the adverse impact they’ve had on the economy, and what seems like an incoherent timeline for a policy that doesn’t seem to be leading China out of the pandemic in any case. That’s magnified as people in China see the rest of the world increasingly finding ways to move on and coexist with COVID.

Weighing Xi’s options in response.

Protests put Xi in a difficult position in terms of the government’s response. At one extreme, China could do a 180 on COVID policy—‘the people have spoken, we’ve heard them, and we’re responding’—but that would be a massive loss of face and political capital. It’s also practically challenging because vaccine coverage among the elderly is relatively poor and China’s healthcare system vulnerable to being overwhelmed if Omicron runs rampant. At the other extreme some pundits imagined a swift and heavy-handed suppression of the protests, which has the benefit of showing strength and deterring future unrest, but also isn’t a long-term solution to the problem and wouldn’t have been good for Xi’s or China’s image abroad. Thus far, it seems the CCP has taken a middle road, with state media defending ‘dynamic zero’ policy, and pinning blame for COVID hardship on local corruption leading to failed rollout in some cities.

COVID policy trajectory and its investment implications.

As we have expected for some time, rather than a dramatic about-face on zero-COVID, the most likely course remains a gradual scaling back of restrictions—e.g., more localized and shorter lockdowns, less quarantine required for foreign travelers, etc.—leading to a more explicit shift in policy at some later point, likely with the availability of a better “Made in China” vaccine. Under that scenario, the protests will have benefited China investors, accelerating little decisions at the margin, significantly reducing the prospect for broad and prolonged lockdowns like those witnessed in Q2, and putting pressure on the party to improve their messaging. Evidence of this scenario is already playing out, as China’s COVID tsar, Sun Chunlan, recently described Omicron as a weaker variant heralding China’s shift to a “new stage” in the fight against COVID. On this and other news, forward-looking markets began pricing in a gradual softening of COVID policy, with Chinese stocks rallying sharply over the course of the last week.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED