More than the weather is heating up. The EU’s threat to Swiss independence makes China’s stand-off with Hong Kong look benign, while Iran’s militarized response to US pressure and the ever-escalating rhetoric between the US and China are occasionally moving even UK political dramas off the front page. Bull markets—and the US bull market is now at an all-time high—love a bit of worry.

Although US bond yields seem to be bottoming, illustrated in Figure 1 below, downward pressure remains intense globally as the ECB says it is open to further QE and more bonds enter negative yield territory. Even some junk bonds are trading with negative yield in Europe. Is this sustainable, or is the US leading the turn in this powerful 30-year trend?

Meanwhile, US unemployment is as low as in the late ‘60s, productivity is rising and unit labour costs are still falling. What more could you ask of “sound money?” The trouble is that this kind of soundness has the stability of a spinning top and is based on unprecedented central bank intervention. Investors are haunted by two questions as equity markets soar. The first is “When will it end?” and the second is “Given exceedingly low bond yields, where else but equities do you go?” There is some near-term comfort because the US is in a mini cycle upswing, even if there really is a long-term interest rate trend change coming down the tracks. In any case, the December sell-off made the Fed lose its nerve and it is now in ease mode.

China’s credit cycle is likely to loosen in sync with the US, not least because as the Fed eases, capital tends to flow into China. Chinese state support is increasing along with a resurgent construction sector and strong business confidence, which offsets trade weakness and massive tariff increases. China’s financial system is looking stressed at the edges. A small bank, Baoshang, collapsed in June and a mutual fund house defaulted on some products, so the Peoples’ Bank of China pumped 600bn Yuan ($125bn) into the system via brokerages and was forced to extend the deposit guarantee to all banks as interbank rates spiked. Big crises start with small ones, but there can be plenty of false warnings. President Xi Jinping is likely to keep running with a fiscal deficit larger than forecasted, given his credit and trade war issues. He is also loosening bond market restrictions.

Eurozone equities are expected to trough soon as the ECB is forced to resume easing and Mme. Lagarde may restart QE during the year. Germany’s benchmark Bund yields are plumbing new depths at minus 0.75%. This is impressive given the stresses of Brexit, a zombie banking sector (is it now cheap?) and rebellions in the UK, Italy and Visegrad regions. Europe AsiaPac and Emerging Markets are, to a large extent, hostage to the main protagonists: the US and China and the US Dollar.

The simultaneous bull markets in equities and bonds raise the issue of whether bonds are the best diversifier at this stage. If rates rise hard then bonds could suffer, but we use shorter durations to limit downside. There is a case for using gold for diversifying equity risk in inflationary periods, but gold has needed no help from inflation to act as a speculative release valve, along with Bitcoin, over the last month.

The yield on 3-month US government bonds is now lower than on 10-year notes—the infamous inverted yield curve. Such inversions have preceded every US recession for the last 50 years, on average by about 9 months, so we will be considering asset allocation carefully. However, there are many other factors at play, including signs of a positive mini cycle upswing in the US as we head into the final year before the next US Presidential election, traditionally never short of market-friendly stimulus.

Equities

Since the end of March, it’s been a roller coaster ride for global stocks. As one Bloomberg analyst—an apparent Sinatra fan—pointed out, the lyrics to That’s Life managed to perfectly capture the experience of equity investors in the second quarter, with the MSCI ACWI “riding high in April” (+3.4%), “shot down in May” (–5.8%), and finally managing to “change that tune…back on top in June” (+6.6%). Despite these ups and downs, through the end of June, equity markets had significantly extended a first quarter rally back from their late-2018 retracement, with US stocks up 4.3%, UK stocks gaining 3.3%, European equities advancing 6.1%, and EM stocks adding a modest 0.7% (see Figure 2).

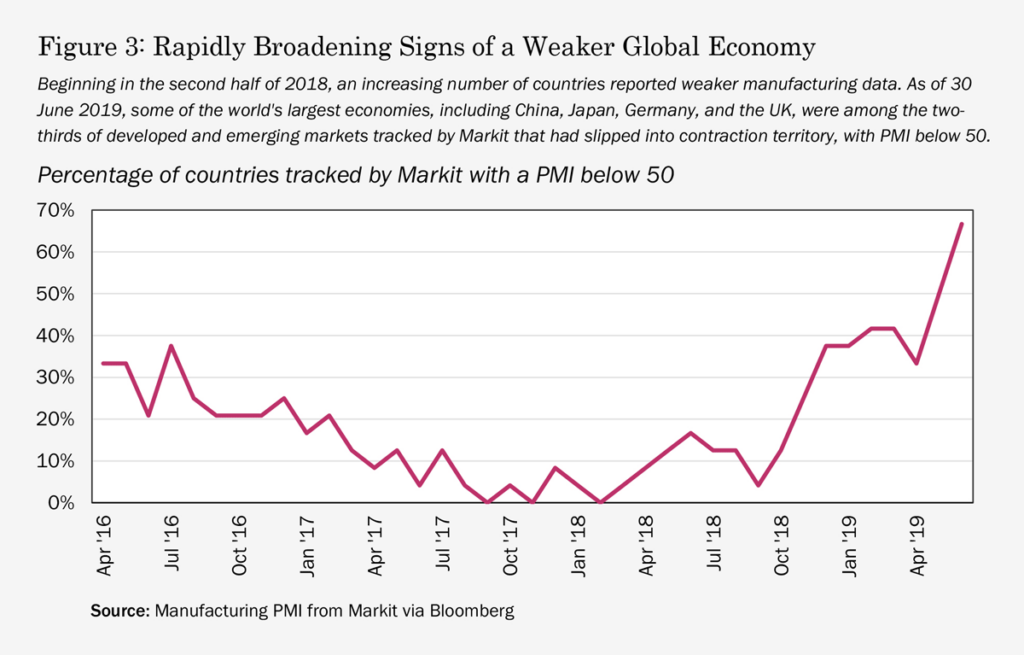

Trade tensions likely explain part of the bumpy ride for stocks in Q2. While April negotiations in Beijing and Washington hinted at possible de-escalation, rhetoric ramped up at the beginning of May, with the US lashing out at China and other trade partners—including a short-lived threat of tariffs against Mexico—which contributed to a temporary dip in equities. Near the end of June, apparently productive talks at the G20 summit between Messrs. Trump and Xi again gave investors some hope on the trade front, culminating in a surprising reversal on June 29th of the US ban on sales to Chinese smartphone vendor, Huawei. Notwithstanding the potential thaw in relations between the world’s two largest economies, the trade war has clearly already taken a toll, with China’s manufacturing activity slipping back into contraction territory during the second quarter, placing the nation in good company with the other 15 of 24 countries tracked showing a PMI below 50 as of the end of June, including Japan, Germany, and the UK (see Figure 3).

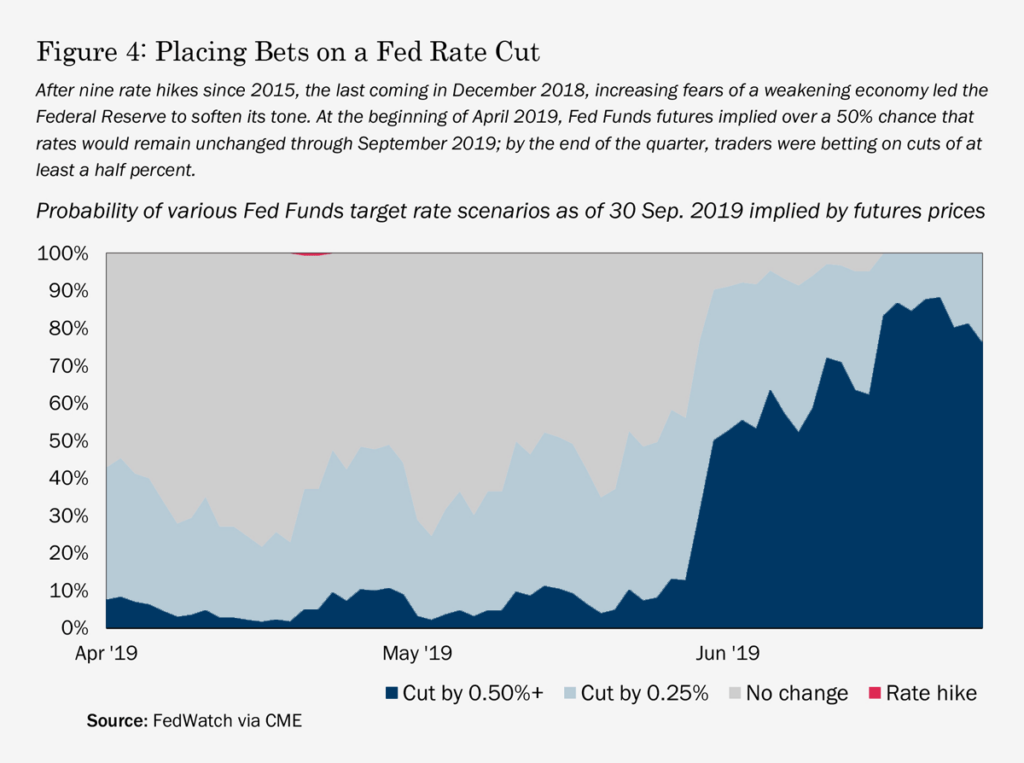

Indeed, mounting concerns of a global economic slowdown prompted the world’s central banks to double down on the first quarter trend toward monetary easing, arguably the most significant driver of stock market gains in the second quarter. In the US, Fed rate hikes to close out 2018 gave way to a “patient” pause in monetary interventions during Q1, which turned to consensus expectations for rate cuts by mid-May, spurred on by comments from Fed officials seemingly paving the way for meaningful reductions in target rates by the end of 2019. At the end of June, futures traders on the CME pegged a falling Fed Funds rate by September 2019 as a sure thing, and the odds of a cut of at least half a percent by at better than three-in-four (see Figure 4).

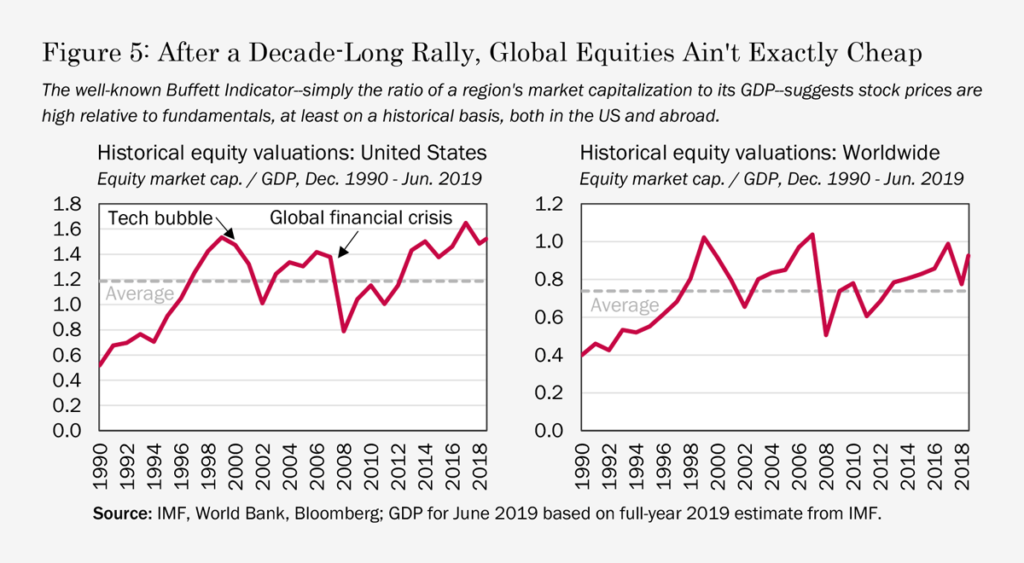

The end result of expectations for further easing has been a surge in equity valuations to record highs, with the popular “Buffett indicator”—the ratio of total market capitalization to GDP—reaching levels not seen in the US since the Tech Crash and surpassing those witnessed just prior to the Global Financial Crisis (see Figure 5). Global markets seem less expensive, but certainly aren’t cheap by historical standards. Given the threat of an impending economic downturn, geopolitical risks galore, not to mention public concerns about financial drivers of social inequality creating the potential for a rollback of deregulation and tax cuts that have helped sustain a decade-long stock market rally, investors would be wise to temper expectations for equities going forward. Incidentally, while Emerging Markets (EM) stocks have climbed by over 11% this year, they still represent a potential haven for equity investors, with the MSCI EM showing a forward P/E of 12.1 vs. 15.6 for Developed Markets (DM) stocks in the MSCI World Index as of the end of June.

Fixed Income

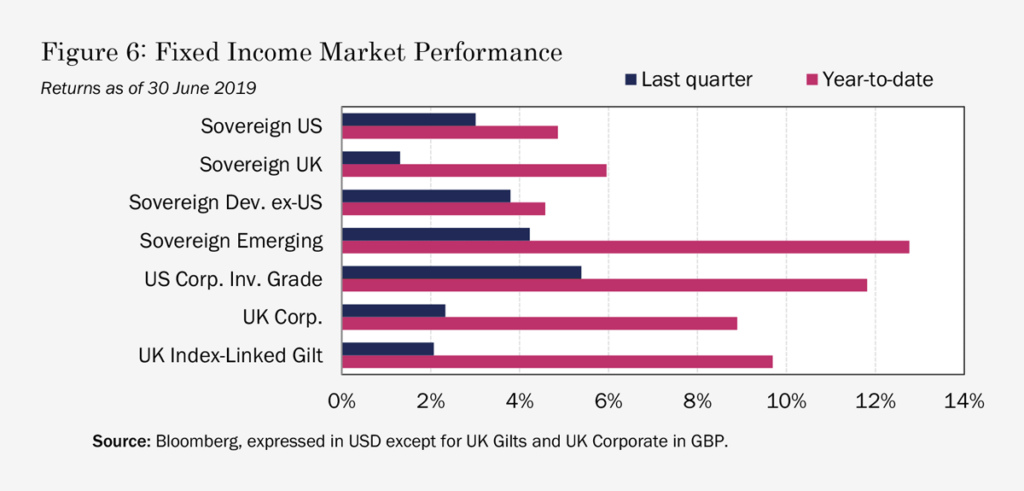

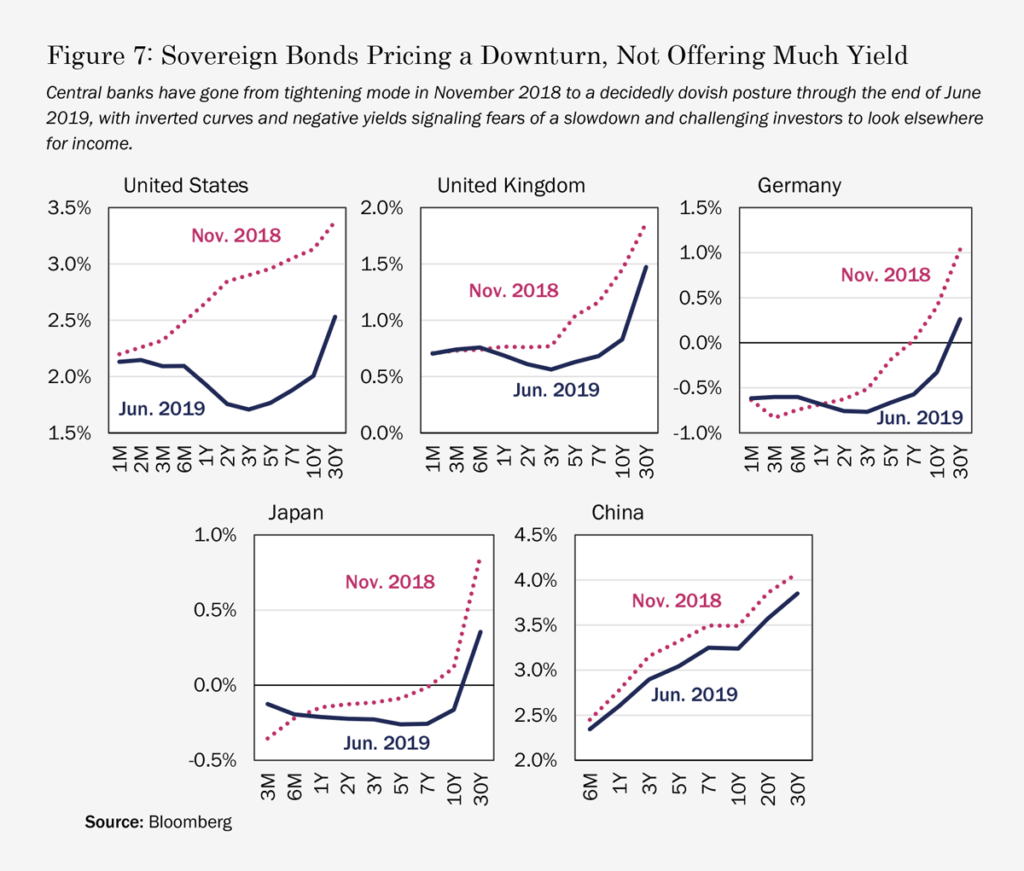

Largely as a result of the macroeconomic headwinds and policy response just discussed, global yields continued to sink lower in the second quarter, producing solid returns for bond investors (see Figure 6). At the end of June, yield curves shifted further from optimistic expectations set last year, with the US yield curve firmly inverted, and UK gilts, on the heels of deteriorating economic data and heightened risks of a “hard” Brexit, flirting with levels not seen since that fateful 2016 referendum (see Figure 7).

To get a sense for just how far rates have fallen in recent months, we note that by the end of June, investment grade government and corporate bonds making up the Bloomberg Barclays Global Aggregate Bond Index included more than US $13 trillion worth of issues with negative yield, making up almost 25% of the index. Despite rock-bottom rates, demand for global bonds remains strong. So strong, in fact, that as the quarter ended, Austria was reportedly contemplating floating yet another 100-year issue. Their last foray into “century bonds,” maturing in 2117, currently yields just over 1%.

Alternatives

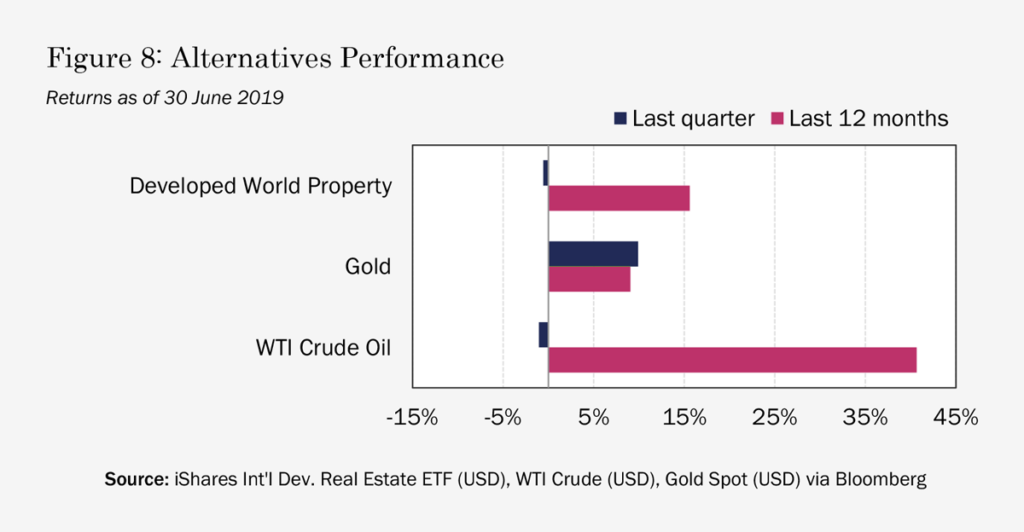

REITs retreated ever so slightly in the second quarter, as developed world property fell –0.6% through the end of June, bringing year-to-date returns to 15.6%. An increasingly dovish monetary policy has led investors reaching for yield to pile into this income- oriented segment, driving richer valuations for many REITs in 2019, although the resulting “NAV premium,” along with fairly strong fundamentals, has the effect of providing firms in the sector with currency to fund growth through acquisition.

In commodities markets, gold benefited during the second quarter from increasing expectations for 2019 rate cuts—which would reduce the opportunity cost of holding bullion—and persistent geopolitical fears, ending the quarter up 9.91%. Notwithstanding political and economic instability in Venezuela and an escalating conflict between the US and Iran, oil prices retreated modestly, returning –1.0% in Q2 on fears that a slowing global economy would put the brakes on demand for crude (see Figure 8).

The tensions between the US and China are not merely about trade, but stem from deep strategic rivalry and are likely to remain a part of the landscape, causing at least intermittent pressure on markets, for some while. This quarter should give more clarity on the efficacy of China’s domestic strategies and the impact of trade tariffs.

What else does the quarter hold? In the UK, everybody expects Mrs. May to tell Her Majesty on July 22nd that her successor in the Conservative party will be able to form a Commons majority—but this is not a foregone conclusion. In the Eurozone, zombie banks and renewed QE are candidates for investment headline material.

The second quarter saw the S&P 500 Index touch new highs despite the above and this quarter has kicked off with a rally into new territory, supported by most other equity markets round the world. Bonds have risen as longer-term US interest rates stopped climbing and settled back to 2016 levels, though in doing so they have created a yield curve inversion. This is normally a reliable leading slowdown indicator and we can expect investor attention to be focused on US growth trends this quarter. Of critical importance is results season. One of the reasons for such strong US markets compared to the rest of the world has been the growth in corporate profit as a share of GDP, and we will shortly see how this is holding up, and how companies see their outlooks going into 2020. Valuations in the US are higher than elsewhere, with forward PERs around 17x in the US and 13x outside it, Emerging Markets on 12x, so the valuation baton could pass from the US to others. It should be born in mind that the flip side of corporate profits being such a high proportion of GDP is that less is going into workers’ pockets. This, coupled with a decade of QE pumping up asset prices for the wealthy, makes the question of Mrs. May’s successor of particular interest to UK investors.

Our Investment Team continuously monitors and works to evolve and adapt our strategies which are designed to dynamically take advantage of market volatility and asset divergences. Now more than ever, our knowledge in a systematic disciplined approach to investing is essential in managing the investments that you have entrusted to us to help meet your financial needs. Please contact us with any questions or if you would like to meet in person to discuss our approach. We greatly appreciate your business and confidence in us.

Subscribe to receive the latest Rayliant research, product updates, media and events.

Subscribe

Sign upIssued by Rayliant Investment Research d/b/a Rayliant Asset Management (“Rayliant”). Unless stated otherwise, all names, trademarks and logos used in this material are the intellectual property of Rayliant.

This document is for information purposes only. It is not a recommendation to buy or sell any financial instrument and should not be construed as an investment advice. Any securities, sectors or countries mentioned herein are for illustration purposes only. Investments involves risk. The value of your investments may fall as well as rise and you may not get back your initial investment. Performance data quoted represents past performance and is not indicative of future results. While reasonable care has been taken to ensure the accuracy of the information, Rayliant does not give any warranty or representation, expressed or implied, and expressly disclaims liability for any errors and omissions. Information and opinions may be subject to change without notice. Rayliant accepts no liability for any loss, indirect or consequential damages, arising from the use of or reliance on this document.

Hypothetical, back-tested performance results have many inherent limitations. Unlike the results shown in an actual performance record, hypothetical results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under- or over- compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical results in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any investment manager.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED