Insights, Research

Vivek Viswanathan, PhD

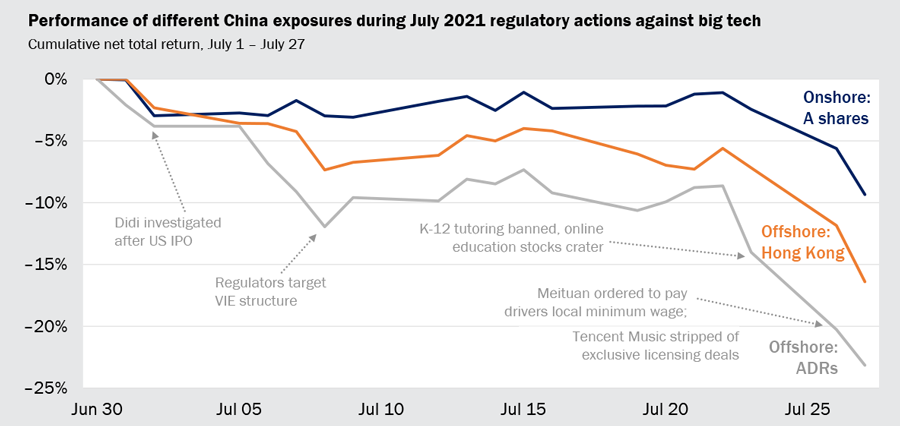

Scroll downChina’s recent market decline is the investment topic du jour. Less discussed are the different ways this decline is manifesting across various China listings. Depending on the source of an investor’s China exposure, their experience of the recent decline may vary widely.

Consider the following for the period June 30 to July 27:

What is driving the divergence among Chinese A-shares, H-shares, and ADRs?

Answering this question starts with understanding the catalyst for the current sell off: regulatory risk. Over the past year – but particularly over the past month – China’s regulators have taken an aggressive stance on a broad range of issues affecting Chinese businesses, from data privacy to education to monopolistic practices. Collectively, this regulatory action has spooked investors who have not already priced in that regulatory risk.

And if regulatory risk is driving the recent sell-off, then it follows that the greatest mispricing of China stocks was in U.S.-listed ADRs (23% decline), followed by Hong Kong listed H-shares (14.5% decline), and finally A-shares (9.3% decline). This data reflects the market’s view–which I share–that onshore-listed A-shares present less regulatory risk than their offshore counterparts.

This is not surprising. China’s regulatory scrutiny over the past year has disproportionately affected firms listed outside of mainland China. For example, big technology firms–which represent the largest category of China ADRs– have been hit particularly hard. So have those companies that listed in Hong Kong or the U.S. to benefit from bloated valuations or to avoid China’s difficult listing process. It would appear the Chinese government may be pressuring firms listed abroad to return to Chinese exchanges or, at a minimum, to ensure offshore-listed firms receive some of the of same scrutiny that their onshore counterparts receive prior to listing.

Based on recent signaling from Beijing, it appears we may be approaching the end of the current burst of regulatory activity. We may also be seeing the end of the corresponding volatility. The reaction we have seen in the market is simply the pricing of regulatory risk into Chinese securities–including the current pricing of potential future regulatory pressures. (For example, we’ve seen volatility in certain industries, like brewing, that are not yet the subject of regulatory scrutiny but may be in the future.) That said, from a fundamental perspective, it’s hard to understand how regulatory punishments will end up equaling 10% of market value, so the steep decline we’re seeing is likely an overreaction.

Moreover, as explained above, China’s regulatory pressure has been primarily directed outside of A-shares–H-shares and ADRs are taking the brunt of the regulatory scrutiny. The decline we’ve seen in A-shares is probably driven by international investors pulling capital out of China A and a general fear of a regulatory crackdown. While understandable, this is again likely an overreaction. It is reasonable to expect the A-shares market to stabilize and for values to revert.

In short, offshore stocks of Chinese companies may well be oversold. But in the long run, it’s clear where the regulatory winds are blowing. Gradually, Chinese firms will begin responding to the positive and negative incentives of China’s government and regulators. New firms will increasingly look to IPO in Shanghai and Shenzhen, and firms listed as ADRs will try to find their way back to mainland China or Hong Kong. The change will not be overnight, but it’s coming. The future of China lives onshore – and for China investors seeking to accurately price regulatory risk, that’s probably a good thing.

Subscribe to receive the latest Rayliant research, product updates, media and events.

Subscribe

Sign upIssued by Rayliant Investment Research d/b/a Rayliant Asset Management (“Rayliant”). Unless stated otherwise, all names, trademarks and logos used in this material are the intellectual property of Rayliant.

This document is for information purposes only. It is not a recommendation to buy or sell any financial instrument and should not be construed as an investment advice. Any securities, sectors or countries mentioned herein are for illustration purposes only. Investments involves risk. The value of your investments may fall as well as rise and you may not get back your initial investment. Performance data quoted represents past performance and is not indicative of future results. While reasonable care has been taken to ensure the accuracy of the information, Rayliant does not give any warranty or representation, expressed or implied, and expressly disclaims liability for any errors and omissions. Information and opinions may be subject to change without notice. Rayliant accepts no liability for any loss, indirect or consequential damages, arising from the use of or reliance on this document.

Hypothetical, back-tested performance results have many inherent limitations. Unlike the results shown in an actual performance record, hypothetical results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under- or over- compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical results in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any investment manager.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED