Insights, Research

Phillip Wool, PhD

Scroll downSince the end of 2018, a year in which Chinese stocks lost 30% amidst a trade war and financial reforms, the world’s second-largest equity market has staged a comeback, climbing by nearly 70% through July. Trading has been so frenzied in recent months that investors have begun to make comparisons with the spectacular rise and fall of A shares in 2015-16 and ask themselves whether China’s market has entered a bubble. Using a range of data and relying on an understanding of China’s unique financial landscape, we seek answers to that question in eight charts illustrating China’s recent rally.

Are we witnessing a bubble in Chinese A shares? In the midst of a pandemic that has shaken the global economy and in the face of escalating trade tensions between the U.S. and China, that might seem like a strange question to ask. When mainland stocks sold off by almost 8% in a single day coming out of an extended Chinese New Year holiday in early February, few might have guessed that at the end of July, A shares would be up over 20% on the year. With such a swift rebound in China’s market, investors will wonder whether that rapid rise is rationally tied to a fundamental recovery or, like the 2015-16 bubble in A shares, fueled by retail overexuberance and destined to end in disappointment. Seeking clues, we turn to the data, beginning with a closer look at prices and fundamentals in the recent rally.

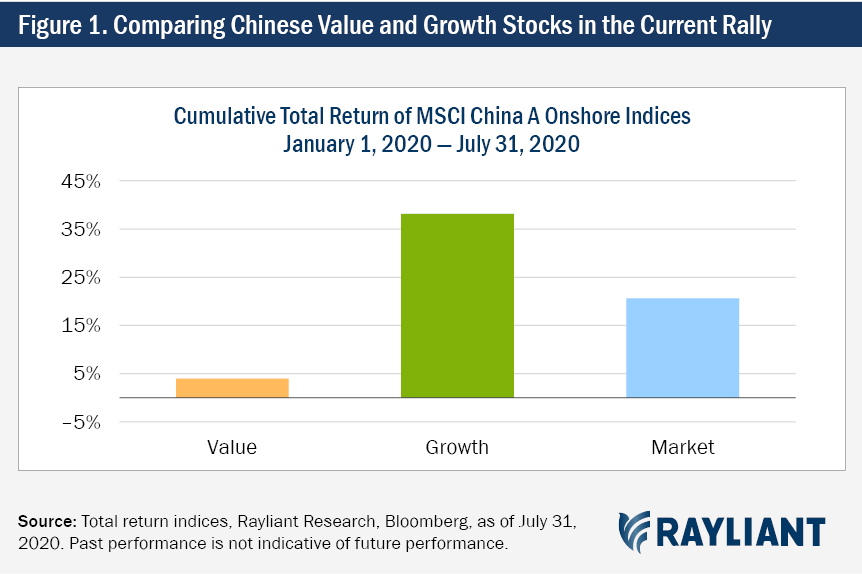

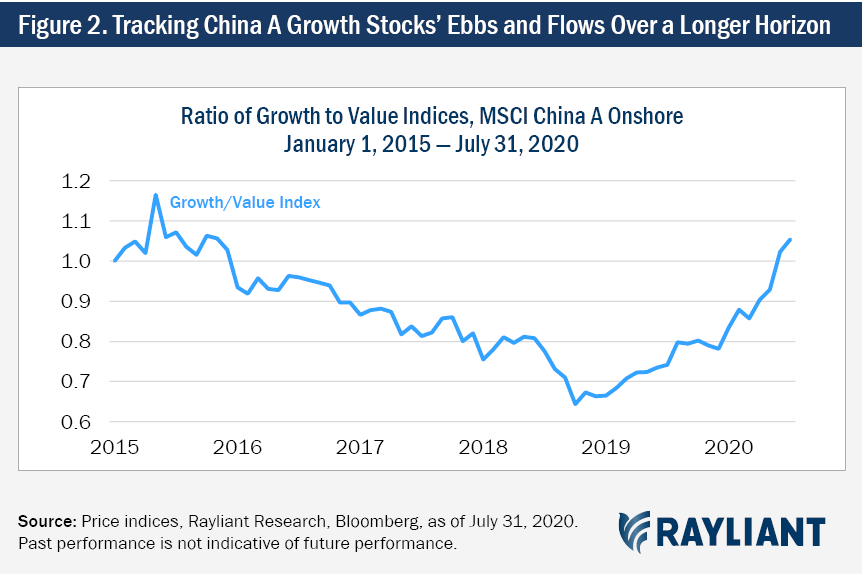

The first thing to note about the runup in Chinese equities since late March is that not all stocks have participated. In particular, as Figure 1 illustrates, value stocks—those with low price relative to fundamentals—have strongly underperformed their growth counterparts since the beginning of the year by 34%. In Figure 2, looking back over a longer sample, we find that growth has been steadily gaining on value, outperforming by almost 78% since November 2018.

Such moves can be painful for investors pursuing rational strategies firmly anchored in data, but are typical of retail rallies in China, which tend to push prices away from fundamentals, sometimes for extended periods of time. When prices converge to fair values, of course, rationality wins out and patience on the part of value-oriented investors is rewarded. The last period of growth dominance, for instance, visible in early 2015 on the left edge of the plot, gave way to a market crash and a winning streak for value stocks that lasted over three years.

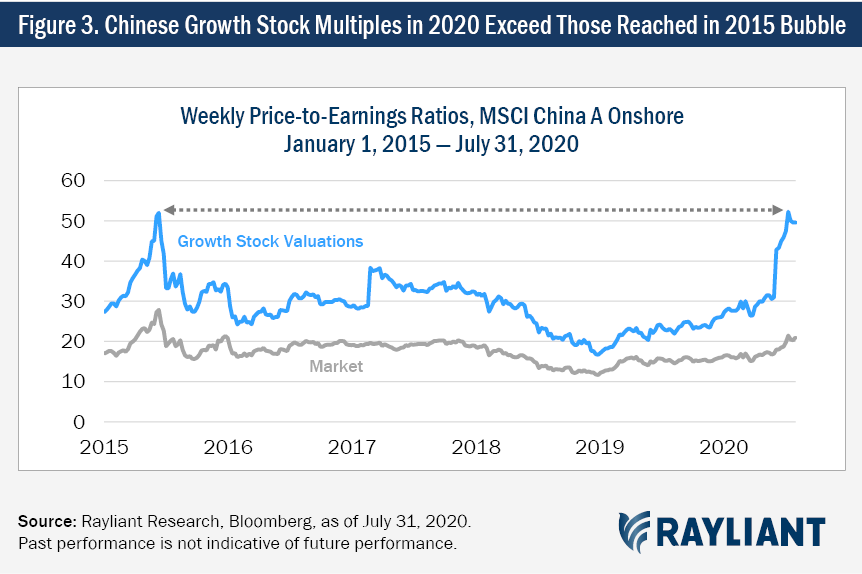

So, how extreme is China’s current growth rally, relative to recent history? To answer that question, in Figure 3, we depict past price-to-earnings (P/E) ratios for growth stocks and the overall market. Since May 2020, growth stocks have seen significant valuation inflation, hitting a P/E multiple of 52x in July, exceeding the high reached at the peak of the last bubble. That hasn’t stopped investors from snapping up shares at record prices, including China’s mass of amateur traders—a group that tends to strongly favor growth stocks and must feature prominently in any discussion of mispricing among A shares.

Indeed, when practitioners and scholars performed the post-mortem on China’s 2015-16 bubble and stock market crash, retail investor speculation was clearly at the heart of the matter. The involvement of individual investor participation can be seen quite easily in statistics on account openings by non-professional investors in China, presented in Figure 4. Peaks in new account creation reflect a telltale “fear of missing out”, whereby each large move up in the index brings a new wave of would-be experts into the market. While the 2015 spike is in a league of its own, with 21 million retail accounts activated in a span of a quarter, the last few months have seen another large swath of amateur investors try their hand at stock trading, with over 17 million accounts opened so far this year, through the end of July.

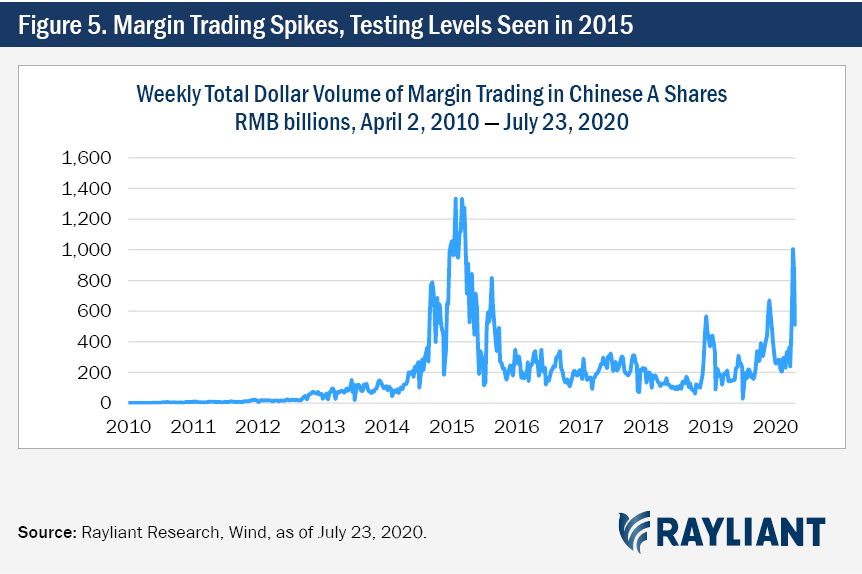

Another key driver of the 2015-16 mania in China’s market was frenzied margin trading, which served to accelerate the runup, but also exacerbated the collapse, as leveraged gains gave way to outsized losses, margin calls, and forced selling. Figure 5 reveals that while margin borrowing had been relatively subdued since the last crash, retail traders have once again thrown caution to the wind in 2020, making levered bets on a continued rally in a pattern eerily reminiscent of the last bubble in A shares. It’s also worth noting that the chart only captures legal margin activity. Recent reports of illicit “shadow” margin trading in China offering leverage of up to 10 times on stock purchases serve as another indication of the speculative frenzy currently gripping China’s retail crowd.

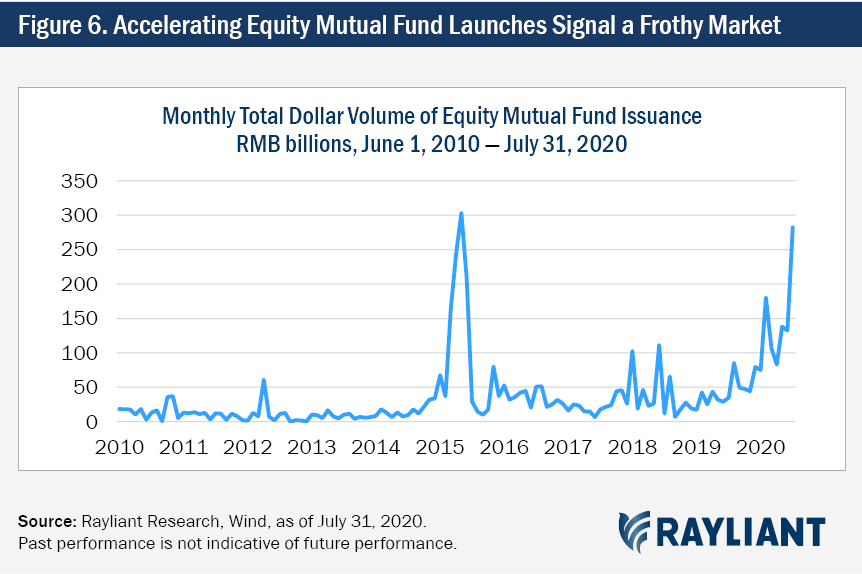

While data on retail investor activity suggest Chinese stocks might be entering a feedback loop—and the rally taking on a life of its own—analysis of amateur trading behavior always yields an alternative, albeit highly related perspective: that of professional money managers. What can we judge from the actions of the presumed “grownups in the room” during this year’s A shares rally? Figure 6 tracks the number of new equity mutual funds launched each month in China since 2010. To understand the pronounced spikes in 2015 and 2020, it helps to have a bit of background on the unique organization of China’s mutual fund industry. Because funds in China follow an initial public offering (IPO) process, after which they don’t generally grow assets under management (AUM), managers carefully time the launch of new funds to benefit from retail overexuberance. This makes mutual fund IPOs a potentially powerful indicator of markets nearing a top.

The picture becomes even clearer when we examine what those funds are buying. We often think of professional money managers as “taking the other side” of retail trades to profit from amateurs’ behavioral mistakes. But a recent examination of Chinese mutual funds’ top holdings reveals retail preferences spilling into the fund space, with fund managers catering to current fads, loading up on stocks in the most overvalued sectors. At the end of July, for example, Pharmaceutical stocks traded near an all-time high on P/E ratio, at an average 72x earnings. Meanwhile, Chinese mutual funds held a record 21% of the sector in their portfolios. When professionals start mimicking uninformed retail trades, it shouldn’t be surprising to see fundamentally grounded strategies out of favor.

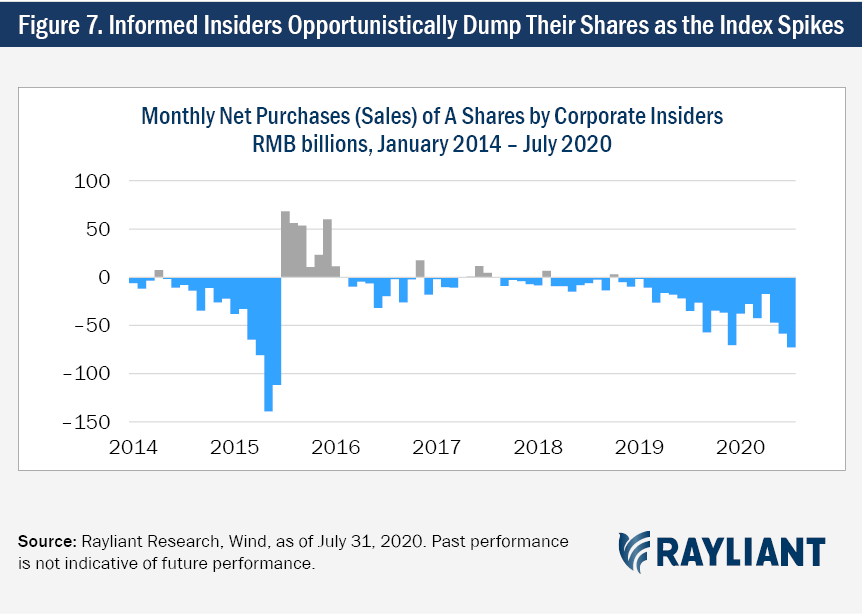

We’ve examined the current rally in Chinese stocks from the perspective of investors, both retail and professional, but what about the companies, themselves? Figure 7 plots monthly transactions by corporate insiders, including major shareholders and senior management—those who have the sharpest view on a company’s fundamentals. Back in 2015, insider selling accelerated sharply as Chinese stocks moved higher and those with privileged information correctly identified overvaluation of their companies’ shares. From January 2019 through July 2020, insiders have been net sellers every month, dumping nearly RMB 660bn worth of stock as A shares rallied by a cumulative 69%.

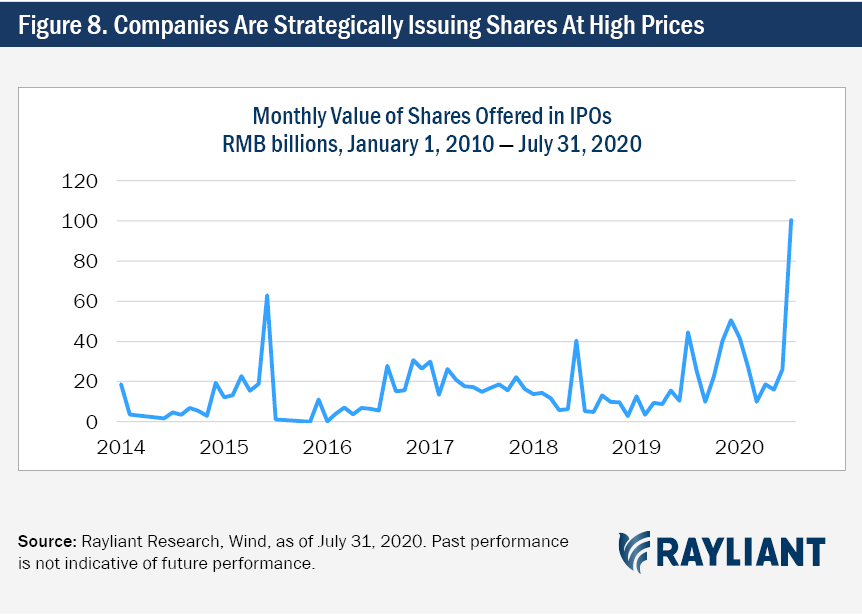

Firms also time the market, issuing shares to raise capital when prices are relatively high. That incentive isn’t unique to Chinese companies, although the IPO process in China has been historically challenging, given extremely tight state control over the listing process, which subjected prospective issuers to lengthy and rigid regulatory approvals. Nevertheless, as Figure 8 shows, IPOs spiked in mid-2015, as companies scrambled for clearance to sell stock at bubble valuations. In July 2020, with A shares again trading at rich multiples, Chinese firms managed to issue over RMB 100bn worth of shares, helped in part by reforms designed to make IPOs easier for Chinese companies and give mainland exchanges an edge over U.S. listing venues. Together with our previous evidence on insider sales, this extreme jump in IPO activity suggests informed insiders see present prices as a good opportunity to cash out.

We could remove axis labels from most of the graphs above, and the message would still be clear: measuring market-related variables in China—whether tracking fundamentals, retail sentiment, fund statistics, or actions by corporate insiders—one finds pronounced spikes in 2015 and 2020. Although history may not repeat, we agree with the adage that it does tend to rhyme. A wide range of data speak to marked similarities between the current rally in Chinese stocks and the last A shares bubble in 2015.

That doesn’t necessarily mean the market is in for a sudden crash, nor will the simple charts we’ve studied do much to help an investor time the top. On the other hand, applying the same data and perspectives to the study of individual firms, systematic models hold promise in identifying overvalued stocks and overlooked bargains. Recognizing companies with low-quality growth, shares pumped up by irrational retail investors, or stocks being sold off by corporate insiders, quantitative models with a local edge will find opportunity—even in a bubble.

Subscribe to receive the latest Rayliant research, product updates, media and events.

Subscribe

Sign upIssued by Rayliant Investment Research d/b/a Rayliant Asset Management (“Rayliant”). Unless stated otherwise, all names, trademarks and logos used in this material are the intellectual property of Rayliant.

This document is for information purposes only. It is not a recommendation to buy or sell any financial instrument and should not be construed as an investment advice. Any securities, sectors or countries mentioned herein are for illustration purposes only. Investments involves risk. The value of your investments may fall as well as rise and you may not get back your initial investment. Performance data quoted represents past performance and is not indicative of future results. While reasonable care has been taken to ensure the accuracy of the information, Rayliant does not give any warranty or representation, expressed or implied, and expressly disclaims liability for any errors and omissions. Information and opinions may be subject to change without notice. Rayliant accepts no liability for any loss, indirect or consequential damages, arising from the use of or reliance on this document.

Hypothetical, back-tested performance results have many inherent limitations. Unlike the results shown in an actual performance record, hypothetical results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under- or over- compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical results in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any investment manager.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED