The CIO’s Take: Since inflation started making a comeback in January, we’ve been poring over every bit of new data on the strength of the US economy in an effort to assess whether reaccelerating prices are a mere blip in the statistics—as Fed chair Powell previously suggested they might be—or something more concerning. Along those lines, we found March’s CPI to be a pretty nasty reading across the board, and one that must be making Fed officials considerably less comfortable with the messaging they rolled out at the end of last year, touting a baseline three rate cuts in 2024 as inflation moves smoothly down to the bank’s 2% target. With prices appearing stickier, we’re seeing more hedging in the language of Fed officials, walking back the timeline for easing, which increases the risk higher-for-longer starts taking a toll on companies’ earnings. If last Friday’s early reports on Q1 results are any indication, such developments might already be upon us, with the biggest banks reporting smaller net interest income, sending their shares sinking to end the week. Though such dynamics have us positioned defensively within our asset allocation models, we’re still finding opportunities: industrial metals, for example, an asset class enjoying better returns than stocks in 2024, and one to which we thankfully added exposure weeks ago.

Unpleasant surprise in March CPI

Last week’s Perspectives flagged Wednesday’s CPI as the biggest event on the macro calendar, and the Bureau of Labor Statistics (BLS) report didn’t disappoint. To the contrary, it featured a big upside surprise in consumer prices, with headline US inflation rising 0.4% month-over-month in March, equating to a 3.5% year-over-year increase: 0.3% higher than the annual rate of inflation posted in February, and higher than the 3.4% rate forecasters expected. Energy and shelter costs figured meaningfully in March, with the former posting a blistering 1.1% rise for the month and the latter jumping 5.7% year-over-year. Even core CPI, which strips out energy and food prices, clocked in higher than consensus estimates, rising 0.4% month-over-month and 3.8% year-over-year, better than analysts’ 0.3% and 3.7% targets, respectively. Consistent with recent trends, the rise in core inflation was driven primarily by services like healthcare and insurance. Stocks declined modestly on Wednesday, in response, while bond yields predictably increased.

Dreams of a June cut evaporate

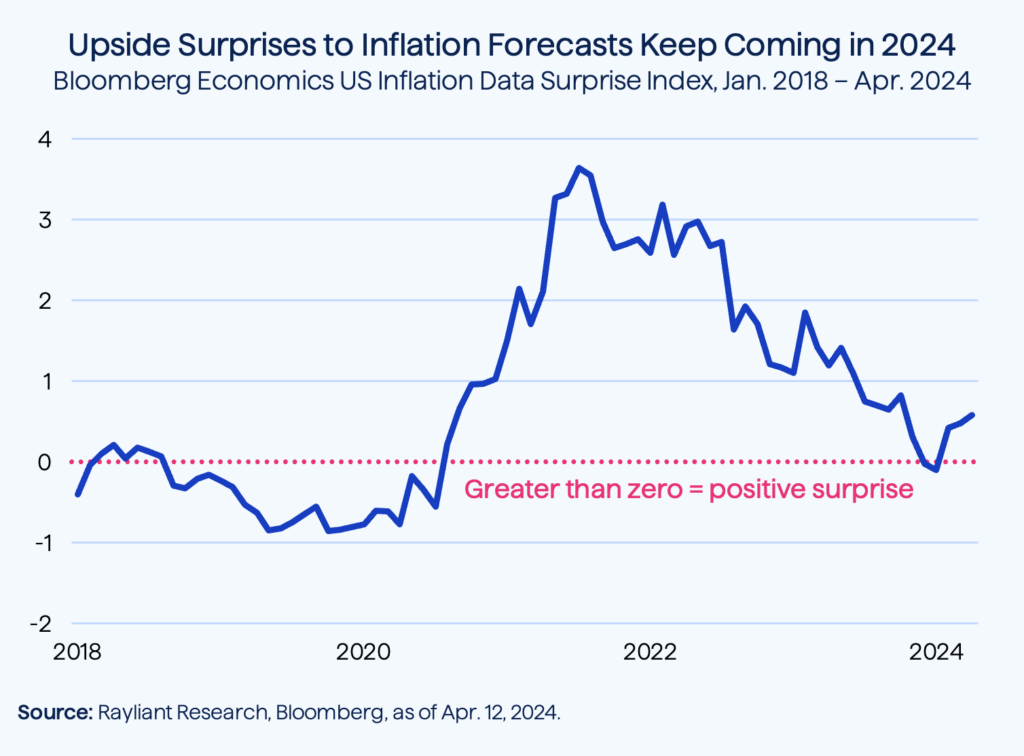

For markets clinging to the dream of a June commencement in the expected three Fed rate cuts of 2024—something we’ve long viewed as a best-case scenario—this was clearly not the news investors hoped to see. Indeed, we view the March CPI reading as a final nail in the coffin for a Q2 start to easing, marking a whole quarter’s worth of upside surprises to inflation (see below), and making Powell’s suspected “bump” on the path to more accommodative conditions look more like a detour. In recent weeks, we’ve pointed to unexpected strength in the labor market and a rebound in manufacturing as making the Fed’s decision to err on the side of patience a bit easier. As we’ve also noted before, the nearer we get to November’s US election, the harder it will be for the FOMC to put in the first cut of the cycle.

At this point, while we wouldn’t go as far as Harvard economist and former Treasury Secretary Larry Summers, who recently told Bloomberg he believes there’s a serious chance the Fed’s next move will be to hike rates, we see one or two cuts as optimistic at this point and can easily imagine a scenario in which the Fed decides to hold rates steady through 2024 and begin easing in 2025.

Supercore bounce underscores concerns

That’s a view increasingly shared by officials at the US central bank. Atlanta Fed President Raphael Bostic, speaking to CNBC a week prior to the March CPI data, noted that his base case is for a single cut this year to come sometime in Q4. Of the many indicators on the radar of monetary policymakers, one that we see flashing a particularly troubling reading in March was the so-called “supercore” measure: a version of CPI that goes beyond the more conventional “core” basket, focusing on services and excluding shelter costs, in addition to food and energy. BLS data showed supercore prices rising 0.7% in March, posting a 4.8% year-over-year increase, the highest reading since May 2023. At this rate, annualizing just the last three months’ data—focusing on the pop in prices since 2024 began—supercore inflation is tracking to top 8% by year end. Looking at stats like that, it’s simply hard to imagine the Fed getting comfort loosening up anytime soon.

Financials lower after big banks report

After such bleak news on consumer prices, Thursday’s PPI reading from the BLS brought investors some respite, growing 0.2% month-over-month, a tick less than economists’ expectation for a 0.3% rise, and well below February’s 0.6% increase. Investors shrugged off the fact that year-over-year PPI climbed by 2.1%, the biggest annual gain since April 2023, and stocks managed to claw back most of Wednesday’s losses. By Friday, however, equities were setting new lows for the week as markets digested the first big earnings releases of the Q1 2024 reporting season: those of some of America’s largest banks. Financial institutions are often thought, by virtue of their early position on the earnings calendar, as well as their central role in the US economy, to set the tone for the rest of firms’ reporting. If that’s the case as earnings news rolls in over coming weeks, it could be a rough ride for equity investors. After reports by JPMorgan, Citigroup, and Wells Fargo on Friday, the S&P 500 Financials Index closed the day -1.4% lower.

Analysts had low expectations going in

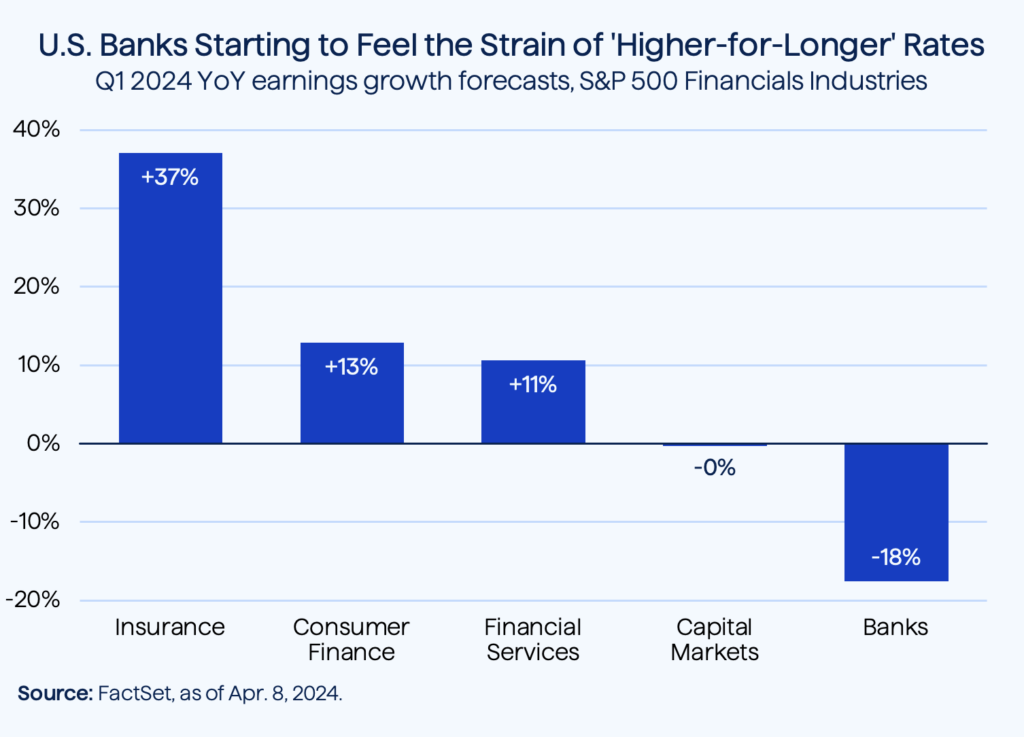

Those who know something about the relationship between banks’ earnings and Fed policy might find it a little surprising that “higher-for-longer” rates could be bad news for lenders. After all, elevated interest rates should help banks to boost net interest income, since it allows them to raise rates on new loans faster than the cost of their deposits rises. Indeed, bank managers had been messaging to the market back in January that profits would likely decline in 2024 as a result of the many rate cuts traders then expected to come through by the end of this year. Not surprisingly, that guidance is shifting as the outlook for easing dims, though it hasn’t made a big difference for analysts’ forecasts of bank earnings which, at the beginning of last week, reflected expectations for an 18% year-over-year contraction in banks’ net income (see below). That may seem like a low bar, though Friday’s bank earnings still managed to disappoint. What gives?

High rates finally hurting bank profits

It turns out there’s some nuance to the conventional wisdom around banks thriving in a high-interest-rate environment, and the longer rates stay high, the harder it gets for even the biggest financial firms. It’s true that the initial surge in rates sent banks’ profits to record highs, with JPMorgan, Bank of America, Wells Fargo, and Citigroup hauling in $253 billion in net interest income last year. But over time, depositors see high rates available outside of checking and savings accounts, plunking money into things like CDs and Treasuries offering better returns. That raises banks’ cost of deposits and compresses their profitability. Meanwhile, as persistently high borrowing costs wear on the companies taking loans, some of those borrowers default and banks’ charge-offs on unrecoverable loans also hit the bottom line. As such, pessimism around the timing of 2024 rate cuts has increasingly dampened projections for banks’ earnings.

JPMorgan issues cautious guidance

JPMorgan, one of the biggest beneficiaries of Fed tightening thus far in the cycle, was certainly feeling the pain of these changing dynamics on Friday, as the bank’s stock closed down by over 6%, its largest single-day decline since March 2020’s COVID crash. That was despite the bank beating Wall Street expectations with 6% growth in its profits from the prior year. One thing rattling investors in JPM shares was the bank’s report of a 4% year-over-year drop in net interest income, which the bank attributed to “deposit margin compression and lower deposit balances”: precisely what we’re talking about above. Wells and Citi likewise reported 4% and 2% declines in net interest income, year-over-year. Guidance was another thing shaking investors’ nerves. JPMorgan’s head, Jamie Dimon, raised the possibility of rates reaching 8% in downside scenarios, citing geopolitical tensions and inflationary pressures as potential obstacles to a more favorable outcome—factors that readers of Perspectives will recognize as weighing on our outlook, as well.

Industrial metals outpacing stocks in Q2

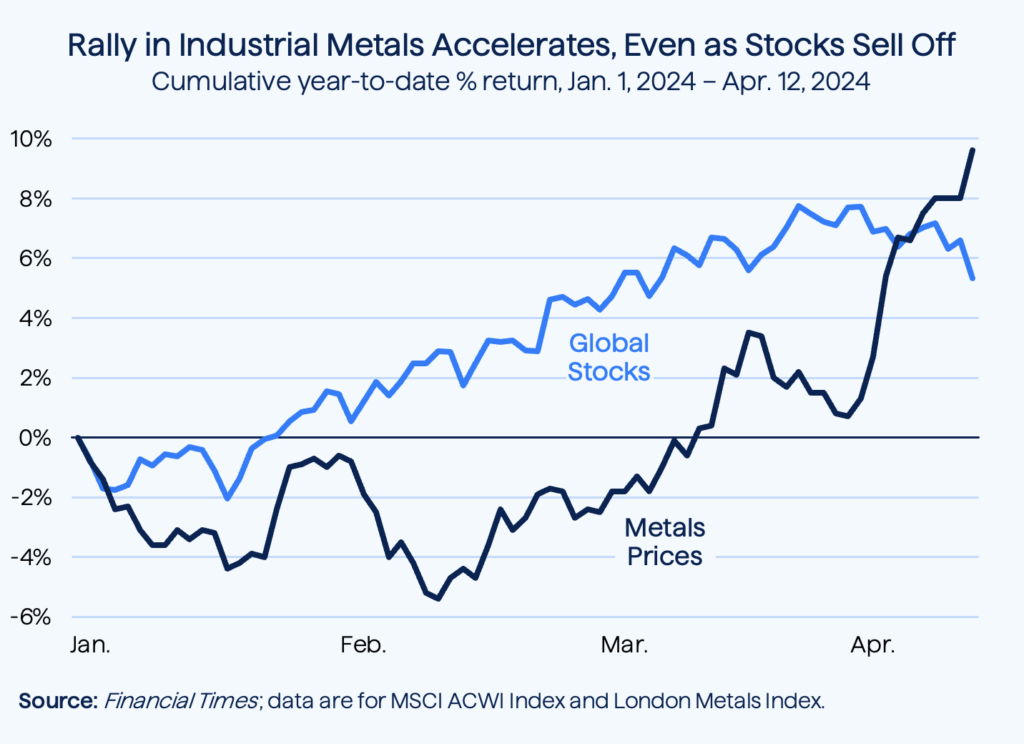

Despite equities’ decline in recent days, the Financial Times recently highlighted one asset class going from strength to strength as we enter Q2: industrial metals (see below). Last week we commented briefly on March’s Institute for Supply Management report on US factory activity, which had finally crossed over into “expansion” territory at the end of the first quarter, its first reading above 50 since September 2022. That’s a positive development, of course, for commodity inputs to US production, though we suspect traders in April have been riding high on a report the prior week from China, whose National Bureau of Statistics reported at the end of March that its manufacturing PMI has also returned to growth, hitting a value of 50.8; that was higher than consensus forecasts of 49.9, and the first expansionary reading since September 2023. Signs of a possible recovery in China are bigger news for industrial metals, as the absence of Chinese demand amidst the country’s domestic economic struggles have been a key feature holding raw material prices down, despite tight global supply.

Analysts see copper bull market beginning

Wall Street is taking notice, too, of the drivers behind building momentum in industrial metals. Last Monday, Bank of America increased its forecasts for prices in the sector, citing supply constraints and an expectation for rising demand. One specific commodity they highlighted was copper, up over 9% year-to-date, as output of producers remains exceedingly low despite signs demand based on the world’s new energy transition could be ramping up. Citi analysts also chimed in last Monday, calling for a secular bull market in copper and suggesting “explosive price upside is possible” in its bullish scenario over the next two to three years. Given the status of copper as something of a barometer for economic health in the global economy, we agree that there’s substantial upside in a soft landing scenario, and believe signs of life among producers coming off years of historically low output and weak sentiment could make miners an interesting way to get exposure in the space.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED