The CIO’s Take:

Labor market a crucial data point

We don’t want to unduly discount market enthusiasm around AI and its ability to keep market sentiment high. In fact, some of the biggest stocks in our DM and EM allocations are key players in the space! That said, we still believe a big driver of investors’ returns over the next twelve months—both in equities and fixed income—will be the Fed’s policy path. After a first quarter marked by hotter-than-expected inflation, markets are looking for anything that might indicate disinflation is back on trend. Last Friday, we got the US Bureau of Labor Statistics (BLS) May jobs numbers.

Upside surprise in nonfarm payrolls

Unfortunately for the Fed, it was another data point that shakes up the hopeful theme of gentle cooling-off in the US economy that would allow the bank to start easing sooner. Nonfarm payrolls jumped in May by 272K jobs, much higher than the 180K consensus forecast. The source of job additions reinforced recent trends: health care led the way, with government jobs and those in the leisure and hospitality sector also showing big growth. In more bad news for inflation, average hourly earnings popped 4.1% year-over-year, versus expectations of just a 3.9% increase.

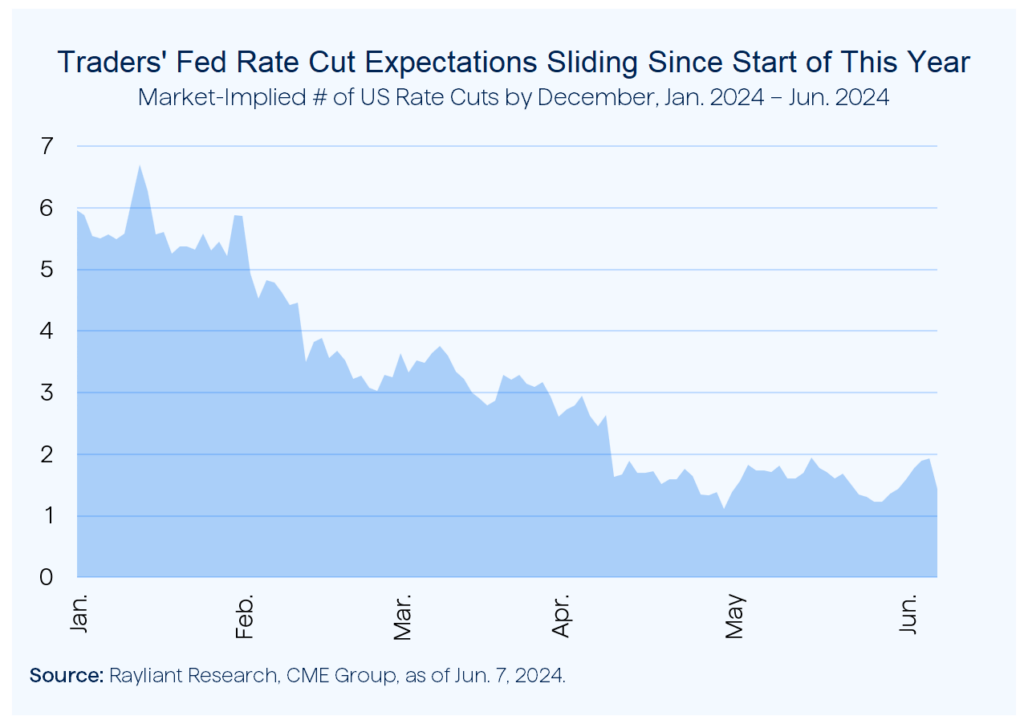

Yields rise, chances of cut decline

Markets took the labor market news as a negative for Fed policy, with 2-year Treasury yields leaping by 16 bps and traders moving to price in fewer rate cuts for 2024, and futures data showing a single cut now representing the consensus expectation (see below), a far cry from the 6+ cuts projected in January. Our readers will know that we never endorsed that kind of exuberance, though we have gradually backed off hopes the pivot could come in September. Absent a big surprise, we think it is likelier than not rate cuts will have to wait until 2025.

More optimistic hints in the data

Now, there were a few glimmers of hope in last week’s jobs data. For one thing, the unemployment rate in the BLS report rose from 3.9% to 4.0%, as 408K fewer American households surveyed reported holding jobs in May; economists had expected no change in the unemployment rate. Likewise, Tuesday’s JOLTS report showed job openings on track toward pre-pandemic levels, falling in April to their lowest point since February 2021. Thinking glass-half-full, such signs could still point to a gradually loosening labor market that helps ease prices without hurting growth.

Need growth to be just slow enough

Before Friday’s nonfarm payrolls, things were looking a bit better, with a recent downward revision to Q1 GDP from 1.6% to 1.3% on the back of declining consumption and a drop in the Chicago PMI for May 2024 to its lowest level since four years prior in May 2020. But again, balance is important. To get the coveted ‘soft landing’, not only do we need the labor market to cool down, we also need that to happen as a result of ‘goldilocks’ moderation in growth: otherwise, we’ll get the rate cuts, but only because of the economy—and investors’ portfolios—tanking.

June start to easing for BoC, ECB

While the prospects for Fed easing in 2024 are looking increasingly dismal, for investors with global portfolios, the US isn’t the only market that matters. In fact, last week witnessed two major economies’ central banks lower rates after a long pause in monetary policy. The Bank of Canada (BoC) takes first place in the race to cut among G7 economies, bumping its benchmark rate last Wednesday down by 25 bps from 5%, where it had been sitting since last July. A day later, the European Central Bank (ECB) cut its benchmark rate by a quarter-point, as well, to 3.75%.

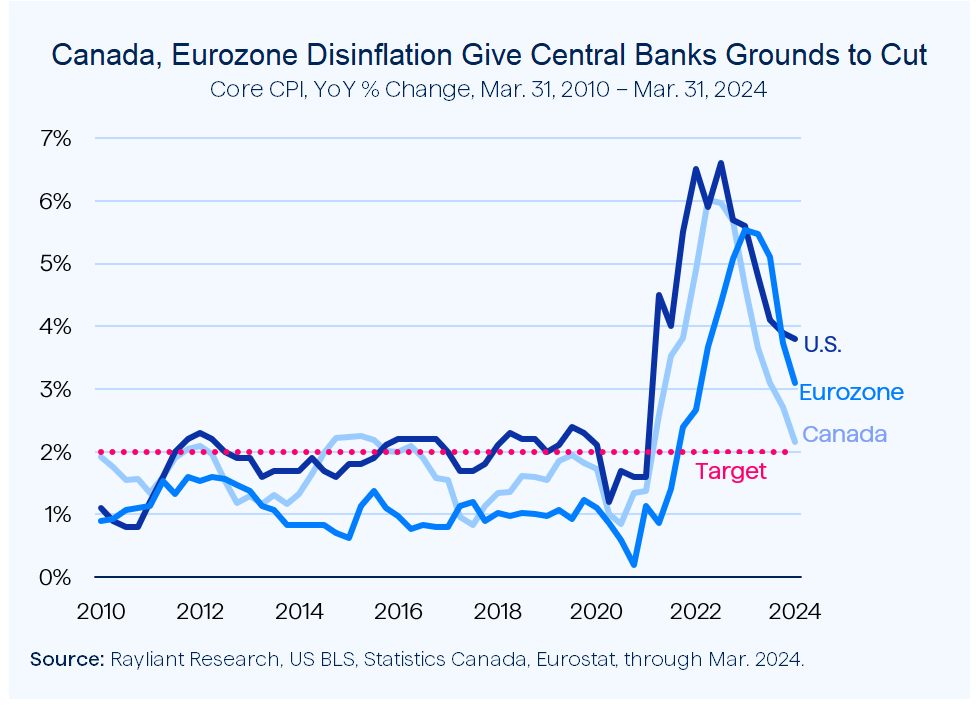

Canada’s situation called for a cut

Particularly for Canada, the timing of the cut isn’t too surprising. As shown below, by the end of last quarter, core inflation had pretty much fallen back to the BoC’s 2% target. More importantly, Canada’s growth has been slowing, with Friday’s Statistics Canada jobs data marking the eighth time in the last twelve months the country’s unemployment rate increased. GDP also cooled, with data last Friday showing Q1 growth at 1.7% annualized, short of the bank’s 2.8% forecast and below the 2.4% market consensus. Fourth-quarter GDP was also revised down, from 1.0% to 0.1%.

The ECB decision was also seen by the market as pretty much a sure thing, and the bank had been telegraphing a June cut for some time, despite the chart above showing Eurozone core inflation still sitting just above 3% at the end of Q1. Bank president Christine Lagarde noted that one governor cast a dissenting vote against the cut, interestingly, and the ECB did increase its inflation forecast, while communicating a cautious tone for future cuts.

Other major economies a mixed bag

What about going forward? Markets expect these won’t be lone cuts by the two banks just discussed, with traders pricing in another 36 bps of easing by the ECB before year end, and two more 25-bps cuts from Canada in the same timeframe. While the UK appeared close to cuts before, recent election uncertainty (discussed in last week’s Perspectives) makes the timing harder to predict. As we’ve explained, we don’t see the Fed pivoting until late this year, at best. And Japan? An interesting outlier, very likely to continue hiking rates, especially in light of a very weak yen.

2024 is a year of big elections

A question that’s come up for us more than once in the last couple weeks is what impact former US president Donald Trump’s 34 felony convictions are likely to have on his election chances and, hence, our clients’ investments. Here, we have to be honest: It’s hard enough to handicap the November election itself in light of Trump’s legal woes, let alone extrapolate that to possible stock market ramifications. As emerging markets investors, we’re no strangers to political uncertainty. Last week was a great example, with two election surprises playing out in EM stocks.

Big win for Mexico’s ruling party

The first shocker came just before midnight on Sunday, June 2nd, when Mexico’s National Electoral Institute reported the results of its ‘Quick Count’ of votes in the country’s presidential election, which showed Claudia Sheinbaum, candidate of the incumbent party, in possession of a decisive lead at the polls. It wasn’t the fact that Mexico is set to welcome its first female president in the nation’s 200-year history that was the surprise—Sheinbaum had a wide lead in pre-election polls and her principal opponent was also a woman—but rather the 32-point margin of her win.

Modi suffers a rare setback

Roughly a day later, on the other side of the world, Indian election officials were counting ballots in another election featuring a strong incumbent party, led by current prime minister Narendra Modi. In this case, though, it wasn’t a landslide victory by a popular head of state that caught pollsters off guard. Rather, it was the fact that India’s ruling Bharatiya Janata Party (BJP) and its NDA coalition underperformed the opposition INDIA bloc, winning far fewer seats in the nation’s legislature than exit polls had suggested.

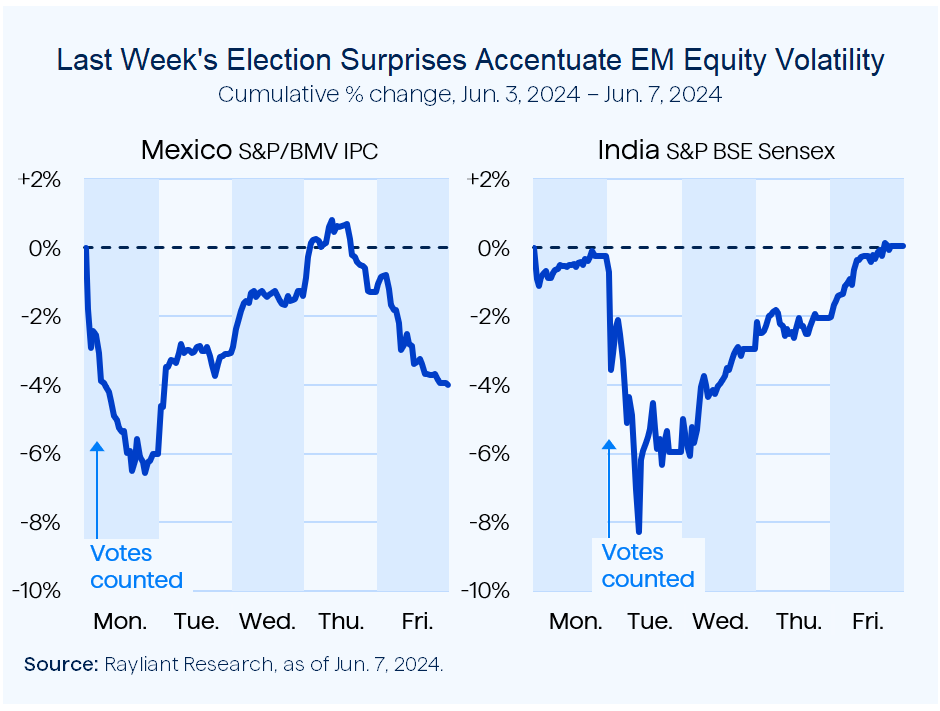

Stocks sink on election shocks

Markets don’t always take such surprises well, and Mexican stocks plummeted by over 6% last Monday (see below), seemingly spooked by the leftist ruling party’s landslide win and congressional supermajority, expecting that could mean anti-market reforms that would pose a setback to an EM country whose fortunes have been rising, with US economic strength and the ‘nearshoring’ trend giving local companies a boost. Likewise, Indian stocks slumped on the prospect Modi’s opposition might put a damper on his market-oriented policies, shedding more than 5% on Tuesday.

Negative reaction was short-lived

Although politics generates big headlines and stokes investors’ emotions, as we remarked at the outset, it’s often harder than one might imagine to gauge the actual market impact—and sometimes it falls short of the initial hype. As the chart above shows, Mexican stocks recovered gradually over the next couple days before taking another step down on Friday after the nation’s current president said he intends to use the new congressional majority to pass constitutional bills before his term is done. Indian stocks likewise powered back, hitting fresh record highs by Friday.

Big inflows as investors ‘buy the dip’

In the case of India and Mexico, it turns out most investors eventually reacted the way we did: searching through the rubble in the aftermath of a post-election sell-off for stocks whose fundamentals made up for negative short-term sentiment. Indeed, Mexican stocks rallied as much as 3.6% on Tuesday, their best intraday rally since last November. Bank of America reported that India’s stock market saw its largest inflow on record last week, at US$1.2 billion, while Mexican stocks got a US$300 million inflow, its biggest since November 2016.

Strong emotions may beget opportunity

All in all, we see last week’s election-based market dynamics as nicely illustrating stocks’ propensity for a big reaction to political events—especially true in the wake of election news, which tends to be more emotionally salient to investors than the dry macro stats we spend most of our time talking about in Perspectives. Ultimately, though, things come back to fundamentals. A strong leftist majority in Mexico seems marginally more concerning to us than a bit more competition for India’s Modi, though we still see opportunities for active stock picking in both markets.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED