So far this year, European equities have outperformed US equities with MSCI Europe up nearly 18% in dollar terms, the Euro Stoxx 50 up 20%, and the DAX up an incredible 28% in dollar terms. Is this the start of a new era for the long-moribund European equity markets, or just a flash in the pan?

The oft-reported reason for this dynamic change is often claimed to be capital flight due to the new Trump administration and potential political instability.

To analyze this thoroughly, we should divide it into politics and fundamentals.

The first is the rise of political instability and uncertainty in the United States. While this is undoubtedly true in Europe, there is a strong case that political uncertainty is higher.

The previous German government collapsed after the coalition fell apart; the new one is another ugly mismatch between the centre-right and the fast-collapsing centre-left party. The new German Chancellor even failed to win a prearranged confirmation vote and was only elected in the second round—hardly a ringing endorsement of his likely political longevity.

In France, President Macron has lost nearly all power and is more of a dead duck than a lame duck president. Italy is another coalition—which at least has the advantage of being from the same side of the political divide—but is somewhat hampered by the fact that the average length of time for an Italian government is 1.1 years. All this is before the problems at the European Union itself—something that even one of the high priests of pan-Europeanism, Mario Draghi, highlighted in his recent report, as a deeply dysfunctional organization needing radical change.

Of the major European economies, only the United Kingdom has a strong government. Unfortunately, by recent UK standards, it’s also very left-wing. It came to power after right-wing voters didn’t bother to turn up at the last general election due to the ineptitude of their party’s 14 years in power. Since then, the UK economy has slowed almost to a halt, economic confidence has dropped to the lowest level on record, and the financial situation continues to deteriorate due to the fiscal recklessness of the government’s heavy spending on welfare.

All of these countries are seeing sharp rises in voter support for right-wing populist parties.

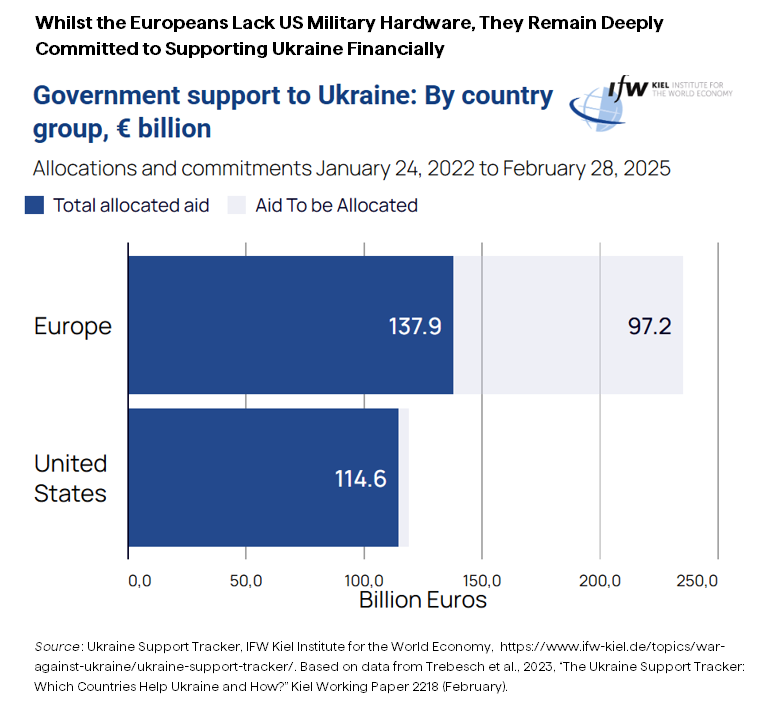

This analysis also doesn’t consider the destabilizing effect of a major war on the use of the eastern borders in Ukraine. President Trump might declare that he can finish the wall within 24 hours—something he has so far failed to achieve—but ending the war is not necessarily in his purview. For the Europeans, stopping Russian aggression is viewed as existential. Despite their lack of military might, they’ve continued to finance Ukraine’s economy and war effort. Additionally, many of the things Putin is demanding— such as re-admission to the SWIFT payment network, the removal of sanctions, and the restarting of energy exports—will be decided by the Europeans, not the Trump administration. Hence, they are very unlikely to agree to any of this.

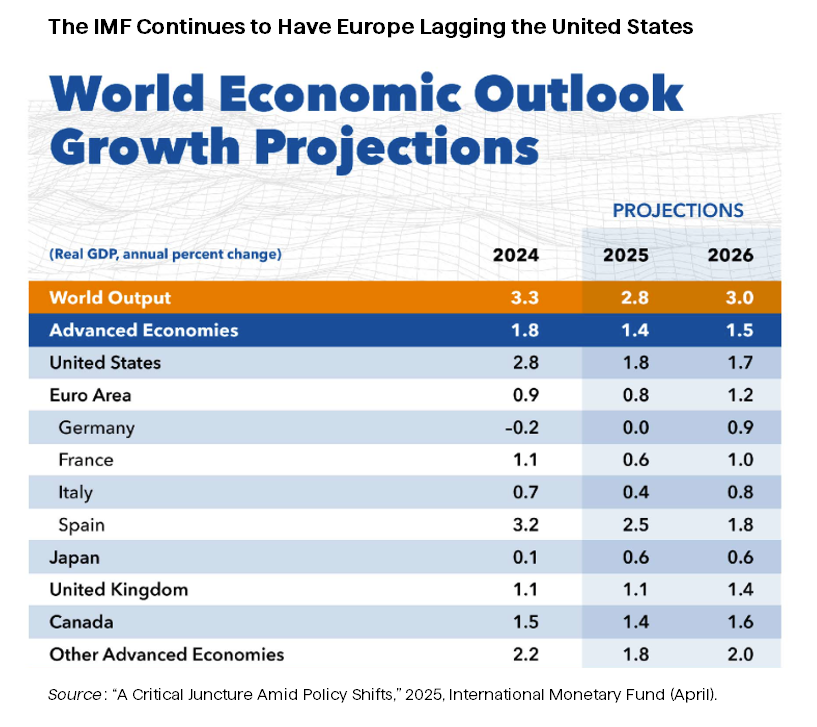

This large military expenditure was the only positive for the European economy. The engine room of that economy—Germany—not only continues to post extremely weak economic data, but also has serious worries that its entire economic business model, based around manufacturing exports, is broken.

Germany faces multiple structural challenges: an aging workforce, the loss of cheap energy from Russia, and serious technological obsolescence in its core automotive industry, especially when compared to Chinese competitors in major export markets. The UK’s exit from the single market continues to weigh on trade. Meanwhile, Trump is likely to impose tariffs, China no longer needs European capital goods, and the European Union itself is increasingly burdened by debt and weak internal demand, limiting its ability to absorb German exports.

France has similar debt and deficit levels to the United States, but with even lower growth. The government already accounts for over half of GDP, while Italy is, well, Italy.

The recent outperformance is perhaps best seen as a technical adjustment.

There have been outflows from the United States and into Europe. But it’s important to remember that European fund managers had long been overweight US stocks relative to their benchmarks. They also tend to be more conservative than US managers and have grown increasingly concerned about US stock valuations for some time in the face of an inevitable economic slowdown. The likely imposition of tariffs and potential changes in the tax code have accelerated already underlying concerns.

This recent equity outperformance reflects a rebalancing and an element of undervalued European assets finally catching up. While valuation certainly plays a role, it’s crucial to remember that these lower valuations often reflect the underlying lack of robust growth across the continent. In fact, except for the UK and possibly Spain, the recent run-up in European equities has started to make them look expensive by historical standards.

While there are undoubtedly some impressive companies in Europe, beyond the headline names, the US offers a plethora of mid-tier firms with comparable valuations operating within a far more dynamic and innovative economic landscape.

Plus, for all its flaws, the dollar will remain a recognizable currency for the foreseeable future—something that cannot be said for the euro, which is another consideration for those seeking to venture into the Old World.

Disclosure: The views expressed herein are those of the author and do not necessarily reflect the views of Rayliant Investment Research. The material is for informational purposes only and should not be considered investment advice. Indices cannot be invested in directly and are unmanaged. The opinions contained herein are subject to change without notice.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED