Perspectives

Phillip Wool, Ph.D.

Scroll down

“So far, global trade growth has been highly resilient, and we’ve also not seen all that

much retaliation from countries hit by US tariffs. That’s partly because those countries

recognize how much they benefit from trade.”

—Steven Altman, senior research scholar at the NYU Stern School of Business

With the S&P 500 Index on a year-to-date rally of some 10.4% through the end of August—an undeniably solid return through the first two-thirds of the year—it’s no surprise that many US investors have been fixated on the performance of domestic equities. We imagine many of the same investors would find it quite surprising to learn that so far in 2025, the MSCI Emerging Markets Index has more than doubled that performance, gaining better than 22% over the same period. So, what explains the outperformance of emerging markets in a year full of the sort of macro uncertainty that usually spells trouble for stocks in developing economies?

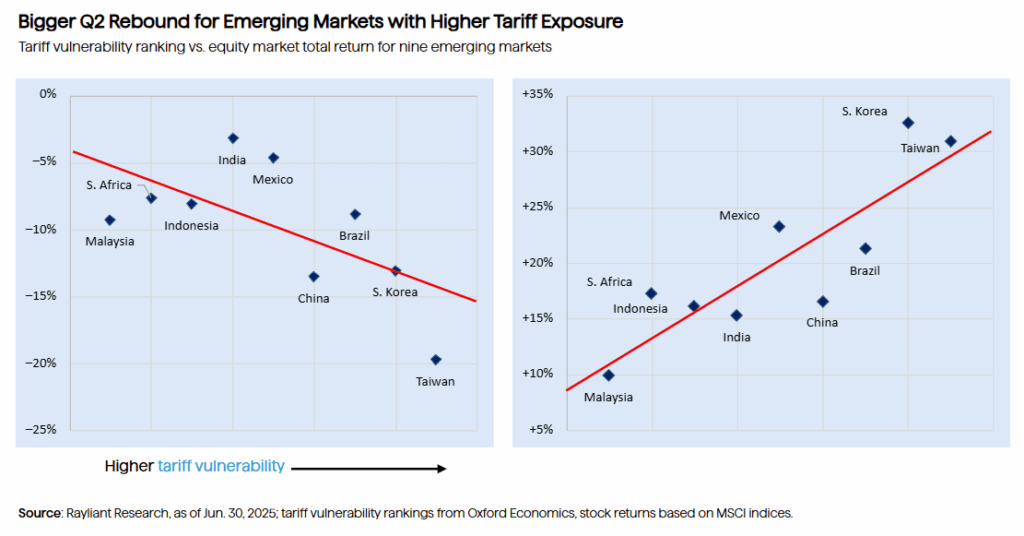

First, let’s consider tariffs, which were a clear headwind to EM stocks at the beginning of the second quarter. The folks at Oxford Economics produced some fascinating analysis of emerging markets’ performance around Washington’s “Liberation Day” trade tax announcements at the start of April. First, they sorted countries around the world on their estimated economic exposure to US tariffs, then they looked at stock returns in the immediate wake of April 2nd. Below, we’ve pulled out just the emerging markets, and it’s obvious to us that in the face of intense fear over new trade barriers, markets showing the most US trade policy risk also tended to experience the biggest selloffs.

What’s really interesting, though, is what happens in subsequent days, as markets process not only the initial trade threats, but also Washington’s follow-up dealmaking with its biggest trading partners. As huge levies were delayed, initial deadlines extended (then re-extended), and a number of deals announced (never mind the lack of details), markets inevitably discounted those massive “headline” tariffs, leading to a rebound that, symmetrically, tended to be greatest for the markets most exposed to a downturn in trade with the US. The upshot? Investors buying the dip in stocks stung by overly negative sentiment over fears of an all-out trade war—including those in some of the largest emerging markets—turned out to be big winners as the second quarter played out.

But it’s not just the ebb and flow of traders’ sentiment that’s been driving EM stocks to big gains in 2025. There are fundamental factors at play, as well, which perhaps bodes well for a continuation of EM equity strength as the second half proceeds. We think that’s easy to see looking at consensus earnings growth expectations, which have risen to more than 15% annualized over the next two years for the MSCI EM Index since April’s tariff turmoil, compared with projections that have fallen for developed markets in the MSCI World Index, showing roughly 8% growth per annum over the same period.

In part, this we believe divergence reflects the reality of global trade: While we typically think of emerging markets like China as being most exposed to US supply chains, the fact we have found many of the biggest EM firms don’t rely too much on sales to the US—they’ve got growing domestic consumption and exports to the rest of the world to tide them over—while companies in developed economies like Japan and Europe are often heavily dependent on US demand to drive growth. The kicker comes when one looks at valuations: Despite expectations for nearly double the EPS growth in coming years, MSCI EM stocks currently trade at a forward P/E of just 14x, versus a multiple of over 21x for the MSCI World Index and a lofty 31x for the tech-heavy US NASDAQ composite.

One more potential catalyst for further EM outperformance? The upcoming September FOMC. Some of the worst macro conditions for EM equities historically have been rising US rates and a strengthening dollar. In other words, just the conditions that have prevailed since pandemic-era inflation and the latest cycle of Fed tightening. With the US central bank under severe pressure to ease from the White House, tamer-than-expected inflation, and a softening labor market, traders put the probability of a September cut at 87%, with another four cuts priced in to occur over the next year—plenty of reason for investors to feel good about the future for EM stocks.

Disclosure: This material is for informational purposes only and should not be considered investment advice. The opinions contained herein are subject to change without notice. Indices cannot be invested in directly and are unmanaged.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED