Perspectives

Fiona Zhang

Scroll down

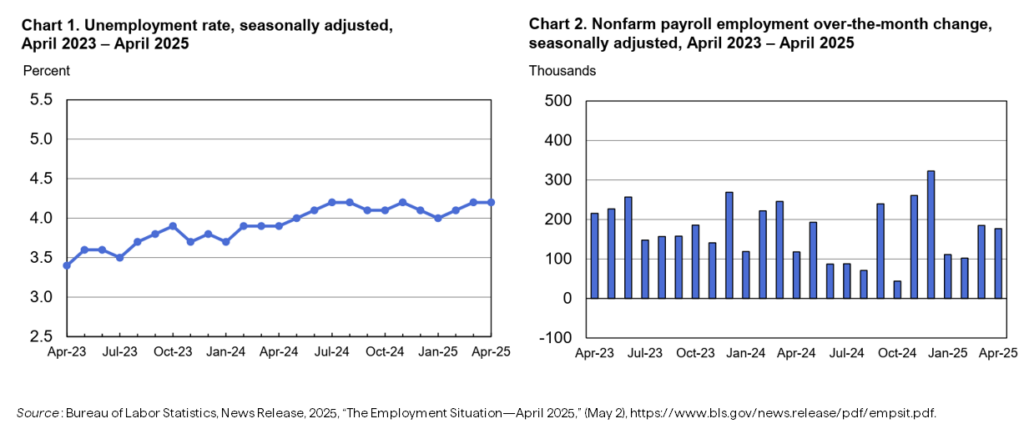

As we move deeper into Q2 2025, the U.S. labor market continues to defy expectations of a broad economic slowdown. The April jobs report showed the non-farm payrolls rose by 177,000, the unemployment rate remained steady at 4.2%, and average hourly earnings climbed 0.2% to $36.06—firm, but not overheating. These figures reflect ongoing demand for labor despite tighter financial conditions, complicating the Federal Reserve’s path forward on interest rates.

Despite this strength, the Federal Reserve maintains a cautious stance on interest rate adjustments. April’s Consumer Price Index (CPI) indicated a 2.3% annual increase—slightly below expectations, but still above the Fed’s 2% target. Complicating matters, recent tariffs introduced by the Trump administration have introduced uncertainty around future inflation trends. Federal Reserve Vice Chair Philip Jefferson highlighted that these tariffs could impede disinflation efforts and temporarily elevate consumer prices.

Market expectations reflect this uncertainty. According to the CME FedWatch, there’s a 52.4% probability of a 25 basis point rate cut by September. However, the Fed has signaled that it requires more definitive evidence of sustained inflation reduction before making policy changes.

For equity markets, the message is mixed. On one hand, strong employment supports consumer spending and earnings stability, especially in cyclical sectors like industrials and financials. On the other hand, persistent wage gains and a Fed in wait-and-see mode may delay the valuation tailwind typically associated with falling rates. Rate-sensitive sectors such as utilities, real estate, and small caps remain range-bound, awaiting clearer monetary guidance.

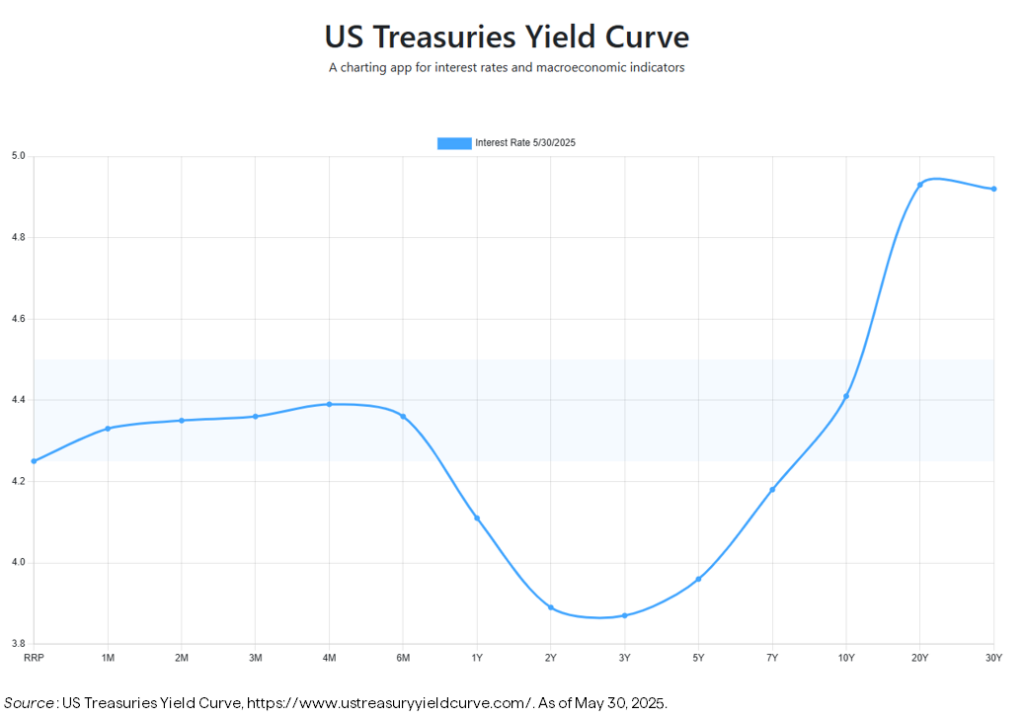

Meanwhile, the bond market is flashing signs of caution. The yield curve remains inverted between the 2-year and 10-year notes, but a subtle shift has occurred: short- and long-end yields are rising in tandem, while the middle part of the curve—namely the 5-year—has dipped, forming an unusual “humped” shape. This suggests investor uncertainty around the timing and magnitude of rate cuts, as well as a growing recognition that inflation could prove more persistent than initially hoped.

In this environment, investors face a balancing act. Fading inflation headlines may not be enough to anchor a full risk-on rally unless the Fed aligns more clearly with market expectations. Until then, labor market resilience—while fundamentally positive—may continue to be a double-edged sword: supportive of growth, but delaying the monetary easing that markets crave. Given the heightened uncertainty and market sensitivity to policy shifts, a cautious stance remains prudent. Close attention to upcoming Fed communications will be essential, as future decisions will hinge on how employment and inflation trends unfold.

Disclosure: The views expressed herein are those of the author and do not necessarily reflect the views of Rayliant Investment Research. The material is for informational purposes only and should not be considered investment advice. Indices cannot be invested in directly and are unmanaged. The opinions contained herein are subject to change without notice.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED