Perspectives

Gregory Lai, CFA

Scroll down

Semiconductors used to be back-office tech—quietly powering our devices from the shadows, until Intel’s 1990’s “Intel Inside” slogan. Today, they’re front-page news. From national security to the AI arms race, we believe the global semiconductor complex has gone from commodity to crown jewel. But as tariffs return and the dream of domestic chip independence runs into the brick wall of global complexity, markets are finally waking up to a harder truth: This isn’t just about chips. It’s about control.

NVIDIA led the way, riding a generational demand wave fueled by AI, cloud infrastructure, and compute-hungry models like ChatGPT. Investors piled in. Semiconductors were no longer cyclical—they were secular. NVIDIA’s stock soared 800% off pandemic lows, powered by the belief that AI is the new oil—and GPUs, the new gusher.

NVIDIA Skyneted!?… oops—Skyrocketed.

But under the surface, the supply chain has always been fragile. Taiwan’s TSMC makes the most advanced chips. ASML in the Netherlands builds the only machines that can etch them. Even the raw materials—like gallium and graphite—are largely controlled by China.

That’s not a diversified ecosystem. That’s a geopolitical Jenga tower.

The recent pullback in semiconductor stocks isn’t just a valuation story. It’s a repricing of policy risk. Trump’s latest round of tariffs and export controls is escalating a completely different kind of battle—one fought across a hurricane of competing forces, if not feelings.

And then there’s “reshoring”—the go-to buzzword in D.C. Let’s call it what we see it as: a mirage.

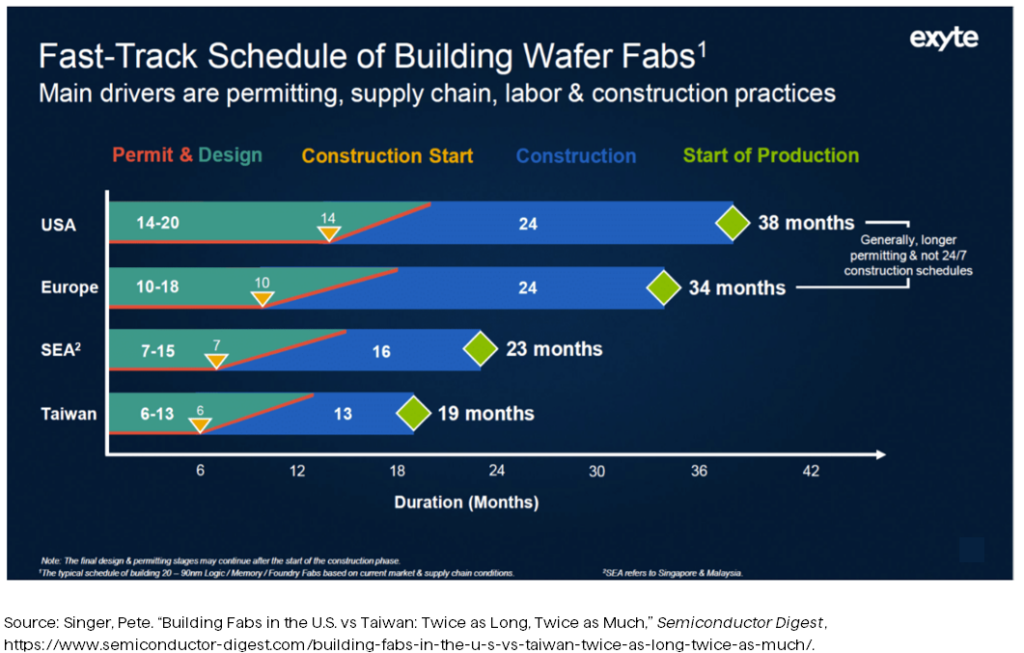

You don’t reassemble a decades-old global supply chain with subsidies and hope certificates. U.S. fabs—if not a pipe dream—are still years away from being truly competitive in our view. Talent is scarce. Cost structures are higher. And Asia’s lead—especially Taiwan’s—likely isn’t closing anytime soon.

We want chip sovereignty, along with those sugar plums. But if we thought our national debt was high, buckle up—the sticker shock is just beginning.

China isn’t standing down. It’s already retaliating with export restrictions on rare earth elements critical to chipmaking and EV batteries. The semiconductor world is rapidly splitting into U.S.-aligned and China-aligned spheres. That’s not resilience—it’s redundancy, fragility, and rising cost.

And maybe provocation, too.

For investors, the key risk is that this sector is no longer priced like a Cold War—it’s still priced like a tech rally.

Or at least, it was.

Here’s the kicker: we don’t believe this is about GDP or trade deficits. We believe it’s about AI. The chips we’re fighting over aren’t just for smartphones and electric cars—they’re powering autonomous weapons, predictive surveillance, and algorithmic warfare.

This is Skynet in slow motion.

The real question isn’t who builds it first. It’s who controls it once it’s built? Where’s Arnold when you need him?

Semiconductors still have one of the most compelling long-term growth stories out there. AI demand isn’t slowing down. Cloud infrastructure, smart devices, autonomous transportation, logistics, productivity tools etc., still need to be scaled. The thesis is intact.

But the narrative has changed—from innovation to industrial vulnerability, from growth to geopolitical exposure. These are no longer pure tech plays. They’re chess pieces in a global contest of power, ideology, and supply chain sovereignty.

So can semis say, with confidence: “I’ll be back”?

That depends on whether the investors buying them understand the machine behind the machine—and the politics behind the processor.

Disclosure: The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. The opinions contained herein are subject to change without notice and should not be construed as investment advice. Past performance is not indicative of future results.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED