Perspectives

Scroll down

At the center of the American healthcare machine sits a paradox: some of our most critical public health programs—Medicaid, Medicare Advantage—are administered not by government agencies, but by some of the largest, most profitable corporations on Earth. Let me say up front—this is a highly nuanced, complicated issue. As portfolio managers, we usually only wade in when the stock is up big or down big. Lucky us.

But this paradox is now playing out in real time at UnitedHealth Group, with the stock down approximately 50% over the past year.

This industry giant, once a model of vertical integration and operational stability, is reeling. A string of compounding crises—spiraling medical costs, regulatory scrutiny, leadership upheaval—has thrown the company off balance. Andrew Witty, UnitedHealth’s CEO, resigned abruptly in May. The company also suspended forward guidance for 2025, citing cost pressures, particularly within its Medicare Advantage unit. The result: UNH shares cratered, shedding nearly 18%—their worst single-day drop since COVID.

UnitedHealth reported Q1 2025 earnings below expectations, with earnings per share of $6.85 (adjusted EPS of $7.20). Worse, the company revised its 2025 earnings outlook to $24.65–$25.15 per share, down from the previous range of $28.15–$28.65. They blamed increased care utilization among Medicare Advantage members, which drove higher-than-expected costs. Additionally, the company cited “unanticipated changes” in its Optum health services subsidiary as a factor in the earnings miss. Revenues for the quarter still grew to $109.6 billion, up 9.8% year-over-year.

And if those numbers weren’t bad enough, there are rumors of a potential fraud investigation. Losing 50% of your stock price in a month tends to bring out the lawyers.

Beneath it all, a deeper structural question has resurfaced: what happens when public health responsibilities are tethered to shareholder value?

If we’re honest, whether it’s public health, national security, or other social responsibilities—the market isn’t new to these conflicts.

Until recently, UnitedHealth was riding high—its diversified business model and data-driven cost controls made it a Wall Street favorite. But in Q1 2025, those controls cracked. Rising utilization in Medicare Advantage blew a hole through projections. Even more troubling: the company openly admitted it couldn’t see clearly enough to issue forward guidance.

Then came the leadership shake-up. Witty’s departure was framed as personal, but the market read between the lines. Stephen Hemsley—long-standing chair and former CEO—has stepped back in, a move that signals both stability and regression. When your crisis plan is “bring back the guy who ran the show 10 years ago,” you’re not innovating—you’re scrambling.

Here’s the real story, though: this isn’t just a company-level issue. It’s a system-level fragility baked into the structure of U.S. healthcare delivery.

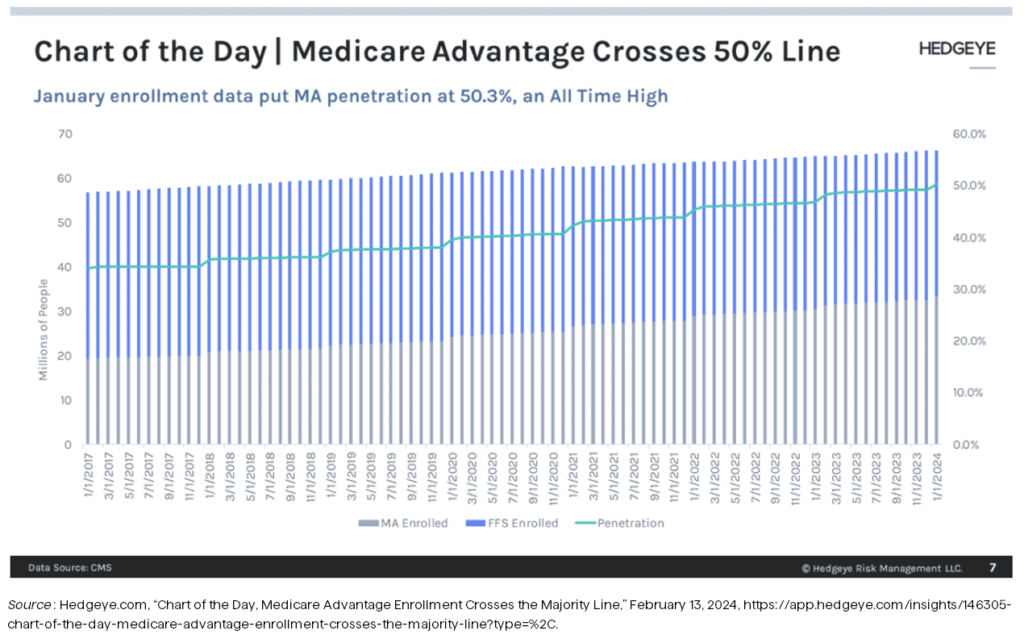

UnitedHealth is not a rogue actor. It is the largest player in a system where government-funded care flows through private-sector pipes. Roughly half of Medicare recipients are now enrolled in Medicare Advantage—a program run not by CMS, but by insurers like UNH. Medicaid managed care? Same story.

These programs are supposed to deliver care more efficiently, more affordably. But what happens when that care comes under pressure from earnings calls, margin targets, and Wall Street expectations?

You get rationed services, complex billing structures, narrow networks—and now, a publicly traded behemoth that can’t project its own financial future because utilization rates went up.

In other words: the system works until people actually use it. OMG.

The most dangerous illusion in for-profit public health is the illusion of control. Models can predict, costs can be managed, but when real humans enter the equation—aging, sick, unpredictable—the system bends under pressure. Do we hope that AI does better

That’s what we’re seeing at UnitedHealth now. It’s not just volatility. It’s a warning: when the stewards of public health are tethered to quarterly earnings, public health becomes a variable expense.

And then there’s the policy wild card. Trump’s renewed focus on lowering drug prices—a populist rallying cry that resonates across party lines—could either ease UnitedHealth’s pain or deepen it. If lower pharmaceutical costs translate into reduced total spending across Medicare and Medicaid, payers like UNH might get some relief on their medical loss ratios.

But the structure of that relief matters. If reforms slash PBM margins or dismantle the rebate-driven economics behind OptumRx, the pressure won’t vanish—it’ll just shift from claims to revenue. In trying to fix one corner of the healthcare system, we may be yanking at the profits holding the rest of it together.

This moment demands more than crisis management. It demands clarity.

UnitedHealth’s stumble is not just a corporate setback. It’s a test of a system that increasingly leans on private enterprise to deliver public good. And if the largest, best-capitalized insurer in the country can be thrown into disarray by a spike in care utilization—what does that say about the resilience of the system itself?

This isn’t just a story about UNH. It’s a story about how fragile our healthcare architecture becomes when purpose and profit pull in opposite directions.

Disclosure: The views expressed herein are those of the author and do not necessarily reflect the views of Rayliant Investment Research. The material is for informational purposes only and should not be considered investment advice. The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. The opinions contained herein are subject to change without notice.

You are now leaving Rayliant.com

The following link may contain information concerning investments, products or other information.

PROCEED